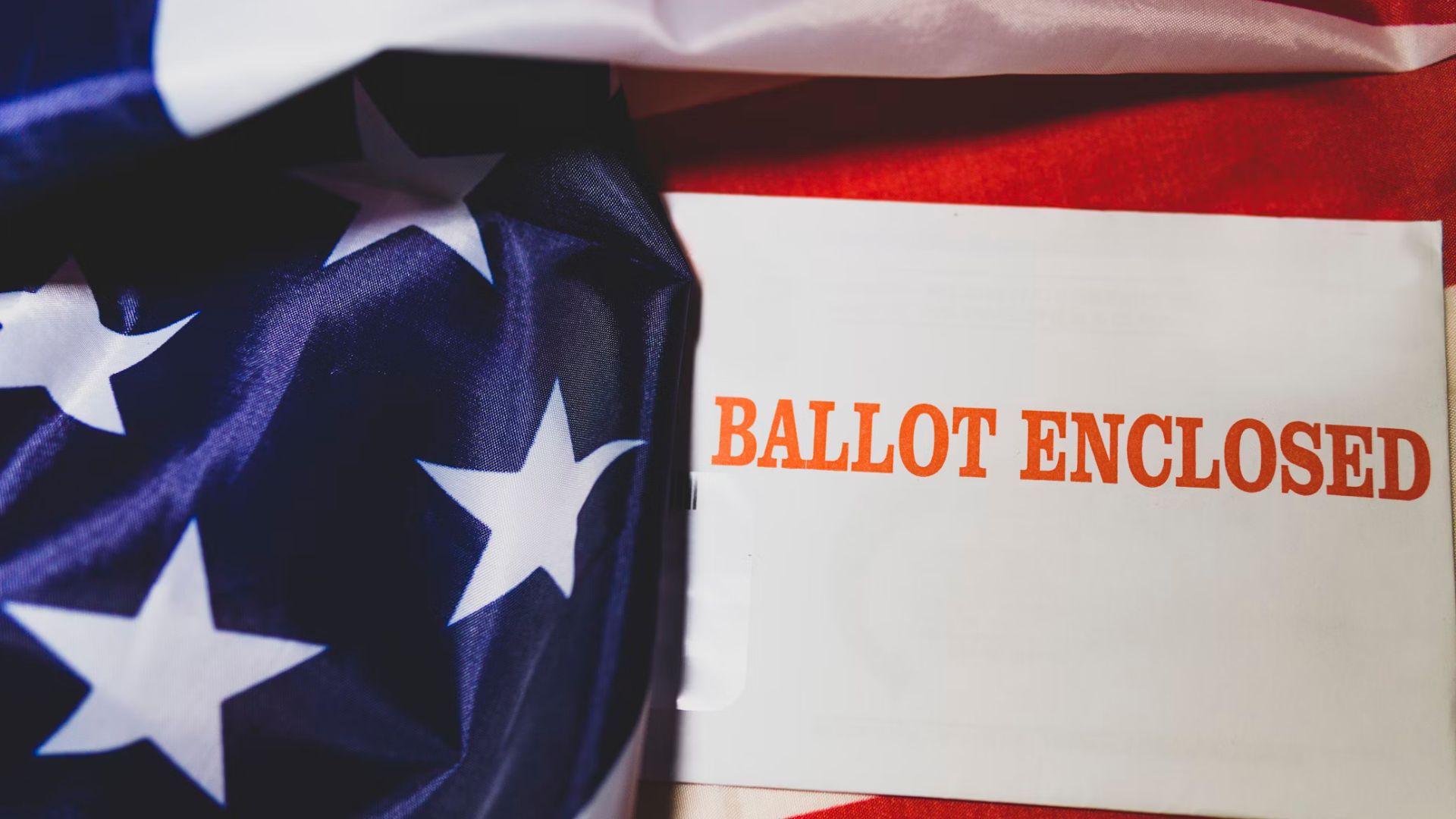

A new ruling by the California Supreme Court has stripped a provision that would have been on the ballot this November. With this decision, the court has sided in the legal fight with Governor Gavin Newsom and California Democrats against business groups and taxpayer advocates.

The ballot measure, which would have needed to be approved by voters, would have changed the current system and required new tax hikes in the state to get voter approval before they could become law.

California Supreme Court Decision

On Thursday, the California Supreme Court ruled on questions regarding the validity of the ballot measure, called the Taxpayer Protection and Government Accountability Act, to be listed as a voter initiative on the ballot in November.

The court unanimously ruled to take the issue off the ballot, saying the provision would hinder the basic function of government, and ordered the secretary of state to halt any further steps to put the initiative on the ballot.

Justice Opinion

Justice Goodwin Liu wrote in the court opinion that changes demanded in the voter provision are too drastic and that constitutional provisions of this magnitude need a larger venue like a constitutional convention or a supermajority vote of legislators.

“[The proposed changes] are within the electorate’s prerogative to enact,” Justice Goodwin Liu wrote, “But because those changes would substantially alter our basic plan of government, the proposal cannot be enacted by initiative. It is instead governed by the procedures for revising our Constitution.”

Companies Supporting the Act

A few different types of companies, including the real estate industry and a private ambulance company, fully supported this act.

Now that the ruling has gone against what they wanted, it has likely left these groups feeling annoyed and upset.

A Threat to Democracy

Those who supported the act have said that not allowing voters to vote on these issues threatens democracy.

Rob Lapsley, president of the California Business Roundtable, has said that Newsom has eliminated the voices of 1.43 million voters who wanted to support the Taxpayer Protection Act on the November ballot.

Rare Occurrence

The court’s decision to pull a voter provision off the ballot before voters get a chance to decide for themselves is a rare occurrence in California.

According to Calmatters, this is the first time in over two decades that the California Supreme Court has struck down a ballot initiative after it has reached the step of having a full hearing.

A Tortured History

California has often been reported to have a long and tortured history of putting items into law through ballot measures.

This is why this is a landmark case: It has prevented the issue of raising taxes from becoming yet another ballot measure and could even pave the way for more decisions like this.

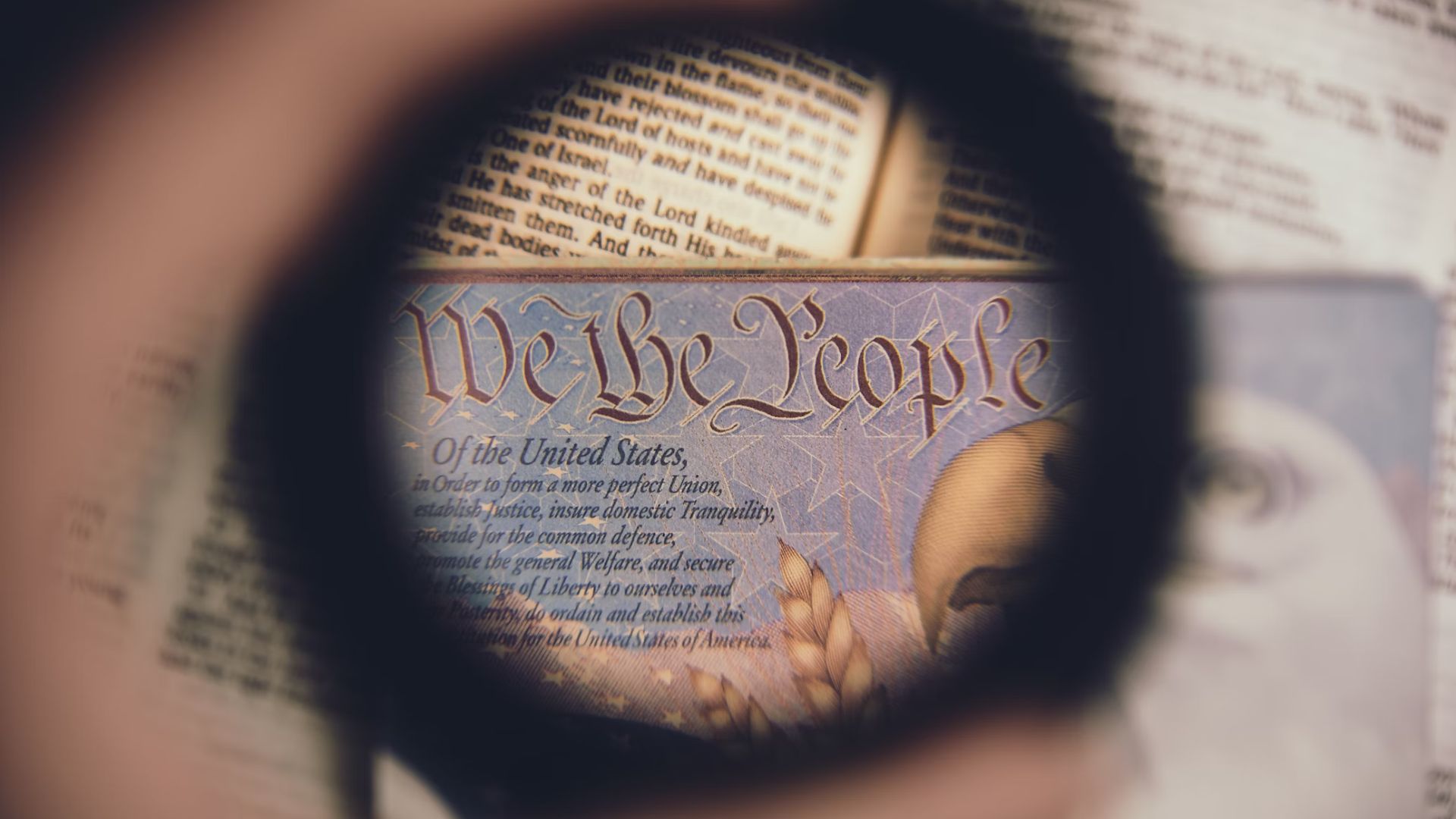

Revising the California Constitution

Newsom and other lawmakers requested that the Supreme Court step in due to this supposedly being an illegal attempt to revise the California Constitution.

Should voters have to approve new tax hikes, which could be seen as an intervention, there would also be issues with the functioning of the state’s government.

The Measure Was Unconstitutional

Many people believe that putting the issue of raising state and local taxes on a ballot is simply unconstitutional and never should have happened.

These same people also believe that the idea was conceived by those who prioritized corporate interests and greed over other Californians.

What the California Legislature Previously Said

The California legislature has previously said that it can raise taxes with a two-thirds vote in the Senate and the Assembly.

However, with this latest ruling by the California Supreme Court, this is all about to change.

Democrats Appointed the Court

One thing that critics have taken issue with is that out of the seven-member court, six were appointed by Democrats. Three of these were appointed by Newsom himself.

Some responded, saying that because the court was mostly Democrat-appointed, it was thinking in its own best interests rather than what is best for California as a whole.

Raising Taxes

Democrats have received substantial criticism from Californians over plans to raise taxes in recent years. Critics argue that California residents already face some of the highest tax burdens while suffering under one of the highest costs of living in the country.

“Yet another reason I left California. Newsom & democrats win, democracy loses. And taxpayers (whoever still calls Commiefornia home) get stuck with the tab,” said an X user in response to the decision.

Record Numbers Are Fleeing California

There have been various ongoing issues in California in the last few years, and it has gotten to the point where more people are leaving the Golden State than those who are moving there.

Taxes are just one of the reasons for this. Other issues include a high cost of living, pricey housing, high bills, and a lack of employment opportunities.

Voters Can’t Understand

In oral arguments before the court, attorneys representing Newsom and the state legislature asserted that California voters don’t have the capacity to understand and decide whether tax rates should be higher.

The justices ultimately ruled in favor of the state saying that the revision would “fundamentally rework the fiscal underpinnings of our government at every level.”

Reaction to the Verdict

Matthew Hargrove, president and CEO of the California Business Properties Association, felt that the court ruling was “a gut punch to direct democracy in California.”

“There is no independent judiciary in California anymore,” said Rob Lapsley, president of the California Business Roundtable. “Be scared. Because it’s only going to get worse.”

Newsom Not Commenting

Governor Newsom, who is usually keen to voice his opinion directly on issues and soak in the spotlight of victories, declined to speak to reporters in the aftermath of the ruling.

However, the Associated Press reported that a written statement with an aide attribution said that Newsom thinks the ballot initiative process “does not allow for an illegal constitutional revision.”

Plans For New Taxes

This court victory is a win for Democrats, who have signaled the intent to propose new tax hikes on wealthy individuals that could help with a state budget crisis.

Last year, Democrats introduced the California Wealth and Exit Tax bill, which could mandate tax increases based on personal wealth and penalize companies and individuals who left the state to avoid its taxes. It finally got a hearing in January of this year.

The Impact on Public Safety

If raising taxes had gone to a public ballot, taxes on guns would have been another issue. Lawmakers had already approved a tax increase on guns.

This tax increase will be used for gun safety programs and school safety improvements. Had the Supreme Court decision gone the other way, it could have had catastrophic effects on this.

Tricky Issue for Newsom

While there is an appetite for wealth tax initiatives among Democrats, Newsom has publicly pushed back against the idea of them.

Earlier this year The Wall Street Journal accused Newsom of supporting a wealth tax, to which the governor responded with “Are you supporting a wealth tax? No, yet again. Why the hell do you keep writing about that?”

Political Implications for Gavin Newsom

Another issue this would have had is the political implications for Newsom. He is in his second term as California Governor and is a potential future candidate for the US Presidency.

Republicans have been able to frame Newsom as being greedy for wanting to raise taxes, which could put him in a bad position should he try and run for the presidency.

Other States Introducing a Wealth Tax

California isn’t the only state to have introduced a wealth tax, as other states seem to have followed suit. Vermont is one of them and has introduced a 3% additional tax on those making more than $500,000 in gross income.

Generally speaking, most Americans support these wealth taxes, as many feel that income is unfairly distributed across the US. However, those who are earning a high income aren’t quite as happy.

California’s Tax Revenues Are Down

Another issue California is facing is its declining tax revenues. As of March 2024, they were down by $5.8 billion, or 4%, from the amount that government officials were hoping for.

Personal income tax receipts contributed $3.4 billion to the revenue shortfall. However, personal income tax payments were down by $4.7 billion, and corporate tax receipts were $1.4 billion less than predicted.

Clarifying a Nuanced Position

Newsom doesn’t want to get painted as someone who supports raising taxes but also wanted to clarify that he opposes the ballot measure because it would hinder government unnecessarily.

“You can both be opposed to new taxes and to destructive ballot measures that would hamstring government from protecting itself in a crisis,” Governor spokesman Bob Salladay said in a statement.

Budget Crisis

One impetus for these tax increase proposals comes from a recent funding deficit affecting California following previous shortfalls in tax revenue.

In February, the Legislative Analyst’s Office estimated that the budget deficit for 2024-25 would be around $73 billion. Newsom and the state legislature have been scrambling to reduce this deficit as much as possible through a series of revised budget proposals.