The Securities and Exchange Commission (SEC) will vote this week on a controversial new climate risk proposal that could change how American corporations do business. The rule proposed by the SEC chair will require businesses in corporate America to disclose any material risks their operations are posing to climate change.

This rule hopes to provide Americans and investors with more information about what corporations in the country are up to.

Rule Proposal

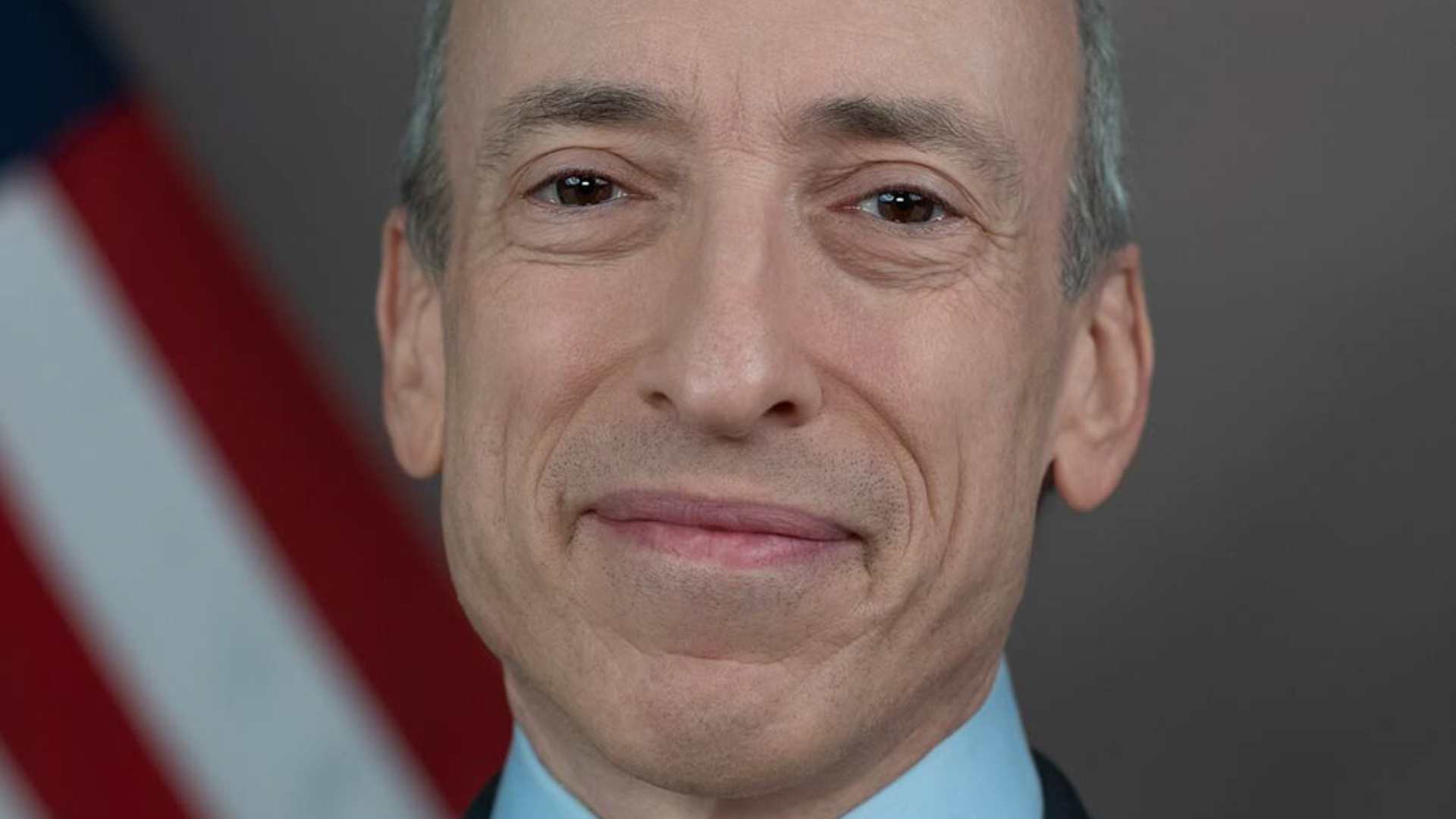

The proposed climate disclosure rule was first brought forward in 2022. In March of that year, SEC chair Gary Gensler spoke about it.

“Today, investors representing literally tens of trillions of dollars support climate-related disclosures because they recognize that climate risks can pose significant financial risks to companies, and investors need reliable information about climate risks to make informed investment decisions,” Gensler said. (via CNBC)

Disclosing Environmental Risks

Gensler pointed out in his comments that these disclosures are something that people have already been asking for and will be a huge boon for investors.

“Today’s proposal would help issuers more efficiently and effectively disclose these risks and meet investor demand, as many issuers already seek to do,” he said.

Three Categories

When the initial proposal was announced in 2022, three categories of disclosures were discussed.

Since the final proposal has not been publicly released, it is not certain which if any of the original categories will ultimately be included. Each category disclosure has to do with the scope of emissions and at which point in the company’s operation cycle they are coming from.

Scope 1

The category of company disclosures has to do with direct emissions that a company produces through any of the sources it controls.

The United States Environmental Protection Agency gives examples such as fuel combustion in boilers or vehicles. Emissions in this proposal have to do with any harmful by-products like carbon dioxide or other greenhouse gases. Other greenhouse gases of concern include nitrous oxide, methane, and fluorinated gases.

Indirect Emissions

Scope 2 is a category that encompasses any of the indirect emissions from a company.

For this category, companies would have to report emissions from things like energy generation that the company uses to power their facilities. Basically, Scope 2 includes any emissions that the company has some loose control of not already included in Scope 1.

Scope 3

The final proposed category is Scope 3 which deals with emissions related to the company but ones that are not directly or indirectly controlled by them.

This category targets emissions by the company’s suppliers, customers, or other involved entities that are contributing emissions through their actions. CNBC reported that this last category received strong criticism, with corporations saying regulations with this category would be overly burdensome.

Some Emission Disclosure Requirements May Be Dropped

A report from Reuters in late February asserted that the SEC had removed some of the disclosure requirements from the final proposal.

The article cites undisclosed sources who talked to Reuters on the matter. One of the notable absences reported was the scaling back of Scope 3 emissions reporting requirements. If true, this would make the United States stand out as the European Union does require this kind of reporting for companies.

Why Do Corporations Oppose Scope 3?

According to Deloitte, a consulting firm, over 70 percent of a business’s carbon footprint comes from the category of Scope 3.

Given this information, it is easy to see why some corporations strongly oppose this category over the others. While it isn’t 100% confirmed that Scope 3 has been dropped from the SEC rule proposal, the Reuters report at least confirms its removal has been considered.

Record SEC Proposal

In remarks from 2023, Gensler commented on how this climate reporting proposal received a flood of comments. This proposal reportedly has received the most comments of any proposal in SEC history.

“We are considering carefully the more than 15,000 comments we’ve received on the proposal. We greatly benefit from public input and, given the economics and the law, will consider adjustments to the proposed rule that the staff, and ultimately the Commission, think are appropriate in light of those comments,” Gensler said.

Letter from Institute for Policy Integrity

The Institute for Policy Integrity issued a letter in support of the rule proposal in June 2022 in response to criticism that they SEC rules are overrreaching.

“Throughout its history, the SEC has repeatedly required disclosure of information that, while not financial on its face, is nevertheless relevant to investors’ assessment of a registrant’s future financial prospects,” the letter said.

Potential for Lawsuits

It remains to be seen what the consequences of the rule adoption will be if it happens in the near future. However, certain companies and political groups who see the rule as government overreach may try to make their voices heard.

These groups may take the government to court over the disclosure requirements to try to restrict or overturn them. Fighting climate change is also a tricky political issue. According to Pew Research, only 54% of Americans view climate change as a major threat.