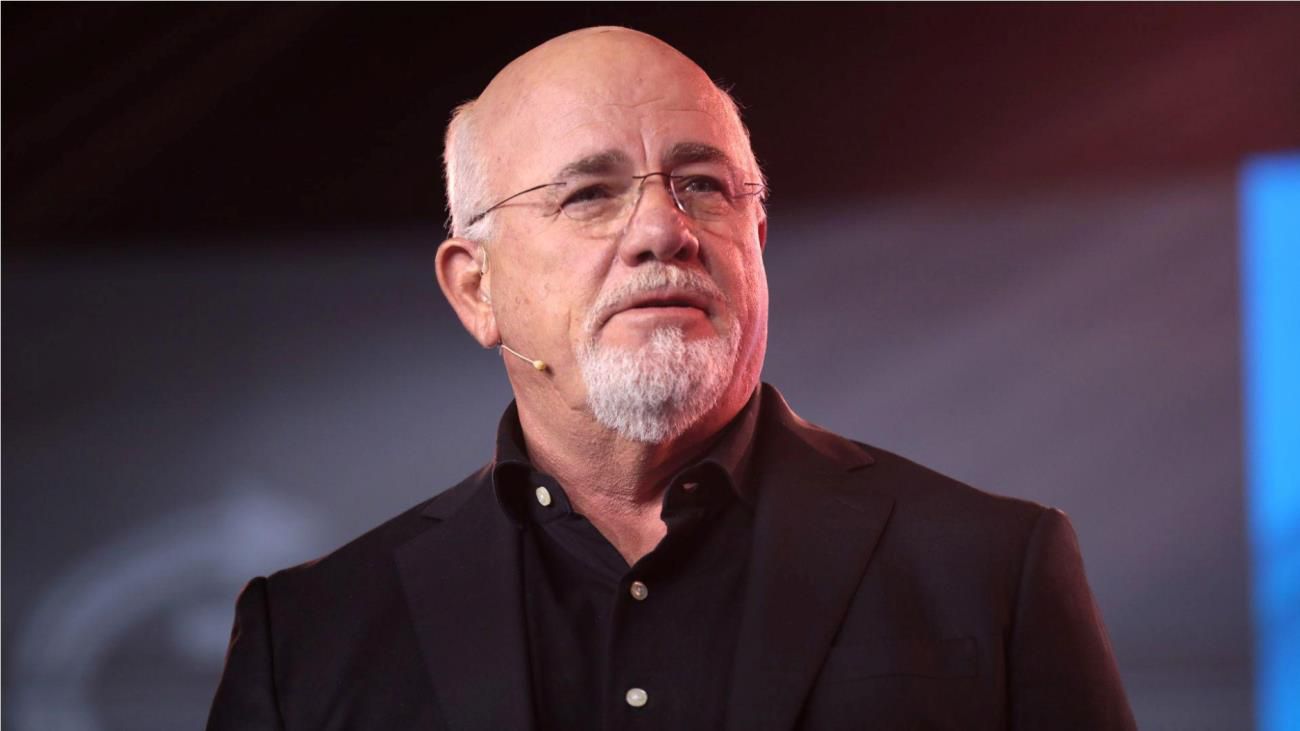

Recently, Dave Ramsey opened up about some of the main differences between the wealthy and the poor. As Ramsey himself comes from a lower middle-class background, he took the time to do a deep dive into the different financial behaviors of these social classes.

As Ramsey helped answer a commentator’s question in a new YouTube video, he explained how the lower and middle class can often partake in harmful financial decisions in an attempt to get ahead.

The Use of Payday Lenders

In Ramsey’s newest video “This Is Why You’re Still A Poor Person,” he discussed the different mentalities between the rich and the poor with his co-host Jade Warshaw. One of the main things that separates these two classes, according to Ramsey, is the use of payday lenders.

Ramsey says that many people considered poor or middle class often rely on things like payday loans. Payday loans are often short-term loans with high costs. These loans are normally offered by a lender at $500 or less. They are meant to be repaid by the borrower’s next paycheck.

People Shouldn’t Rely on Payday Loans

While many poor or middle-class people go to payday lenders often, Ramsey states that they shouldn’t grow to rely on these types of loans. If you do not pay back these loans in the necessary timeframe, you can quickly find yourself stuck in a cycle of debt.

According to Ramsey, wealthy people do not rely on the use of payday loans. He recommends everyone avoid these types of lenders at all costs.

Title Loans Do Not Help Anyone

Another thing the wealthy do not rely on? Title loans. Title loans are normally short-term loans with high interest that require you to put your car down as collateral in order to borrow money from a lender.

Again, Ramsey states that getting a title loan is not something that wealthy people do. Wealthy people do not allow themselves this opportunity to potentially get into more debt.

Buying Lottery Tickets

Many lower and middle-class people also tend to buy lottery tickets. Various studies have proven that lottery sales are highest in poor communities. Therefore, the wealthy do not go out of their way to invest in lottery tickets.

Ramsey has said before that your chances of winning the lottery are slim. Winning the lottery also won’t solve your issues. If you have a poor mentality to begin with, you’ll waste away your money if you do end up winning it.

The Truth About Credit Card Rewards

There are so many credit cards around today that tout various rewards you can get — all while simply using your credit card. However, Ramsey warns against the idea of credit card rewards, as these perks have a high chance of getting you into debt.

According to the financial guru, credit card rewards are a scam. Many people will overuse their credit cards to get these perks… then suddenly find themselves in debt, unable to pay a high-interest credit card bill.

The Wealthy Don’t Need Credit Card Perks

Ramsey doesn’t believe that people should be using credit cards all the time, especially as many smart and wealthy people do not. Instead of relying on credit, these types of people rely on cash.

They do not look at credit card rewards because of the risk associated with credit cards. Instead, many wealthy people simply use the cash they have to pay for items or services. Billionaire Mark Cuban has also warned people against the use of credit cards, saying, “If you use credit cards, you don’t want to be rich.”

Why Home Equity Loans Are Detrimental

Many middle-class homeowners use home equity loans. Home equity loans allow people to borrow money by putting up their home as collateral. These types of loans can be used for various purposes, though many get them to pay for home renovations or large expenses.

According to Ramsey, getting involved with these types of loans can quickly become detrimental. They can be a risky move and you often won’t find yourself getting out of debt immediately when you have a home equity loan.

The Wealthy Do Not Borrow Money

Very rarely do wealthy people take out high-interest loans, or borrow at the rate that lower and middle-class people do. Ramsey says this is because wealthy people will instead pay cash or use the money they have on hand.

One of the worst things people can do is find themselves in debt, as Ramsey says these people will never be able to become truly wealthy. In fact, a study done by Ramsey revealed that almost three-quarters of millionaires have never had a credit card balance.

The Wealthy Avoid Payments

In his video, Ramsey summed up the difference between the rich and poor by saying, “Rich people don’t ask how much down and how much a month; they avoid payments.”

The wealthy will do whatever it takes to avoid having to pay back a debt. However, many lower and middle-class people will take on debt because they’re trying to get ahead — and become wealthier.

Acting Wealthy

Ramsey says that poor and middle-class people can adopt these wealthy mindsets in their lives whenever they want. Instead of trying to live above their means, he says to only spend what they have available and not take out loans or credit.

According to Ramsey, if you’re looking to become wealthy, you should only pay in cash. Instead of buying brand-new cars, buy used ones. Don’t overspend on expensive vacations — or put these vacation expenses on your credit card.

Plan Ahead

Ramsey has long advised people to always plan ahead. Create a budget and stick to it while you live within your means.

As you create this budget, you should also remember to steer clear of credit cards. Don’t rely on things like payday loans or title loans. As Ramsey says, the best way to become rich is to refrain from borrowing money at all times.