Over the past two decades, the American dream of homeownership has shifted dramatically. As of today, homeowners are likely to spend an average of 11.9 years in their residence, a stark increase from the 6.5 years noted in 2005.

This trend, heavily influenced by Baby Boomers, has significantly contributed to the current property shortage and heightened home prices across the nation. With Baby Boomers opting to stay put, the expected turnover of homes that could rejuvenate the market is markedly absent, creating a bottleneck for younger generations eager to step onto the property ladder.

Financial Comfort for Boomers in Their Homes

A significant factor deterring Baby Boomers from downsizing is the financial comfort of living mortgage-free. According to Redfin, over half the Boomer generation owns their homes outright, enjoying minimal living expenses without the burden of a mortgage.

This financial advantage has made the prospect of moving and tackling a new mortgage at current rates far less appealing. The result is a generation of homeowners with little incentive to move, exacerbating the already critical shortage of available homes.

Millennials’ Mobility Meets Market Constraints

Millennials, characterized by their job mobility and changing lifestyle demands, face a starkly different housing market than their predecessors. Despite their readiness to move more frequently, Millennials are finding themselves boxed out of the market by high prices and low inventory.

The generational shift in homeownership tenure reflects broader economic and societal changes but also highlights the significant impact of Boomer homeownership and the availability of affordable homes for younger buyers.

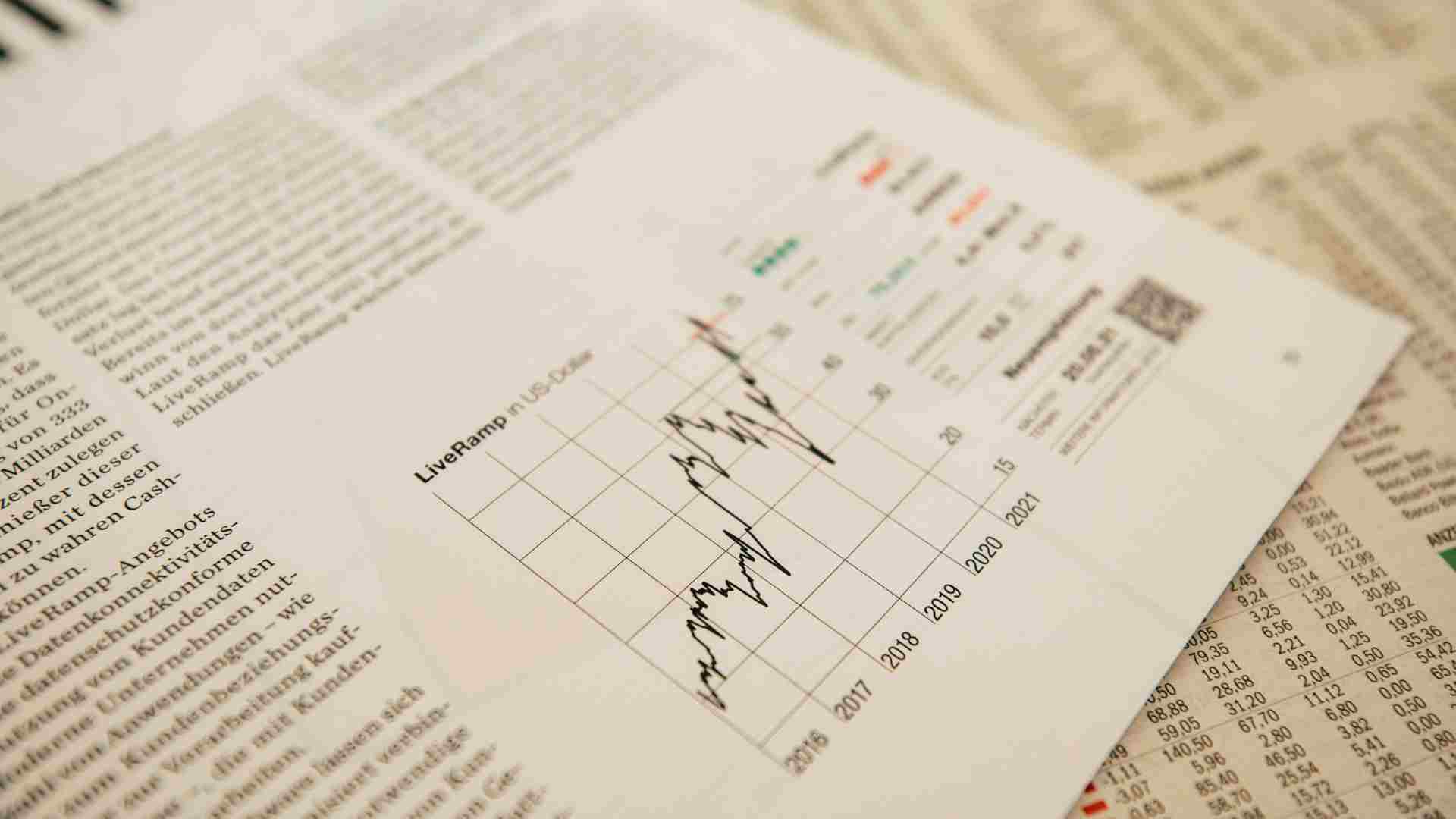

Soaring Mortgage Rates Discourage Selling

The current mortgage landscape, with rates hovering around 6.77%, according to The Washington Post, presents a daunting challenge for potential sellers. Homeowners, particularly those from the Boomer generation who might consider downsizing, are deterred by the prospect of taking on a new mortgage at these elevated rates.

This reluctance further tightens the housing market, keeping available inventory at a minimum and preventing the traditional natural cycle of home sales that could lead to more reasonable prices and availability.

Anticipating the Market’s Future

Analysts like Meredith Whitney tell Business Insider that the housing market is on the cusp of a significant correction, driven by a gradual increase in Boomer downsizing. While this shift is unlikely to result in a dramatic crash, it is expected to alleviate some of the pressure on the housing market, offering hope for future buyers.

This correction, however, will unfold slowly, reflecting the gradual nature of demographic and economic changes influencing the market.

Regional Differences in Housing Dynamics

The impact of Boomer homeownership is not uniform across the United States. In states across the Sunbelt, the housing market dynamics differ significantly.

These areas, attractive for their tax benefits and growing economies, may see continued growth despite broader national trends of movers.

Generational Disparities in Homeownership

Today’s housing market is marked by significant generational disparities, per The Washington Post. Baby Boomers disproportionately occupy larger homes, often with much more space than they need, while Millennials and Gen Z struggle to afford their first homes.

This imbalance not only highlights the challenges facing younger generations but also points to the broader issue of housing allocation and affordability in the current market.

The Cost of Aging in Place

The preference among Baby Boomers to age in place and maintain their lifestyle in familiar neighborhoods has a direct impact on the housing market.

This trend limits the availability of larger homes for younger families who are looking to move up from starter homes. The shortage of suitable housing options for these families is a direct consequence of the decision by many in the older generation to hold onto their properties longer than previous generations did.

Wage Stagnation vs. Housing Price Inflation

The struggle for Millennials and Gen Z to afford homes is also impacted by wage stagnation relative to the rapid inflation of housing prices (via Forbes).

This economic squeeze makes it increasingly difficult for younger generations to achieve milestones such as homeownership, traditionally seen as a cornerstone of financial stability and adult life.

The Silver Tsunami: A Gradual Wave

Some industry observers have coined the term “Silver Tsunami” to describe the anticipated wave of homes that will hit the market as Baby Boomers downsize. However, this influx of properties is expected to be more of a trickle than a flood, with the demographic shift occurring gradually over the coming years.

This slow pace means that while some relief to the housing shortage is on the horizon, it may not be as immediate or as impactful as some hopeful buyers might wish.

Worse Before It Gets Better?

The combination of wage stagnation, housing price inflation, and the Silver Tsunami has created a perfect storm for younger generations looking to buy homes.

As more and more Millennials and Gen Z enter the workforce and start families, their demand for housing will only continue to rise. However, with limited options available and prices beyond their reach, many may be forced to delay homeownership.

Looking Ahead: A Glimmer of Hope for Affordability

As mortgage rates are expected to decline slightly, there’s cautious optimism for an improvement in housing affordability in 2024. This potential easing of financial constraints could open the door for more young families to enter the market.

However, the long-term solution to the housing shortage will likely depend on a more substantial increase in the inventory of available homes, driven by a generational shift in homeownership patterns.