Over the past year, President Biden has forgiven nearly $144 billion in student loan debt among nearly 4 million Americans.

However, it’s become glaringly apparent that almost every one of those 4 million Americans are Millennial Gen Xers. President Biden has essentially left Gen Z out of it.

Gen Z Has More Student Debt Than Millennials

According to data collected by the Federal Reserve Bank of St. Louis, Gen Z, who were born between 1997 and 2012, actually have more student debt than Millennials.

They found that the average Gen Zer has $20,900 in student debt, which is 13% higher than the average for Millennials. Additionally, the median debt among Gen Z is 14% higher than Millennials at $12,800.

Biden’s Relief Plans Focus on Older Borrowers

As of 2024, Gen Zers are between 12 and 26 years old, which means they’re either headed to college, currently studying or have recently graduated. So, while the average Gen Zer with student loans has a higher debt percentage than Millennials, there are far fewer of them.

Almost half of the 72.24 Millennials in the United States have student debt, so simply statistically speaking, it makes sense that President Biden decided to focus first on helping these 35 million people.

Why Did Biden Relieve Billions in Student Debt?

It’s important to understand that President Biden didn’t just create plans to help Millennial borrowers get out of crushing student debt because there were more of them.

Biden had promised that he would forgive student debt during his campaign in 2020 because the vast majority of Americans were exceptionally frustrated with the student loan system. Specifically, Biden wanted to cancel the loans for former students who were misled by for-profit schools between 10 and 20 years ago.

Biden Forgave $6.1 Billion in Debt for Students of The Art Institutes

For example, President Biden just passed a bill that forgave $6.1 billion in debt for students who attended one of the many schools of the for-profit organization The Art Institutes.

He and the U.S. Department of Education agreed that the organization made “pervasive and substantial misrepresentations to prospective students about post-graduation employment rates, salaries and career services.” Therefore, those students deserved to be compensated.

Biden Hasn’t Completely Forgotten About Gen Z

Although the president has passed several pieces of legislation that forgave billions of dollars in student debt, not every one of his bills has been approved.

In 2023, the Supreme Court denied one of the president’s plans to cancel $430 billion in student debt. If this bill had gone through, the majority of all borrowers in the U.S., including millions of Gen Zers, would have seen up to $20,000 of their debt forgiven. Still, the Supreme Court ruled that the federal government did not have the authority for such an enormous “bailout.”

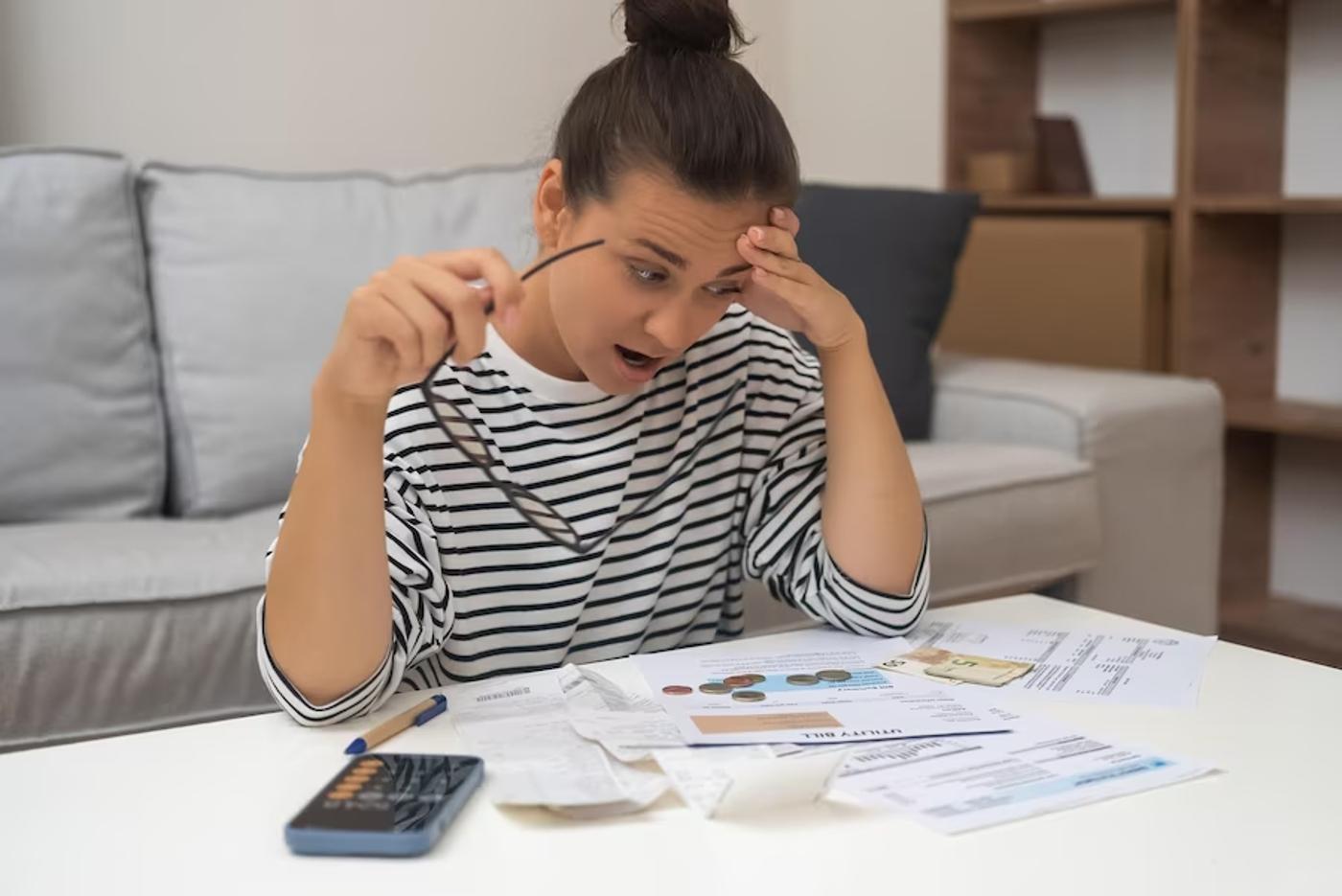

Gen Zers Are Graduating College at an Extremely Tumultuous Time

Sadly for the Gen Z generation, they are and will be graduating from college during an exceptionally hectic time in history.

From the job market to the cost of living, Gen Zers are starting their lives in the “real world” with disadvantages their Gen X parents could not have imagined.

Jobs for Graduates Are Certainly Not Guaranteed

Throughout U.S. history, having a college degree almost always meant the guarantee of a solid job after graduation. But that’s not really the case anymore.

The current job market is wildly uncertain. From the use of AI to the increase in labor costs, companies around the country are cutting back on new staff, and job opportunities are slim. Additionally, many companies that once only accepted applicants with college degrees are opening their doors to people who didn’t complete higher education.

The Cost of Living in America Is Higher Than Ever

Also, Gen Zers paid more for college than any previous generation, as the average cost of one year at a four-year institution is now a whopping $19,806. Which, of course, means that after school, they will owe more than anyone else.

To make matters even worse, the inflation rate in the U.S. has increased the cost of living to an almost outrageous price point. Millions of younger Americans are struggling to pay their utilities, rent and groceries every month, let alone pay back their debt.

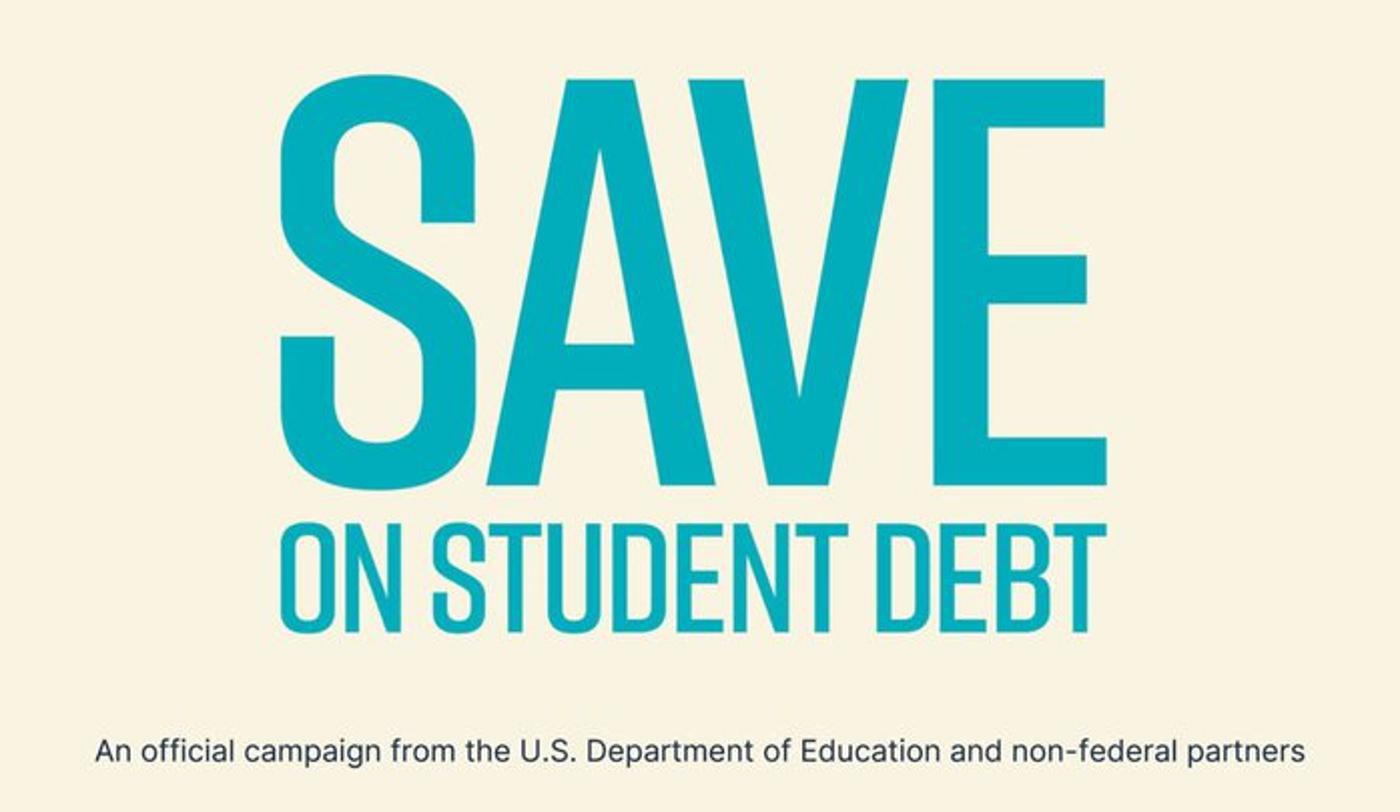

Gen Z Will Benefit From the SAVE Plan

However, while the vast majority of Gen Zers are not seeing any immediate relief from Biden’s student forgiveness plans, there are new policies that will potentially help these kids fare better than their Millennial predecessors after graduation.

SAVE, a plan from the U.S. Department of Education, offers millions of Gen Zers the opportunity to make smaller monthly payments on their student debt, which directly correlates to their income. Within this plan, some of their debt could even be completely forgiven over time.

Many Gen Zers May Wait to Pay Off Their Loans Until More Forgiveness Plans Are Passed

Because SAVE offers the possibility of debt forgiveness in the future and Gen Zers witnessed the president canceling billions of dollars of debt for Millennials, many of the younger generation believe that they won’t have to pay back their loans.

There is already talk that millions of Gen Zers may refuse to pay their student loan bills and try to wait and see if future legislation offers them the same benefits. However, financial experts are warning Gen Zers against this course of action.

Experts Warn Gen Zers Not to Put Off Paying Student Loans

Alex Beene, a financial literacy instructor at the University of Tennessee at Martin, told Newsweek that “avoiding your student loan payments will have long-term financial repercussions on your credit score.”

They also explained that “there’s no guarantee there will be forgiveness plans down the line.” So, while millions of Millennials got their student loans completely forgiven, it may never happen for Gen Z.