A hedge fund manager and founder of Hayman Capital made recent comments during a CNBC interview comparing China’s economic growing pains to the United States 2008 financial crisis.

China has seen a meteoric rise in the global economy in recent years, but it seems that economic growth has stalled after the pandemic. The country may have to worry about the consequences of its quick growth finally catching up to it.

US Financial Crisis on Steroids

Kyle Bass, founder of Hayman Capital, commented on China’s missteps in managing their burgeoning economy.

“This is just like the US financial crisis on steroids,” he said. “They have 3 ½ times more banking leverage than we did going into the crisis, and they’ve only been at this banking thing for a couple of decades.” (via CNBC)

A Broken Economy

Bass continued to diagnose the problem behind China’s economic symptoms. “The basic architecture of the Chinese economy is broken,” he said. “Every single property developer in China that is public or listed is in default bankruptcy today.”

Without a strong real estate sector, Chinese families will struggle to maintain the wealth from one of the most important investments, a home.

Real Estate Investments in China

“70% of Chinese individual assets are in real estate,” Bass said during the interview. (via CNBC) “Real estate is down, we don’t know the number, nobody knows, [the market] is down 25, 30, 40%.”

The collapse of China’s housing bubble caused the downfall of Vergrande and Country Garden, two of China’s largest property developers. In particular, Evergrande became the most indebted developer in China with over $330 billion in liabilities. (via Cato Insititute)

Local Government Bankruptcies are Possible

During the interview, Bass suggested that the real state defaults are having downstream effects in China.

Local governments will struggle as they are unable to properly collect tax revenue on land sales. This will further increase the debt held by local governments, which is estimated to be around $13 trillion. (via Business Insider) These governments are stuck without the ability to raise tax revenue or make the tax cuts that the struggling Chinese middle class may need during a financial crisis.

Chinese Market Struggles

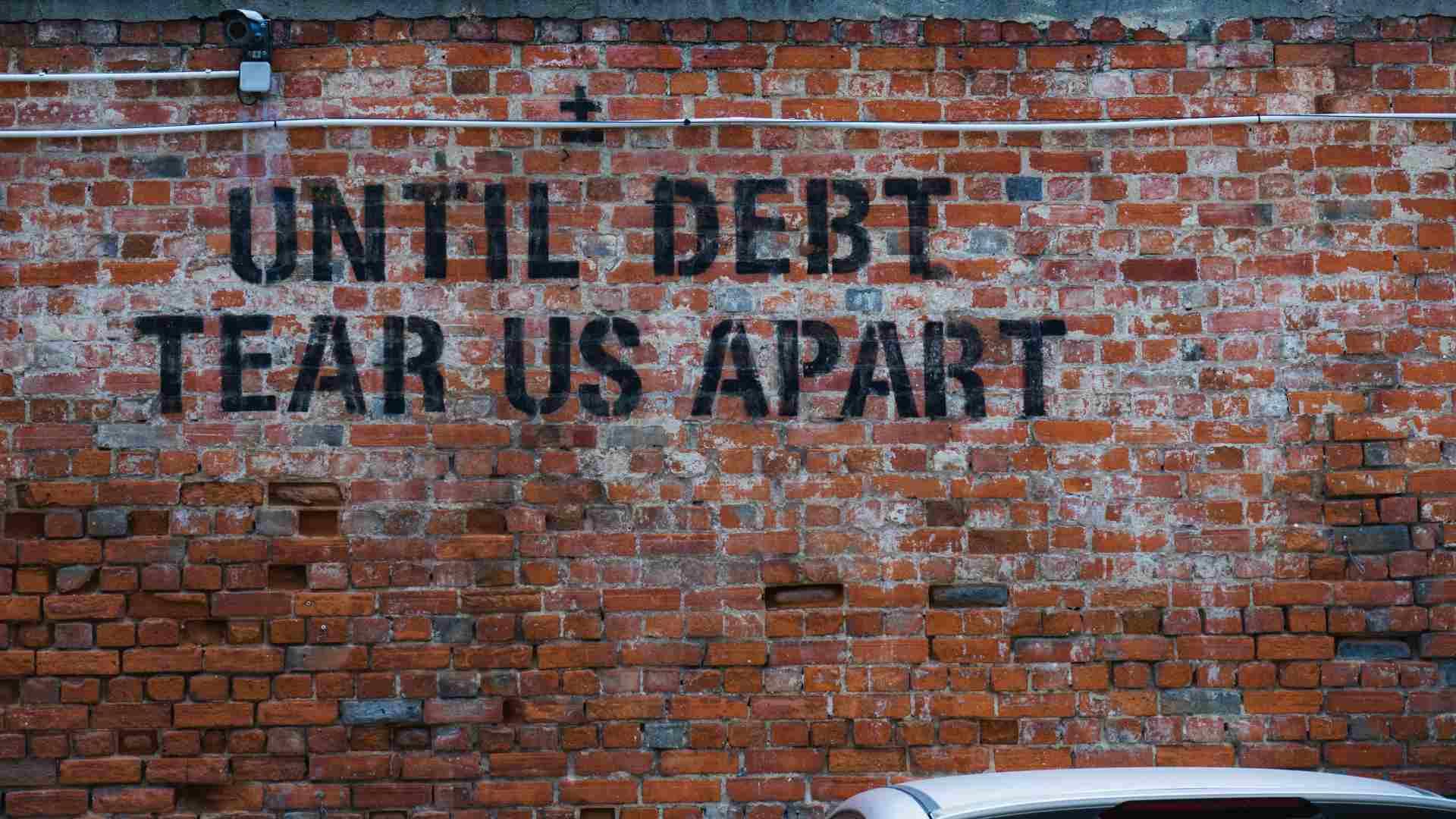

According to Business Insider, markets in China have endured a $7 trillion fallout since 2021. To fund some of its economic growth, certain market segments like the real-estate sector relied on debt to keep the growth going.

After the financial ruin wrought by the pandemic, many real estate developers lost their ability to keep the debt train fed.

Real Estate in China is Unregulated

One major difference between the United States and China is that the real estate market in the country is largely unregulated. This creates the perfect breeding ground for nefarious actors to try to game the economy for their own personal gain at the expense of the broader public.

In 2023 Fortune reported that China’s middle class saw significant wealth decreases following the consequences of this unregulated housing market.

Desperate Strategies from Property Developers

The Wall Street Journal reported in January that more than 50 property developers in the real estate market have defaulted on their debts

These defaults have caused some strange marketing tactics to recoup their losses. One video advertisement tried to draw in customers with a tagline saying, “Buy a house, get a wife for free.”

China Mirrors the United States

While China’s economy has several drastic differences compared to the United States, it’s ironic that they might soon share the same cause of their recession, a housing crisis.

The 2008 financial crisis in the United States was started by a housing price drop that caused people to be unable to repay their mortgages and house loans.

Crisis of Confidence

As China’s economy starts to stall and more people feel the effects, it will become a self-fueling cycle.

Chinese citizens will start to develop increasingly negative perceptions of the economy causing them to engage in behaviors that make things worse. For example, they might start saving money because they don’t trust the economy to help them earn it back, which will further stall economic recovery.

What Did the US Do to Recover?

The recovery from the 2008 crisis in America was not an easy task. Then President Barack Obama passed a $789 billion stimulus package to put the country on a better track.

This stimulus, called the American Recovery and Reinvestment Act, instituted huge tax cuts and invested heavily into the country’s infrastructure. Even with this action, the economy took over four years to start recovering at a satisfactory rate.

Will China Try Something Similar?

So far, Chinese leadership has shown reluctance to institute a massive public program to help reverse the course of their economy.

Economists are puzzled why China hasn’t tried a large form of public stimulus so far. China seems reluctant to rely on a public stimulus, fearing repeating some of the mistakes they see in the American bailout. In particular, they want to avoid adding any more debt, which is one of the reasons they are in this crisis in the first place.