The government in Florida has recently been trying to clamp down on out-of-control insurance premiums that many homeowners in the state have been facing as multiple private insurers have been cutting coverage and raising rates in the wake of extreme weather events.

However, efforts to manage the insurance crisis in the state haven’t relieved the pressure of some residents who have been hit hard by increased premiums.

People are Hurting

Florida resident Chris M. sent an email to Newsweek describing his personal situation and the hurt that other residents feel.

“People are hurting,” wrote Chris M. “No one wants to pay that much money for insurance. I live on a fixed income. I can’t sell my house, and I can’t refinance. If things don’t change I might have to walk away.”

Out of Control

Florida homeowner Jennifer Fehrs told WINK news that the insurance burden on her has gone out of control.

“It’s out of control. It’s completely off the charts,” said Fehrs on the cost of her property insurance.

Insurance Companies Are Seizing Homes

The situation in Florida has gotten so bad that insurance companies are now seizing the homes of people who can’t afford to pay the ridiculously high insurance premiums.

While this is standard practice, it’s now happening at alarming rates. It used to happen once every so often, but thousands of Floridians are now being forced out of their homes and being made homeless.

Hurricane Blame

Another Florida resident, Seth Ford, blamed a recent spike in premiums on the aftermath of Hurricane Ian which hit the Florida coast in 2022.

“It’s gone up, went up immediately after the hurricane, and it hasn’t gone back down. That’s for sure,” said Ford, a Fort Myers homeowner.

Florida Nightmare

According to Ann S, a Michigan resident who owns a mobile home in Sarasota County, Florida, the situation in the state has become a “nightmare.”

“The insurance situation in Florida is a nightmare”, Ann S. told Newsweek. “Many people are leaving the state. Our Michigan neighbors had a second home in Florida, on Pine Island, and their insurance went up to over $18,000 for one year this year after [Hurricane] Ian. They sold the house and left Florida.”

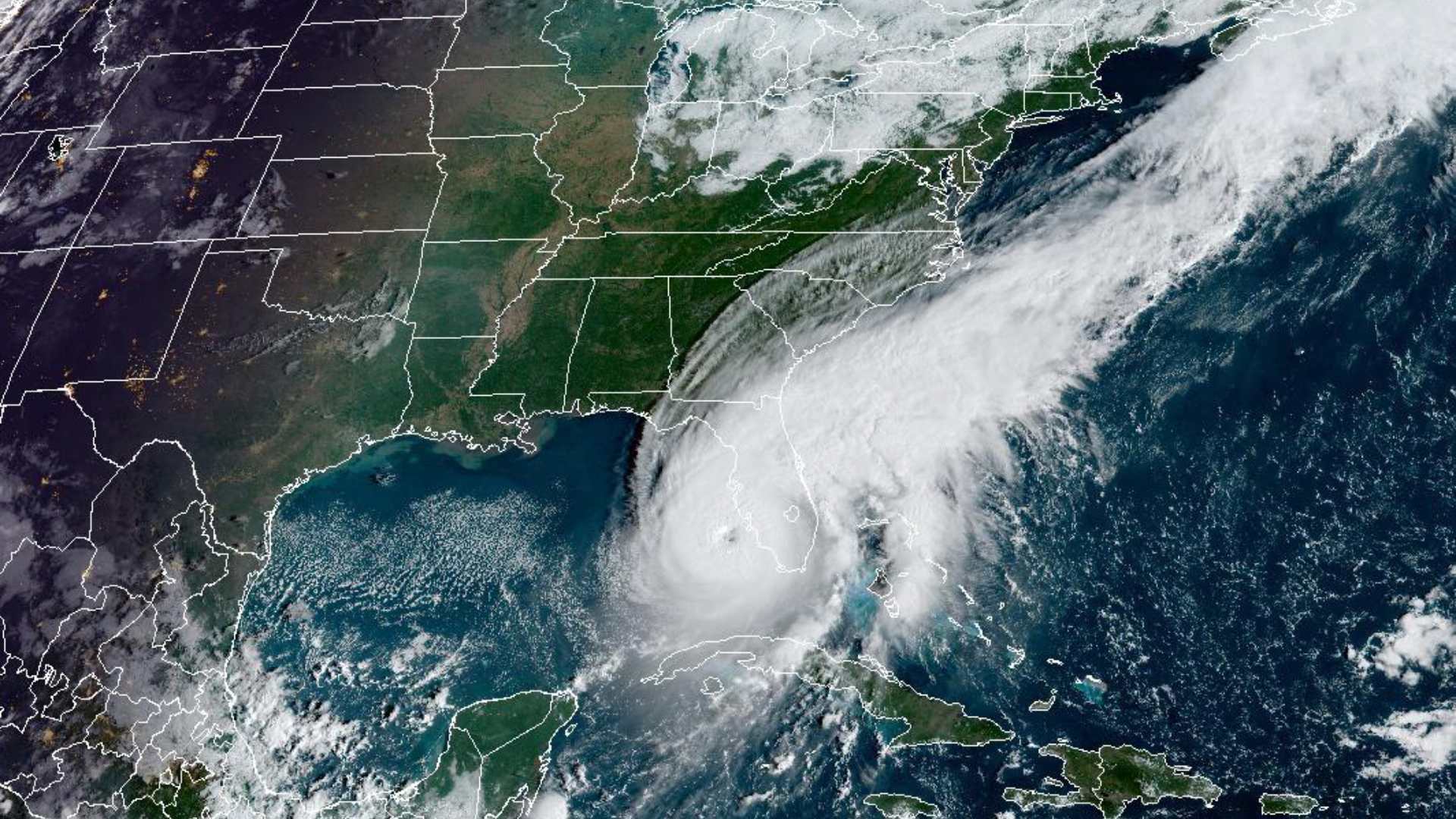

Hurricane Ian’s Impact

Hurricane Ian significantly impacted Florida residents’ opinions on how home insurance companies can deal with claims.

Many residents reported that their home insurance company had utterly dropped the ball when they were claiming the damages their property received due to the hurricane, which made them lose their trust in these companies.

How Floridians Are Dealing with High Home Insurance Prices

Different Florida residents have ways of dealing with the high home insurance premiums, which could not work in their favor.

Some are cutting back on parts of their policies that they don’t feel are necessary to pay for. Some are entirely dropping their insurers and don’t have any home insurance. Others have chosen to leave the Sunshine State to live somewhere with cheaper home insurance.

Residents Living Out of Cars

Florida residents that have been forced out of their own homes, they are now having to live out of their cars as they cannot afford to live anywhere else.

Even if residents are not forced out of their homes, they still choose to live in their cars because that is cheaper than living in a house.

Non-Resident Struggles

While Florida residents are struggling with insurance premiums, property owners in Florida who aren’t residents are sometimes even worse off.

“Because we are not Florida residents, this year Citizens added a 40 percent surcharge for non-Florida residents to our policy. We now pay $1,000 more for our insurance on the park model in Florida than we do for 2 houses insured for 5 times the amount of our park model in Michigan,” said Ann S.

Skyrocketing Premiums

According to Florida Tax Watch, a research institute based in Tallahassee, property insurance premiums have risen by around 42% since 2019.

“The high cost and availability of property insurance is an issue that impacts all of us, and Florida TaxWatch once again reminds policymakers that while initial measures in bringing premiums down and attracting insurance companies into the market — and ending frivolous lawsuits — show promise, it will take continued vigilance,” said Florida TaxWatch President and CEO Dominic Calabro.

Weird Advice From Insurance Agents

One Florida resident, Gregg Weiss, lives in a West Palm Beach neighborhood and saw the windstorm part of his insurance go from $10,000 to $20,000 a year.

When he called his insurance agent for advice, he got something he didn’t expect. He told him to pay off his mortgage and self-insure himself, as that is the cheapest option. He did just this and dropped his insurance company entirely.

What’s Driving the Increase?

According to researcher Meg Cannan, there is not just one simple cause for the price hikes. A combination of natural disaster events, property insurance fraud, and the market responding to insurers fleeing the state is all driving prices up.

“As people are trying to combat inflation, they’re trying to combat high prices everywhere, when you have to worry about your homeowner’s insurance. That’s another thing that can push you out of the state,” Cannan said.

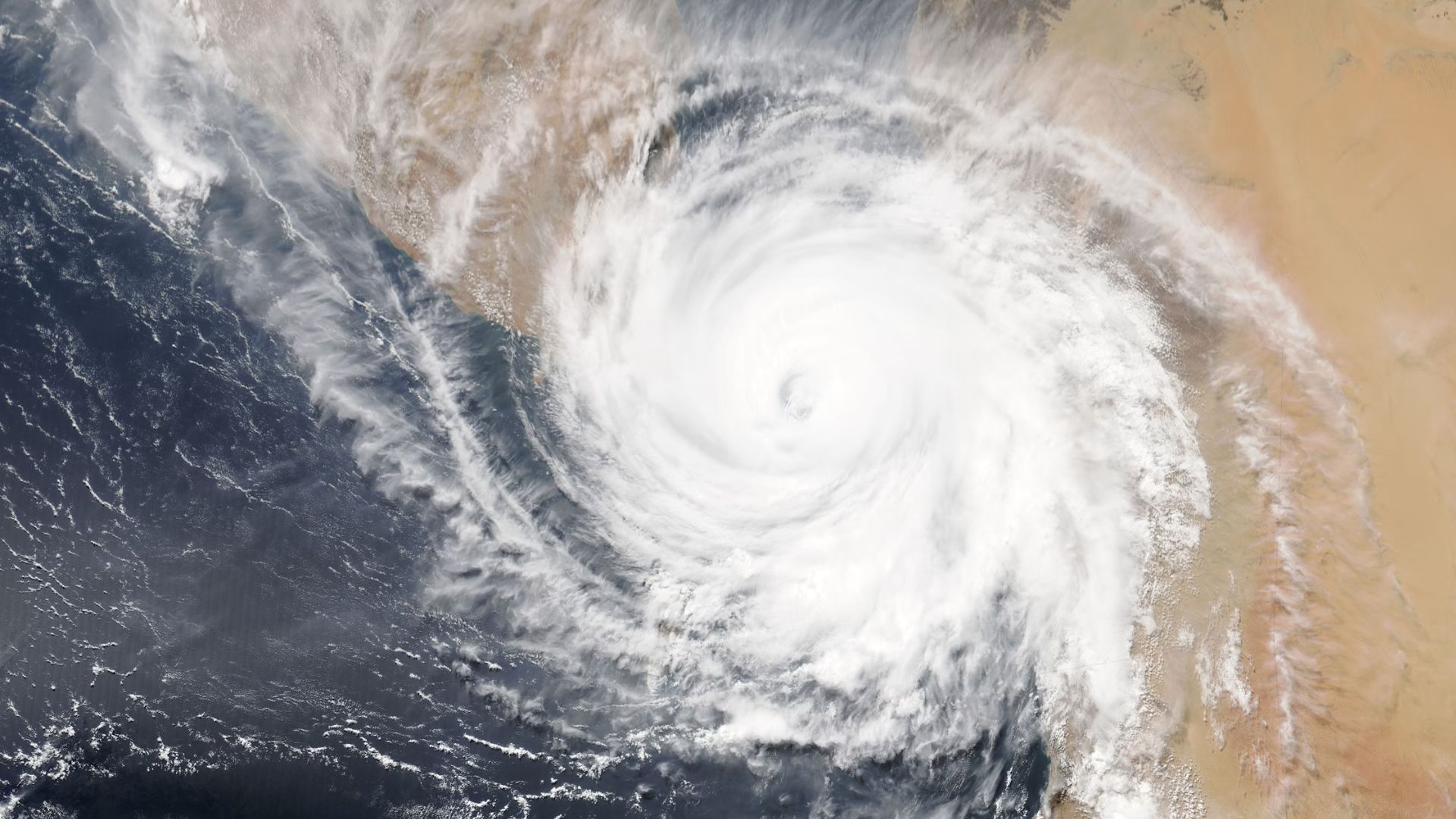

Climate Change Is a Key Factor

Climate change is one of the main driving factors behind this rise in insurance premiums.

This is because the worse climate change gets, the more extreme weather is experienced. As Florida tends to have a lot of extreme weather, it will only drive up insurance premiums.

Different From Other States

While several other US states are experiencing their own problems with keeping insurance premiums affordable, Florida is in a unique position due to a confluence of different factors.

“Over the last two decades, the Florida homeowner’s insurance market has suffered from a convergence of natural, financial and regulatory disasters that set it apart from most other states,” Martin D. Weiss, founder of rating agency Weiss Ratings, told Newsweek.

House Insurance Is Rising Everywhere

Florida is not unique in that homeowner’s insurance is rising everywhere. However, it is unique in that it is the most expensive.

Prices are expected to rise by an average of 6% in 2024. However, any state subject to severe weather conditions, such as Florida, can expect a 23% rise in home insurance premiums.

Florida’s Most Expensive Cities

The situation in Florida has become so bad that six out of ten of the most expensive cities for home insurance in the US are in Florida.

This is driving many people out of the Sunshine State and is also causing people who may have once been considering moving to Florida to choose to live elsewhere.

Predicted Increases in 2025

The increases aren’t just stopping in 2024. Due to the predicted 2024 Atlantic hurricane season, insurance premiums will only rise further in 2025.

It has been predicted that there will be at least 30 named storms in the hurricane season, which is record-breaking and will come as bad news for Florida residents.

Highest Failure Rate in the US

Weiss would go on to mention an increase in storm damage and the high failure rate of state insurers as other reasons Florida is struggling.

“Rising levels of storm damage, the highest failure rate in the U.S., the departure of larger national companies, plus a regulatory environment and severely biased insurance company rating that obscured the weaknesses,” Weiss said.

Government Officials Speak Out

Florida’s State Representative Hillary Cassel has spoken out about Florida’s home insurance crisis, making it clear that any hurricanes will hurt homeowners the most and even more so than they are currently.

Somewhat surprisingly, it would also hurt home insurance companies. While the more prominent companies should still be alright, the smaller companies will be hurt the most.

State Lawmakers Proposed Solutions

In an attempt to solve or at least improve the situation in Florida, lawmakers have been devising solutions that they could implement to help homeowners.

These solutions include direct subsidies, allowing state-run insurance to cover more homes, lowering the cost of reinsurance, and increasing insurance company transparency.

Legislator Response

In response to the various factors driving prices up, state legislators have taken steps to address some of them. Last year, Florida lawmakers signed off on legislation to restrict lawsuits against insurance companies to clamp down on “billboard lawyers” taking advantage of the system.

They also reinstated a program that gives grants to homeowners who take steps to fortify their homes to prevent damage from hurricanes which can reduce the help needed from an insurer after a disaster.

Insurance Rates Are Decreasing (Sort Of)

In what might be some sort of good news to Florida’s homeowners, insurance rates are decreasing.

Even though insurance rates are technically on the increase, they aren’t increasing as much as they have in previous years, which insurance companies hope their customers will be happy with.

Progress Made

Data from the Insurance Information Institute (Triple-I) has shown promising results for improvement since last year when it was predicted that the average annual premium of Florida homeowners would be $6,000, the highest rate in the United States in 2023. This number was later revised down to $3,340, which the group attributed to recent legislative efforts.

“Triple-I’s researchers noted the significant difference was due to the positive impacts of legislative reform that addressed rampant legal system abuse and claim fraud that led to the state’s risk crisis,” Triple-I director Mark Friedlander told Newsweek. “These reforms were not anticipated when Triple-I’s premium estimate was made.”