Activists are reinventing the reparations movement by advocating for significant tax breaks for Black Americans. This new strategy comes as efforts to secure direct financial compensation have waned.

Tiffany Cross, a notable author and former MSNBC host, has been vocal about this innovative approach on her podcast, “Native Land Pod,” highlighting the historical context and current necessity of such measures.

The Rationale Behind the Movement

The push for tax breaks is rooted in the historical exploitation of Black labor, particularly during the slavery era. Activists argue that the unpaid labor of Black people laid the groundwork for the United States’ emergence as a global power.

Shared on “Native Land Pod,” Cross emphasized that Black labor on Southern plantations made America the “superpower” it is today, referring to the lack of compensation for these efforts.

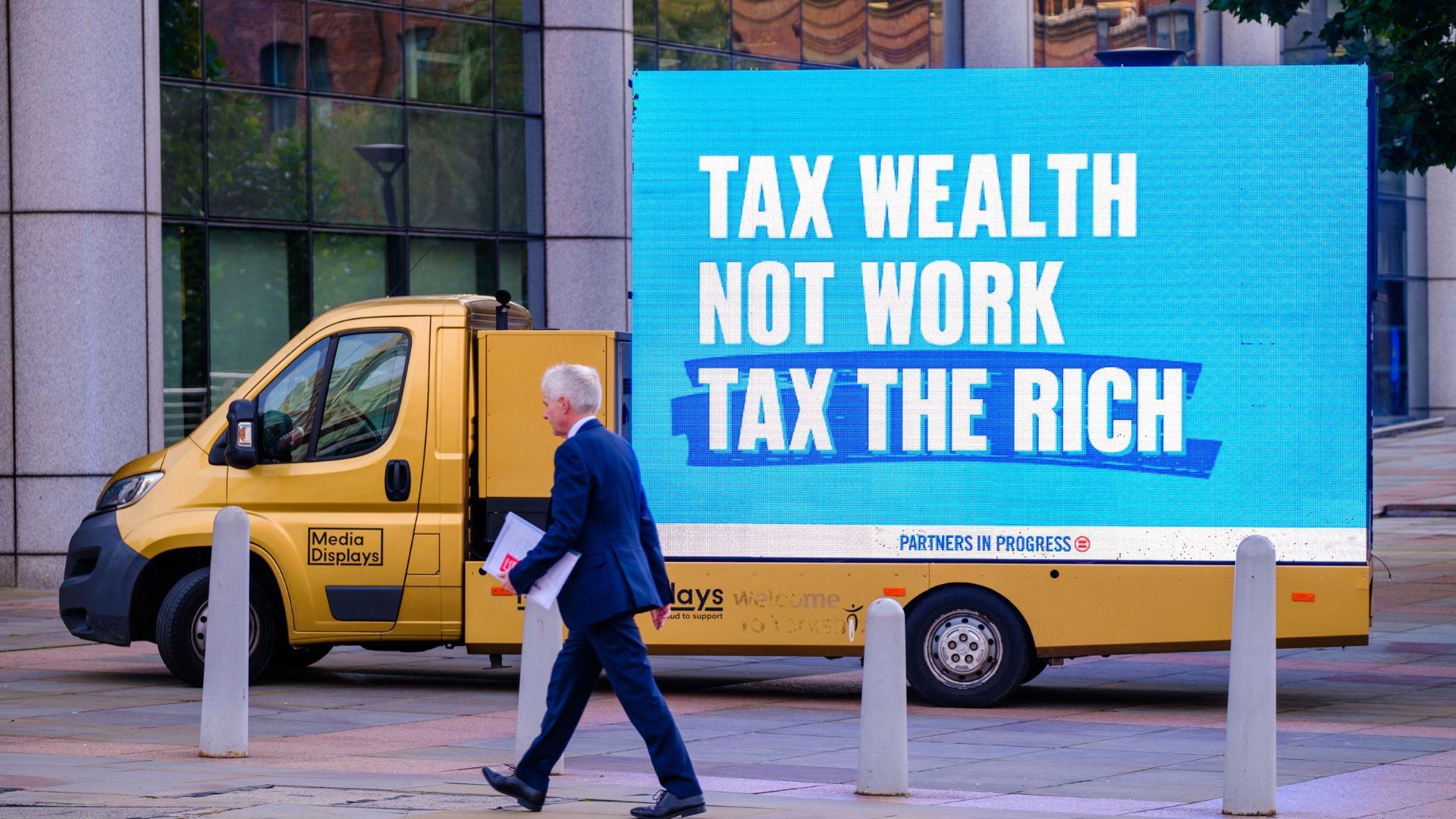

Chicago’s Billboard Campaign

In Chicago, billboards advocating for Black-only tax breaks have become a common sight.

These advertisements aim to garner public support for reducing the typical $6,000-a-year property taxes for Black residents. The campaign reflects the city’s larger effort to address racial inequalities rooted in its history (via ABC Chicago).

The Concept of Tax-Based Reparations

The proposed tax breaks vary from income tax reductions to property tax exemptions for descendants of slaves (via ABC Chicago).

The idea is to alleviate the economic disparities that have persisted due to historical injustices like slavery, Jim Crow laws, and discriminatory housing policies. Tiffany Cross suggests, “If you are a descendant of the enslaved, then we will decrease your tax bracket” (via The Daily Mail).

Challenges and Controversies

Implementing race-specific tax policies is not without its challenges. Determining eligibility and addressing the concerns of other racial groups are significant hurdles.

Critics argue that such measures could exacerbate divisions, while proponents see them as a step toward rectifying historical wrongs (via U.S. Department of Treasury).

RERAN’s Proposal for Chicago

The Reconstruction Era Reparations Act Now (RERAN) group in Chicago proposes waiving property taxes for Black residents as a form of reparations.

They aim to address the city’s history of discriminatory practices and provide relief to affected communities, stressing that “our Black citizens in Chicago are being kicked or forced out,” according to RERAN’s founder, Howard Ray Jr. (via ABC Chicago).

Tax Relief as Historical Payback

Ray Jr. advocates for tax relief as compensation for the long history of racial injustices, from slavery to mass incarceration.

This approach aims to rectify the economic disadvantages imposed on Black people over generations.

Public Response and Debate

While the proposal for tax-based reparations has gained traction among some groups, it remains controversial.

A survey in California showed that only 23% supported cash reparations, highlighting the diverse opinions on how to address historical injustices (via The Los Angeles Times).

Impact on Other Groups

The debate extends beyond Black citizens, raising questions about reparations for other marginalized groups, such as Indigenous Americans.

Critics of race-specific tax breaks argue for a more inclusive approach to addressing America’s historical debts.

The Road Ahead

As activists push for tax breaks as a form of reparations, the coming months and years will be crucial in shaping the conversation and policies around racial justice and historical compensation.

The current movement seeks not only to address past injustices but also to foster a more equitable future.

The Role of Public Opinion

The success of the reparations movement, particularly the new tax break approach, will largely depend on shifting public opinion and legislative support.

The journey toward reparations is a reflection of America’s ongoing struggle to confront and amend its racial history (via Brookings).

Looking Forward: The November Referendum

Activists in Chicago aim to bring the issue of tax-break reparations to voters in a November referendum.

This could mark a significant step in the reparations movement, providing a model for other cities and states to follow.