According to a comprehensive analysis by the Committee for a Responsible Federal Budget (CRFB), a leading budget watchdog, the fiscal policies under the Trump administration resulted in an additional $8.4 trillion to the national debt.

This figure encompasses the impact of tax cuts, pandemic relief measures, and discretionary spending increases during his tenure.

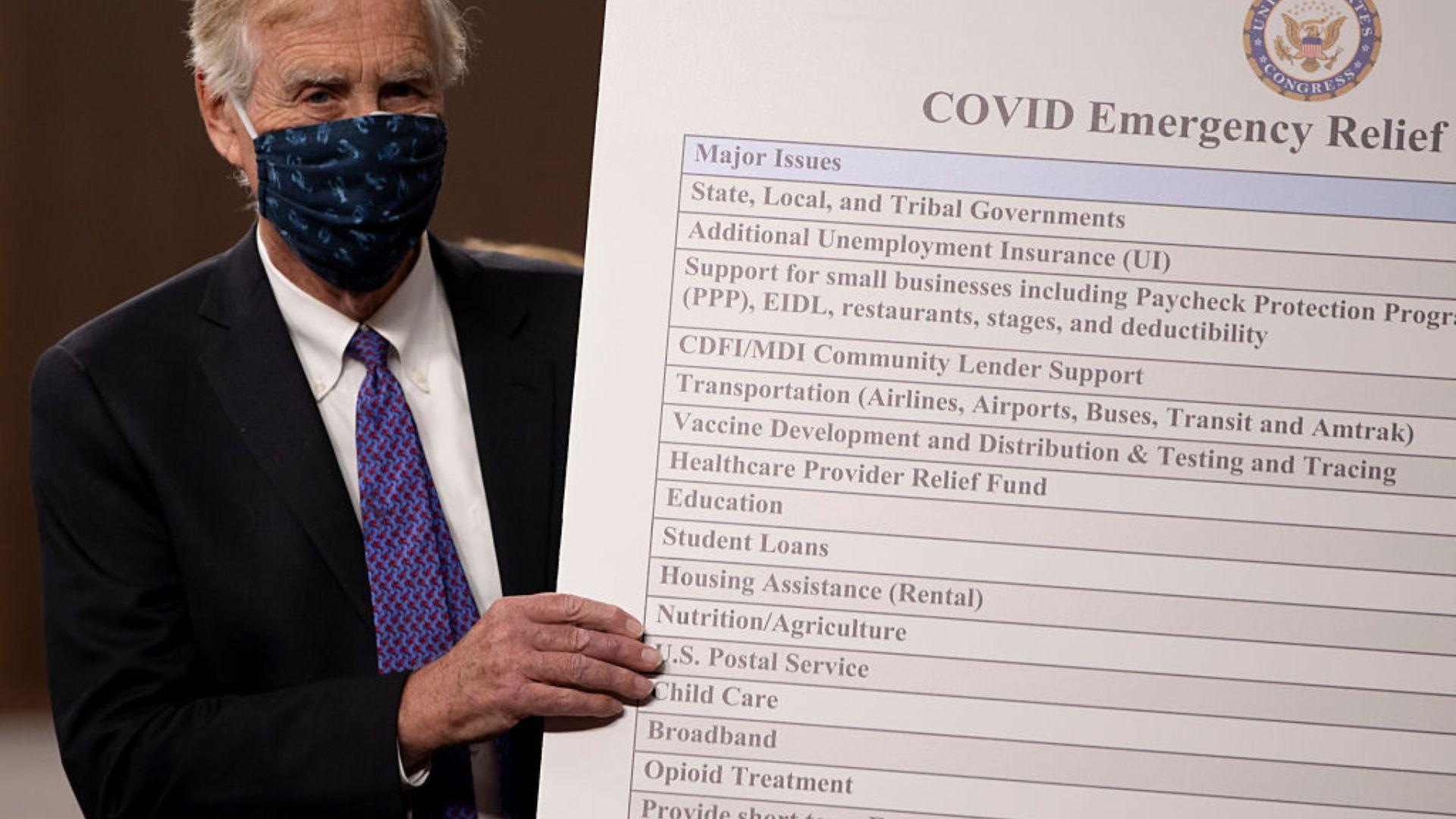

Detailed Breakdown of Spending Increases

The CRFB’s study reveals that the $8.4 trillion increase in national debt includes $2.1 trillion from discretionary spending hikes in 2018 and 2019.

Additionally, $1.9 trillion was from the Tax Cuts and Jobs Act, and $1.9 trillion from the bipartisan CARES Act for pandemic relief.

The Composition of Trump’s Debt Increase

The CRFB report states, “Of the $8.4 trillion President Trump added to the debt, $3.6 trillion came from COVID relief laws and executive orders, $2.5 trillion from tax cut laws, and $2.3 trillion from spending increases.”

This breakdown offers a detailed look at how various measures contributed to the national debt, from pandemic-related expenditures to tax cuts and spending increases.

Tariffs as a Method of Deficit Reduction

The Hill reports that the only significant effort to reduce the deficit during Trump’s administration, as noted by the CRFB, was through the implementation of tariffs on a variety of imported goods.

These tariffs are projected to have generated $445 billion over 10 years, serving as a counterbalance to the otherwise expansive fiscal policies.

Trump Proposes Aggressive Tariff Strategy

CNBC reports that Trump has revealed plans to significantly escalate the U.S-China trade war if re-elected, proposing tariffs of 60% or higher on Chinese imports.

This bold strategy, reminiscent of his first term’s $250 billion in China tariffs, aims to revive the intense trade conflict, despite its previous impact on the global economy and U.S.-China relations.

Trump’s Tariff Plan: A Return to Trade War

In a recent interview, Trump confirmed his intention to impose tariffs of at least 60% on Chinese goods, potentially reigniting the trade war that disrupted global markets, increased consumer costs, and strained diplomatic ties.

The Washington Post highlighted Trump’s consideration of this plan, indicating a significant shift towards more aggressive trade policies.

Expanding Tariffs Beyond China

Trump’s tariff strategy extends beyond China, proposing a blanket 10% tariff on all U.S. imports, CNBC notes.This comprehensive approach has faced widespread criticism for its potential to harm consumers by raising prices on a wide array of goods.

Despite the backlash, Trump insists on the necessity of these measures, suggesting they could even exceed the initial proposals.

Fiscal Policies Under Political Scrutiny

The fiscal strategies of the Trump administration have sparked considerable debate among political figures.

Notably, former U.N. Ambassador Nikki Haley and Florida Governor Ron DeSantis have publicly criticized Trump’s approach to managing the deficit, The Hill notes. Despite these criticisms, Trump’s performance in the New Hampshire primary suggests strong ongoing support within the GOP.

Haley’s Campaign Ad

NBC News reports that Haley is intensifying her efforts in the state by adding $2 million to her advertising budget. This increase brings her total ad spend to $6 million ahead of the South Carolina primary on February 24.

The additional funding is aimed at supporting a new television advertisement that claims Donald Trump plans to raise taxes and allow a Russian victory, reflecting Haley’s critical stance towards the former president’s policies.

Haley’s New Ad Targets Trump’s Tax and Foreign Policy

In a bold move, Haley’s campaign has released a new 30-second television spot titled “More Chaos,” which directly challenges Trump, NBC News reveals.

The ad accuses Trump of proposing policies that would increase taxes and lead to greater debt, citing his suggestion for a 10% tariff on trade imports. The advertisement also criticizes Trump’s stance on NATO, implying that his approach could lead to a Russian victory.

Trump’s Tariff Plan Criticized for Potential Tax Increase

The new advertisement from Haley’s campaign highlights Donald Trump’s proposal for a 10% tariff on imports as a significant policy flaw.

According to the ad, “A 10% across-the-board tax increase. More record-breaking debt.” This plan, first outlined by Trump in August, has been presented as a means to address unfair trade practices but is now being scrutinized for its potential to raise costs for U.S. consumers.

Janet Yellen Warns Against Trump’s Tariff Proposal

According to Reuters, Treasury Secretary Janet Yellen has expressed concerns over Trump’s tariff plan, warning that it could lead to increased costs for a wide range of goods essential to American businesses and consumers.

Yellen’s critique underscores the potential economic repercussions of such a tariff, highlighting the complexity of trade policies and their impact on the domestic economy.

Haley’s Ad Critiques Trump’s NATO Stance

NBC News notes that Haley’s campaign ad takes aim at Trump’s comments about NATO, particularly his suggestion that he would let Russia do “whatever the hell they want” to NATO countries that fail to meet spending obligations.

The ad frames this stance as potentially leading to “A Russian victory that will bring more war,” signaling Haley’s concern over Trump’s foreign policy direction.

Haley Campaign Raises Concerns Over Military and Global Security

On the campaign trail, Haley has not only criticised Trump’s approach to managing the deficit but she also voiced her worries about the implications of Trump’s foreign policy remarks, stating that they “put every military member in danger; he put every country in danger.”

This statement reflects Haley’s broader critique of Trump’s approach to international relations and national security.

Commitment to Challenging Trump

The decision to increase the ad spend in South Carolina to $6 million demonstrates the Haley campaign’s commitment to challenging Trump’s bid for the presidency.

Olivia Perez-Cubas, a spokesperson for Haley, emphasized that “With a world on fire and a crisis at home, America can’t afford Donald Trump’s chaos and unhinged policies.” This increased investment is also a response to the positive momentum gained from online fundraising around Haley’s criticisms of Trump, NBC News reports.

DeSantis Responds to Trump’s Fiscal Management

Florida Governor Ron DeSantis has directly addressed criticisms from Trump, particularly focusing on Trump’s fiscal policies during his presidency.

DeSantis criticized Trump for significantly increasing the national debt, stating, “He added almost $8 trillion to the debt in a four-year period of time.” This comment was in response to Trump’s critique of DeSantis for voting against an omnibus spending bill that Trump himself had approved, marking a clear stance by DeSantis on fiscal responsibility.

Fiscal Responsibility: DeSantis vs. Trump

Newsweek reports that DeSantis’s critique extends specifically to the signing of omnibus spending bills that contributed to the national debt’s increase from $19.9 trillion to about $27.7 trillion.

DeSantis highlighted this point to underscore his commitment to fiscal conservatism, contrasting his approach with Trump’s decisions as president.

Comparing Fiscal Policies: Trump vs. Biden Administrations

The Hill reports that the Biden administration has also enacted significant legislation impacting the deficit, including an infrastructure bill that added $256 billion to the national debt and a bill to boost domestic semiconductor production, adding $79 billion.

However, the Inflation Reduction Act is anticipated to reduce the deficit by between $200 billion and $300 billion, showcasing a different approach to fiscal management.

The Pandemic’s Impact on U.S. Deficit

Following the pandemic, the U.S. deficit soared to more than 130% of GDP, a dramatic increase from pre-pandemic levels, which were around 100% of GDP between 2012 and 2020.

Although, The New York Times reports that the deficit has slightly decreased to around 120% of GDP, it remains significantly higher than before the pandemic.

Rising National Debt and Political Responses

With the U.S. national debt reaching approximately $34 trillion, fiscal responsibility has become a central issue for Republicans, especially after gaining control of the House in January 2023, AP News explains.

The political discourse around debt and spending cuts has intensified, reflecting the urgency of addressing the nation’s fiscal challenges.

Debt Ceiling Negotiations and Government Shutdown Threats

As per information from The Hill, the U.S. faced a potential default on its debt last summer due to partisan standoffs over the debt ceiling.

An agreement to raise the ceiling averted the crisis, but threats of government shutdowns have persisted in the divided Congress, highlighting the contentious nature of fiscal policy debates.

GOP Advocacy for Spending Cuts

The Republican-controlled House has been vocal about the need for steep spending cuts to address the burgeoning national debt, CNBC reports.

This stance reflects a broader concern within the party regarding the long-term sustainability of current fiscal policies and the importance of prudent financial management.

Fiscal Policy Debates

The debate over fiscal policies, particularly those affecting the national debt and deficit, remains a hot topic in American politics, as per information from PBS.

The discussions encompass a range of issues, from the efficacy of spending cuts to the impact of new legislation on the country’s financial health.

America’s Fiscal Future

Politico reports that as the U.S. grapples with the consequences of past fiscal decisions, the focus on reducing the national debt and managing the deficit continues to be a priority for policymakers.

The ongoing debates and decisions will shape the financial landscape of the nation for years to come, with the aim of achieving a more sustainable fiscal path.