California’s financial management is in the spotlight again as the Democrats have decided to hold off on increasing minimum wages for health care workers.

This decision, aimed at mitigating a massive $46.8 billion budget deficit, reflects the state’s continued struggle with financial shortfalls.

A Crucial Agreement Amid Fiscal Challenges

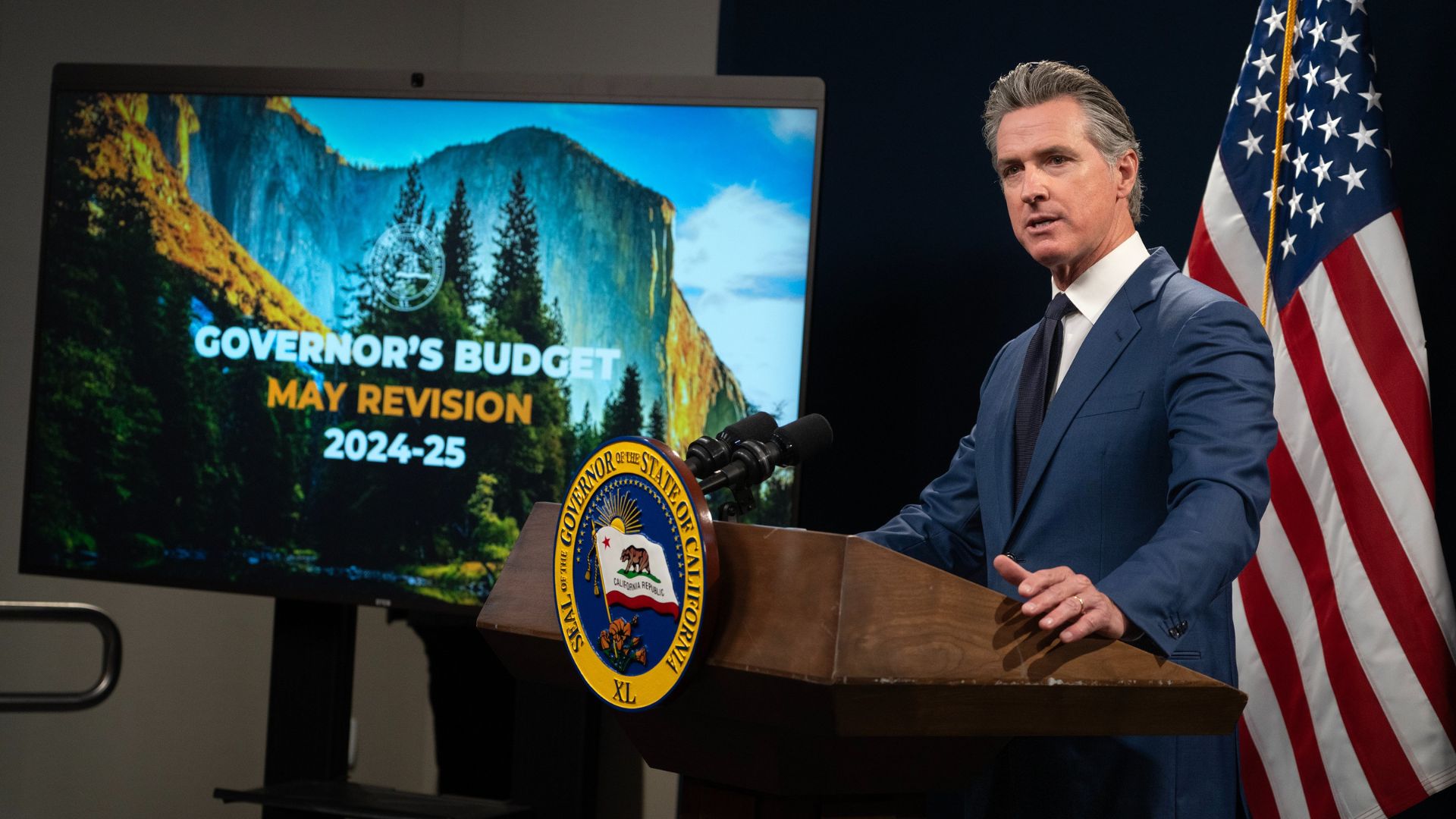

Governor Gavin Newsom and legislative leaders have concurred on postponing the wage hike as part of a broader strategy to curb the financial crisis.

This pivotal agreement involves around 426,000 healthcare professionals who were expecting a raise starting July 1.

Conditional Wage Increase: A Glimmer of Hope

There is a conditional plan in place where healthcare workers could receive their delayed raise by October 15, contingent upon state revenues being at least 3% higher than estimated from July to September.

This provision introduces a performance-based element to the wage increase, directly tying it to the state’s financial health.

What If Revenues Don’t Meet Expectations?

Should the state’s revenues not meet the projected increase, the wage rise for healthcare workers will be postponed further, with the new effective date being no earlier than January 1.

This extension illustrates the precarious nature of the state’s financial planning, which remains highly susceptible to fluctuating economic indicators.

Labor Unions’ Perspective

Dave Regan, president of SEIU-UHW, expressed a mixed reaction.

Although there’s a palpable disappointment among workers for not receiving the summer raise, there’s an acknowledgment of the state’s efforts in addressing the healthcare workforce crisis during these tough times.

High Stakes in Healthcare: Wage Comparisons

The current minimum wage in California stands at $16 per hour, remarkably higher than many other states. For fast-food workers, it recently bumped to $20.

This comparison demonstrates the complexities of wage management in different sectors amidst budget constraints.

Financial Implications of the Wage Delay

The delay is not just a temporary fix but a significant budgeting tactic.

Originally costing $2 billion, the postponement until January reduces the immediate fiscal impact to about $600 million, according to the Newsom administration.

Revenue Trends Offer a Silver Lining

Recent trends in California’s revenues, which had been declining, show signs of recovery.

This rebound could be critical in ensuring that the wage increase for healthcare workers doesn’t face further delays.

Comprehensive Budget Planning

The overall budget plan involves a hefty $297.9 billion in spending for the upcoming fiscal year.

It’s a delicate balance of cuts and reserves, with Newsom and leaders opting for $16 billion in reductions but sparing some crucial programs from the chopping block.

Legislative Adjustments and Compromises

Key adjustments include a $400 million loan to Pacific Gas & Electric and enhanced payments in the state’s Medicaid program.

These decisions reflect broader compromises and the complex interplay of various interests within California’s budget planning.

Impacts and Adjustments Across the Board

The agreement also entails an 8% reduction across state agencies and an additional $350 million cut from the state prisons’ budget.

Moreover, a temporary tax increase on businesses earning over $1 million is set to start this year, signaling tough but necessary choices.

Looking Ahead: Fiscal Stability and Resilience

As California prepares for a legislative vote on the budget, the path ahead is framed by strategic cuts and prudent fiscal management.

Senate President Pro Tempore Mike McGuire and Assembly Speaker Robert Rivas highlight the efforts to shrink the shortfall and protect vital public services.