The Treasury Department has taken aim at Florida’s new anti-woke banking law, stating that it could allow criminals to use and manipulate the American financial system.

The new state regulation (HB 989), signed by Florida Gov. Ron DeSantis in May, states it would be “unsafe and unsound” for banks to consider non-monetary variables such as politics, religion or environmental, social and corporate-governance (ESG) when conducting business.

Aggressive Campaign

When signing HB 989 into law, DeSantis, who has led an aggressive campaign against so-called “woke” ideology in the Sunshine State, stated, “We reject a global elite trying to force their ideology on us by capturing major institutions.”

“We are not going to allow big banks to discriminate based on someone’s political or religious beliefs.”

Threat to National Security

Yet, while DeSantis claims he’s battling discrimination, the U.S. Treasury has stated that the Florida law is a possible threat to national security.

There are other laws similar to DeSantis’ that are under consideration in conservative dominant states like Arizona, Georgia, Idaho, Indiana, Iowa, Kentucky, Louisiana, and South Dakota.

“Strengthen Florida’s Protections”

DeSantis was aiming to “strengthen Florida’s protections for consumers… from being forced to adopt ideologies or reflect a preferred political behavior” with HB 989.

DeSantis stated that the law would safeguard the financial sector’s access to conservative groups and the firearms industry and prevent them from having their accounts frozen or closed.

Factors of the Law

Under the law, it is illegal for banks to “deny or cancel, suspend, or terminate its services to a person, or to otherwise discriminate against a person in making available such service” on the basis of several factors.

This includes the person’s political opinions, speech, or affiliations and any factor that is not a quantitative, impartial, or risk-based standard, including any factor related to the person’s business sector.

Appeal “Unwarranted Account Cancellations”

Other factors include the person’s participation in the lawful manufacture, distribution, purchase, or use of firearms or ammunition as well as the person’s participation in the exploration, production, utilization, transportation, sale, or manufacture of fossil fuel-based energy; timber, mining, or agriculture is another factor.

The state’s Office of Financial Regulation also allows Floridians to appeal “unwarranted account cancellations and restrictions.”

Conflict with Federal Law

This possibly puts banks and other monetary establishments working in the Sunshine State in a difficult situation.

They are required by federal law to implement U.S. criminal and national security policies, which include conducting thorough background checks. However, by doing so, they run the risk of breaking Florida’s comprehensive anti-discrimination law.

Open Criticism

The new Florida law and any other state laws that prevent financial institutions from conducting necessary risk assessments have been openly criticized by the Treasury.

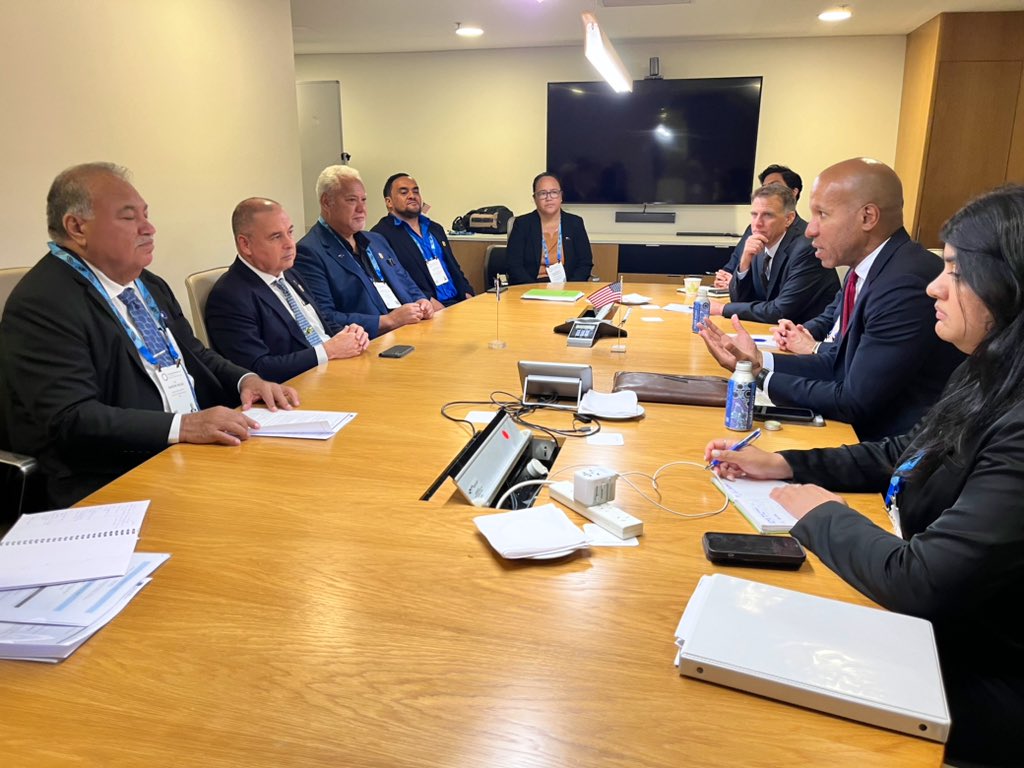

The Wall Street Journal was able to obtain a letter Treasury Undersecretary Brian Nelson sent to lawmakers in July which revealed the issues the Treasury Department has with the law.

Increasing Risks

In the letter, Nelson emphasized how crucial it is for banks to be able to investigate customers in order to combat terrorist financing and prevent money laundering.

He wrote, “State laws interfering with financial institutions’ ability to comply with national security requirements increase the risk that international drug traffickers, terrorists, transnational organized criminals, and corrupt foreign officials will use the U.S. financial system to launder money, evade sanctions, and threaten our national security.”

“Think Twice”

The letter was sent in response to a request made on July 8 by Rep. Blaine Luetkemeyer, R-Mo., Rep. Josh Gottheimer, D-N.J., and California Rep. Brad Sherman, who expressed concerns regarding the potential adverse effects of the new debanking laws.

Gottheimer issued a statement in which he said, “To any states that are considering similar laws, I urge them to think twice before putting America’s national security at risk.”

DeSantis Team Response

While DeSantis has not directly responded to the letter, his communications director made remarks on his personal feed on X.

He stated that the Biden administration is only opposing the law because it threatens the administration’s political agenda, even though the letter was sent in response to a bipartisan request earlier this month from several House lawmakers.

High-Risk Sectors

Some banks have interpreted the law as preventing them from taking a closer look at high-risk sectors.

These include trades in goods that Russia could use to aid its war effort as well as the sale of fentanyl precursors according to the Treasury Department.

The financial sector has often been utilized in order to achieve geopolitical goals such as imposing sanctions on Russia following its invasion of Ukraine.