A high-speed train service in Florida reaching speeds of up to 125 mph is a venture by the company Brightline, which has set its sights on an even more ambitious project – Brightline West.

This effort involves a $12-billion, 218-mile high-speed rail route connecting Las Vegas and Rancho Cucamonga, touted as the first true high-speed rail line in the United States.

Brightline is Optimistic About High-Speed Rail Project

The executives at Brightline are optimistic about opening the western route.

Promising speeds of up to 200 mph, if they can open the project by their 2028 deadline it will be perfectly timed for the Los Angeles Olympics. For planned ground-breaking to occur in spring, they’ll need their aspired financing to fall into place.

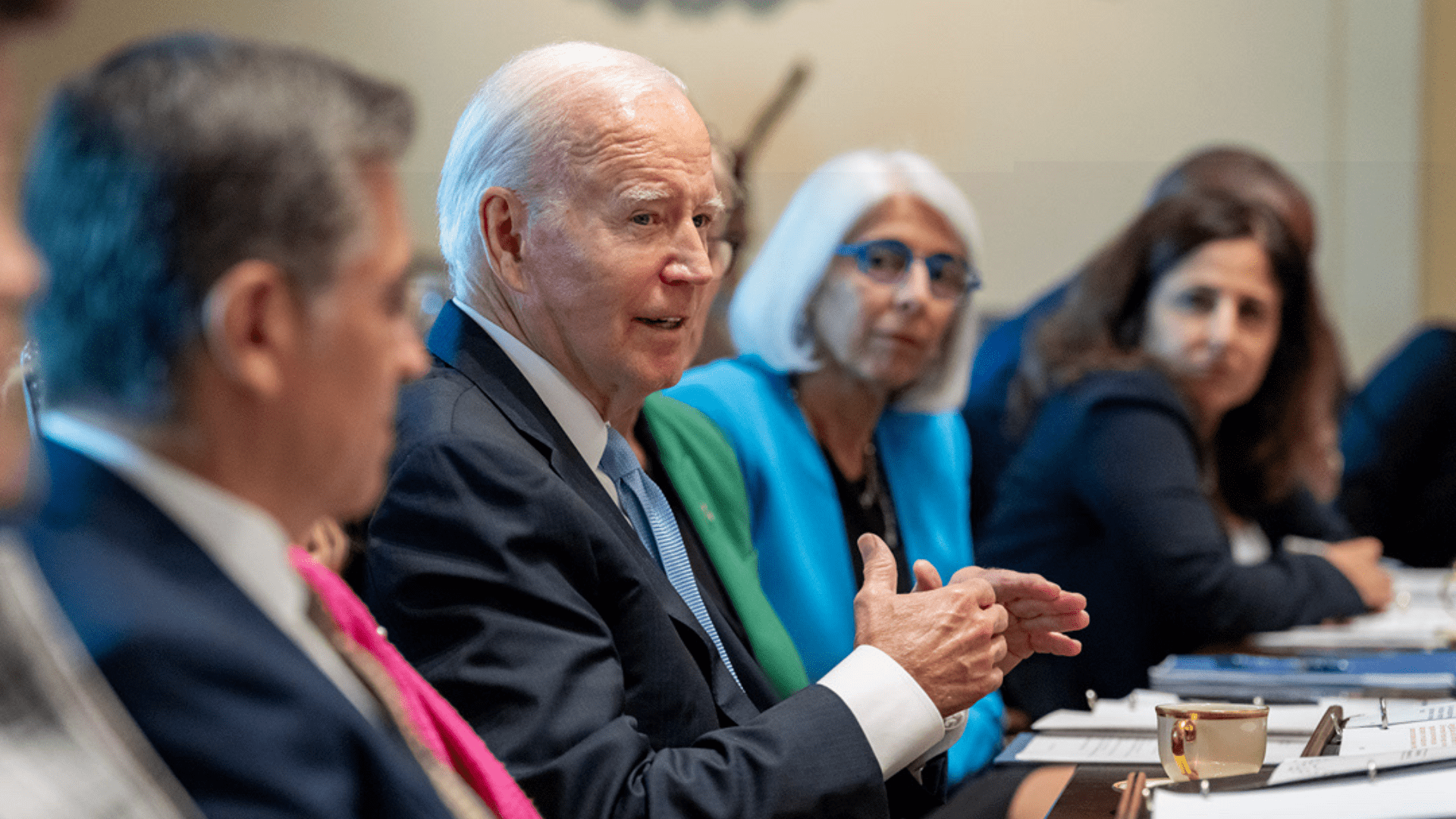

Biden Administration Actively Supporting Brightline Project

The Biden administration is actively supporting this private initiative, injecting $3 billion in taxpayer dollars into the project, along with access to $3.5 billion in tax-exempt bonds.

This financial backing aims to demonstrate that private companies can succeed where various public bullet-train ventures, including California’s long-delayed San Francisco to Los Angeles project, have faced challenges.

California’s Bullet Train: A Rising Financial Forecast

The Brightline West isn’t the only rail project facing challenges in California. Back in 2008, a “bullet train” linking Los Angeles to San Fransisco was pitched to voters.

However, the financial outlook for California’s high-speed rail project, initially projected at $40 billion has drastically increased over the years. As per recent statements from state officials, the cost for completing just a 171-mile stretch between Bakersfield and Merced has escalated to $35 billion. To complete the entire line, an additional $100 billion is necessary, underscoring a significant leap from the original budget estimates.

Doubts Over Completion

Republican State Senate Minority Leader Brian Jones has expressed strong skepticism regarding the project’s feasibility, stating, “It’s never going to get built.”

He highlighted concerns over the bullet train’s extension to San Diego and Los Angeles, criticizing the continuous financial gap of “$100 billion away” from completion. Jones’s perspective reflects a growing uncertainty around the high-speed rail’s future.

The Call to End the Project

Jones has been vocal about his opposition, urging California to terminate the high-speed rail project.

He argues that the escalating costs do not justify the already expended $18 billion, deeming it a waste. This stance advocates for a reassessment of the project’s viability against its burgeoning financial requirements.

Seeking Additional Funding

Despite the financial hurdles, the project’s leadership remains hopeful. The California State Senate High-Speed Rail Authority’s CEO, Brian Kelly, has been actively seeking further support from the federal government and private industry.

Kelly insists on the project’s viability, signaling an ongoing effort to secure the necessary funding to push the high-speed rail project forward.

Improving Performance to Gain Public Support

In a bid to garner public support, Kelly emphasizes the importance of performance improvement. He believes that the authority is “performing better today than it was” and expects continued progress.

This approach aims to demonstrate the project’s potential benefits and operational enhancements to the public and stakeholders alike.

Concerns Over Financial Prioritization

Critics of the high-speed rail project argue that it diverts critical financial resources from other pressing issues facing California residents, including education, housing, and mental health.

The financial commitment to the rail project has sparked a debate on whether state funds are being allocated in the best interests of Californians.

A Vision for High-Speed Rail’s Future

Despite his criticism of the state-led bullet train project, Jones acknowledges the potential of high-speed rail in California.

He points to the Brightline West project, aiming for a two-hour connection between Las Vegas and Los Angeles, as a successful model. This project distinguishes itself by relying more on private investment than taxpayer funding.

The Advantage of Private Investment

Jones argues for the efficiency and planning benefits of private enterprise in developing high-speed rail projects.

By contrasting the state’s project with Brightline West, he suggests that private investment can lead to more effectively managed and financially viable rail services, reducing reliance on state funds and taxpayer contributions.

Financial Overview of the Project

The financial trajectory of California’s bullet train has seen a dramatic shift from its initial $40 billion estimate to a current projection exceeding $135 billion for full completion.

This increase has raised questions about the project’s overall financial management and the justification of continued investment in the face of escalating costs.

The Challenge of Meeting Financial Expectations

The disparity between the initial visions of the high-speed rail and its current financial reality has become a focal point of contention.

As costs continue to rise, the feasibility and practicality of achieving the ambitious goals set for the project are increasingly under scrutiny.

Exploring Federal and Private Funding Avenues

With the project in need of substantial additional funding, the focus has shifted towards securing support from both the federal government and the private sector.

This strategy is crucial for moving forward, as Kelly and his team work to demonstrate the project’s viability and potential benefits to gain the necessary financial backing.

The Future of California’s High-Speed Rail

The ongoing debate and financial challenges leave California’s high-speed rail project at a crossroads. The outcome will not only affect the state’s transportation infrastructure but also set a precedent for large-scale public infrastructure projects across the country.

The coming years will be pivotal in determining whether the bullet train can overcome its obstacles to become a hallmark of modern transportation in California.

Founder Sees Brightline West as Beginning of Movement

Wes Edens, Brightline’s founder, chairman, and a private equity billionaire, envisions Brightline West as a groundbreaking project.

Once proven successful, the Brightline founder believes it could pave the way for numerous high-speed rail endeavors across the country.

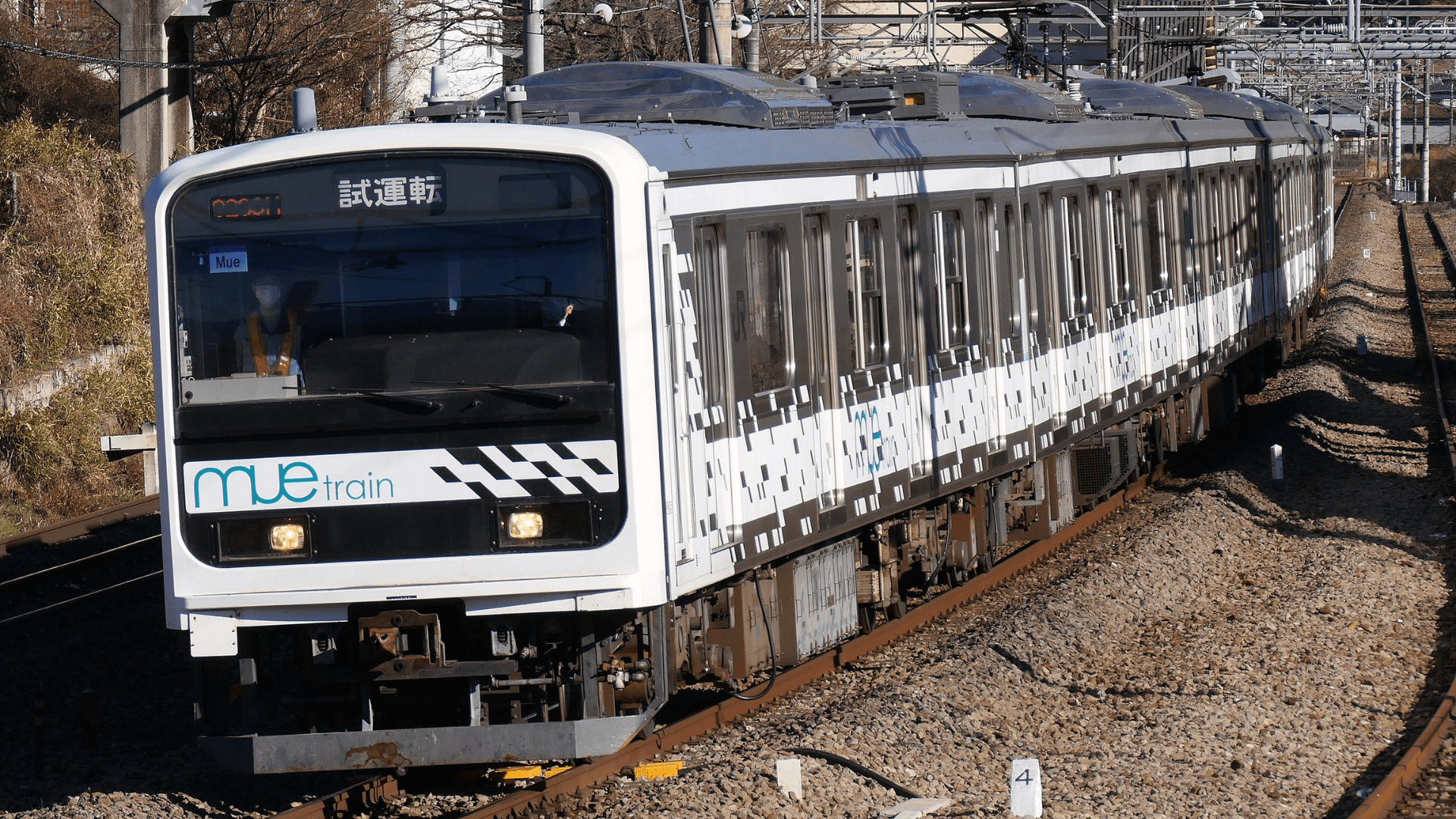

Only High-Speed Rail with Labor Deals and Environmental Permitting

The uniqueness of Brightline West lies in being the only high-speed rail project with completed labor deals, right-of-way access, and environmental permitting, setting it apart from publicly funded projects like California’s.

However, skepticism remains among specialists, reflecting the historical challenges faced by high-speed rail initiatives in the United States.

Why High-Speed Rail Might Fail in the United States

Factors such as dispersed population centers, city designs focused on highways rather than transit systems, and a preference for personal vehicles due to lower driving costs contribute to the hurdles. Further, U.S. rail is subject to outdated labor laws that make operating rail systems unlikely to be profitable.

Some skeptics also see an issue with rail in general, as U.S. passenger trains contend with congested single-track systems that are shared with lumbering freight trains, unlike the multi-track railroads in Europe.

Brightine Executives Believe Rail Systems Can Work

Brightline’s executives assert that they have studied successful rail systems worldwide, absorbing lessons from Britain, France, Spain, and Japan.

They emphasize selecting routes with fewer legal battles over land and environmental impacts. Identifying strategic locations on the map, connecting points that surpass air travel times but remain attractive to motorists, is crucial for the project’s success.

50 Million Annual Travelers Between Southern California and Vegas

The estimated 50 million annual travelers between Southern California and Las Vegas, predominantly in cars, form a significant market for Brightline West.

Edens envisions motorists driving past the train station, witnessing trains speeding by at 220 mph while stuck in traffic, offering an appealing alternative.

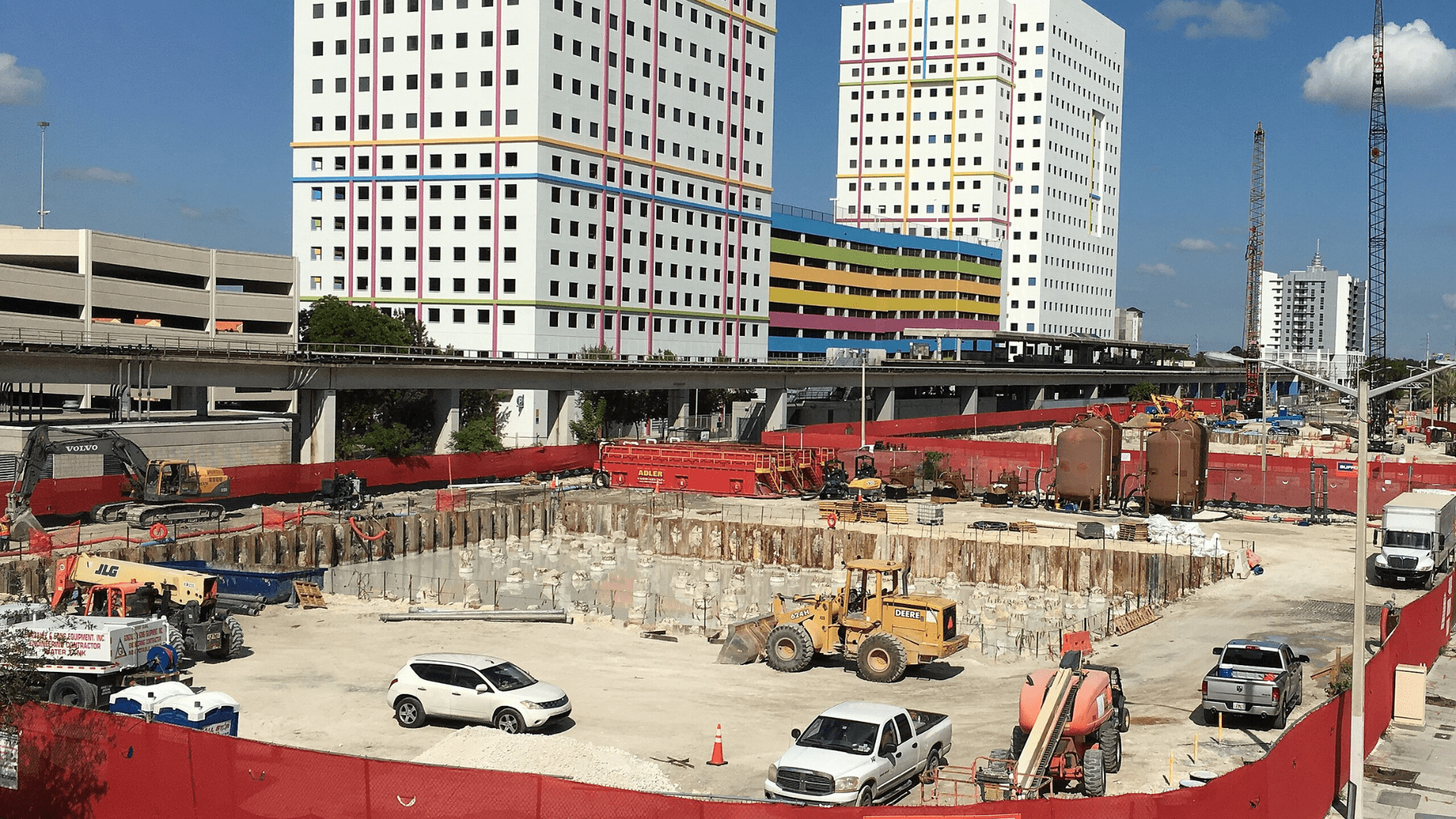

Brightline’s Initial Florida Venture Operates at $190 Million Loss

Despite these aspirations, Brightline’s initial venture in Florida has yet to meet ridership projections since its 2018 launch.

Operating losses of $190 million during the first nine months of the previous year indicate financial challenges, particularly as the company expands services from Miami to Fort Lauderdale and West Palm Beach.

Geographical Difficulties in Southern California Landscape

Brightline West faces additional obstacles, including navigating steep changes in elevation on the Las Vegas to Southern California route.

The terminus in Rancho Cucamonga, 40 miles east of downtown Los Angeles, poses logistical challenges, requiring riders to either take a slower MetroLink rail connection or endure a 1- to 2-hour drive, depending on traffic.

Roundtrip Tickets on Brightline West Could Cost More than $400

The financial aspect also raises questions, with Edens suggesting a round trip from Las Vegas to Rancho Cucamonga could eventually cost more than $400, potentially limiting affordability for many travelers.

The contrast between Biden’s vision for high-speed rail and its practical accessibility is evident.

Ultimate Fate of Brightline Land Development in SoCal-Vegas Project

Brightline’s significant real estate holdings, including stations and adjacent land, have become key assets for financing its railroad in South Florida.

Regardless of the company’s financially beneficial land development in Florida, the ultimate fate of the 300 acres in Victor Valley, San Bernardino County, and the 110 acres around the Las Vegas station remains uncertain. Real estate development is integral to the Brightline West project, suggesting that the strategic use of land could play a crucial role in its success.