According to experts, Tesla is in serious trouble as problems continue to mount in 2024.

From a drop in share prices to accusations of blackmailing investors, Tesla has experienced several setbacks in the first few months of the new year.

Tesla Prices Drop at the Beginning of 2024

Tesla’s most notable problem came in January, when, according to CNN, its share price dropped a staggering 12%.

This was the lowest the price had fallen to in over a year. In the wake of the drop, experts have suggested 2024 could be a slow year for Musk and Tesla.

The Company’s Outlook Is a Cause for Concern

According to CNBC, investors are concerned about Tesla’s outlook after announcing that vehicle volume growth “may be notably lower” in 2024.

Tesla argues that this is due to focusing on its “next-generation vehicles” before explaining to stockholders that it is “currently between two major growth waves.”

Barclays Cut Price Target for Tesla

Tesla’s stock was further stressed as numerous brokers dropped the company’s target price. Barclays cut the stock price from $250 to $225.

Speaking on the situation, a Barclays analyst wrote, “Not as bad as feared, but a cloudy path ahead reinforces some downside risk for now” (via CNBC).

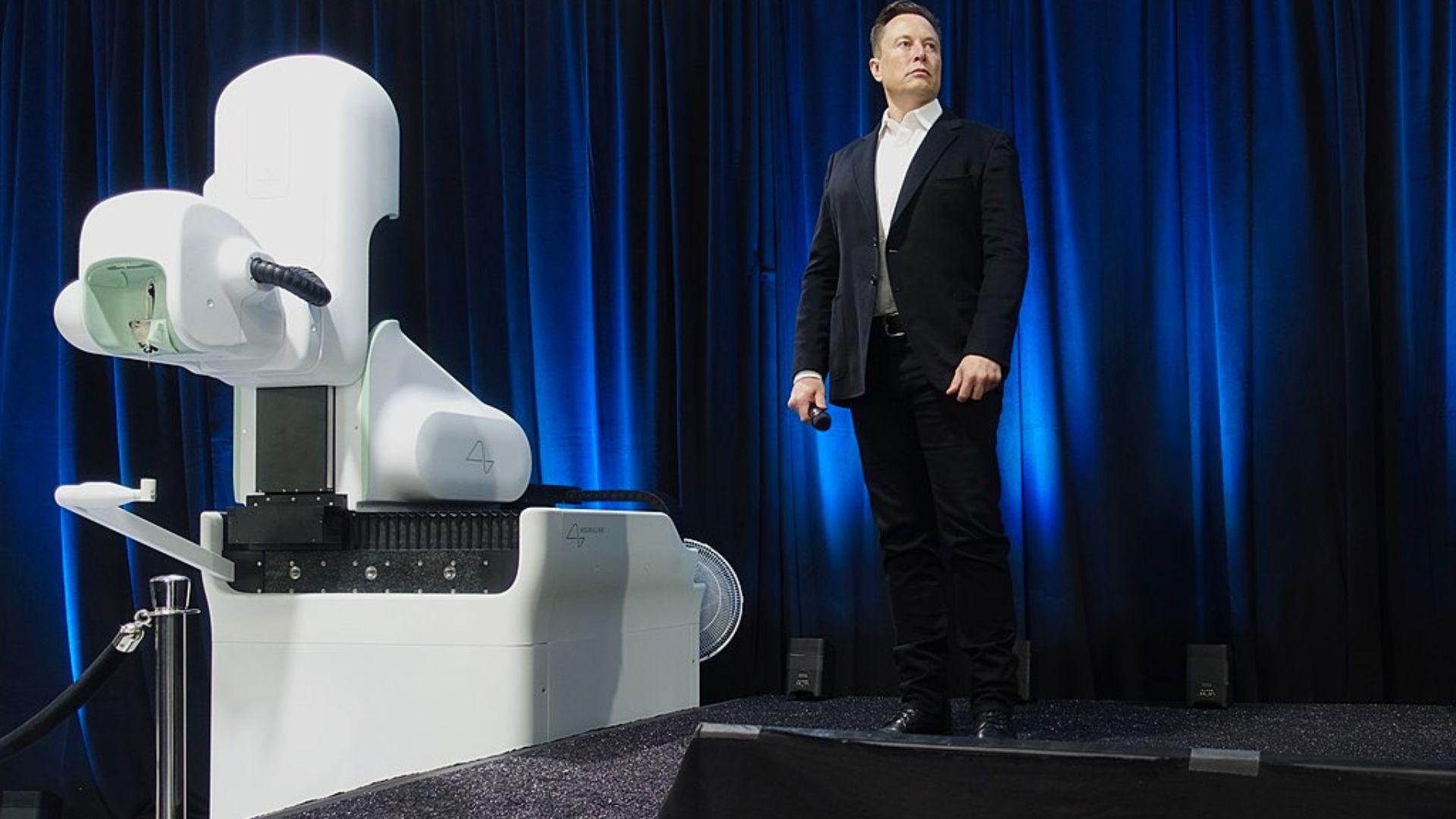

Elon Musk Makes Things Worse

To add to the list of problems, Elon Musk, the face of Tesla, has been accused of blackmailing investors in a series of tweets.

At the beginning of March, the Tesla CEO claimed he was “uncomfortable” with the company’s engagement in robotics and AI if he didn’t have “25 percent voting control.”

Musk Calls for Enough Control to Be Influential

Tesla’s founder and CEO wants to ensure that his ideas can influence the company’s AI programs without overstepping.

Musk wrote, “Enough to be influential, but not so much that I can’t be overturned.”

Musk Threatens to Work on AI Outside of Tesla

During his rant on X, Musk went as far as to threaten the Tesla board.

The company’s CEO threatened to work on AI projects “outside of Tesla” should he not receive what he had requested.

Shareholders Displeased with Musk’s Comments

Investors are unhappy with Musk’s ultimatum, with many suggesting the CEO is blackmailing shareholders.

Speaking with CNBC, Tesla investor Ross Gerber said, “Now he seems to be blackmailing the Tesla shareholders, saying he won’t build stuff for us unless he gets another $30 billion.”

Tesla CEO’s Unreasonable Demands

Gerber went on to argue Musk’s demands are unreasonable.

“Where in the world does paying a CEO $30 billion make any logical sense in the modern world, who already has a $150 billion stake in the company?” he said.

Too Much Control Over the Board

While Musk tries to obtain more control over the Tesla board, Gerber argues he’s in full control as friends and members of the CEO’s close family sit in powerful positions.

“The idea that he doesn’t control Tesla when everybody on the board is a friend or family member of his is the part I’m really pushing back on,” he said.

Musk Tries to Reassure Shareholders

Musk tried to reassure investors last month by promising a low-cost EV is still on the way. However, the company has yet to produce a prototype.

Best estimates suggest the budget vehicle will not hit the market until late 2025, further testing shareholders’ patience.

Sacrifices to Bring Cybertruck to Life

To top the long list of problems, Musk’s pet project, the Cybertruck, hasn’t performed as well as the company would have liked.

Many owners of the highly anticipated truck were disappointed with its lackluster performance, per UNILAD.

Tesla Car Sales Down in 2024

As reported by the BBC, Tesla has sold less than 370,000 new vehicles in the first quarter of 2024.

This led to an 8% decrease when compared to year-on-year sales, a figure much less than anticipated by experts.

Shares Fall 4% After News Broke.

After the news broke of lower vehicle sales, Tesla shares fell by around 4%.

Dan Ives, an analyst for Wedbush Securities, described the lower figures as an “unmitigated disaster that is hard to explain away.”

Tesla Stock Continues to Drop

The further drop in Tesla’s stock price after the first quarter results were released means it has now dropped by around 30% this year.

This leaves the company as one of the worst performers on the S&P 500 in 2024.

Major Disruptions in Supply Chain

2024 has brought with it major disruptions in Tesla’s supply chain. One event saw an arson attack at a factory in Germany, which halted work.

Meanwhile, disturbances in the Red Sea have also led to a shortage of components, further halting factory work.

Train Wreck of a Year for Tesla

Speaking on the setbacks for Musk and Tesla this year, Ives called it a “train wreck into a brick wall.”

“This is a fork in the road time to get Tesla through this turbulent period; otherwise, troubling days could be ahead,” he said.

Driverless Car Software Under Scrutiny

Electric vehicle companies across the board have been forced to reanalyze their EV ambitions after warnings of lower demand have been issued by experts.

While this could be the case for Tesla’s weaker-than-average sales, the company is evidently facing a plethora of personal problems. One further problem is centered on its driverless car software.

Driverless Steering to Bring New Wave of Growth

According to Musk and experts at Tesla, the next generation of driverless car software will usher in a new period of growth for the company.

However, many safety experts have suggested problems lie in the power steering and other aspects of the software.

Investors Growing Tired of Promises

Some investors have argued the only thing Musk has offered them this year is a selection of promises that things will get better.

Now, investors have begun questioning whether projects like the driverless software and the next-generation vehicles will really bring Tesla back to glory.

Musk Has Turned Toxic According to Gerber

According to Gerber, Musk is to blame for Tesla’s shortcomings in 2024.

The investor believes the SpaceX founder’s “toxic behavior” has absolutely damaged the brand.”

Tesla CEO Fires Back at an Investor

Musk is never one to take it on the chin without firing back. Speaking on the claims made by Gerber, he went on to call him an “idiot.”

The Tesla CEO also noted that it was a “tough quarter” for all major EV companies.

China’s BYD Experiences Dip in Sales

Musk may be correct in his assessment of the EV industry. Tesla’s biggest competitor, China’s BYD, also released reports on its Q1 sales, which experienced a dip compared to the previous quarter.

The EV company, backed by investor Warren Buffet, has appealed to many citizens in Asia and Europe thanks to their lower prices.

Musk Turns His Back on Tesla

Tesla’s largest problems appear to stem from Musk’s new idea of promoting Tesla as a robotics and AI company, which has led investors to suggest the CEO has turned his back on the company’s core business, vehicles.

One thing is for sure: If the CEO can’t find common ground with the investors, further problems may await the company later in the year.