The California budget deficit for the upcoming year, which is estimated to be at least $38 billion, might be getting worse.

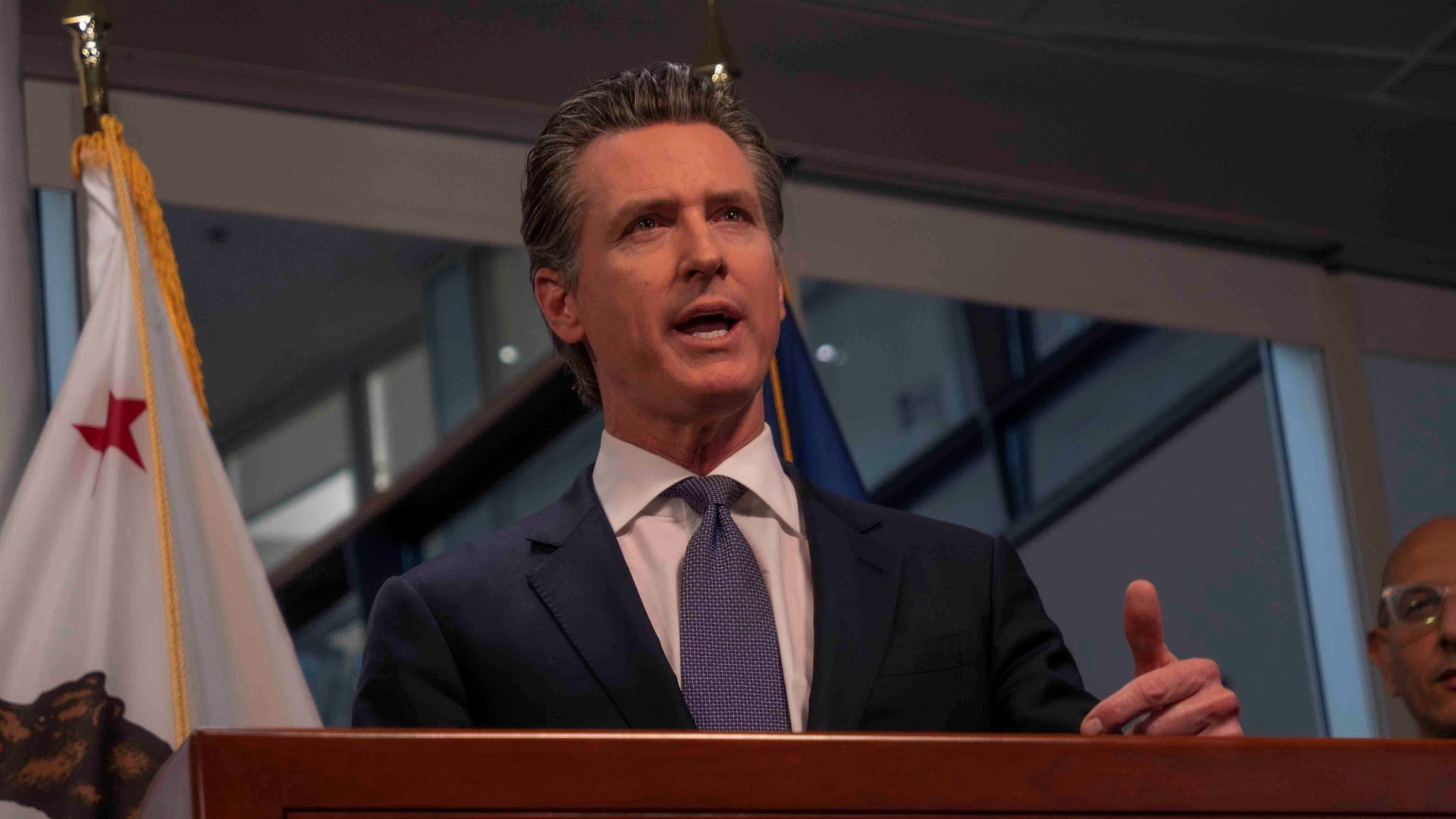

Gavin Newsom’s Department of Finance released a new bulletin that showed that state tax receipts had brought in disappointing revenue that was underneath expectations set by the department earlier in the year. This spells more trouble as state lawmakers are already struggling to come up with a balanced budget.

Below Forecast

According to the Department of Finance bulletin, California’s tax revenues as of March were $5.8 billion, or 4%, below the forecasted amount government officials were hoping for.

Personal income tax receipts contributed to $3.4 billion of the revenue shortfall, with personal income tax payments being down $4.7 billion to forecast. Corporate tax receipts were $1.4 billion below forecast.

Income Growth

The California Department of Finance reported that personal income in California has managed to increase by 4.2 percent in 2023, which was a positive change after a 0.2 percent decline in 2022.

However, California’s income growth was less than the 5.2% average growth experienced by the rest of the United States in 2023.

Headline Inflation

Economists and analysts use a number called headline inflation to measure the effects of inflation in the economy. It is a raw number reported in the Consumer Price Index which is released every month by the Bureau of Labor Statistics.

Headline inflation in California decreased from 3.5 percent in December 2023 to 3.3 percent in February 2024 when looking at year-over-year numbers.

Government Deficit

The disappointing news in this finance bulletin comes as the state is grappling with a multi-billion dollar deficit. Earlier this year, Newsom estimated the total deficit amount to be $38, however, other estimates suggest that it could be much higher when it is also said and done.

The Los Angeles Analyst’s Office originally projected the figure to be closer to $58 billion, however, they would later expand this estimate to $73 billion in February.

From Surplus to Deficit

This historic deficit level has happened to the state in a short period of time. Just a short while back in 2022, Governor Newsom approved a $301 billion budget for California which included a $97 billion surplus. At the time this budget was triple what the state spent the previous year, but Newsom felt like the state could afford it.

However, following economic challenges and declining tax revenues, a historic deficit in the budget emerged.

Action on the Deficit

Lawmakers are hard at work trying to figure out a way to reduce the projected California budget deficit. Earlier this month Newsom and the state legislature reached a deal to shrink the deficit by $17 billion.

However, much of this spending reduction was done through cuts that were easier to make, and some that just delayed or deferred spending to another time. Tackling the full volume of the deficit will be a much harder fight.

Gimmick Solutions

Earlier this month, Assembly vice chair of the budget committee Vince Fong said to Fox News that Newsom and Democrats are only interested in gimmick solutions.

“This most recent deal that he’s touting is all reliant on budget gimmicks, cause shifts and deferrals, which, when you look at the numbers, it’s clearly not enough,” said Fong. “We have a sustainability problem. We have an overspending problem in California, and nothing the governor is working on tackles that.”

Population Decline

In the background of political fighting over the budget, California as a state is undergoing massive changes in response to recent events.

In 2020, California saw its first population decline on record. Many people began moving away from the state between 2020 and 2022, which saw an exodus of over half a million people that far exceeded the number of people moving in.

Reversing Trends

Recently, Politico reported that California had finally managed to grow its population for the first time since 2019.

However, it is still losing a net amount of people to other states. This population increase has been attributed to fewer COVID-19 deaths and an increase in legal immigration.

Low Birth Rates

In 2023, the birth rate in California fell to its lowest point in more than 100 years. According to the Public Policy Institute of California, the birth rate in the state fell from 2.15 in 2008 to 1.52. The replacement rate for birth rates is considered to be 2.1 children per woman, making California far below that number.

When looking at the future taxable base of the state, many of these changes California is going through don’t bode well for the future.

What the Future Holds

It’s unclear if the dispute between the deficit numbers from Newsom and the LAO and this newly reported tax revenue shortfall will play a role as budget negotiations continue to heat up as the summer deadline approaches.

The state legislature must pass a 2024-2025 budget proposal to be approved by June 15th as the fiscal year starts on July 1st.