In the ever-turbulent sea of global finance, Richard X. Bove, a seasoned financial analyst with over five decades of experience, has made a startling prediction that could send waves across the world.

According to Bove, the U.S. dollar, which has long been the cornerstone of the global economy as the world’s reserve currency, is on the brink of collapse. This forecast comes amid signs of economic resilience in the United States but aligns with Bove’s track record of going against the grain with his bold predictions.

Who Is Richard X. Bove?

Richard X. Bove has been a prominent figure in the financial world, known for his deep insights and sometimes controversial predictions. At the age of 83, Bove has worked at 17 brokerage firms, gaining a reputation for his fearless forecasts.

His most notable prediction came in 2005, three years before the global financial crisis, when he foresaw the housing market collapse. Bove’s career has been marked by both acclaim and criticism, making his latest prediction about the U.S. dollar a topic of intense interest and debate.

The Core of Bove’s Latest Forecast

“The dollar is finished as the world’s reserve currency,” Bove has declared in speaking with The New York Times, suggesting a seismic shift in the global financial landscape.

This forecast is based on a variety of factors, including the rise of China’s economy and the challenges facing the U.S. financial system. Despite the immediate health of the U.S. economy, Bove believes that structural issues and global dynamics will lead to the decline of the dollar’s dominance on the world stage.

China’s Economic Ascent

China’s economy has been on a rapid growth trajectory, positioning it as a contender to overtake the U.S. as the world’s largest economy.

Despite recent setbacks such as the Evergrande crisis, which has had significant implications for its property market, China’s economic engine continues to push forward. Bove’s prediction takes into account these dynamics, suggesting that China’s rise is a critical factor in the potential decline of the U.S. dollar’s global standing.

The Evergrande Crisis Explained

In 2020, the Evergrande Group, a giant in China’s property market, faced a crisis that sent shock waves through the global economy (via BBC). With over $300 billion in liabilities, the company’s struggles highlighted the vulnerabilities within China’s economic system.

However, Bove’s analysis suggests that despite such setbacks, the broader trajectory of China’s economy could still challenge the U.S. dollar’s supremacy.

U.S. Economy: A Resilient Giant

The U.S. economy has demonstrated remarkable resilience, with GDP growth rates outpacing expectations in recent quarters. In the last three months of 2023, the economy grew at an annual pace of 3.3%, surpassing analyst predictions.

This strength reflects the robustness of the U.S. financial system, yet Bove believes that underlying challenges could undermine the dollar’s dominance in the long term.

Why Bove’s Opinion Matters

Richard X. Bove’s opinions carry weight due to his history of accurate, albeit sometimes controversial, predictions. His foresight regarding the 2008 financial crisis has cemented his reputation as a visionary analyst.

As such, his latest prediction about the U.S. dollar has garnered attention, sparking discussions about the future of global finance and the potential shifts in economic power dynamics.

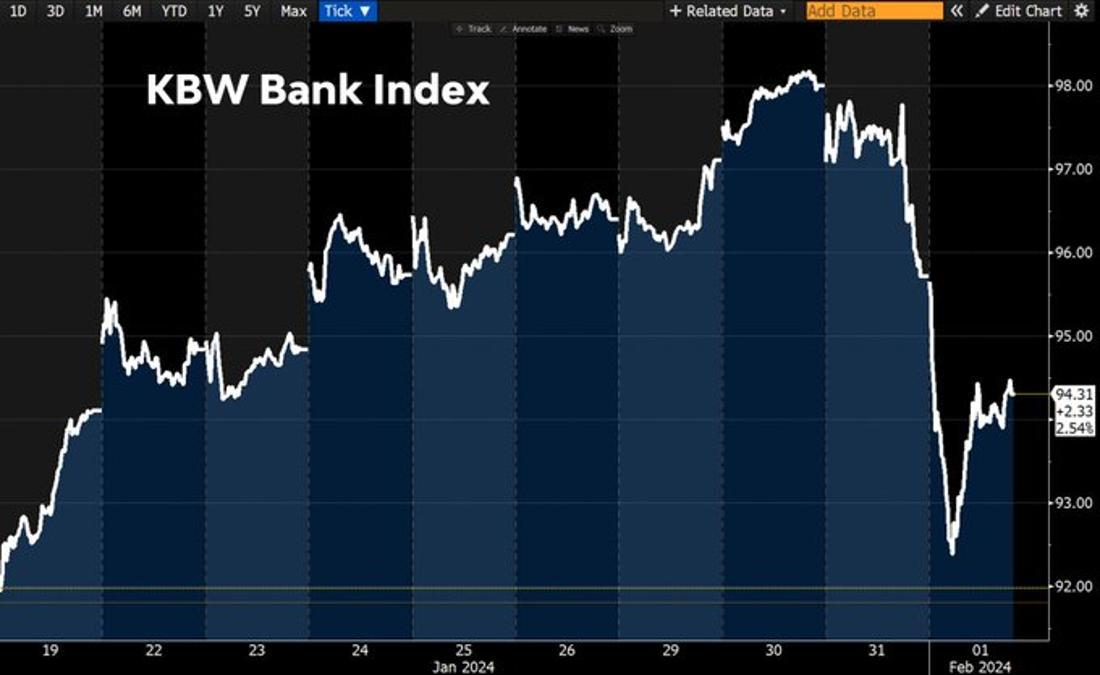

Wall Street’s Mixed Reactions

The financial community is divided on Bove’s latest forecast. Figures like Jamie Dimon of JPMorgan Chase have shown support for Bove’s analytical prowess, while others, such as Bank of America’s Brian Moynihan, have been more critical.

This division underscores the controversial nature of Bove’s predictions and the complex factors that influence the global financial system.

The Role of the U.S. Dollar in the Global Economy

The U.S. dollar’s status as the world’s reserve currency is a cornerstone of the global economy, facilitating international trade and investment.

A shift away from the dollar would have profound implications, affecting everything from exchange rates to global financial stability.

Comparing Economic Growth Rates

The economic trajectories of the U.S. and China are central to understanding Bove’s prediction.

While the U.S. has shown recent signs of strong growth, projections indicate that China’s GDP could more than double that of the U.S. in the coming decade.

Bove’s Critics and Supporters

Opinions on Bove’s prediction are split, with some viewing his forecasts as insightful while others dismiss them as overly pessimistic.

This divide reflects the broader debate within the financial community about the future of the U.S. dollar and the global economy. Bove’s track record adds weight to his forecasts, but only time will tell if his latest prediction will come to fruition.

What the Future May Hold

Richard X. Bove’s bold prediction about the U.S. dollar has sparked a vigorous debate about the future of global finance. While the immediate economic indicators in the U.S. show strength, Bove’s forecast invites us to consider the longer-term trends and the possible realignment of global economic power.

As the world watches, the ultimate fate of the U.S. dollar and its role in the global economy remains to be seen, underscoring the ever-changing nature of international finance.