The Florida State Senate has recently passed a legislative proposal granting state authorities enhanced regulatory powers over the short-term vacation rental market.

This move is aimed at companies like Airbnb and Vrbo, marking a significant shift from local to state-level oversight. Lawmakers throughout Florida have shown resistance to this change, signaling a complex debate surrounding the balance between state control and local autonomy in the vacation rental industry.

State Supersedes Local Regulations

Under the new bill, SB 280, the state’s power would overrule city and county regulations concerning short-term vacation rentals that were approved since 2016.

However, any regulations enacted before this date would remain unaffected. This legislative action represents a centralized approach to managing the short-term rental market, aiming to standardize regulations across the state.

New Requirements for Rentals

The legislation introduces several new requirements for short-term rentals, including occupancy limits of two people per bedroom, with an additional allowance for two people in common areas.

Moreover, rental owners will be mandated to register their properties with the local government. Failure to comply with these registration requirements could result in fines up to $500 if not rectified within 15 days.

Dedicated Response Personnel Required

An additional provision in the legislation mandates that all short-term vacation rentals must have a designated person available 24/7 to respond to renter complaints and emergencies.

This requirement aims to ensure that any issues can be promptly addressed, improving the experience for renters and addressing potential concerns from neighboring residents.

Statewide Database and Tax Collection

The Department of Business and Professional Regulation (DBPR) is tasked with creating a comprehensive database of all short-term vacation rentals within Florida.

Furthermore, platforms and operators, such as Airbnb and Vrbo, are required to collect and remit specified taxes on behalf of the counties, streamlining the tax collection process from these rentals.

Enforcement and Oversight

To facilitate the enforcement of these new regulations, the DBPR will hire nine additional officers. This decision, however, has faced criticism from individuals like Brevard County Republican Randy Fine, who expressed concerns about the effectiveness of such a small team managing the vast vacation rental market across the state.

Fine stated, “There will be nine people – not in your homes. Not in your neighborhoods, not in your counties. Not in your cities – there’ll be nine people here [in Tallahassee].”

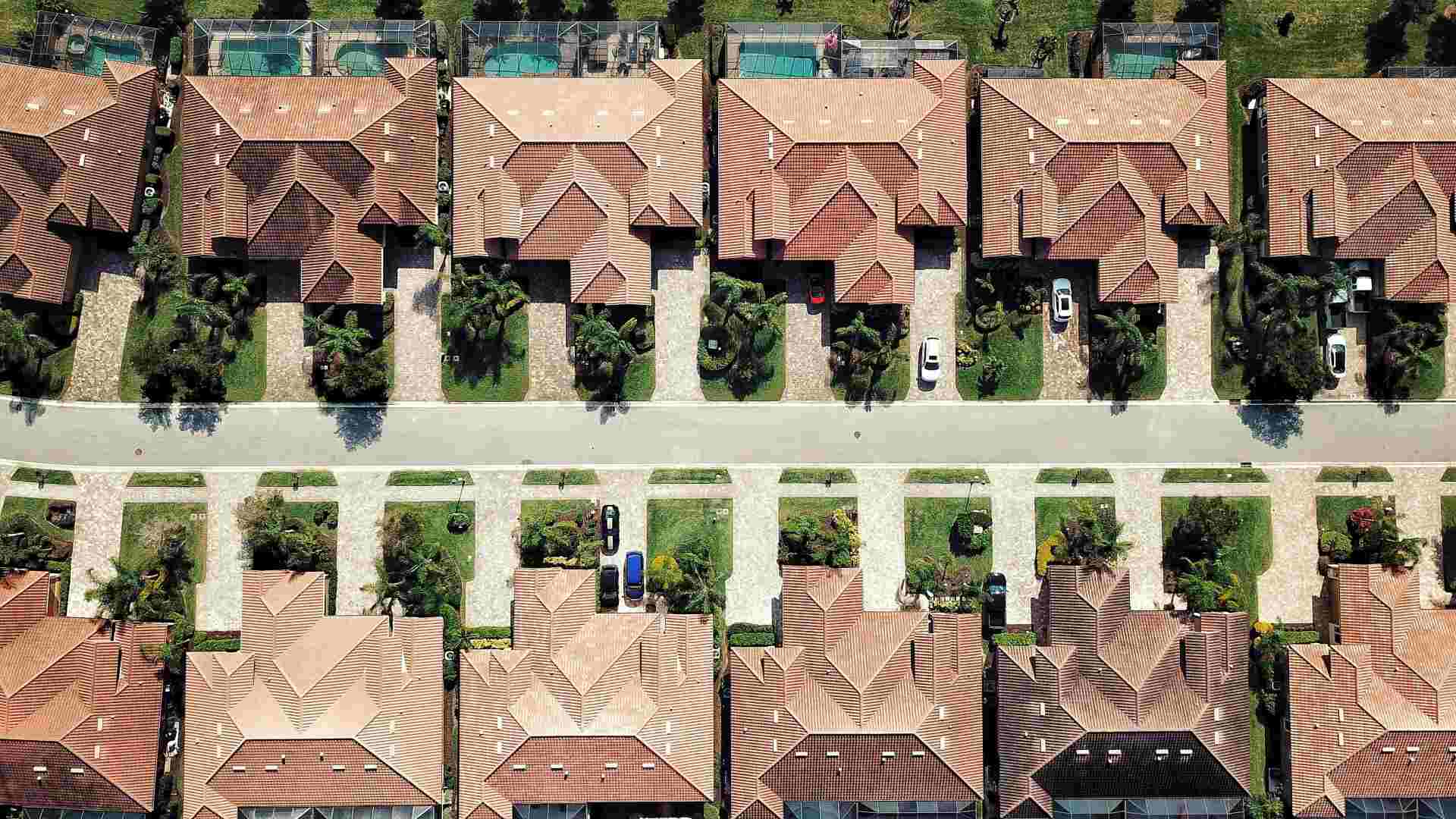

Florida’s Vacation Rental Market

The short-term vacation rental market is a significant component of Florida’s tourism industry, attracting over 100 million American tourists annually since 2019.

Last year, the state welcomed approximately 122.89 million U.S. tourists, illustrating the economic importance of this sector to the Sunshine State’s economy.

Airbnb’s Economic Contributions

In a demonstration of the economic impact of short-term rentals, Airbnb reported generating $387 million in tourism taxes for the state of Florida in 2023 alone.

This figure represents the highest amount of tourism taxes collected by Airbnb in any state, highlighting the significant role that short-term rentals play in Florida’s tourism and economic landscape.

Opposition and Calls for a Veto

The bill’s passage has sparked considerable opposition, with many urging Republican Governor Ron DeSantis to veto the legislation.

Critics argue that the bill centralizes too much control at the state level, removing the ability of cities and counties to regulate the short-term rental market effectively according to their local needs and concerns.

Stakeholder Reactions

Various stakeholders, including the Florida Realtors Association and the Florida Alliance for Vacation Rentals (FAVR), have publicly called on Governor DeSantis to veto SB 280.

They argue that the legislation is “a unique example of very ‘imperfect’ legislation” and emphasize the importance of maintaining a balance between private property rights and local government regulation.

Potential Impacts on Tourism and Local Governance

The bill’s critics, including city officials and local government representatives, have raised concerns about its potential to disrupt local tourism economies and undermine local regulatory efforts.

They emphasize the importance of local autonomy in addressing the unique challenges and opportunities presented by the short-term rental market in their communities.

The Path Forward

The legislation is now awaiting Governor Ron DeSantis’s decision. If signed into law, it would take effect on July 1, 2024, marking a significant change in how short-term vacation rentals are regulated in Florida.

The outcome of this decision could have far-reaching implications for the state’s tourism industry, local governance, and the short-term rental market.

Airbnb Struggles

Florida’s move for greater oversight of Airbnb and similar short-term hotel alternatives comes amidst a growing customer resentment around the experience they provide.

In November, Airbnb CEO Brian Chesky said in an interview he was aware of “tens of thousands” of complaints from its customers on social media around rapid increases in the price of Airbnb stays.

Growing Resentment

In 2023, a slew of articles with titles like “Airbnb Really is Different Now” and “Airbnb Hosting Isn’t What It Used to Be” were published by major publications like The Atlantic, Bloomberg, and others.

Core to the complaints of these pieces was a growing alienation between customers and hosts, and a feeling that the brand wasn’t “part of the gig economy at all.”

Large Property Companies Take Over

In November, Fortune reported that many of the Airbnb houses in Florida are now owned by a large private equity firm. There has been a clear transition from Airbnb hosts as plucky property owners to corporate overlords.

NerdWallet reported in August that three in four Airbnb listings are now managed by hosts with more than one property under their ownership.

Rent over Stay

Gone are the days of the customer experience where guests couch-surf with a host in their own home. The majority of Airbnb users now rent out the entire residence, having it all to themselves, rather than sharing it with the hosts.

Bookings of private rooms was only 16% of U.S. short-term rental bookings in May 2023. At the time this was an all-time low.

Multi-Property Hosts Exceed Single-Property Hosts

In May 2023, 30% of the active listings on Airbnb were managed by hosts that controlled 21 or more properties. This exceeded the listings managed by single-property owners, which stood at 26% at the time.

More short-term rental guests are interacting with a company instead of a person, which may be having an effect on people’s attitude towards their stays.

Guest Experience

Guests report a change in the experience they receive at companies like Airbnb. In previous times, Airbnb hosts would offer local recommendations and enhance the experience in a personal way a hotel could not. Now few Airbnb hosts are available 24/7 to respond to issues guests have with their stay. This could be an effect of there being fewer single-property hosts.

“There’s typically lower review scores when you’re reviewing a company rather than a person,” said Jamie Lane, chief economist at AirDNA.

Affordability

Chesky outlined the problem he saw around affordability and recognized the struggle between balancing low prices for customers and suitable profits for hosts. He acknowledged that “the price of Airbnbs has gone up significantly over the past five years.”

In 2023, TechCrunch reported that the average price of an Airbnb rental has gone up 36% since 2019.

Democratizing Travel

Airbnb’s CEO sees their hotel alternative service as a way to enable more people to travel who couldn’t before. However, in his view, Airbnb can only be in a position to do this if it maintains affordability for travelers.

“I think that Airbnb has always been a way to help democratize travel as you make something more affordable more people do it,” Chesky said.

A Brand for Young People

In support of his point about affordability, Chesky talked about how he imagines the brand being for young people as one of the reasons it needs to remain affordable.

“Airbnb has always been a brand for young people. I was 26 when I started this company…I want to know in my heart that the 26-year-old me if they were alive today they would still use Airbnb, and if that’s true then they would have to be affordable.” said Chesky.

Renting Out His Own Room

In 2022, Chesky listed his own spare room on Airbnb. “Stay with me – the co-founder of Airbnb and its first host. Back in the day, my roommate Joe and I blew up some air mattresses and welcomed three guests – Michael, Kat and Amol,” the listing said.

However, the catch was that there were no available dates to book a stay until 2024, prompting scorn online. On user Twitter user commented “Another PR stunt Brian, no availability in a zero price tag. You yet again delivered something unattainable.”

Profitability

Airbnb was founded in 2008 by Chesky, Nathan Blecharcyk, and Joe Gebbia. However, despite being founded over almost two decades ago, the company’s first year of being profitable didn’t come until 2022.

A 2023 Airbnb statement shared that they had a revenue of $8.4 billion that had grown 40 percent year over year. “Net income was $1.9 billion—making 2022 our first profitable full year on a GAAP basis,” the statement said.

Florida Divison

The new Florida provision targeting short-term rentals has Florida residents divided. Some see it as a good thing because the property rental industry is taking homes away from residents that need them. It is also causing housing prices to be out of reach for some.

However others see property rental as an important revenue stream and are not keen to have the government come in and tell people how to run their businesses. These opponents see these restrictions as infringing on private property rights.