Vermont is the latest state to propose a plan to tax its wealthiest residents in the name of equality and funding the government.

“Tax the rich” has become a popular political slogan among progressive Democrats and activists. There is a general unwillingness among the Democratic base to accept government cuts, which means the only option Democratic leaders can take is to increase taxes to cover budget shortfalls.

Vermont’s Plan for Wealth Taxes

Government lawmakers in Vermont have put forward two separate proposals for adding wealth taxes to the state. One plan would involve putting a 3% additional tax on every Vermont resident who makes more than $500,00 in gross income (via CBS News).

The other plan would place a capital-gains tax on assets valued above $10 million. These types of proposals are becoming increasingly popular with Democratic voters.

What Is a Wealth Tax?

A wealth tax is an additional tax an individual must pay based on their income, wealth, or property. While the idea has been popular with progressive Democrats lately, the idea is not unheard of in America’s history.

Previously in U.S. history, there was a wealth tax imposed on property. This general property tax in America applied to essentially all property that someone could own. Over time its scope was narrowed because it started hurting the middle class as well.

What Is a Capital-Gains Tax?

Unlike a wealth tax on income, a capital-gains tax only applies once someone sells an asset. The tax takes a percentage of the profits the person is able to earn on it. The most common assets that a capital-gains tax applies to include things like stocks or real estate.

A capital-gains tax differs based on the time the asset is held. Short-term capital-gains tax applies to assets held for less than a year and is taxed at the same rate as a person’s ordinary taxable income.

Efforts at a Wealth Tax are Spreading

In just the previous year, eight different states have proposed some form of wealth tax.

Some states making these proposals are hoping to find a way to compensate for falling tax revenues. Tax revenues in many states have been suffering from the declining economy and circumstances arising from the pandemic. Lawmakers are hoping to use these taxes to continue funding social programs in their states.

California’s Efforts to Tax the Rich

California has been experiencing difficulty funding the government in recent years. CalMatters reported in December 2023 that the state is projected to have a budget deficit of as much as $68 billion in the 2024 to 2025 fiscal year.

Gov. Gavin Newsom and Democratic lawmakers have been hard at work drafting proposals that include wealth taxes for the highest earners and an additional 1% tax on residents who have more than $50 million in assets.

Americans Support Wealth Taxes

Democrats and Americans generally support tax proposals that make the rich in society pay more.

A poll by Gallup in 2022 showed that six out of 10 Americans are not happy with the way income is distributed in the country. Of those polled, 52% said they would support heavy taxes on the rich, while 47% of respondents disagreed.

A Popular Refrain from High-Profile Democrats

Many Democrats running for high offices in the country have relied on wealth tax rhetoric to earn the support of their base.

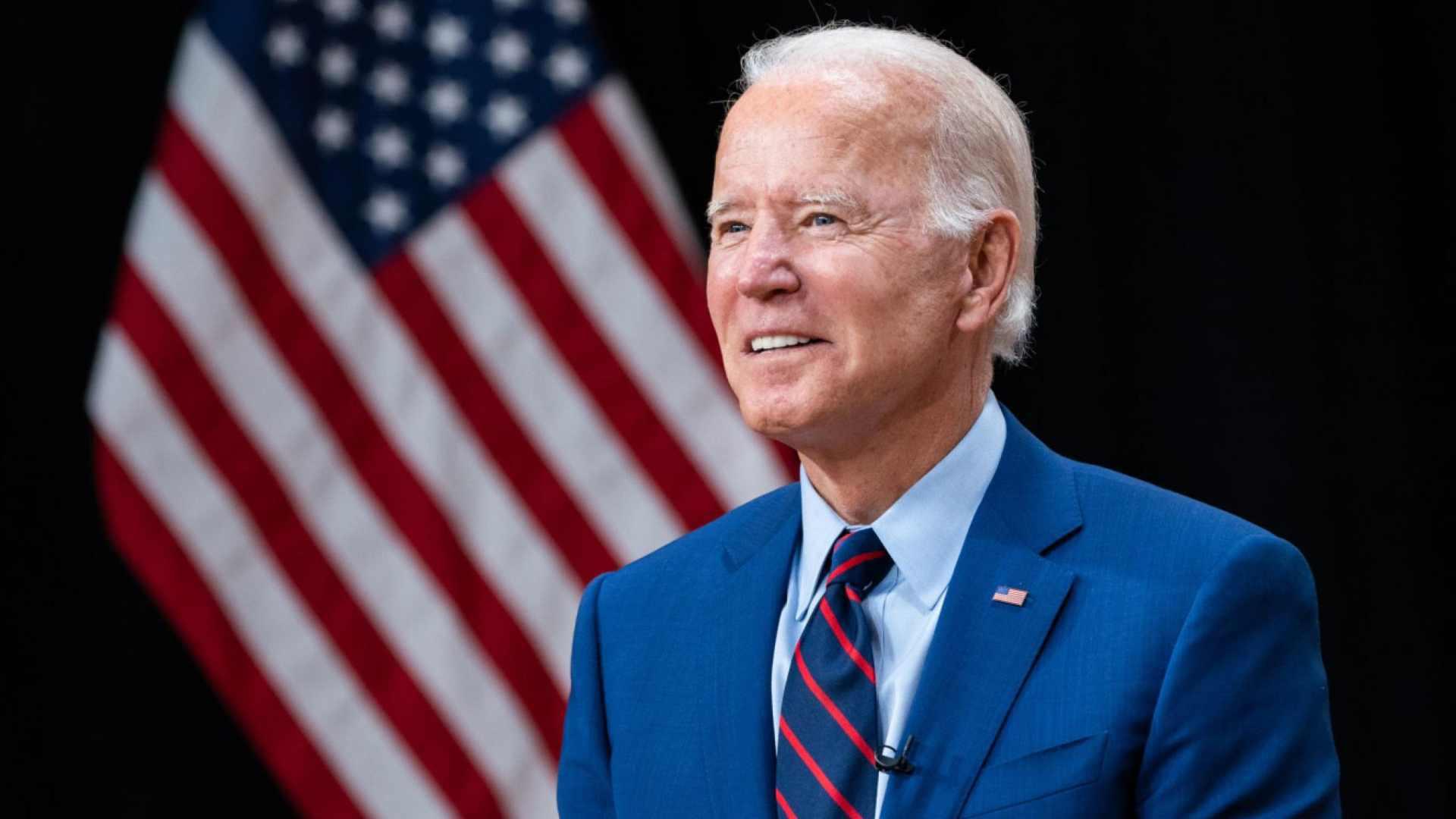

Notably, President Joe Biden has indicated he is in support of a wealth tax. His proposed wealth tax is aimed at ultra-rich billionaires, including a 25% tax on individual wealth that exceeds $100 million.

Billionaires Are a Focus

When people hear the word “billion,” they hear a number that is so high it is hard to comprehend properly. Politicians have used this number to emphasize the wealth inequality in the country and have made it a focus for proposals.

Bernie Sanders and Democrats introduced “The Make Billionaires Pay Act” in 2020, which would target the 467 American billionaires who represent the top echelon of rich people in the country.

Wealth Inequality Persists Even in Progressive Areas

Vermont has a reputation for being particularly progressive and liberal. World Population Review ranked it as the fifth most liberal state in the nation. The state is working toward 100% clean energy sustainability and was the first state to legalize same-sex marriage through the legislature instead of a court ruling.

Despite its progressive credentials, it is still experiencing problems with wealth inequality. It makes one wonder how wealth inequality can exist in a place so opposed to it.

Wealth Inequality in Vermont

Despite liberal politics being ascendant in the state, the wealth gap between rich and poor has grown in Vermont, according to The Center on Budget and Policy Priorities.

Since the 1970s, income has grown by 75.1% for the richest 20% of residents in Vermont. However, in that same time, the poorest 20% of residents have only seen their income grow by 32.5%.

What Are the Chances of a Wealth Tax Passing?

It is tough to know the chances of a wealth tax passing in Vermont. It has a Democrat-controlled legislature, but proponents will still need to convince moderate lawmakers of its benefits. Despite general support for the idea among the American public, legislation efforts have overwhelmingly failed at the national level.

One worry that opponents of the legislation bring up is the possibility of rich Vermont residents just moving away. Unless many states adopt a wealth tax at the same time, a wealth tax may just harm tax revenues and wealth equality more than it helps.