China Wants to ‘Ditch the Dollar’ as Trade Tensions Intensify With U.S.

China has set a new record by selling $53.3 billion of Treasury and US agency bonds in the first quarter of this year.

This action highlights China’s strategy to diversify its financial portfolio away from American assets amidst ongoing trade tensions between the two nations.

Belgium's Role in China’s Treasury Sales

In a related move, Belgium, often regarded as a custodian for China’s holdings, has disposed of $22 billion of Treasuries during the same period.

Source: Wikimedia Commons

This significant transaction forms part of the broader pattern of China reducing its exposure to US financial instruments.

Renewed Focus on China’s US Investments

The recent large-scale sell-offs by China have renewed global investor interest.

Source: Li Yang/Unsplash

This financial maneuver comes at a time when relations between the world’s two largest economies might deteriorate further, influenced by the United States’ latest policy adjustments under the current administration.

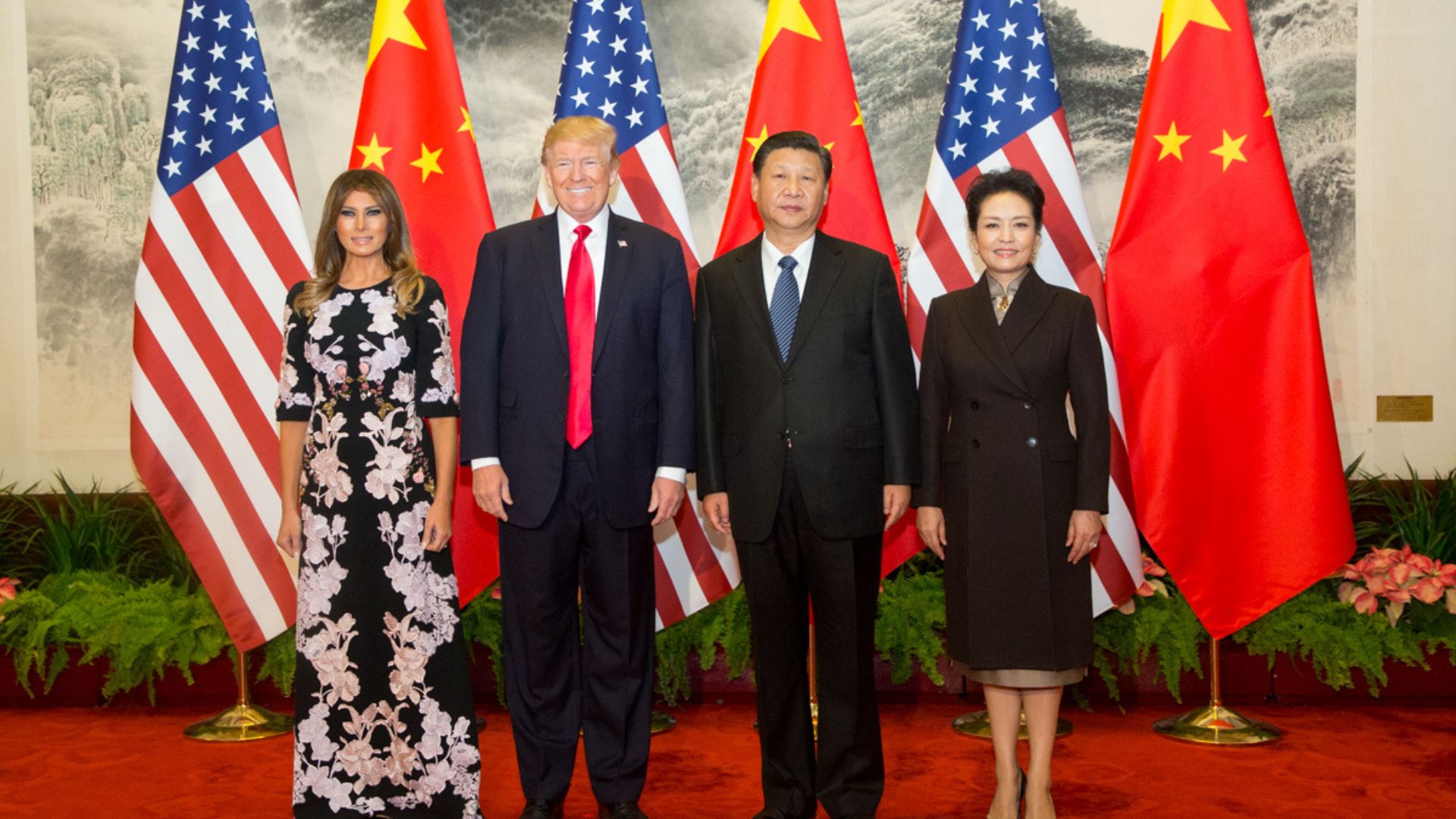

Potential Impacts of Political Changes in the US

Political developments in the US also play a critical role.

Source: Wikimedia Commons

Former President Donald Trump has indicated potential aggressive fiscal policies towards China, stating he might impose a levy of more than 60% on Chinese goods if re-elected. This political stance could significantly influence China’s future economic decisions.

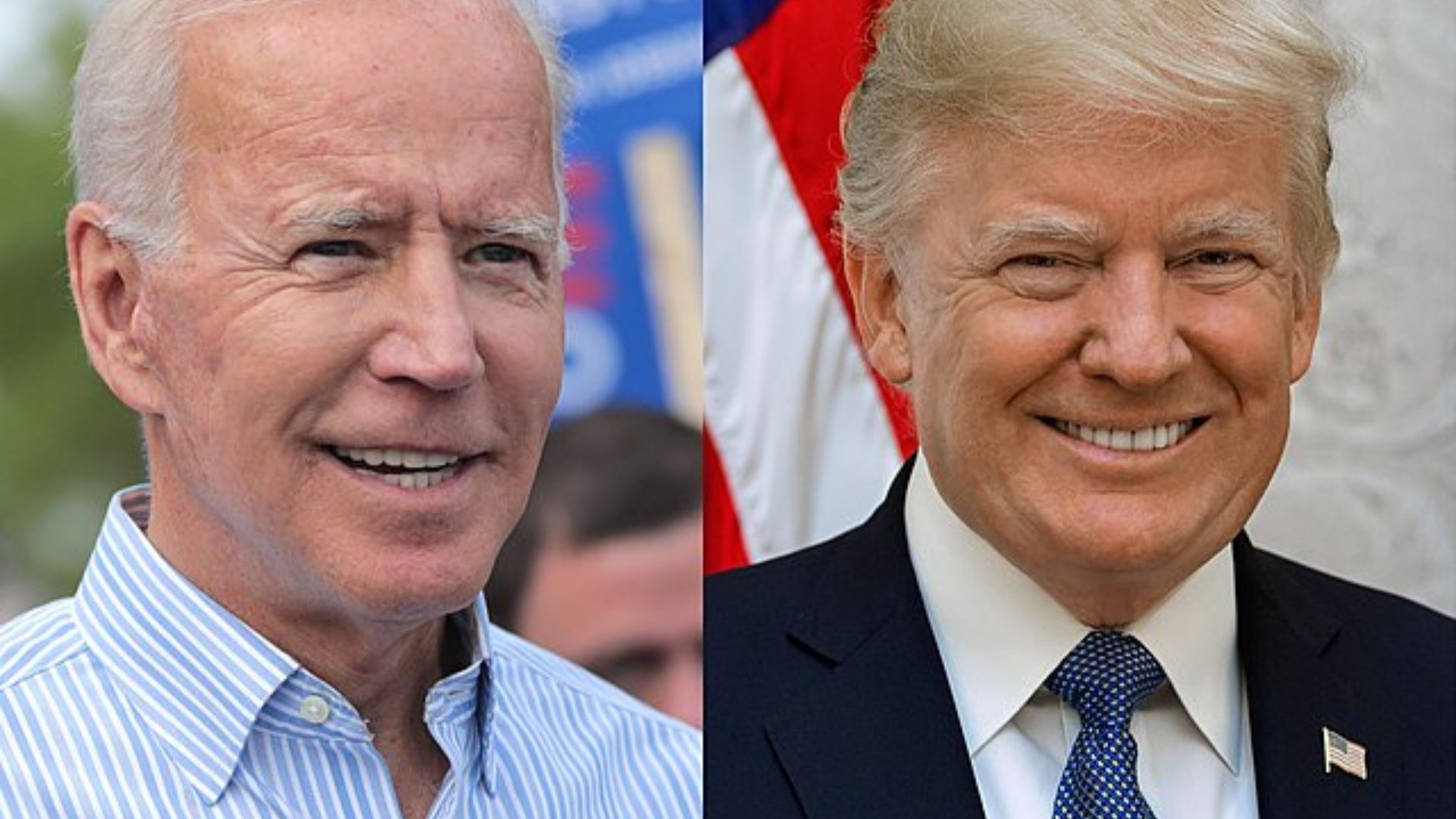

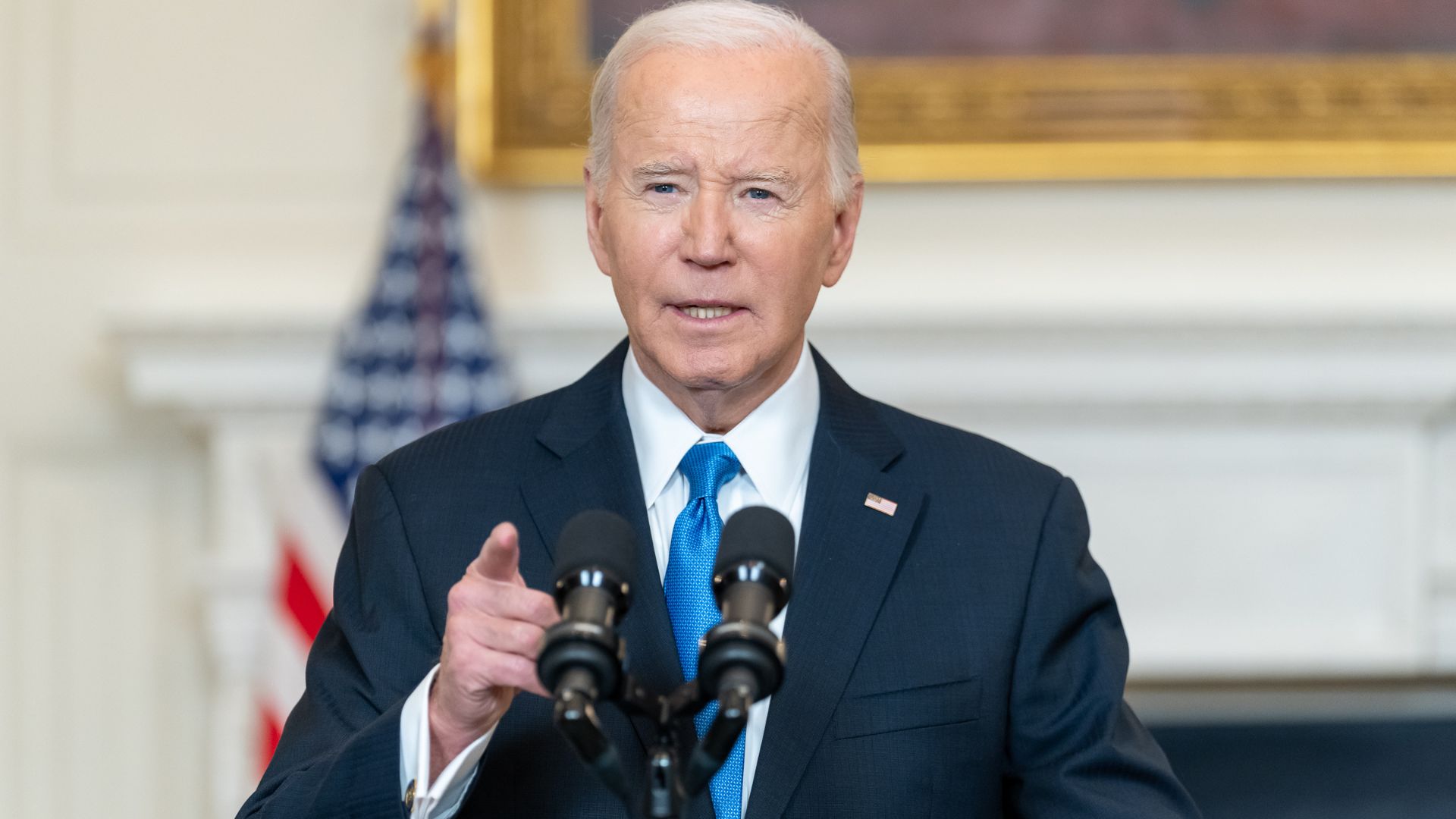

Biden and Trump's Impact on China

However, it is likely that tensions will remain high regardless of the outcome of the 2024 U.S. election. While Trump is more unpredictable, both he and Biden have spoken to their intentions to decrease reliance on China.

krassotkin/Wikimedia Commons

The candidates seem to be able to agree on one thing: The trade deficit with China must be addressed and this will likely result in further tensions between the two powerhouse nations.

Strategic Insights from Financial Experts

Stephen Chiu, chief Asia foreign-exchange and rates strategist at Bloomberg Intelligence, noted, “As China is selling both despite the fact that we are closer to a Fed rate-cut cycle, there should be a clear intention of diversifying away from US dollar holdings.”

Source: Alejandro Luengo/Unsplash

He also suggested that “China’s selling of US securities could speed up as US-China trade war resumes” especially if Trump returns as president.

Shift Towards Gold Investments

Amidst selling dollar assets, China has increased its gold holdings, now accounting for 4.9% of the nation’s official reserves as of April, marking the highest level since records began in 2015.

Source: Jingming Pan/Unsplash

This shift indicates a strategic adjustment in China’s reserve management policies.

Global Trends in Gold Reserves

The trend of increasing gold reserves is not limited to China. Gita Gopinath, first deputy managing director of the International Monetary Fund, pointed out in a recent speech that since 2015, countries closely aligned with China have boosted their gold reserves, while those in the US bloc have maintained stable levels.

Source: Wikimedia Commons

She said, “This suggests that gold purchases by some central banks may have been driven by concerns about sanctions risk.”

Diversification Away from the Dollar

The consistent sell-off of US securities by China indicates a deliberate strategy to lessen its reliance on the US dollar.

Source: Giorgio Trovato/Unsplash

This financial strategy aligns with broader geopolitical shifts and ongoing uncertainties in global trade relations.

China's Calculated Financial Maneuvers

China’s financial strategy is complex and calculated, involving significant sales of US debt and increased investment in gold.

Source: Wikimedia Commons

This diversification reflects its cautious approach towards maintaining economic stability amid fluctuating global dynamics.

Global Market Reactions

The global markets are sensitive to these large transactions by major economic players like China.

Source: Wikimedia Commons

The divestment from US securities and the increased acquisition of gold could have far-reaching effects on international financial markets and investment strategies.

Expert Analysis on Market Implications

Analysts are closely monitoring these developments, as China’s shift from US debt securities to gold could signal broader changes in global finance.

Source: Road Trip with Raj/Unsplash

These actions may influence other nations’ financial strategies and affect global economic stability.

Russia's Role in All This

Another factor in China’s decision to “ditch the dollar” is that the West elected to freeze Russian foreign exchange reserves. This move was a sting to many Chinese policies and was not quickly forgotten

Source: Wikimedia Commons

Chinese financial expert Yo Yongding explained that the move was seen as “a blatant breach of…trust” and proof of the United States’ “willingness to stop playing by the rules.”

Future of US-China Economic Relations

The ongoing changes in China’s investment strategies are pivotal in shaping the future economic relationship between the United States and China.

Source: Wikimedia Commons

As both nations navigate through their respective financial and political landscapes, the decisions made today will undoubtedly impact their bilateral interactions for years to come.

China’s Economic Strategy

China has been an adversarial influence on the interests of the United States in the world as its economy has rapidly grown over the past few decades.

Source: Christian Lue/Unsplash

Recently, China has been playing its economic strategy close to the vest, canceling a traditional press conference this year that had many international observers and analysts scratching their heads. This press conference was one of the most widely followed Chinese events in the world and had been a 30-year tradition.

Deciphering the Strategy

China’s decision to not have this press conference has caused many in the Western media to try to decipher what plans China has for its economic policies and sees the move as a sign of secrecy.

Source: Markus Winkler/Unsplash

“This signifies a strategic shift to a ‘diversified, procedural and standardised’ information-sharing approach. It implies the Chinese government is exploring new communication methods for economic policies, despite criticisms of reduced transparency,” wrote Yuan Zhang of UC Berkeley.

Moving Towards Minerals

Since economic tensions started to rise in 2018 between the U.S. and China, the Chinese government has made a financial move to focus on mineral exchanges.

Source: Wikimedia Commons

Ganzhou, a city in China that is about the size of the state of Alaska, is at the heart of the effort to use mineral exchanges to increase the use of their currency- the renminbi. With a stronger renminbi, China can have more control over global markets.

Defying Propaganda

China is ruled by a single party: the Chinese Communist Party (CCP). This canceled press conference was one of the few times that those in the West could get a glimpse into CCP positions without such a heavy propaganda filter. For example, at a 2020 conference, Chinese Premier Li Keqiang used the forum to reveal a critical issue regarding poverty among Chinese citizens.

Source: Nuno Alberto/Unsplash

“China is a developing country with a great number of population. The average annual income in our country is 30,000 yuan, but there are 600 million people with merely a monthly income of 1,000 yuan. In a medium-sized city, [an income of] 1,000 yuan is probably difficult to rent a place to live,” said Keqiang.

Population Problems

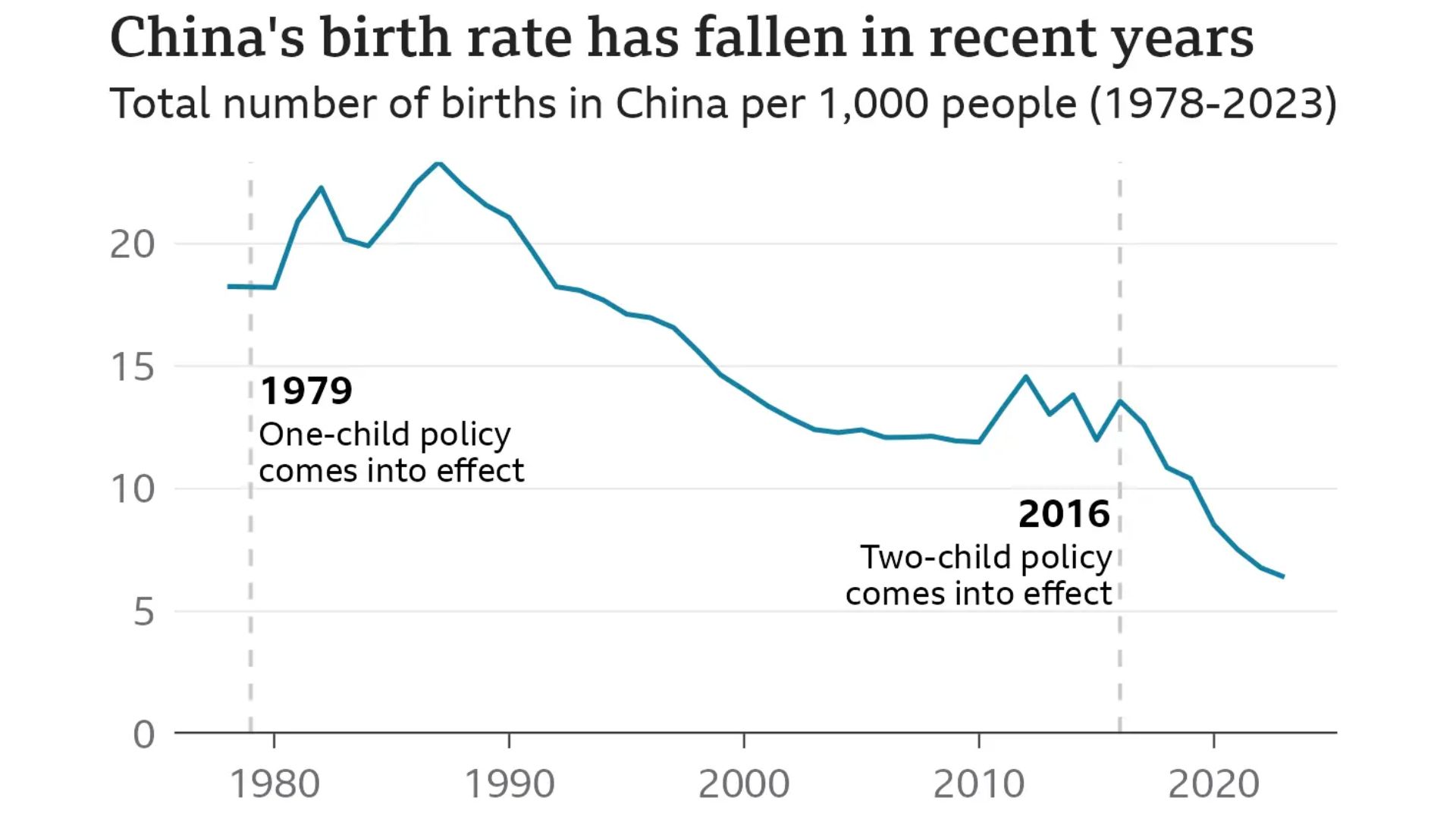

As China works to regain control over their own currency and thus their control over pricing power and global markets, they are facing another problem at home: their declining population.

Source: China Statistical Yearbook

The crisis began in 2022 when China’s population started falling off dramatically. It is predicted that their population will continue to fall to 1.3 billion by 2050 if the current rate continues.

Population Decline is so Severe it May Be Irreversible

The population decline has become so severe in the past 2 years that experts fear it may become irreversible based on birth and death rate trends.

Source: Wikipedia

In 2023 alone the country’s population dropped by 2 million, largely due to a collapse in birth rate. Conversely, Japan’s population and fertility rate continues to soar.

Ambitious Goals

In March, China announced that it is trying to target “around a 5% growth rate” in 2024, and wants to combat notable challenges in real estate and other markets.

Source: Road Ahead/Unsplash

In 2023, China claimed its economy grew by 5.2%, however, some economic analysts doubt this figure.

China’s Struggles

While China is setting ambitious goals for itself, it is also reeling from a slowdown in its meteoric economic growth from the past decades.

Source: Ling Tang/Unsplash

During this period of growth, China took out heavy investments to continue expanding, and now that economic growth has slowed, it may be unable to pay some of its debts.

Miserable Year

Despite the reported Chinese growth number of 5.2%, CNN reported in December that the country had a miserable year in 2023, with 2024 not looking much better.

Source: Nik Shuliahin/Unsplash

“The 2024 challenge for the Chinese economy will not be GDP growth — that will likely be above 4.5%,” said Derek Scissors, senior fellow at the American Enterprise Institute. “The challenge will be that the only direction from there is down.”

Middle-Income Trap

Scissors warned of the possible of a “middle-income trap” dynamic playing out in the Chinese economy.

Source: Eric Prouzet/Unsplash

This “middle-income trap” occurs when a nation quickly grows out of poverty only to become “trapped” in that economic state, being unable to reach a higher income level needed to stabilize.

China’s Debut

In 1978, the once-hermit nation of China opened its doors to world trade. After this action, it quickly became one of the fastest-growing economies on the planet.

Source: Hanny Naibaho/Unsplash

GDP growth numbers for decades averaged around 10.5% growth every year. However, after 2011, this rate of growth has been slowing down tremendously.

Why Is China Changing?

The Chinese leadership, hoping to take advantage of consistently high economic growth, sought to heavily run up debt to keep boosting that growth in the hopes economic activity would continue on its trajectory.

Source: Navigator 84/Wikimedia

China’s government kept borrowing and borrowing to pay for expensive infrastructure upgrades to ensure its economy could continue to grow.

Chinese Companies Can’t Keep Up

In recent years, several Chinese companies have run up corporate debt to the point that they cannot keep up with the repayment process. Many companies in China are nationalized, meaning some degree of government control is involved with the decisions these companies make.

Source: Jay/Unsplash

A Reuters report found that the share of companies with healthy levels of debt has been falling dramatically in recent years. “Healthy debt” companies fell by 31.7% between 2008 and 2016.

Affecting Relations

China is currently the second biggest economy in the world, behind the United States. For this reason, the US and China have become adversaries in trying to influence world trade to give themselves a better deal, leading to some tension.

Source: POTUS/X

In May, Biden escalated the trade war with China by quadrupling tariffs on Chinese electric vehicles.

Trade War Continues

In response to Biden’s actions, China vowed to take every step necessary to correct his administration’s “wrongdoing.”

Source: Adam Nir/Unsplash

“China opposes the unilateral imposition of tariffs which violate (World Trade Organization) rules, and will take all necessary actions to protect its legitimate rights,” said Chinese foreign ministry spokesperson Wang Wenbin.

What Does a Weak U.S. Dollar Mean?

If China is successful in their strategy to diversify their economic portfolio and “ditch the dollar”, what does that mean for the U.S. economy and the world economy at large?

Source: Wikipedia

If the U.S. dollar were to be replaced by another currency as the world standard it would have great impacts on competitiveness and trade. Most notably, inflation would skyrocket domestically as import costs would rise.