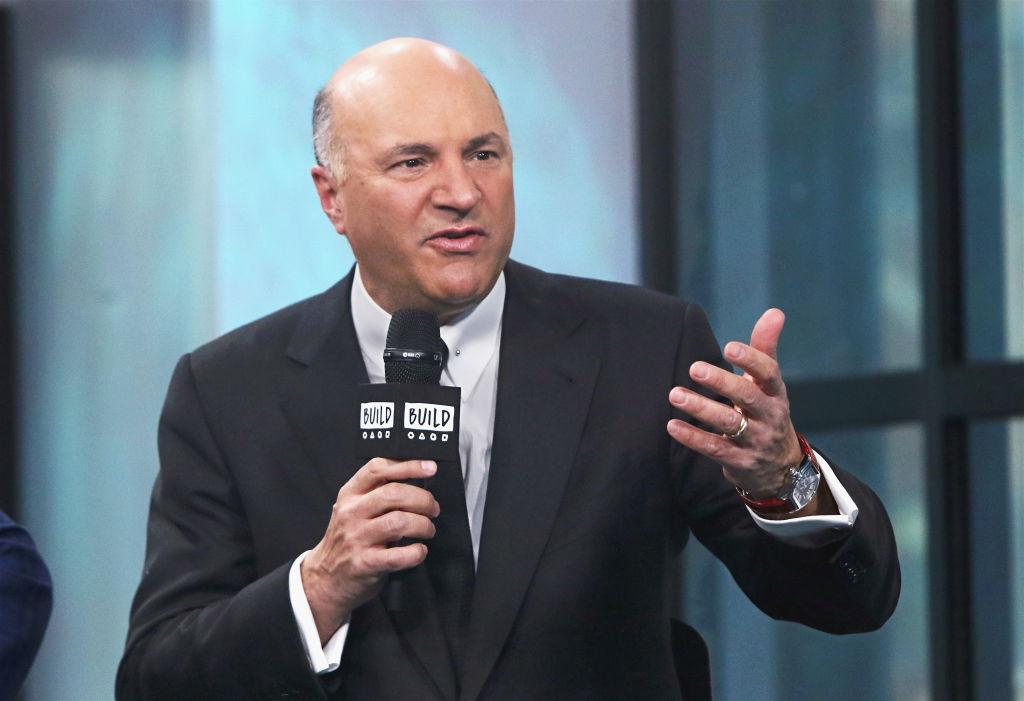

Kevin O’Leary is known for his role on Shark Tank as an expert investor and financial guru.

In a recent interview, O’Leary told his fellow Americans that even though inflation has settled down, the entire country will still need to “downsize” and be smart with their money if they want to stay out of debt.

Let’s Talk Inflation

In order to understand O’Leary’s advice, it’s first crucial to acknowledge the current inflation rates.

According to the US Inflation Calculator, the current rate for the past 12 months is 3.1%. And while this number is significantly lower than it has been for the past two to three years, it’s still quite high.

What Is Inflation?

Understanding inflation can be quite challenging for many who don’t work in finance, but it’s really not all that complicated.

Essentially, inflation means that the prices of goods and services have increased, which consequently decreased the value of currency.

Inflation Affects Cost of Living

Of course, increased inflation directly affects a person’s cost of living, known as the consumer price index.

Items such as groceries, gas, utilities, cars, homes, and rent, all increase in price as the consumer price index climbs, and if Americans aren’t careful, that can mean rising debt.

O’Leary Says Now Is the Time to Downsize

Kevin O’Leary explained that even if the Federal Reserve can minimize inflation, “We’re [still] looking at a downsized America.”

He continued to say that for Americans in their 20s, life will be about “20% less,” than it used to be.”

How Will Life Be 20% Less?

Essentially, what O’Leary means by life will be “20% less,” is that the next generation of young professionals and consumers will likely have to spend less than their parents or even their older siblings.

That means a 20% smaller home, a 20% less expensive car, and generally, spending about 20% less on life.

Cars & Homes Are Simply More Expensive Than They Used to Be

O’Leary expanded on his comment and said, “Three years ago, even 24 months ago, you’d get a mortgage at 4.5%. You’re lucky to get one at 8% today.”

And it’s not just homes; loans for new vehicles are at a whopping 7.4%, which hasn’t been that high since 2007.

What Can Americans Do to Stay Out of Trouble?

Realistically, O’Leary’s advice is meant to help the next generation entering the workforce to use their money wisely. But besides cutting down costs by 20%, there are a few other tactics people can and should take to stay out of financial trouble.

And the very first is arguably the most important way to ensure finances stay on track is to get out of debt as soon as possible. Or better yet, never fall into debt in the first place.

Getting the Best Possible Insurance

Next, it’s crucial to cut down on insurance costs; between home, auto, medical, and whatever else they need, Americans pay a fortune in insurance costs every year.

And the best way to save money is to find out which companies provide the best services for the lowest price points. Usually that means bundling the various insurances together, but it’s first important to find the right company.

Invest Wisely

Finally, in order to get the most out of any paycheck, it really helps to invest wisely and watch the money multiply.

These investments can include inflation-resistant choice, real estate, and various retirement options. But if someone doesn’t understand the world of investing, it’s better to get some help, or at least do quite a bit of research first.

O’Leary Isn’t Here to Scare America

Kevin O’Leary does believe that more inflation rate hikes could be coming in the near future; however, the point of his advice wasn’t to scare young Americans.

It was simply to explain that with the current economic climate, it’s more important than ever to not overdo it when it comes to buying a home or car, and for Americans to be attentive to their finances.

The Economy Will Always Fluctuate

For many Gen Zers, this reality can feel quite frustrating; it seems as though their parents were able to buy the cars and houses they wanted without having to downsize by 20%.

However, as all financial experts know, the economy is fickle and changes constantly throughout a lifetime. But for now, it’s time to save and spend carefully.