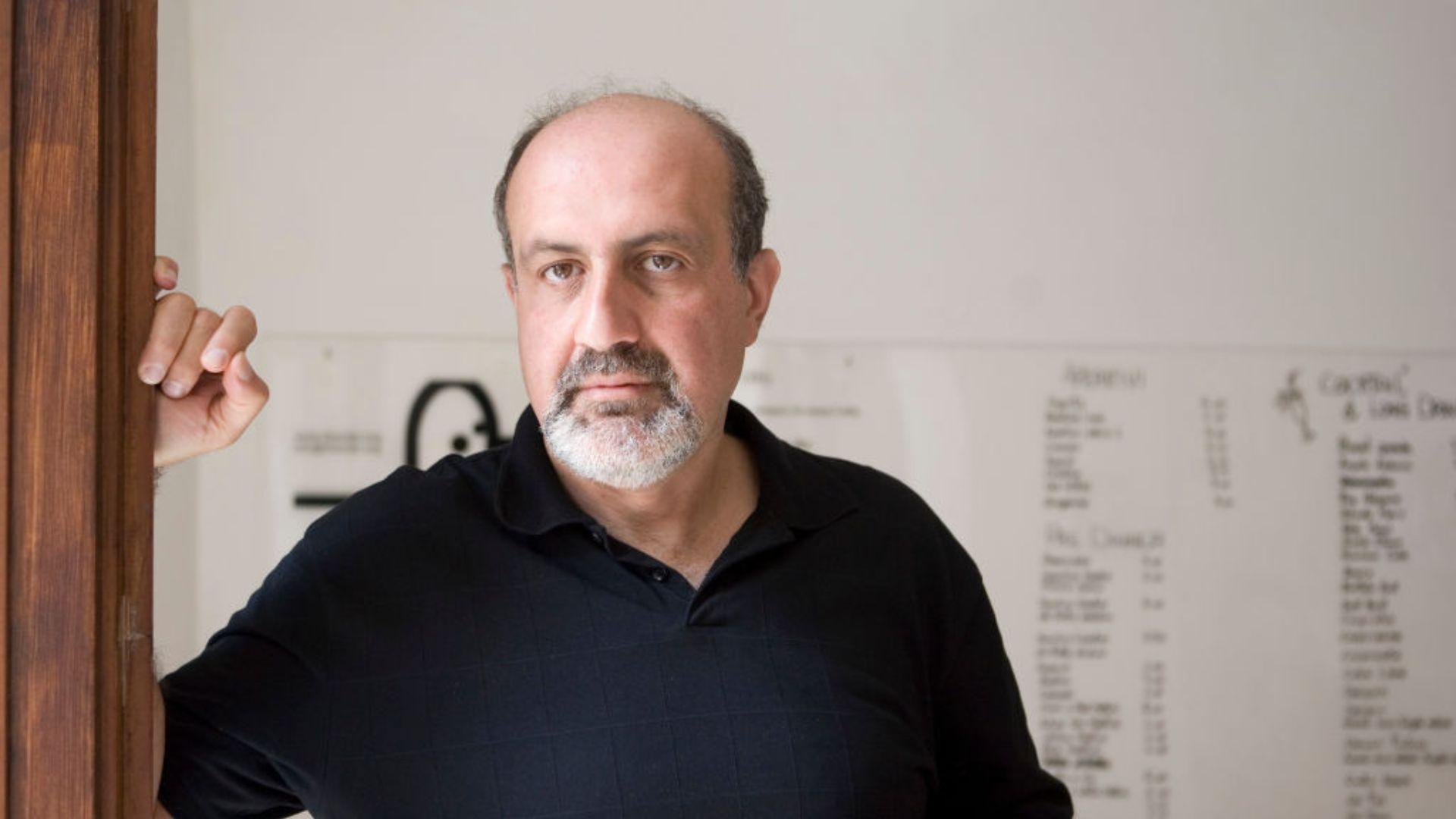

Nassim Nicholas Taleb, author of the book “The Black Swan” and renowned for his prediction of the 2008 financial crisis, has voiced concerns about the U.S. facing a “death spiral” due to its mounting government debt.

During an event hosted by Universa Investments, a Miami-based hedge fund he advises, Taleb described the national debt problem as a “white swan,” a term he uses to signify a risk that is highly probable rather than unexpected. He emphasized the critical nature of the situation, indicating that it is a more visible threat compared to the unpredictable “black swan” events he has previously written about.

The Growing Burden of National Debt

Fortune reports that the United States’ national debt has reached $34.14 trillion, translating to approximately $100,000 for every person in the country. Despite this alarming figure, some short-term economic indicators appear positive, such as decreasing inflation rates and stable employment.

However, Taleb, alongside other financial leaders like Jamie Dimon, CEO of JPMorgan Chase, has been vocal about the imminent dangers posed by the escalating debt levels, warning of severe long-term repercussions.

Dimon Highlights Looming Debt Crisis

Dimon has expressed significant concern over the United States’ current trajectory regarding its national debt. Speaking at the Bipartisan Policy Center, Dimon warned that the U.S. is rapidly approaching a critical point due to its escalating debt levels, Fox Business reports.

He emphasized the urgent need for measures to address this issue before it spirals into a full-blown crisis, indicating the severity of the situation by comparing it to driving toward a cliff with increasing velocity.

Recalling Economic Challenges of the 1980s

During a panel discussion, Jamie Dimon reflected on the economic conditions of the early 1980s, a period marked by high inflation, interest rates, and unemployment, Fox Business details.

He drew a parallel between the past and present, noting that while the economic figures were dire in the 1980s, with inflation at around 12%, the prime rate at about 21.5%, and unemployment at approximately 10%, the current debt-to-GDP ratio, which exceeds 100%, presents a more alarming challenge.

The “Hockey Stick” Growth of U.S. Debt

Fox Business reveals that Dimon used the metaphor of a “hockey stick” to describe the projected growth pattern of the U.S. national debt, highlighting its relatively stable trajectory that is expected to surge dramatically.

This growth pattern is particularly concerning because it suggests a sudden and steep increase in debt levels, which could have significant repercussions for the U.S. economy. Dimon warned that such a surge could lead to a global financial backlash, especially considering the substantial amount of U.S. government debt held by foreign entities, totaling around $7 trillion.

Anticipating a Crisis within a Decade

Dimon provided a stark timeline for the impending debt crisis, estimating that the U.S. has about 10 years before the situation becomes critical.

He likened the country’s current pace of accruing debt to driving at 60 miles per hour toward a cliff, implying that time is running out to avert disaster, as per information from The New York Post.

Paul Ryan Agrees on the Predictability of the Crisis

Fox Business notes that former House Speaker Paul Ryan, also a member of the panel, echoed Dimon’s sentiments regarding the debt situation.

Ryan labeled the looming debt crisis as “the most predictable crisis we’ve ever had,” indicating a consensus among financial and political experts about the inevitability of the problem if left unaddressed.

The Urgency of Addressing the Debt Issue

The discussion led by Dimon at the Bipartisan Policy Center serves as a critical call to action for policymakers and the public to confront the national debt challenge head-on.

By comparing the current debt situation to a dire moment in economic history and illustrating the growth of debt with a ‘hockey stick” analogy, Dimon and Ryan have highlighted the seriousness of the issue.

Congressional Actions and Their Impact

Taleb criticized the U.S. Congress for its continuous extension of the debt limit, arguing that this practice stems from a fear of facing the immediate consequences of fiscal responsibility.

“So long as you have Congress keep extending the debt limit and doing deals because they’re afraid of the consequences of doing the right thing, that’s the political structure of the political system, eventually you’re going to have a debt spiral,” he said, according to Bloomberg.

The Search for a Solution

Regarding potential solutions to the burgeoning debt crisis, Taleb suggested that a miraculous intervention might be necessary, Fortune reports.

His commentary reflects a deep-seated concern about the capability of the current political system to effectively address the issue.

Market Valuations Under Scrutiny

In addition to his warnings about national debt, Fortune reports that Taleb also expressed skepticism about the current state of stock market valuations.

He pointed out a disconnection between traditional valuation metrics and the actual worth of companies, saying, “We have no idea how to value companies.”

Risks in Venture Capital Investments

Taleb also highlighted the precarious nature of venture capital investments, where substantial profits have been made from companies that ultimately failed to generate sustainable revenues.

Fortune reveals he said, “Think of the number of people who made a lot of money in venture capital off of companies that ended up making no money. Someone got stuck with that bill at the end of the meal. This is what I mean about these crazy company valuations.”

The “Death Zone” of High Valuations

Echoing Taleb’s concerns, Mike Wilson of Morgan Stanley used the term “death zone” to describe the perilously high valuations in the stock market, per Fortune.

Wilson’s comments suggest that investors, driven by liquidity, are reaching unsustainable heights, risking severe consequences when market conditions change.

The Warning from Wall Street’s Summit

This grim analogy, drawn from the challenging realms of high-altitude mountaineering, made by Wilson of Morgan Stanley, highlighted the precarious position of investors who, driven by a mix of necessity and choice, have pushed stock prices to perilously high levels, Fortune reveals.

Wilson’s commentary suggests that this financial ascent is leading investors into areas “where they know they shouldn’t go and cannot live very long.”

The Mountaineering Metaphor for Market Risks

According to Fortune, Wilson has compared the current market rally to a hazardous climb, referencing the tragic narrative of mountaineering expeditions depicted in Jon Krakauer’s “Into Thin Air”.

The S&P 500’s significant rally, up 16% from October lows and 6% since the year’s start, is seen as a trek into the financial equivalent of the “death zone”. This term describes altitudes at which human life cannot be sustained for long due to insufficient oxygen levels, drawing a parallel to the current market conditions where investors are chasing gains despite the inherent risks.

Elevated Valuations and the Warning of Thin Air

Wilson warns that the S&P 500’s price-to-earnings ratio has escalated to 18 by the end of the last year from 15 in October, indicating that the market has reached its thinnest air since the bull market began in 2009.

Despite these warning signs, investors seem to be disregarding the risks, opting to invest in even more speculative stocks. This behavior, according to Wilson, represents a dangerous course, as it assumes markets can ascend without facing significant downturns.

Wilson’s Track Record and Future Predictions

Wilson’s reputation for accurate market predictions is well-established, having correctly foreseen last year’s sell-off, which marked the worst performance for U.S. equities since the global financial crisis, Fortune reports.

His latest forecast suggests a challenging road ahead, with the stock market expected to bottom out this spring before a modest recovery in the second half of the year. However, the anticipated year-end gains for the S&P 500 are minimal, expected to close at 3,900 points, slightly up from December 2022’s close of 3,839.

The Mirage of Market Optimism

Fortune notes that Wilson critiques the prevailing optimism within the stock market, arguing that it is largely based on an illusion. This optimism is driven by expectations that the Federal Reserve’s pause on rate hikes and the possibility of a soft economic landing will buoy the market.

He highlights a concerning trend where this positive sentiment is artificially supported by a massive infusion of liquidity from global central banks, which have injected $6 trillion into the economy since October. Wilson warns that this buoyancy may mislead investors into overlooking the substantial risks that lie ahead.

Questioning the “No Landing” Scenario

Wilson’s skepticism extends to the discussions around a “no landing” scenario within the market—a concept that suggests the economy might avoid a recession or significant downturn altogether, Fortune explains.

He views this as a psychological trap set by the “death zone,” where the thin air of high market valuations leads investors to see and believe in outcomes that may not have a basis in reality. This scenario, according to Wilson, is one of the many illusions that can distort investors’ perceptions and decision-making processes.

Tech Giants as Market Pillars

Despite widespread caution about overvaluation, some analysts remain optimistic about the role of major tech companies in stabilizing the market, Fortune notes.

The “Magnificent 7” including Alphabet, Amazon, Apple, Meta Platforms, Microsoft, Nvidia, and Tesla, are seen as central to the market’s future. This perspective offers a contrast to the broader concerns about valuation and market sustainability.

Globalization Increases Economic Vulnerability

Bloomberg reports that Taleb pointed out that the global interconnectedness resulting from globalization makes the U.S. economy more vulnerable to international shocks.

This increased exposure adds another layer of complexity to managing the national debt crisis, as issues in one part of the world can quickly affect economies elsewhere.

Taleb’s Track Record and Current Concerns

With a history of accurately predicting financial downturns, including the 2008 crisis, Taleb’s warnings carry significant weight, per Bloomberg.

His advisory role at Universa Investments, known for its focus on protecting against market downturns, positions him as a key observer of financial stability.

Consensus on the Need for Fiscal Reform

Other financial experts, including former Treasury Secretary Robert Rubin, and BlackRock Inc.’s Vice Chairman Philipp Hildebrand, have echoed Taleb’s concerns about the U.S. debt.

In an interview with Bloomberg, Rubin highlighted the nation’s “terrible place” regarding federal deficits, suggesting tax increases as a potential solution.

A Gloomy Outlook for the Political System

Taleb’s assessment of the situation is not just financial but also deeply political.

Fortune reports that he said in response to how the problem could be corrected: “We need something to come in from the outside, or maybe some kind of miracle, this makes me kind of gloomy about the entire political system in the Western world.”

Diagnosis on the Debt From the Council on Foreign Relations

In December, the Council on Foreign Relations weighed in on the debt crisis, calling the current debt “levels not seen since World War II.”

The piece blamed a variety of factors. Top on the list of blame fell to excessive spending during the COVID-19 pandemic, which took debt to nearly $26 trillion in 2023. According to the Council of Foreign Relations, the national debt is almost the same size as the U.S. economy.

How Did We Get Here?

According to the Council on Foreign Relations, after World War II, America briefly had a federal surplus when comparing GPD to spending.

Given that information, just how did we end up in such massive debt not even a century later? One of the answers to this question is sustained economic growth. All the borrowing the United States did from World War II was effectively offset by a burgeoning economy.

Keeping the Borrowing Going

The American government got more used to borrowing as a matter of policy. They could rely on the economy to continue growing to offset the percentage of debt that continued to accrue.

Even during future wars like Korea and Vietnam did not see a substantial increase in debt relative to American GDP. In the 1960s, entitlement programs like Medicare were established. According to the Council of Foreign Relations, debt bottomed out at 24 percent in 1974 when compared to the nation’s GDP.

Ronald Reagan and the 1980s

When the Republican candidate Ronald Reagan won a huge victory over his Democrat opponent Jimmy Carter, he ushered in a new era of American government spending.

He vastly increased the amount the government was spending on the military, but more importantly, he instituted sweeping tax cuts that made the government take in much less tax revenue. This was the start of a period of rising debt.

Bill Clinton Increased Taxes

During the 1990s the Clinton administration worked to undo the effects of the tax cuts from previous years.

President Bill Clinton signed the Tax Reform Act of 1993, which raised the top federal income tax rate and other tax rates. The combination of these efforts and a prosperous economy is that the Clinton administration managed to achieve a balanced government budget for the first time in 30 years in 1998. (via Center for American Progress)

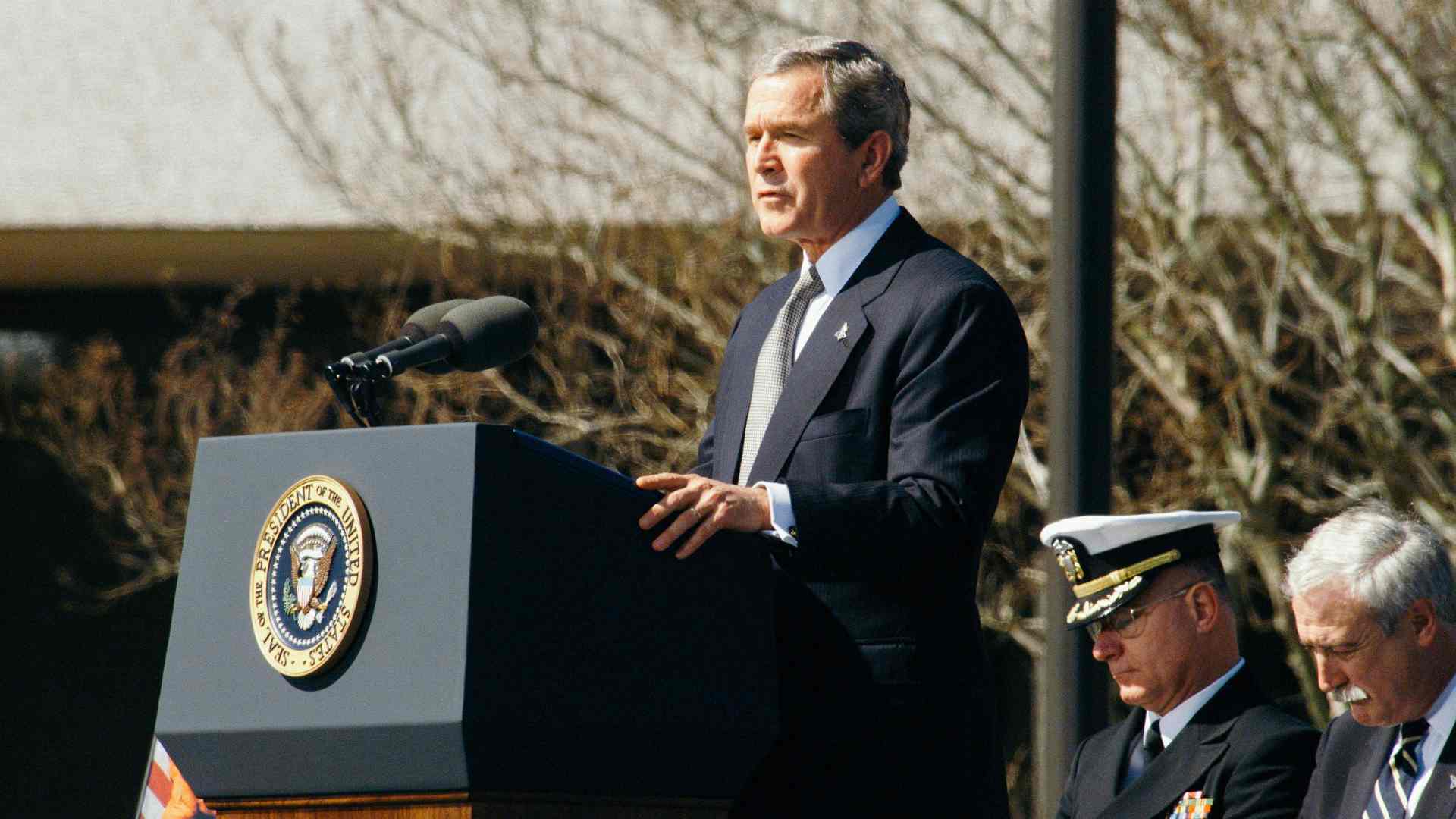

The Bush Tax Cuts

In a familiar pattern, the next Republican President, George Bush, saw fit to reintroduce tax cuts while increasing spending on foreign wars like Afghanistan and Iraq. In 2006, Medicare Part D went into effect, which supplemented existing Medicare with coverage for expensive prescription drugs.

The cost of Medicare Part D for citizens was around $26 a month in 2006 and has since increased to $48 per month in 2024. (via Statista)

Government Spending Has Become Routine

At this point, it has been several decades of government spending expansions and the introduction of new things to spend that money on.

The American government and voters of both political parties had gotten used to demanding their leaders spend their way out of the problems of the day. This meant that when the financial crisis of 2008 hit Americans, the solution would also come through government spending.

Barack Obama’s Stimulus Package

In response to the financial crisis, dubbed the “Great Recession”, Democrat President Barack Obama instituted the American Recovery and Reinvestment Act of 2009.

This act eventually provided $831 billion to help save the economy through the creation of jobs and the repairing of infrastructure. While the act was ultimately successful in saving jobs and reversing negative economic trends, it put the US national debt at $1 trillion for the first time in history. (via National Archives)

What Does The Government Spend All Its Money On Today?

The United States budget is divided into discretionary spending, mandatory spending, and interest on debt payments.

According to the Congressional Budget Office, discretionary spending accounted for 26% of the budget in 2022. Around 65% of the budget goes to mandatory expenses like Medicare and Social Security. 8% of the budget in 2022 went to interest payments on the debt, which was $475 billion that year.

Entitlement Programs Are a Large Part of the Budget

According to the Congressional Budget Office, a whopping 19% of the budget went to Social Security in 2022.

The government spent $1.2 trillion on social security during that year. Medicaid accounted for 9% of spending at $592 billion. $747 billion went towards paying for Medicare, which represents 12% of the budget. Just these three programs together accounted for 40% of the entire federal budget in 2022.

How COVID-19 Accelerated Debt

According to a report by USA Facts, the United States government spent nearly $6.6 trillion dollars in 2020. Of that spending $2.6 trillion was earmarked for the COVID-19 response, with $1.6 trillion actually being spent that same year.

USA Spending estimated based on 2023 data that the current budgetary allocation for the COVID-19 response has reached at least $4.7 trillion in total.

There Isn’t a Clear Solution on the Horizon

Although there are many ideas proposed by politicians, unfortunately, there is not a simple way to eliminate the spiraling debt so easily.

Even harder than that, the rising political polarization of the country makes it hard for these politicians and their voters to agree on the way forward. There is a lack of desire to compromise to find the solution, which may be necessary to ultimately solve the issue.