The Internal Revenue Service is warning taxpayers of a new “elaborate scam” set up to steal your tax refunds.

Pretending to set up an account or offering to help filing, these scammers will hit your personal information and steal your identity.

Official Warning

The scam was revealed by the IRS in a press release on April 1. The hijacking of taxpayer’s personal accounts online is rampant enough to merit an official warning.

IRS Commissioner Danny Werfel explained in the release, “An Online Account at IRS.gov can help taxpayers view important details about their tax situation. But scammers have realized the sensitive information there is valuable to them, so they’re now focusing on tricking people that they need help setting up an account.”

The IRS’ Official Website

Only processes done on the IRS.gov website are official. Whether setting up an account, checking on your refund, or looking at your payments, the only valid place to do so is the website.

IRS spokesperson Eric Smith spoke to CNBC and emphasized, “If someone contacts you saying, ‘We’ll help you set up an IRS account and send us all of your information,’ that’s bogus.”

Identity Theft

In many cases, a third party account will advertise services or approach taxpayers about signing up for an online account.

If a taxpayer agrees, the third party account will be able to gain details of their identity, including addresses, Social Security number, photo identification, and other sensitive materials.

Keep It Private

Hence, the agency’s warning that taxpayers should never allow anyone else to set up an online account on their behalf. Doing it yourself is the safest way to keep your possible tax refund safe.

People should also be wary of the unexpected occurrence of the IRS and other financial institutions reaching out of the blue. Taxpayers are urged not to share sensitive personal data over the phone, email, or social media.

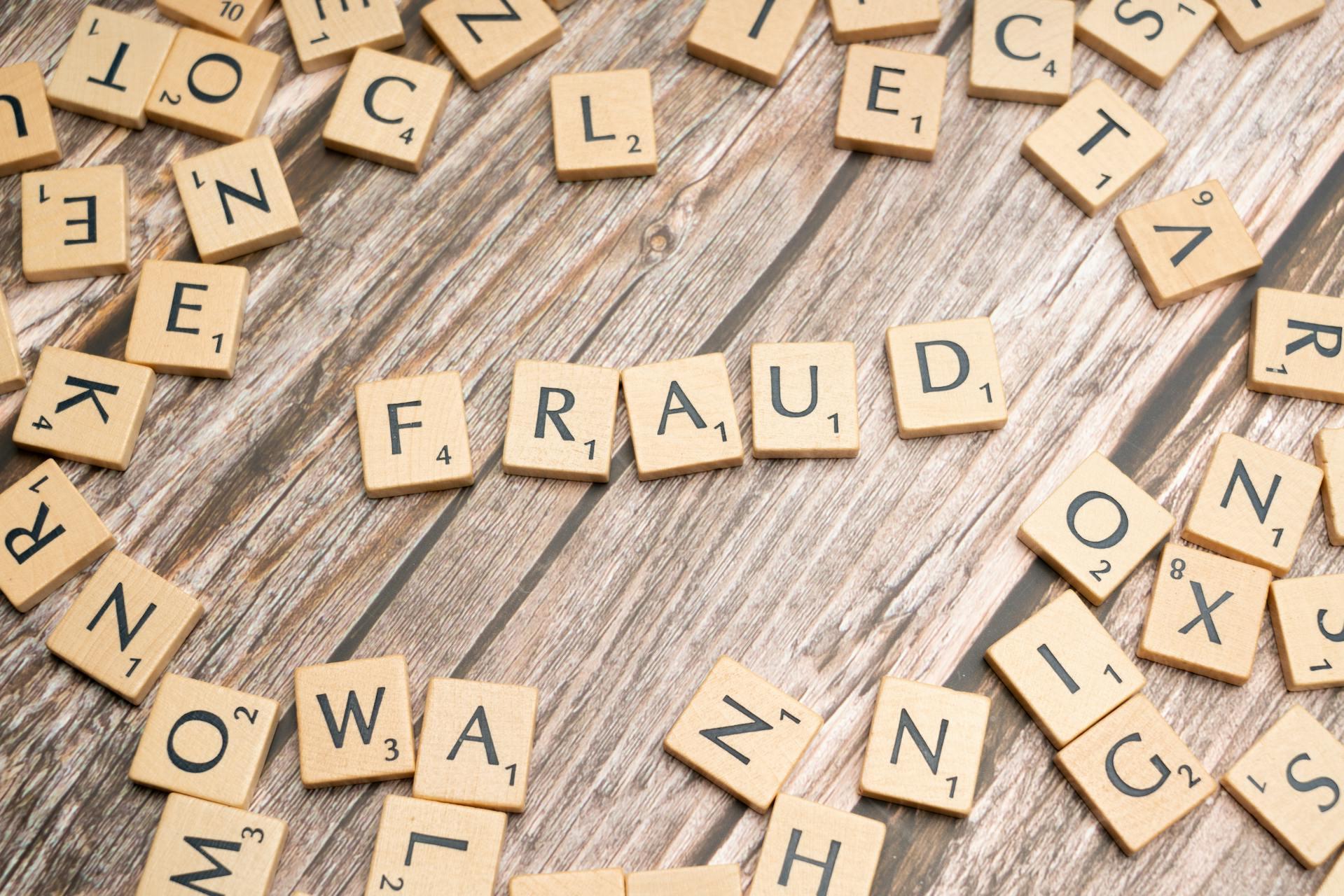

More Common Than You Think

It’s an elaborate scam, the IRS said in a press release, but unfortunately it’s more common than you think. The agency reported 294,138 cases of identity theft in 2023, with a total over $5.5 billion in tax fraud.

So, what should a person do if they think a scammer is targeting them? Report the activity by filling out Form 14242. Then, submit it via (snail) mail or the agency’s website.

Know Their Tactics

To avoid getting scammed, knowing how the scammers work might be a good idea. Playing on people’s fear and sense of urgency, as well as throwing money as bait, are usually how they work.

Saying that there was a problem with your tax report or offering a bigger tax refund is a commonplace tactic. Amy Nofziger, director of victim support at the AARP Fraud Watch Network, said, “When people are under pressure and under anxiety, they might do something with the speed that they’re not thinking through it and not doing their research.”

A Dozen Tax Scams

Identity theft is just one among many types of scam. There are at least a dozen tax scams usually committed by scammers, with different targets. Seniors and non-English speakers are among their targets.

Security expert Petros Efstathopoulos advised taking simple steps to prevent getting scammed, like not answering unfamiliar numbers. But if the call happens on a landline, there’s a trick to answering the phone. “If my bank calls me and says ‘Hi, I need some information’, I say ‘Thank you very much, I’ll call you back on the number I know is yours,’” he said.

Know the Real IRS

With many scammers impersonating the IRS, how would someone know it’s really the agency calling? Chief scientist at Aura, a digital security company, Dr. Zulfikar Ramzan said the organization’s “old fashioned way” is a clue.

That’s right — the IRS usually contacts taxpayers through the physical mail, using the US Postal Service. Ramzan explained, “Typically, they’re going to ask you to contact them either via their website or by sending correspondence directly to their main address, which is easy to verify.”

From Audits to Criminal Investigation

Even the IRS website has a very detailed list of how the agency usually contacts the taxpayers. For an audit, for example, it may reach out to the taxpayer by mail and conduct an in-person interview.

For an investigation of a tax crime, however, the IRS may show up unannounced. And when collecting taxes, IRS officers carry special identification and will help you, in person, directly understand your obligations.

Helpful Tools

Another nifty tool to avoid getting scammed by people claiming to be “tax professionals” is the IRS directory of Federal Tax Return Preparers with Credentials. If the “tax professional” is not listed, it’s better to avoid them.

And AARP Foundation has a Tax Aide Site Locator. It “provides free tax assistance with several preparation options now through April 15,” implying that a trustworthy “tex professional” wouldn’t charge you. The website also coaches you on how to prepare your own tax online.

The Scam Continues

Unfortunately, many scams don’t stop with the end of the tax season. There are still many other scams that rob people of their money. Being vigilant is the only way you can get through it.

Sharing what you know with your loved ones, especially older family members, will be helpful. It helps them falling victim to a tax crime and perhaps even soothe their worries over taxes.