Acorda Therapeutics, a biotech firm celebrated for pioneering treatments in the fight against Parkinson’s and Multiple Sclerosis, has hit a rough patch.

On April 1, they filed for Chapter 11 bankruptcy with plans to liquidate following a pending sale. This move shines a light on a broader issue: the healthcare sector’s growing financial instability over the past few years.

Escalating Bankruptcy Filings in Healthcare

According to a report by Gibbins Advisors, bankruptcy filings in the healthcare arena have jumped significantly, from 25 in 2021 to 46 in 2022, and skyrocketed to 79 in 2023—the highest in half a decade.

The early months of this year alone have seen a spike from around five filings in January to an additional 12 by February, signaling a continued atmosphere of uncertainty.

Notable Chapter 11 Cases in the Sector

High-profile Chapter 11 filings are becoming more common, including Cano Health, which reported over $1 billion in both assets and liabilities when it filed on February 4.

Soon after, on February 13, Invitae Corp. followed suit, also declaring over $1 billion in liabilities against $500 million to $1 billion in assets.

Acorda Therapeutics Files for Bankruptcy

Located in Pearl River, N.Y., Acorda Therapeutics took the legal route to restructuring on April 1, seeking relief under Chapter 11 in the Southern District of New York.

Their goal is to negotiate a sale to Merz Therapeutics with a bid of $185 million.

Merz Therapeutics

According to this Chapter 11 bankruptcy filing, Merz Therapeutics has agreed to an asset purchase with Acorda Therapeutics.

Merz also creates medications for people who have movement disorders, such as MS and Parkinson’s.

Merz in North America

Merz Therapeutics, which is based in Germany, is likely best known for manufacturing Xeomin, a major rival of Botox. Recently, the company has made moves to have more reach in North America.

By taking control of the medications Acorda once made, Merz will seemingly continue to grow its presence throughout the United States, Canada, and Mexico.

A Merz Expansion

The company’s CEO, Stefan König, talked about this upcoming expansion in North America in a statement.

König said, “We recognize the responsibility of providing continued patient care and support for Acorda’s well-established and innovative therapies and see this as an optimal potential portfolio expansion that underscores our ambition in key therapeutic areas.”

Financial Strategy During Bankruptcy

During this transition, they’re seeking $60 million in debtor-in-possession financing.

This financing can be broken down into $10 million upon interim and final court approval, plus a $40 million debt roll-up.

Acorda’s Debt and Assets

In its filing, Acorda outlined a challenging financial landscape: $266.2 million in debt versus $108.5 million in assets.

The news sent Acorda’s shares tumbling nearly 40%, according to Market Watch, signaling investor concerns over the company’s viability.

Lay Offs Ahead

Unfortunately, Acorda Therapeutics also recently announced that they would be laying off many of their employees as they file for bankruptcy.

According to a New York State Department of Labor notice, all 97 Acorda Therapeutics employees located at their Pearl River-based location will be laid off. This location will also fully shut down. The layoffs, and the closure of the office, will occur in June of 2024.

Working Until the Sale Is Complete

A Business Wire statement posted by NASDAQ also sheds some light on these layoffs. According to this statement, employees will continue to run Acorda until June while the sale to Merz is working toward completion.

This is occurring as both companies work to ensure medication access is steady for all patients during this time.

Thinking About Patients

In a statement, Acorda’s president and CEO Dr. Ron Cohen explained that they were taking into consideration how patients who need these medications may be affected.

“One of our top priorities is to ensure an uninterrupted supply of our medications to people with multiple sclerosis and Parkinson’s disease,” Dr. Cohen stated. “We are confident that Merz Therapeutics, if they are the ultimate acquirer, will be able to seamlessly continue serving these patients’ needs, given Merz’s longstanding dedication to improving the lives of people who suffer from movement disorders and other neurological conditions.”

Frequent Layoffs

This isn’t the first time Acorda has had to lay off much of its staff. Even before they filed for bankruptcy, the company faced massive issues and tried to save money.

This resulted in Acorda laying off 25% of its entire workforce in 2019 alone. In 2021, they laid off 16% at the beginning of the year, only to then lay off another 15% later that same year.

The History and Impact of Acorda Therapeutics

Since its foundation in 1995, Acorda has played a vital role in advancing treatment for neurological conditions.

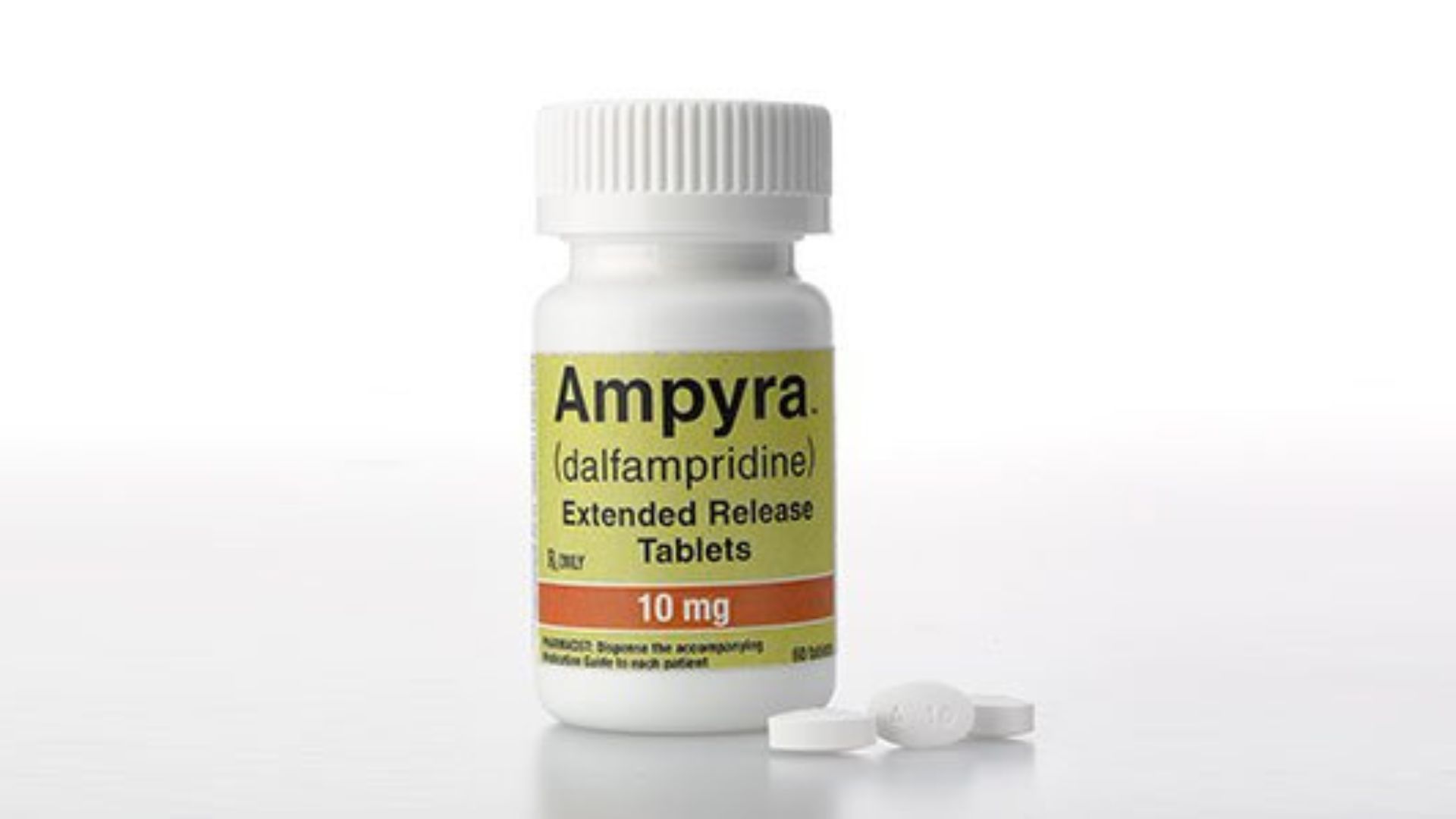

Their flagship drug, Ampyra, has been a game-changer for patients with multiple sclerosis, enhancing their mobility and quality of life, managed through a partnership with Pantheon Inc.

Challenges Leading to Bankruptcy

The road to bankruptcy was paved with several setbacks for Acorda. In 2016, the company faced a failed $363 million acquisition of Biotie Therapies, which failed to generate any revenue.

They also faced a devastating court ruling in 2018 that invalidated key patents for their drug Ampyra, leading to generic competitors drastically cutting their revenue streams.

COVID-19 and Prescription Challenges

Additionally, the COVID-19 pandemic further strained their operations, slowing down sales and complicating prescription processes for their Inbrija drug.

These factors hindered the company’s ability to finance further drug development and exploration.

Years of Low Sales

This bankruptcy also comes amid years of lower-than-expected sales. Many anticipated that the company would do incredibly well in the market. However, the company as a whole failed to bring in high sales.

This occurred for a variety of reasons. Regular competition in the pharmaceutical industry played a huge role.

Disappointing Sales

When Inbrija, one of the Parkinson’s drugs that Acorda was approved to make, first hit the market in 2018, analysts projected that the company would hit $800 million in sales.

However, adjustments had to be made when it became apparent that the treatment wouldn’t be bringing in this much money. Quickly, it was estimated that the company would instead make anywhere from $350 million and $500 million.

A Huge Drop in Estimations

However, even these high estimations in sales for Acorda would turn out to be too high. In 2022, the company’s global sales only hit $30.9 million.

Therefore, the enormous sales estimations seemingly set the company up to fail, as Acorda didn’t bring in nearly as much as they anticipated they would.

Ampyra’s Sales

Ampyra, the other medication that Acorda manufactured, also was anticipated to bring in high sales. At first, this did happen, as the drug produced $455 million in sales in 2018 alone.

However, when the company lost its four patents, the sales of the medication slipped to $163 million the next year.

2023 Earnings

In 2023, Ampyra’s sales fell even further as the medication faced a massive amount of generic competition on the market.

The drug only generated $15.7 million in 2023, becoming another medication treatment that only brought in disappointing numbers for Acorda.

Auction Deadline Approaches

With a deadline of May 16 for receiving bids and an auction slated for May 22, Acorda is on a tight timeline to navigate its financial crisis and seek a new owner for its assets.

This process is part of the company’s efforts to find a viable path forward through its financial difficulties, as it seeks to liquidate its assets and address its liabilities.

A Sale Hearing Scheduled

A crucial sale hearing is scheduled for May 31, which will likely determine the future of this once-thriving biotech innovator.

The hearing is a critical point in the bankruptcy process, as it will determine the future of the company’s assets.

The End of an Era for Acorda Therapeutics

Acorda Therapeutics’ journey through bankruptcy and towards liquidation marks a pivotal moment in the pharmaceutical world.

Despite its significant contributions to neurological disease treatment, the company’s financial challenges reflect the broader pressures weighing on the healthcare industry today.