The US Treasury Department has labeled an “anti-woke” banking law signed by DeSantis earlier this year as a potential threat to the nation’s security.

This warning comes as other states, inspired by Florida’s and Tennessee’s example, have considered passing similar legislation.

DeSantis’ Law

In May, Ron Desantis signed House Bill 989 into law, which is aimed at protecting Florida residents from being discriminated against for their political views.

According to a Florida government statement the law “increases protection for customers of financial institutions operating in Florida from unwarranted account cancellations and restrictions through a coordinated complaint and investigatory process within the Office of Financial Regulation.”

Protecting Against Banks

DeSantis gave his own statement about the law during its signing, insisting it is necessary to protect political and religious beliefs in the state.

“We reject a global elite trying to force their ideology on us by capturing major institutions,” said DeSantis. “We are not going to allow big banks to discriminate based on someone’s political or religious beliefs, and we will continue to fight back against indoctrination in education and the workplace.”

Fight Against Wokeness

This law is part of DeSantis’ overall “war on wokeness,” a campaign where he seeks to prevent the spread of what he sees as the harmful ideology of wokeness and policies like DEI.

“@GovRonDeSantis is signing our agency bill. Does tons of great things, but one is allowing credit unions to participate in our qualified public depositor program. If banks go too woke, public orgs will have other options for maximizing returns. Florida is where WOKE GOES TO DIE,” said Florida’s Chief Financial Officer Jimmy Patronis in a May X post.

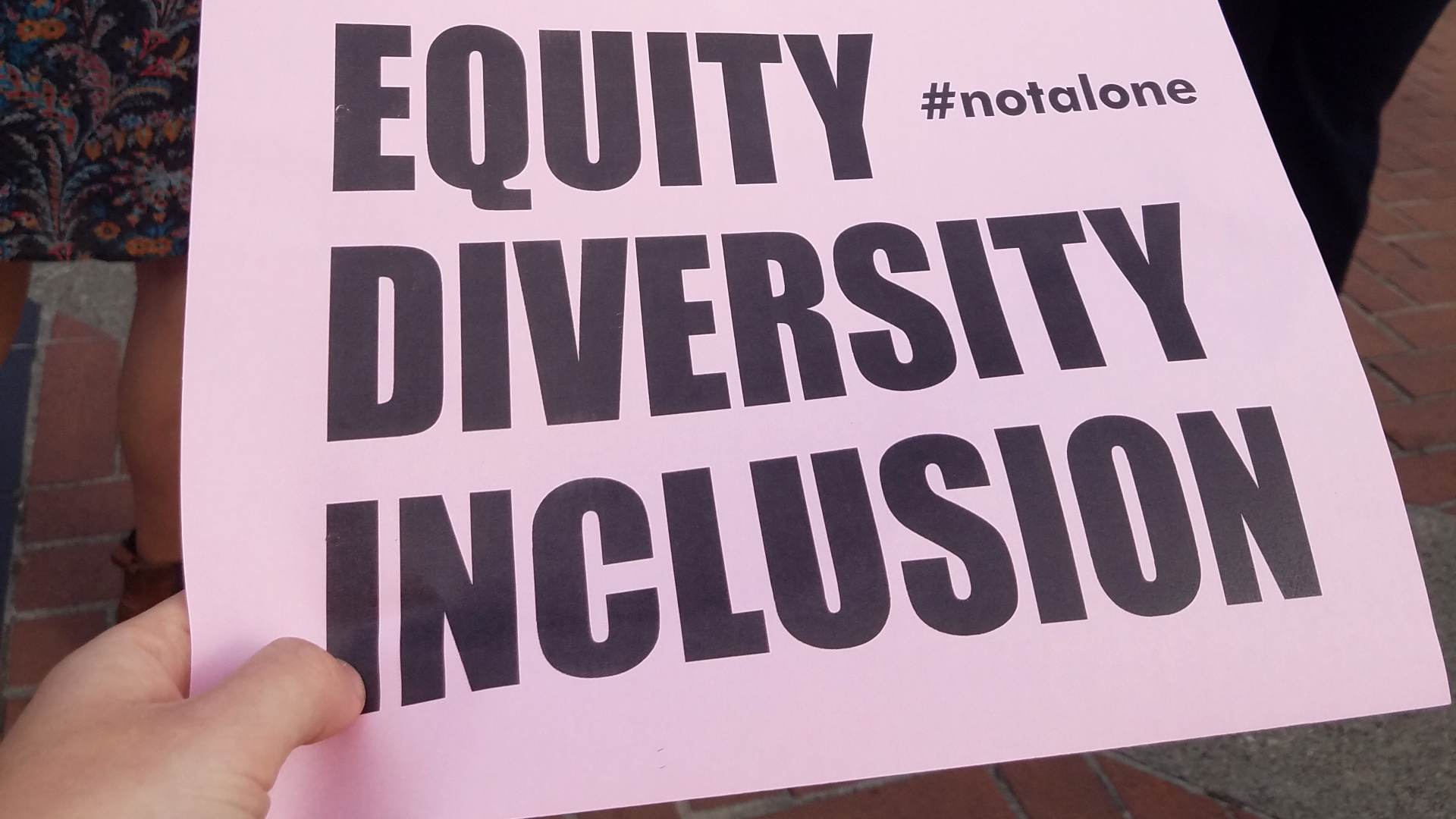

DEI Not What It Appears To Be

While supporters of DEI frame related initiatives as critical for promoting inclusiveness in society, DeSantis and opponents feel that it often has the opposite effect.

“The Left tells us DEI stands for ‘Diversity, Equity, and Inclusion.’ But as practiced, it more closely represents ‘Discrimination, Exclusion, and Indoctrination,’” the governor said in a November X post.

Treasury Department Letter

Recently, the Associated Press obtained a letter from the US Treasury Department that highlighted the dangers of the new DeSantis banking law.

The letter accused the law of promoting an “unsafe and unsound practice” and asserted that “such laws create uncertainty and may inhibit” protections for national security.

Heightened Risk

In the letter, Treasury Undersecretary Brian Nelson warned of the increased risk that the country’s financial system now faces.

“State laws interfering with financial institutions’ ability to comply with national security requirements heighten the risk that international drug traffickers, transnational organized criminals, terrorists and corrupt foreign officials will use the U.S. financial system to launder money, evade sanctions and threaten our national security,” Nelson said.

Motivation for the Letter

According to AP, the letter was sent as a response to New Jersey Democrat Rep. Josh Gottheimer and other politicians who were concerned about the possibility of more states adopting similar measures.

“To any states that are considering similar laws, I urge them to think twice before putting America’s national security at risk,” said Gottheimer in a statement.

Tennessee Law

Tennessee already passed a similar “debanking” bill back in April aimed at protecting the religious and political beliefs of bank customers.

“Gov. Lee and state lawmakers have taken an important step forward in protecting the fundamental freedoms of Tennesseans of every political and religious stripe. This is a win for everyone. No one should be denied access to basic financial services because of their political or religious beliefs. Banks that are too big to fail are too big for bias. It’s the government’s duty to protect the fundamental freedoms of its citizens,” said Senior Counsel Matt Sharp for the organization Alliance Defending Freedom, a group that supports the legislation.

Other States Considering Similar Measures

While Florida’s and Tennessee’s laws went into effect on July 1, other states are trying to follow in their footsteps in the fight against so-called debanking.

Arizona, Georgia, Iowa, Indiana, Kentucky, and Idaho have reportedly all considered similar laws.

Trump Joins In

Former President Donald Trump has also hoped to capitalize on the conservative momentum against big banks, putting an increased spotlight on the issue.

At a rally earlier this year, Trump promised that he would “place strong protections to stop banks and regulators from trying to debank you from your political beliefs” if elected president in November.

Thanking Trump

In April, the State Treasurer of Mississippi praised Trump for bringing more attention to the issue of debanking.

“It wasn’t that long ago (maybe two or three years) that the term ‘debanking’ existed far out of reach of the American lexicon. But in recent months, President Trump has drawn much-needed attention to this freedom-stifling tactic,” said Treasurer David McRae.