American consumers are actively resisting price increases in various sectors, showing a notable shift in their purchasing habits.

The reluctance to accept inflated prices is most apparent in grocery shopping, where individuals are opting for store brands over national brands, and in the automotive sector, where more consumers are choosing used cars over new. This shift is a clear indicator of the broader impact of inflation on consumer choices and the economy.

Impact on Food Prices

AP News reports that recent consumer behavior has forced large food corporations to reconsider their pricing strategies, slowing down the rate of price increases. Despite this change, experts do not anticipate a return to pre-pandemic price levels.

However, the moderated price increases in essential goods like food are expected to contribute to the overall cooling of inflation rates, offering some relief from the previous years’ high inflation spikes.

Political Repercussions

The persistent high prices have become a significant issue in political discourse, affecting public opinion and possibly influencing upcoming elections.

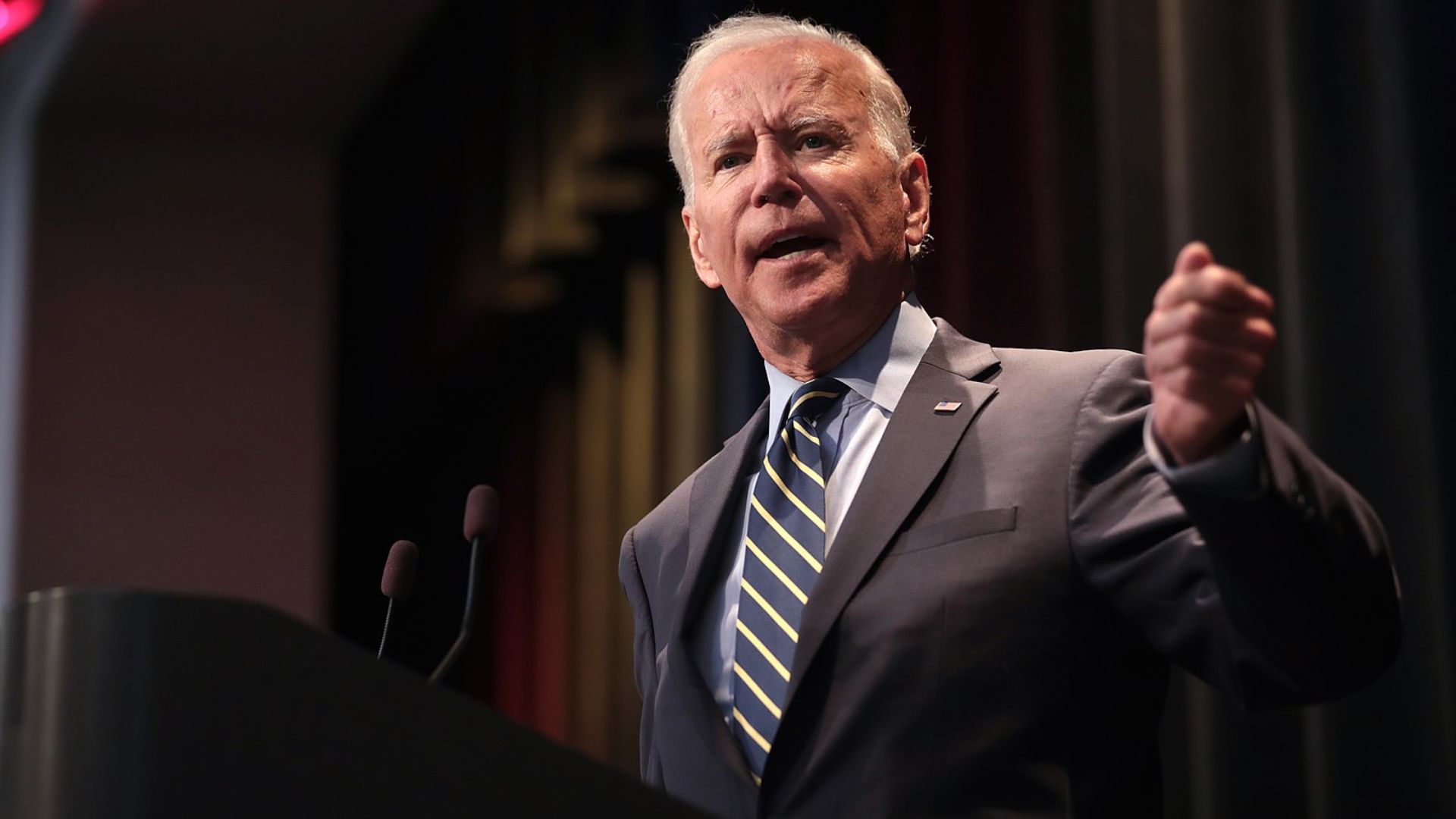

President Joe Biden has highlighted corporate pricing practices and the phenomenon of “shrinkflation” as key concerns, suggesting a strong link between consumer discontent and political narratives, as noted in recent polls regarding the administration’s handling of the economy.

President Biden Addresses Shrinkflation Concerns

President Joe Biden has openly criticized food manufacturers for engaging in what he terms “shrinkflation” – a tactic where product sizes are reduced while prices remain constant.

During a Super Bowl-related video message, he highlighted this issue, stressing that “the American public is tired of being played for suckers,” pointing to a widespread concern among consumers about not getting their money’s worth.

Highlighting Subtle Consumer Deception

In his address, Biden pointed out that some companies might be reducing their product sizes incrementally, hoping the changes go unnoticed by consumers.

He articulated this strategy as companies attempting “to pull a fast one by shrinking the products little by little and hoping you won’t notice.”

Choosing the Super Bowl for Maximum Impact

The President chose the Super Bowl, an event with massive viewership, to voice his concerns about shrinkflation.

This strategic choice ensured the message reached a broad audience, emphasizing the significance he places on this issue.

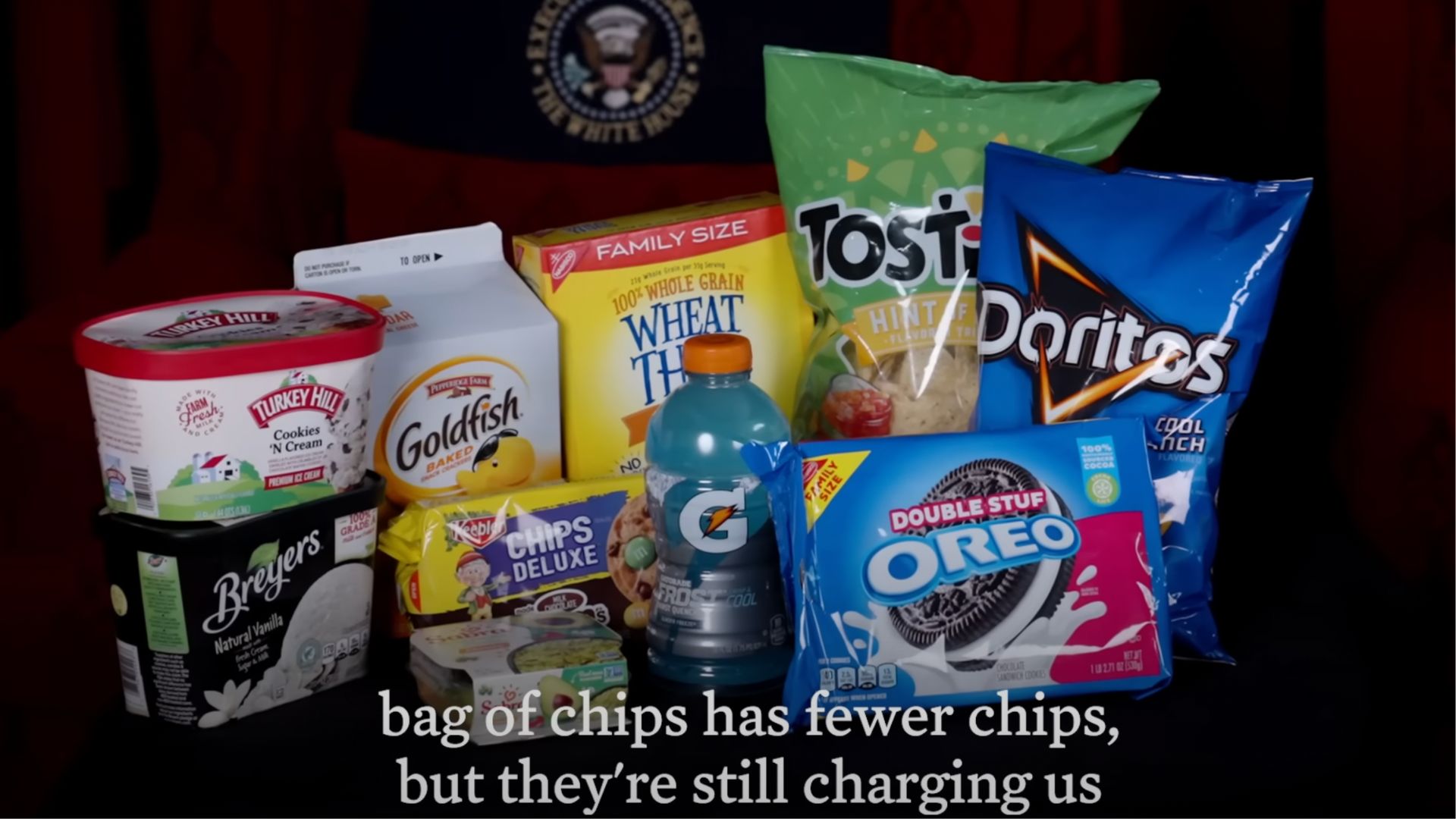

Unnamed Brands in the Spotlight

Though President Biden did not specifically name any brands in his criticism, the video he released featured prominent products, implying the involvement of major companies in shrinkflation practices.

This inclusion of brands such as Gatorade and Oreo suggests the administration’s focus on larger corporations in its campaign against this deceptive practice.

Biden’s Personal Annoyance with Shrinkflation

The President expressed a personal grievance with the shrinking sizes of consumer goods, particularly ice cream, a product he professed to love.

He stated, “What makes me the most angry is that ice-cream cartons have actually shrunk in size.”

Cookie Monster Echoes Consumer Frustration

NBC News reports that the character Cookie Monster from “Sesame Street” also voiced his dissatisfaction with shrinkflation on social media, stating, “Me hate shrinkflation! Me cookies are getting smaller.”

This sentiment was acknowledged by the White House, which responded to the post saying “C is for consumers getting ripped off.”

Senator Sherrod Brown Supports Cookie Monster’s Stand

The issue of shrinkflation not only caught President Biden’s attention but also resonated with U.S. Senator Sherrod Brown of Ohio.

He amplified Cookie Monster’s grievance over social media, posting, “Me too, Cookie Monster… People in my state of Ohio are fed up — They should get all the cookie they pay for.”

Biden Criticizes Chip Manufacturers

The President extended his criticism to the makers of potato chips, speaking at a White House event.

He said “Many corporations are raising their prices, pad the profits, charging folks more and more for less and less. In fact, some of the small snack companies, you won’t — think you won’t even notice what they’re doing, when they charge you just as much for the same size bag of potato chips, only there’s a helluva lot fewer chips in it.”

Senator Bob Casey’s Report Highlights Specific Shrinkflation Examples

A report from Pennsylvania Senator Bob Casey’s office has brought to light concrete examples of shrinkflation affecting everyday products.

It reveals that OREO cookie packages have seen a 6% reduction in size since 2019, and a family-size box of Wheat Thins has shrunk by 12% in weight.

Beyond Snacks: Shrinkflation Hits Various Consumer Goods

The phenomenon of shrinkflation extends beyond just snack items. The report points out that even essential household items like Charmin Ultra Soft toilet paper have not been spared, experiencing a reduction of approximately 20 sheets per roll.

Moreover, consumers are finding smaller quantities in a range of other products, including cleaning supplies, coffee, and frozen foods.

Navigating Economic Fluctuations Amid Inflation Concerns

Despite a notable decrease in inflation rates compared to two years ago, a Bureau of Labor Statistics report indicates a 3.1% rise in consumer prices this January from the previous year, which was contrary to expectations.

However, experts urge caution in interpreting these figures hastily. Susan Collins, president of the Federal Reserve Bank of Boston, said “The path will continue to be bumpy, and we should not overreact to individual data readings.”

The Ongoing Dialogue on Consumer Value

As the dialogue on shrinkflation continues, it remains to be seen how food companies will respond to the criticisms laid out by President Biden and echoed by public figures and consumers alike.

The administration’s focus on this issue signals an ongoing commitment to addressing consumer concerns in the marketplace, ensuring that value, fairness, and transparency remain at the forefront of corporate-consumer relations.

Inflation Psychology and Consumer Behavior

Analysts highlight the distinction between the current inflation scenario and past inflationary periods, noting a lack of an inflationary psychology among consumers.

The proactive stance against accepting higher prices reflects a strategic shift in consumer behavior, aiming to prevent a self-perpetuating cycle of inflation where anticipation of future price increases fuels current spending.

A Shift in Loyalty at Panera Bread

NBC News tells the story of Brooke Benson, a long-time patron of Panera Bread, who changed her dining habits due to a noticeable price increase at her local outlet. The price of her favored soup jumped significantly over three years, prompting her to seek alternatives.

Her experience reflects a growing trend where consumers, feeling the pinch of price increases, are exploring more affordable options, impacting even established customer relationships with brands.

The Inflation Challenge and Company Responses

As inflation reached a four-decade high, companies cited rising costs for materials and labor as reasons for hiking their prices.

However, with the inflation rate decreasing to 3.1%, businesses are finding that continuous price increases may no longer be sustainable without risking customer loss. Fortune notes that major brands like McDonald’s are now emphasizing affordability, recognizing the need to cater to budget-conscious consumers.

Consumer Spending Shifts Impact Sales

The MTY Food Group, operator of over 70 brands, observed a slight decline in same-store sales, attributing it to consumer pushback against price increases.

CEO Eric Lefebvre emphasized the importance of not alienating customers with steep price hikes. Similarly, General Mills noted a sales drop in its pet food sector, acknowledging an overestimation of consumer willingness to pay more for products.

The Pricing Dilemma Facing Kraft Heinz

Kraft Heinz experienced a sales downturn, suggesting a consumer threshold for price tolerance.

After a significant price increase in the previous year, the company plans a modest adjustment this year, indicating a strategic pivot towards more cautious pricing to avoid losing customers.

Home Improvement Spending Cools Off

Home Depot anticipates 2024 being “a year of continued moderation”, following a surge in home renovation projects during the pandemic.

This trend points to a broader consumer behavior shift, with individuals becoming more selective and less inclined towards high-cost purchases in a post-pandemic economic environment.

Price Moderation Benefits Shake Shack

Shake Shack’s strategy of moderate price increases led to positive sales growth, demonstrating the potential benefits of a balanced pricing approach.

NBC News notes that this experience contrasts with other brands that have faced backlash for more aggressive pricing tactics, suggesting a nuanced understanding of consumer price sensitivity can yield favorable results.

Walmart’s Pricing Strategy Sees Positive Results

Walmart’s decision to lower certain prices, like its French bread, has been met with strong customer approval.

The retailer’s efforts to offer value reflect a broader industry trend towards price sensitivity and the importance of aligning pricing with consumer expectations.

The Role of Consumer Power in Inflation Dynamics

AP News reports that Federal Reserve officials recognize the growing consumer resistance to price hikes as a critical factor in the projected decline of inflation rates.

The heightened price sensitivity among consumers is playing a pivotal role in shaping the economic outlook, with expectations of a more stable and predictable inflation trend in the near future.