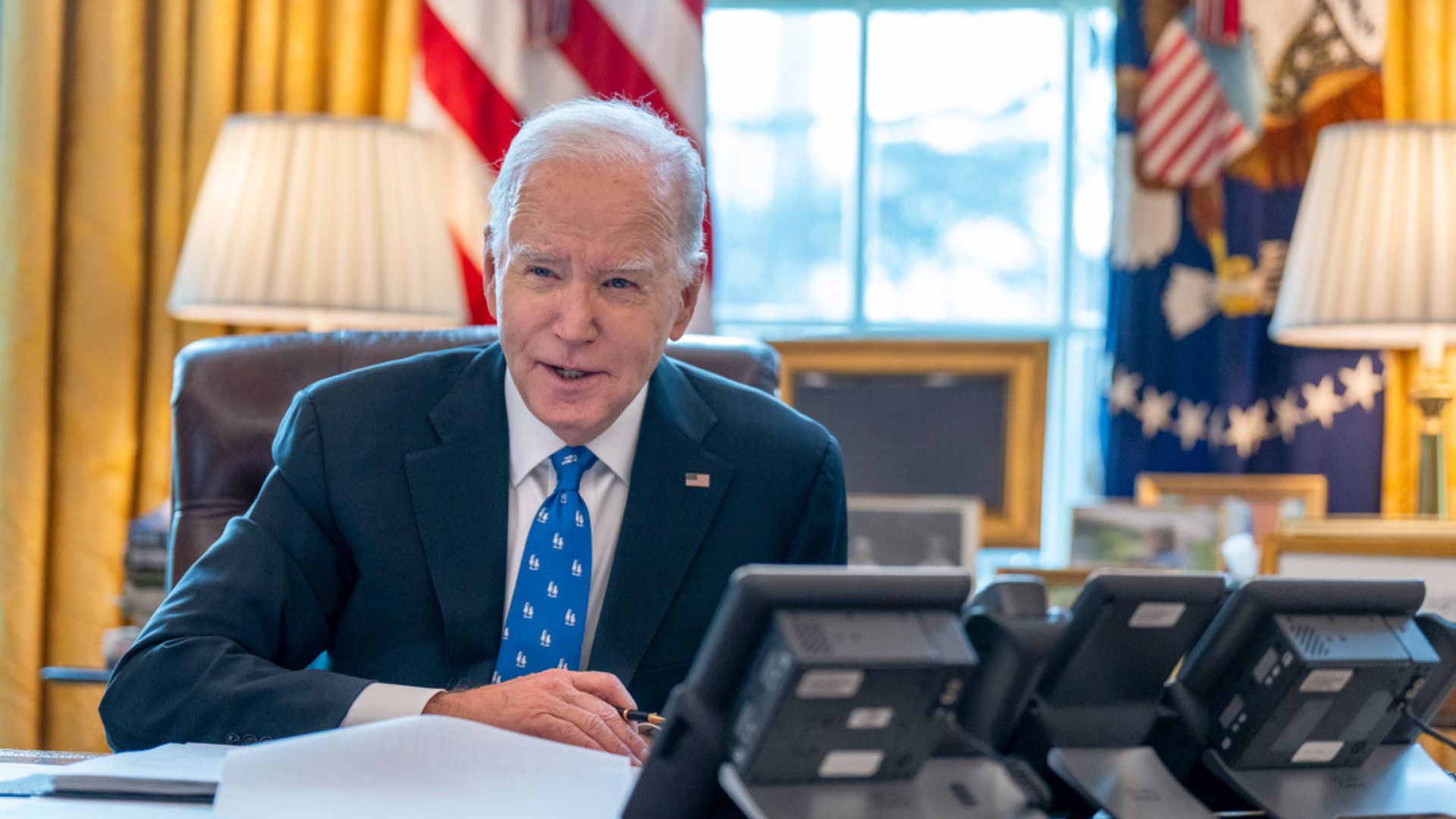

In response to the challenges many Americans face with high interest rates and rising home values, President Joe Biden, in his State of the Union address, introduced a proposal for a new tax credit aimed at first-time homebuyers.

This initiative suggests a $10,000 tax credit to aid individuals entering the housing market for the first time, aiming to make homeownership more attainable amidst financial hurdles.

Additional Support for Upgrading Homeowners

President Biden also put forward a proposal for a separate $10,000 tax credit targeted at existing homeowners. This credit is designed for those looking to sell their “starter home” to purchase a larger residence.

The intention behind this move is to stimulate the real estate market, particularly benefiting homeowners who are currently reluctant to sell due to the increased mortgage rates compared to the rates they locked in during the pandemic.

Historic Housing Address Recognized

The proposals put forth by President Biden have been met with enthusiasm from affordable housing advocates.

David M. Dworkin, CEO of the National Housing Council, lauded Biden’s address as “the most consequential State of the Union address on housing in more than 50 years.”

Highlighting the Housing Affordability Issue

Nick Luettke, an associate economist at Moody’s, reflected on the significance of housing affordability across various demographics and political divides.

He noted the steady housing policy in recent congressional budgets, emphasizing the widespread recognition of housing affordability as a critical issue. Luettke’s comments suggest that the proposed tax credits could address a concern that affects a broad spectrum of Americans.

Challenges with Closing Costs and Mortgage Payments

The proposed $10,000 tax credit, while appearing beneficial, may not fully cover the expenses associated with selling and buying a home.

Closing costs, including broker commissions, inspection fees, and loan-origination fees, could consume the entirety of the tax credit. Additionally, the possibility of increased housing payments exceeding the $10,000 mark raises questions about the long-term financial implications for homeowners.

The Impact of Rising Mortgage Rates

CBS News highlighted a stark comparison between current and past mortgage rates, illustrating the financial strain on homeowners.

For instance, a decade ago, the average mortgage payment was significantly lower than what it is today due to the lower interest rates at the time. This increase in mortgage rates presents a challenging landscape for those looking to buy or sell homes.

Financial Considerations for Homeowners

The decision to sell a home and purchase a new one, encouraged by Biden’s tax credit proposal, might not be financially advantageous in the long run.

Homeowners could find themselves paying considerably more over time, especially with the increase in mortgage rates. This situation highlights the need for careful financial planning and consideration before making such a significant decision.

Comparison to Credit-Card Promotions

The National Review draws an analogy between Biden’s housing proposal and credit-card promotions that offer initial benefits followed by higher costs.

This comparison is used to caution against the potential financial pitfalls of the proposal. It is a reflection of concerns similar to those raised by the Consumer Financial Protection Bureau regarding credit-card promotions.

Homeowners’ Concerns Highlighted

Homeowners like MacKenzie Kipp express skepticism about the financial viability of Biden’s proposed tax credit, especially for those who benefited from historically low mortgage rates. She said “I understand the intention behind Biden’s proposal, but frankly, the math doesn’t add up for me.”

The increase in interest payments over time, as a result of selling and buying with the current rates, could outweigh the immediate benefits of the $10,000 tax credit.

The Lock-In Effect and Its Consequences

The Federal Housing Finance Agency (FHFA) has identified a “lock-in” effect, where rising mortgage rates deter homeowners from selling due to the prospect of higher rates on a new mortgage.

This effect has tangible impacts on housing mobility, market supply, and home affordability, illustrating the broader implications of current mortgage rate trends on the real estate market.

Market Dynamics Amidst High Rates and Prices

Despite the challenges posed by high interest rates and home prices, there remains activity in the housing market. A report by the National Association of Realtors, indicates a significant monthly increase in existing-home sales.

However, the year-over-year decline in sales suggests that high rates and prices are influencing buyer decisions, highlighting the complex dynamics of the current housing market.

Congressional Approval Required

For President Biden’s housing proposals to take effect, they must first be passed by Congress.

This legislative hurdle poses a significant challenge to the implementation of the tax credits.

Impact on Rental Market

Biden’s new housing plan could significantly impact the rental market. With more individuals moving from renting to owning, rental demand might decrease, potentially leading to lower rental prices.

However, this shift could also reduce rental property supply, affecting availability. The dynamics between landlords and tenants will be crucial in determining how rental affordability and housing stability are impacted in the long run.

Regional Disparities in Housing Markets

The $10,000 tax credit’s effectiveness will vary across different U.S. regions. In high-cost areas like San Francisco or New York, this amount might barely dent the high entry barriers for first-time homebuyers.

Conversely, in more affordable regions, the credit could be a substantial boost. Regional economic conditions, housing supply, and local market trends will influence how beneficial this credit is in different locales.

Environmental Considerations

Encouraging homeownership through tax credits can have significant environmental implications. Increased housing demand might lead to more urban sprawl unless guided by sustainable development practices.

Incentives for green building and energy-efficient homes could be integrated into the plan, promoting environmentally friendly housing solutions. This alignment with sustainability goals could enhance long-term benefits for both homeowners and the environment.

Green Building Practices

To maximize the environmental benefits of the housing plan, additional incentives for green building practices could be introduced. Homeowners might receive extra credits for investing in energy-efficient appliances, solar panels, or sustainable materials.

Such measures would not only reduce the ecological footprint of new homes but also lower long-term utility costs for homeowners, aligning financial and environmental goals effectively.

Alternative Housing Solutions

Beyond tax credits, innovative housing solutions could address affordability issues. Co-housing, tiny homes, and increased investment in affordable housing projects offer diverse approaches.

These models can provide more flexible and sustainable options, particularly in urban areas where space is limited. Encouraging a variety of housing types could ensure that the benefits of Biden’s plan reach a broader spectrum of the population.

Co-housing and Tiny Homes

Co-housing communities and tiny homes present viable alternatives to traditional homeownership. These models foster community living and efficient use of space, reducing overall housing costs.

They can also be more sustainable, requiring fewer resources to build and maintain. Promoting such innovative housing solutions could complement Biden’s tax credit plan, offering more inclusive and affordable options for diverse demographics.

Challenges for Low-Income Homebuyers

Low-income families face distinct challenges in leveraging the proposed tax credits. Barriers such as saving for a down payment, securing affordable financing, and navigating the buying process can be significant.

Additional support measures, like down payment assistance programs and financial counseling, could be necessary to ensure these families benefit from the new housing plan and achieve stable homeownership.

Financial Barriers

Financial barriers often prevent low-income individuals from entering the housing market. Even with a $10,000 tax credit, the initial costs of homeownership, including down payments and closing costs, can be prohibitive.

Enhancing access to affordable financing options and providing financial assistance for these upfront costs could help bridge the gap and make homeownership a more attainable goal for low-income families.

Technological Innovations in Home Buying

Technological advancements are revolutionizing the home-buying process. Online platforms, virtual tours, and digital mortgage services simplify purchasing a home, potentially reducing costs and time.

These innovations can enhance the effectiveness of Biden’s tax credits by making the home-buying process more accessible and efficient, allowing more individuals to take advantage of the financial incentives offered.

Digital Mortgage Services

Digital mortgage services streamline the home buying process by offering online applications, instant approvals, and reduced paperwork. These services can lower the costs associated with securing a mortgage, making homeownership more accessible.

By integrating such technologies into the housing plan, the administration can enhance the user experience and efficiency, ensuring that more people can benefit from the proposed tax credits.

Role of Financial Education

Financial education is crucial for potential homebuyers to make informed decisions. Programs focusing on budgeting, credit management, and understanding mortgage options can empower individuals to navigate the complexities of homeownership.

By incorporating financial literacy initiatives into the housing plan, the government can help ensure that recipients of the tax credits are well-prepared to handle the responsibilities and financial implications of buying a home.

Financial Literacy Programs

Financial literacy programs can significantly impact the success of homeownership initiatives. By educating potential buyers on budgeting, credit scores, and mortgage processes, these programs equip them with the necessary tools to make sound financial decisions.

Implementing widespread financial education as part of Biden’s housing plan could enhance the long-term stability and success of new homeowners, ensuring they are better prepared for the financial challenges ahead.