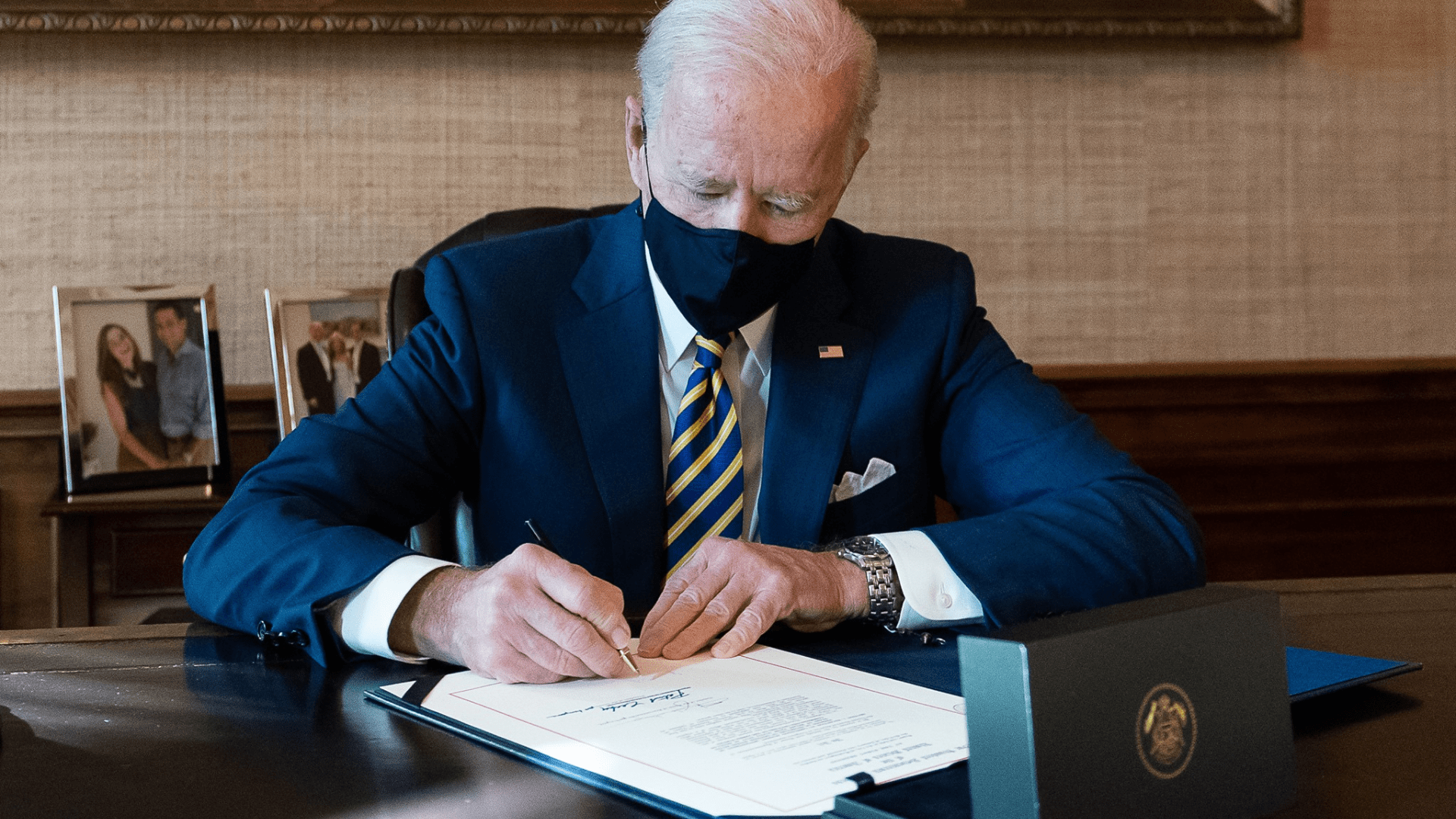

Earlier this year, the Biden administration announced new labor laws that sent shockwaves through the American workforce.

The new rules took effect March 11th, and in doing so redefined the classification of workers, particularly in the gig economy, marking a significant departure from the independent contractor model that has become very popular in recent years.

Companies Reliant on Gig Work Perform Internal Audits

Finance expert John Williams delves into the far-reaching implications of this transformative change in a comprehensive video analysis.

One costly consequence of this change is that companies who rely on independent contractors or gig workers are forced to perform internal audits and ensure full compliance ahead of schedule. See the full video here.

Biden’s Labor Law Reclassifies Workers as Regular Employees

The essence of the Biden Administration’s labor reform lies in reclassifying workers as employees rather than independent contractors.

This shift, aimed at fortifying worker protections and benefits, has generated substantial concerns regarding its potential ramifications for businesses and the broader economy. There have been a lot of questions around its rapid implementation and the readiness of both employers and workers for such a seismic shift.

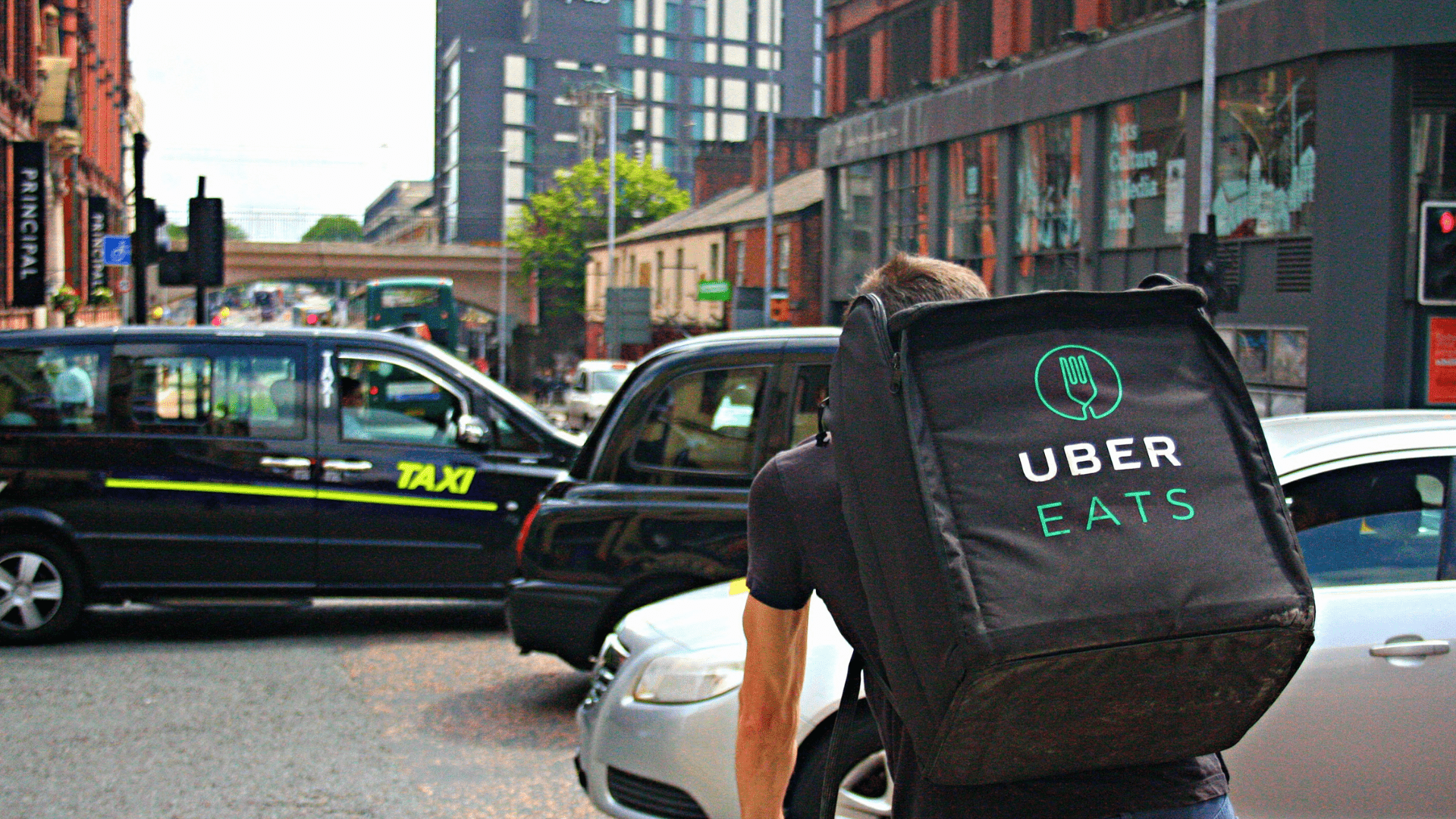

Labor Law Will Affect Gig Economy Workers Across America

Gig economy workers make up a substantial portion of the American workforce and will bear the immediate impact of these new rules.

Under the Fair Labor Standards Act, employers are mandated to provide minimum wage, overtime pay, and various statutory benefits to classified employees. The failure to adhere to these guidelines may expose businesses to significant damages and penalties, even in cases of unintentional misclassification.

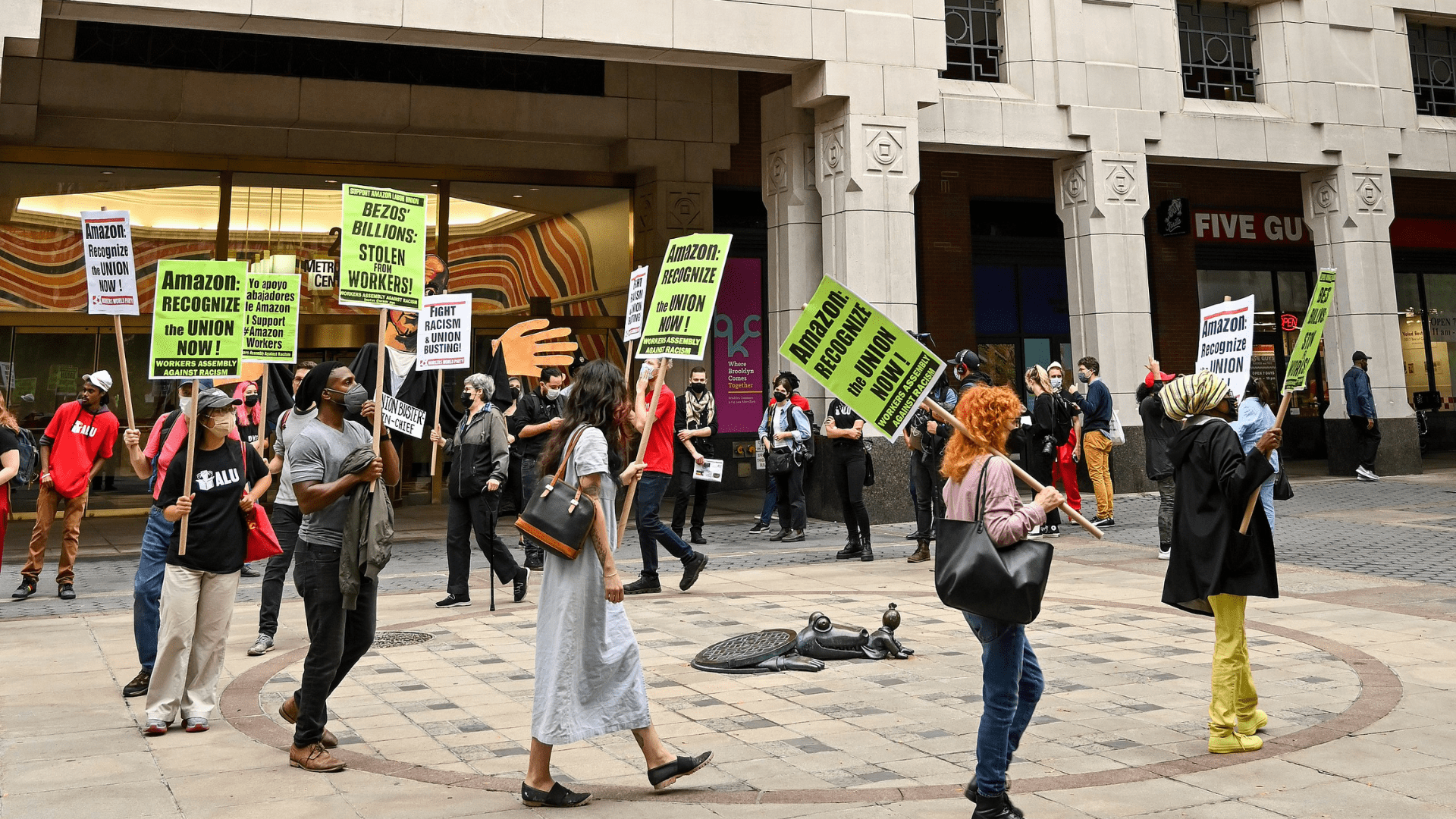

Group of Freelancers Files Lawsuit Against Department of Labor

The discontent with these regulations has manifested in legal challenges.

A group of freelance writers and editors has filed a lawsuit against the U.S. Department of Labor, contending that the new rule, unveiled just last week, is so vague that it violates the U.S. Constitution.

Business Given No Useful Guidance About New Labor Rules

This legal action adds a layer of complexity to the implementation of the rules, signaling potential legal battles and protracted debates over the constitutionality of the labor reform.

In their lawsuit, the freelancers stated that “Businesses are given no useful guidance on the scope of the statute and cannot structure their conduct to comply with its demands,” which they believe may cause businesses to drop gig workers simply out of fear and uncertainty.

Repercussions Extend to Construction, Trucking, and Healthcare

The repercussions extend far beyond the gig economy, reverberating through industries such as construction, trucking, and healthcare.

As noted, companies, both large and small, are now scrambling to conduct internal audits to ensure compliance and mitigate the risk of penalties from the IRS. The urgency of this audit emphasizes the challenges businesses face in adapting to the swift and comprehensive changes imposed by the new rules.

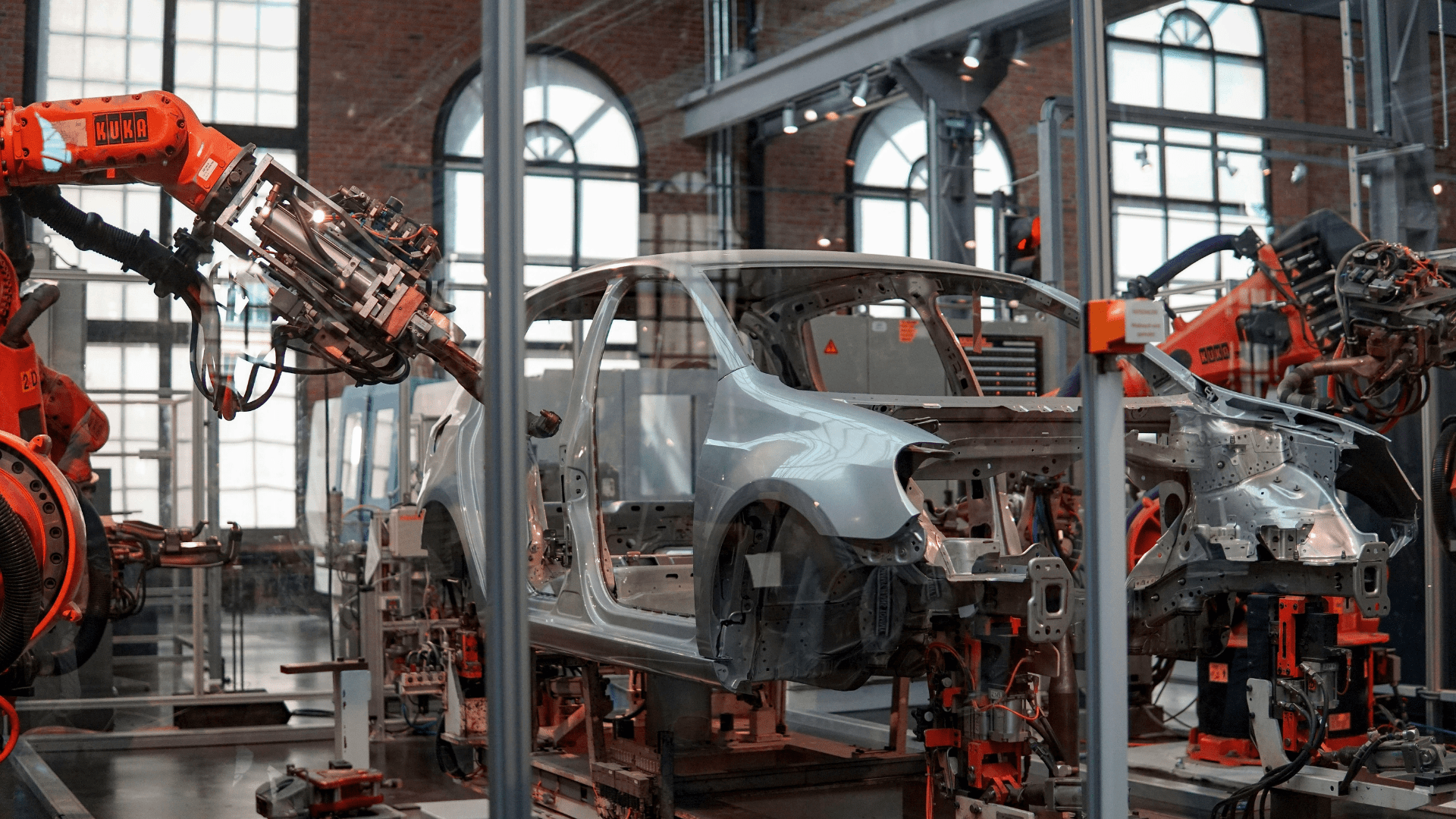

Labor Law Could Create Substantial Financial Strains

The transition from independent contractor to employee status poses substantial challenges for businesses.

The financial strain induced by this shift may lead to layoffs, outsourcing, and an increased reliance on automation. This is compounded by the conclusion of the Biden Administration’s relief programs for small businesses, painting a somber picture for the economic landscape.

Expert Foresees an Economic Fallout

Finance expert John Williams foresees an economic fallout, warning of a potential wave of defaults and delinquencies as millions of Americans face job losses and financial uncertainty.

The already precarious state of household debt, auto loan debt, and credit card debt amplifies the looming threat of further economic hardship. There is an obvious need for proactive measures and strategic financial planning in the face of these potential challenges.

Practical Advice for Those Grappling with Economic Fallout

In response to these developments, Williams offers practical advice to individuals grappling with the impending changes.

Prioritizing debt reduction, engaging in comprehensive financial planning, and positioning oneself to leverage what he anticipates as the greatest wealth transfer in American history are key recommendations. Seeking assistance in addressing credit issues and preparing for the anticipated economic challenges are crucial steps for individuals navigating this transformative period.

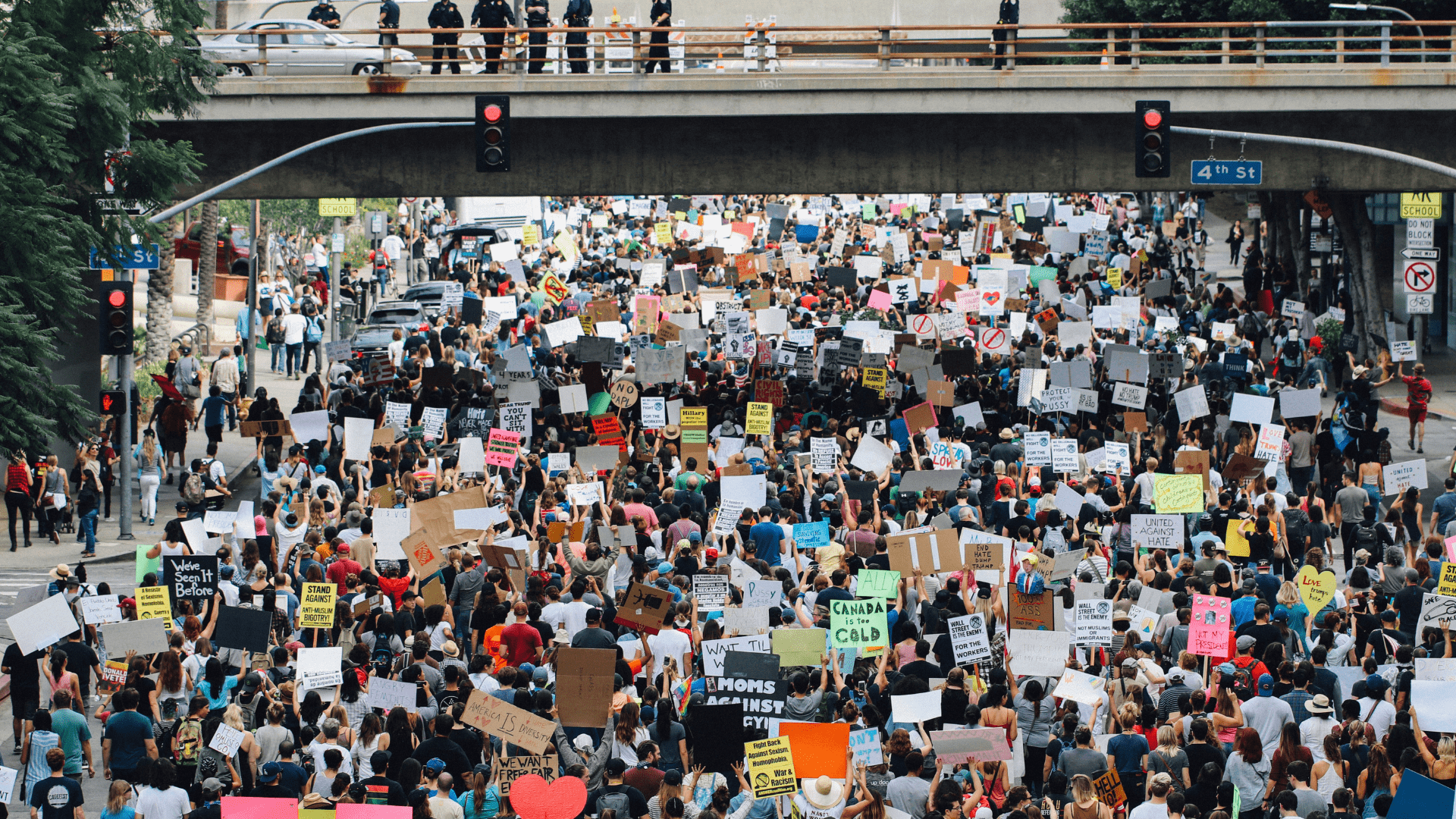

Public Sentiment Regarding New Labor Rules

Public sentiment reveals bitterness and skepticism towards the government’s role in these labor rule changes.

In comments on Williams’ video, Individuals express concerns about the legality of tax collection and the perceived infringement on their right to work and earn as much as they desire. The potential consequences, including a shift of teenage starter jobs to illegal adults and the emergence of a black market labor force, are highlighted by commenters.

March 11th Deadline Approaches

As the March 11th deadline approaches, the nation stands on the precipice of a seismic shift in the labor landscape.

The Biden Administration’s decision is groundbreaking, marking a pivotal moment in labor policy that sets the stage for a new era of economic uncertainty in America. Williams concludes his analysis by urging viewers to stay informed, take proactive steps to secure their financial futures, and brace for the turbulent times ahead.