In 2022, Governor Gavin Newsom revealed California’s record $100 billion budget surplus—a first in U.S. state history.

Just two years later, the state faces a staggering near $50 billion deficit. This swift reversal is straining California’s budget plans and testing its policy ambitions.

Emergency Measures Kick In

Faced with a dire fiscal shortfall, Governor Newsom has declared a state-wide fiscal emergency.

This move unlocks rainy-day funds and mandates tough budget cuts, complicating Newsom’s efforts to push forward his policy agenda.

Mixed Reviews for Newsom

Recent polls show Governor Newsom with only a 46% approval rating among Californians, who are deeply concerned about the budget deficit’s impact.

As Newsom nears the end of his term, these figures could influence his future political ambitions.

Reaching a Budget Agreement

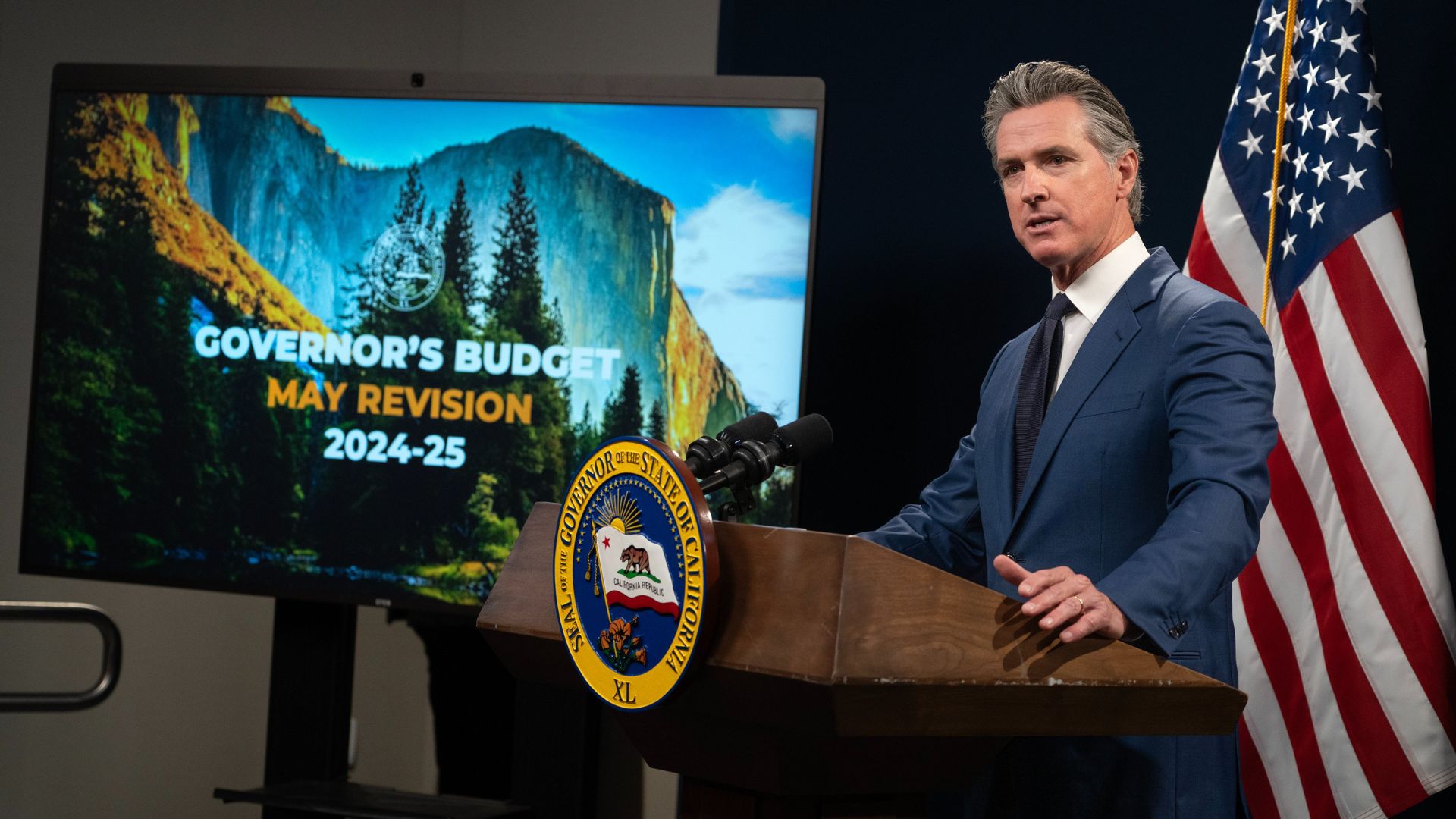

In response to the crisis, Governor Newsom and California’s Democratic leaders have ironed out a nearly $300 billion budget deal.

“This agreement sets the state on a path for long-term fiscal stability — addressing the current shortfall and strengthening budget resilience down the road,” Newsom remarked.

GOP’s Take: Mismanagement Claims

Critics argue that California’s deficit is a result of Democratic mismanagement, suggesting that the state’s progressive model might not be as solid as it seems.

This debate heats up as Newsom’s national ambitions grow.

Navigating Economic Instability

The state’s budget woes have been worsened by unpredictable market shifts, making it hard to forecast income and capital gains taxes.

These challenges have been intensified by the economic disruptions of the pandemic.

There Are Multiple Factors Behind California’s Economic Decline

Newsom’s legislative analyst office reported that the decline in revenues is partly the comedown from abnormally strong growth when COVID-19 stimulus boosted income taxes, resulting in a state surplus.

Investments in California’s tech industry have also dropped over the last two years, with 80% fewer companies going public in 2022 and 2023 compared with 2021. The number of unemployed people in the state had also risen by 200,000 since last summer.

Newsom Signed the Budget Based on an Unpredictable Tax Structure

California’s tax system is based largely off income taxes that are paid by top earners, which are directly affected by the ebbs and flows of the stock-market and are tough to pin down.

Due to the delay of the 2022 tax filing deadline from April to November, California leaders were also cornered into building up the current budget without a complete understanding of the decline in state tax revenue.

Emergency Economic Deal Has Caused Rifts For Newsom

This agreement lays out a spending plan with $297.7 billion at the state’s disposal. The deal was concluded after weeks of negotiations with labor unions, business interests, and Democrat lawmakers.

This whiplash between a $100-billion surplus in 2022 and the current deficit compromises Newsom’s pride in California as the economic hub for the rest of the nation. Regardless, California still has more funds to dip into than before Newsom took office.

Democratic Dissonance

Budget negotiations have exposed fractures within the Democratic Party, illustrating the difficulty of maintaining fiscal discipline while fulfilling promises on social programs.

This intraparty tension underlines the complexities of governing a solidly blue state.

Newsom Is Gaining Momentum in the Presidential Race

After President Biden’s performance at the presidential debate against Donald Trump, Newsom is gaining traction from the wider Democratic party.

His current position as a presidential candidate may further complicate his need to get California back on track economically. Newsom himself has attempted to bat off rumors of his replacing President Biden as “unhelpful” and “unnecessary” but is currently the second-placed candidate for the presidency at 14%.

Cutbacks to Close the Gap

To address its $46.8 billion deficit, California is slashing $16 billion in spending.

These cutbacks affect everything from housing budgets to prison funds. These are tough but necessary choices to regain financial footing.

Postponed Pay Raises

Healthcare workers in California face delayed wage increases.

This move has disappointed many but is seen as essential to averting more severe financial cuts.

The Healthcare Pay Delay Is Despite Promises of a Significant Increase

The pushing back of the healthcare minimum wage is a big dampener on morale in California considering Newsom signed a bill last year to increase the healthcare minimum wage to $25 an hour.

Newsom explained a few weeks after signing the bill that he would not let the law come into practice if the state budget crisis deteriorated further. The law was estimated to cost the state $2 billion.

Doctors Are Pushing For Policies That Will Result in Higher Pay

In response to the delayed increase of the minimum wage for healthcare workers, doctors are pushing for policy change.

Doctors are at the forefront in the push for a measure on the 2024 ballot that would introduce a Managed Care Organization tax and have a portion of the revenue from that tax feed into providing a higher reimbursement rate for healthcare workers.

Educational Opportunities Will Suffer Despite Funding of Core Services

In a statement, Governor Newsom said that he is making sure “to preserve programs that serve millions of Californians, including key funding for education […]”. However, educational opportunities in the state will suffer as a result of the cuts.

The greatest cuts in the education sector are the $500 million that have been slashed from a loan program to fund affordable student housing and $485 million for work-study programs.

Cuts to the Budget Will Affect the Minimum Funding Guarantee For Education

Newsom stated that core public services like education would be preserved and prioritised.

However, the state of emergency Newsom announced allowed him to bypass the minimum funding guarantee for Californian schools and community college which was voted in by the public in 1988. The California Teachers’ Association has criticized this change to education funding as this would reduce funding to school by about $12 billion in two years.

Debating Prison Closures

There’s a heated debate over whether closing underused prisons could save the state money.

Budget director Scott Graves questions the logic behind keeping empty facilities running: “Why are we spending a billion dollars a year to keep 15,000 beds empty in our state prison system? It’s a massive waste of resources.”

Spending Up, Results Unclear

Despite a significant increase in spending over recent years, California has shown little progress on key issues like housing and homelessness.

This lack of effectiveness, highlighted by a state audit, raises serious questions about accountability and results.

California’s Commitment to Climate Change Is Shaken by the Cuts

Newsom also said that wildfire prevention programs would not suffer under the $16 billion cut to the state budget. However, Democratic lawmakers and environmental advocates are lobbying for Newsom’s support of a bond to counteract the spending decrease.

This would combat rising sea-levels and to help low-income Californians buy electric vehicles. This is in response to Newsom’s $2.8 billion cut to a $54.3 billion spending package called the California Climate Commitment.

Resources to Recover From State Blackouts Will Suffer

With grid emergencies over the last few years, Newsom’s budget could severely compromise the $6.7 billion in funding to protect the grid against blackouts caused by heatwaves.

Representatives of Demand Side Grid Support and Distributed Electricity Backup Assets wrote in a letter to state legislative readers: “investing in these programs is an investment in California’s clean energy future and our resilience against the growing threats of climate change.”

Fortifying Financial Foundations

Looking ahead, Governor Newsom and state leaders are bolstering California’s budget strategy.

By planning for the next two fiscal years and enhancing reserves, they aim to protect the state against future economic downturns, ensuring greater stability.

Law Enforcement Will Take a Hit From Budget Cuts

Law enforcement is not exempt from the monumental state budget cut. The budget will include a cut for multiple branches of California law enforcement.

This includes a $97 million cut to trial court operations, $10 million to the Department of Justice’s Division of Law Enforcement and over $80 million to the Department of Corrections and Rehabilitation. This is the second year in a year that California has faced a shortfall of billions.

The New Budget Will Will Suspend Tax Breaks For Some Businesses

The budget agreement has been passed onto the full legislature to vote on this week. The budget will come into effect July 1. As well as cuts to public services, the budget will suspend tax breaks for businesses earlier than initially intended.

The new budget will suspend the net operating loss for companies with more than $1 million in taxable income and limit business tax credits to $5 million annually.