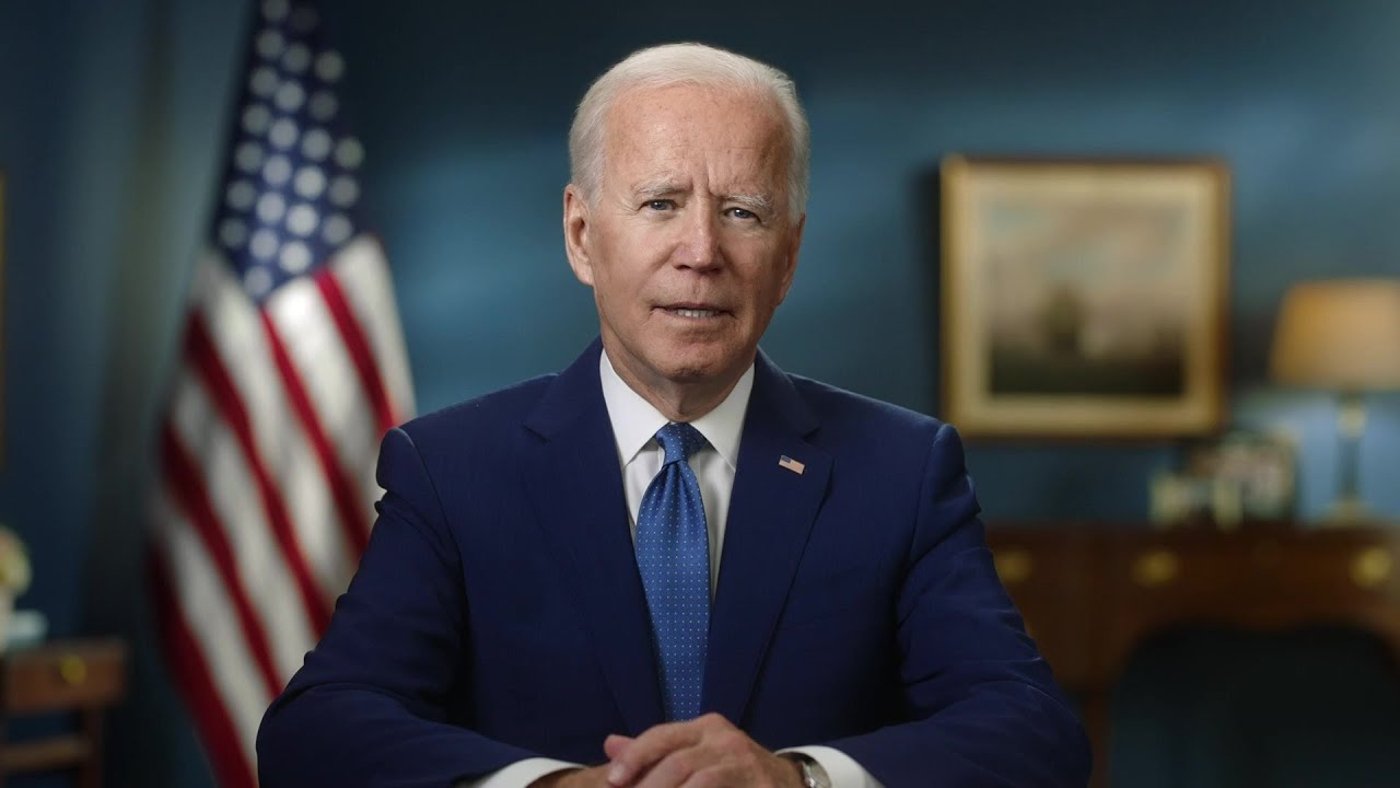

President Biden is still intent on canceling student loans. But a new study is saying that his latest plan will burden taxpayers heavily.

The president’s cancellation plans will bring relief to many Americans but it’s accruing criticism from the opposite side of the political corridor. Now let’s study the plan.

New Plans

Under the latest cancellation plans, the total cost of the student loan cancellation plans that taxpayers must bear is a whopping $559 billion.

Households earning more than $300,000 in annual income will benefit the most.

Long-Term Debt Relief to Lower-Income Households

The estimates came from the University of Pennsylvania’s Penn Wharton Budget Model, a study analyzing President Biden’s student debt relief.

Accroding to the study, “The main reason for this high average household income is that the SAVE plan already provides long-term debt relief to households with lower incomes.”

Billions Added to the Old Plan

The Budget Model estimates the new plans announced by Biden in early April 2024 will cost $84 billion over a decade.

This figure is outside the previous figure the Budget Model previously estimated for President Biden’s SAVE plan ($475 billion.) The total of the new plans and SAVE plan amounts to $559 billion.

Biden’s Commitment to Canceling Student Debt

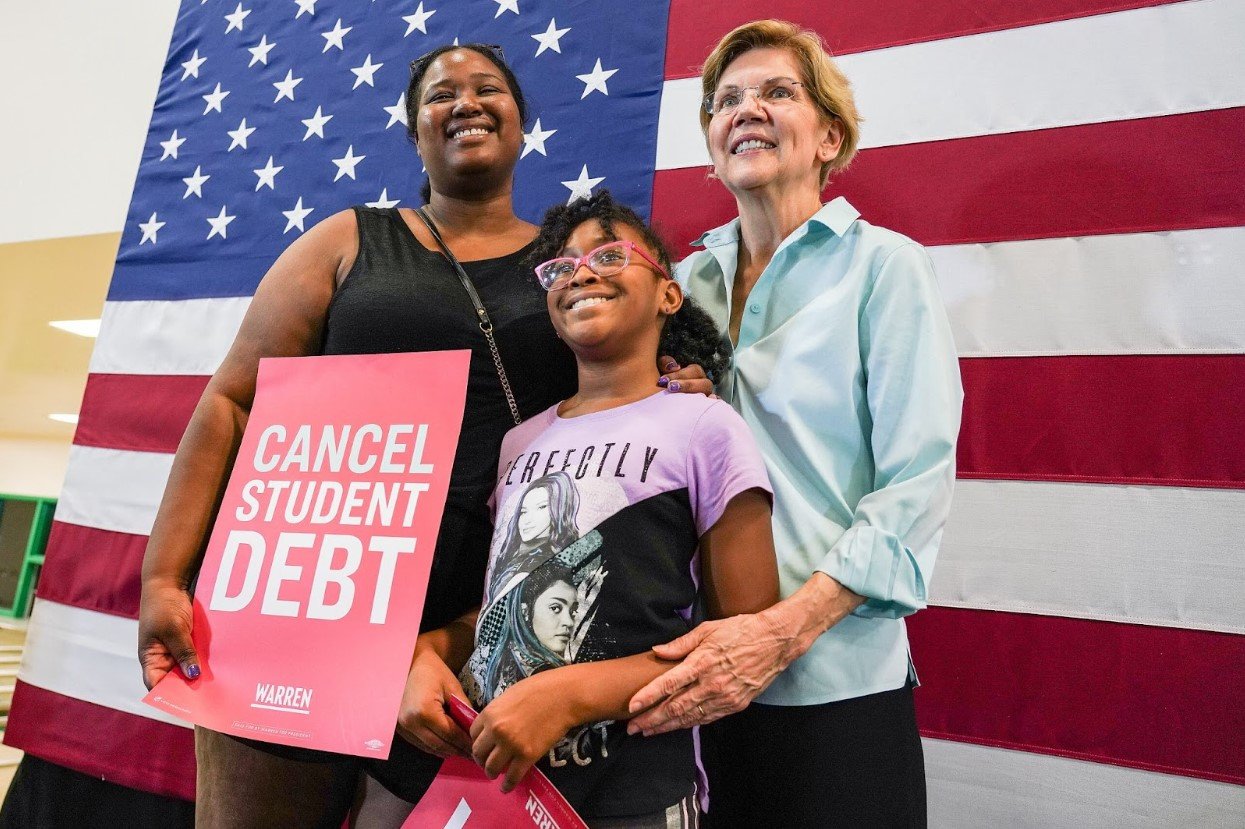

Back in April, the Biden Administration announced its plans to cancel student loans for another 277,000 borrowers.

At the time, this accounted for around $153 billion in total debt forgiveness.

Biden Administration Looking Out for Hardworking Americans Says Education Secretary

Cardona continued by suggesting that millions could benefit from the SAVE program introduced by the Biden administration.

“As long as there are people with overwhelming student loan debt competing with basic needs such as food and healthcare, we will remain relentless in our pursuit to bring relief to millions across the country.”

Is SAVE Safe?

The SAVE (Saving on a Valuable Education) Plan was rolled out last summer in 2023.

It’s an income-driven repayment scheme in which many borrowers are eligible for $0 payments if they earn less than the federal poverty limit.

7.5 Million Americans Enroll in Safe

Since the program was launched last year, more than 7.5 million borrowers have enrolled in this repayment plan.

Forgiveness was even granted to borrowers who’d been paying for at least ten years with an original loan of $12,000 or less.

Relief for High-Income Households

Besides the new price tag of over $500 billion, the Budget Model finds the new plan will relieve some longer-term student debt.

The relief comes for about 750,000 households making over $312,000 in average household income.

Households Across the US Can Save More Money

According to the Penn Wharton Budget Model study, the high average household income can be attributed to the SAVE plan.

It already provides long-term debt relief to households with lower incomes and will allow Americans to put more money into savings.

High Average Debt Relief

Under the new plan, households earning more than $312,000 annually and with more than 20 years in repayment will have their debt relieved on average by $25,541.39.

Plus, it should be noted that the Budget Model doesn’t count Biden’s April 12th announcement that he would cancel $7.4 billion in student debt for 277,000 additional borrowers.

Erasing Older Than 20-Year-Old Debt

Under the new plan, the Biden administration will cancel student loan debt without income limits for borrowers who only have undergraduate student debt and entered repayment 20 years ago.

The cancellation also applies for those with graduate student debt that first entered repayment 25 or more years ago.

Slammed by Republicans

In the tense political climate of an election year, the Penn Wharton Budget Model is fueling Republicans to criticize the president.

House Budget Committee Chairmen Jodey Arrington (R-Texas) already fired a shot, arguing that it’s unconstitutional. Arrington also accused the move as the president’s “quest to buy votes.”

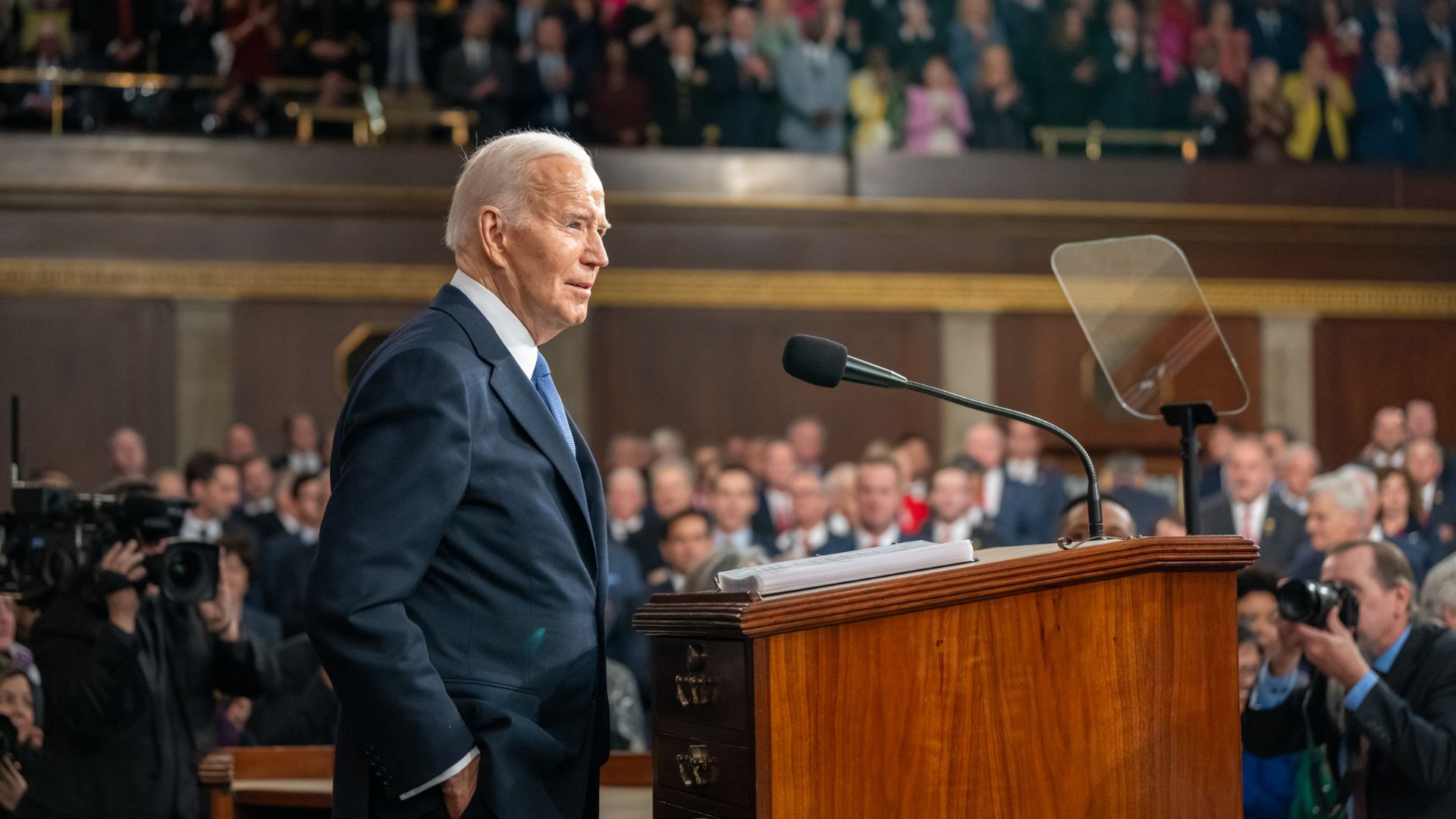

Saddling America With More Debt

Arrington claimed Biden was placing heavy burdens on the American taxpayers during a statement.

”In reality, his plan will shift the responsibility of paying for loans owed by high-income earners who freely incurred them onto the backs of all taxpayers, many of whom do not even have a college degree.”

Biden Saddles US With More Debt

During the statement, Arrington went on to suggest the Biden administration will undoubtedly increase the national debt.

“[Biden’s] administration is dead set on circumventing the Supreme Court, defying Congress, and saddling our country with more debt,” he added.

Biden’s First Plan Was Rejected

Biden’s SAVE Plan commenced only weeks after the Supreme Court rejected another student cancellation plan of his.

That earlier plan, announced in June 2023, would’ve erased a $430 billion debt by more than 40 million borrowers.

11 States vs. Biden

11 states with Republican leaders ended up filing a lawsuit against the president and Education Secretary Miguel Cardona as a response to the SAVE plan.

Filed in Kansas, the lawsuit is backed, among others, by Texas, Alaska, and Louisiana.

Biden Administration Unmoved

But the Biden administration remains unmoved, even by the lawsuit.

They are fully committed to providing as many Americans as possible with financial relief by canceling student debt.

Many Borrowers Relieved

The borrowers surely have no complaints when it comes to the Biden administration’s SAVE plan.

The 10% who’ve been approved for some debt relief under Biden’s many student loan cancellation programs are grateful.

The SAVE Plan is a Game Changer

According to Lauren Michael, an interior designer in Raleigh, North Carolina, the SAVE plan has helped change her life.

“We don’t want our loans dictating our life choices and us not being able to do other things because we’re paying so much money. The SAVE plan is definitely a game changer for us.”

Critics of the SAVE Program

While the SAVE debt relief plan may help millions of Americans, not everyone is on board.

Critics, such as House Education and Workforce Committee chairwoman Virginia Foxx, argue the financial burden is simply being shifted.

The Biden Administration is Tone Deaf, Says Chairwoman

According to Foxx, “The administration is tone deaf. There’s no other way to put it,” and went on to criticize the Education Department for its debt cancellation “scheme.”

Foxx is under the impression that the cancellation of student debt will result in an increase in tax for those without college degrees.

The Biden Administration Isn’t Doing Its Job

“That has been frustrating, especially since it has jeopardized the academic journey of millions of students,” Foxx said.

“But what is absolutely maddening is that the administration is STILL not doing its job and instead focusing on its student loan shenanigans.”