A Lebanese immigrant has been accused of being at the center of an elaborate investment scheme that stole millions of dollars from over 150 people.

According to twin filings from West Palm Beach federal court, a Florida company created a Ponzi scheme by lying to investors and brought in over $5.3 million.

Lebanese Immigrant Accused of Ponzi Scheme

Henry Abdo, 46, is a Lebanese immigrant with a U.S. visa. His company, Titanium Capital, recently had civil filings brought against it by the Securities and Exchange Commission.

Alongside Abdo, Carol Ann Barsh of Edwardsville, Pennsylvania, has been charged with perpetrating the scheme. The SEC had also included Abdo’s wife, Ganna, and relative Eias Abdo as defendants who received over $300,000 from the scheme.

U.S. Justice System Comes Down on Abdo

The U.S. Department of Justice brought the criminal filings against Abdo, which included two counts of wire fraud.

Abdo pleaded not guilty. However, he was detained following a hearing before U.S. Magistrate Judge Bruce Reinhart.

Judge Sheds Light on Case During Detention Hearing

“Mr. Abdo has no prior criminal history,” Reinhart wrote. “But, he also has no ties to the United States. He has no stable residence anywhere in the world. He travels constantly.”

The judge noted that the amount of “allegedly diverted funds” to which Abdo might have access gave the magistrate pause. During the detention hearing, Abdo proclaimed the “investor funds were properly handled and were held in a different Titanium entity in the U.K.”

Money Vanished into Thin Air

Titanium, under Abdo and his accomplices, was able to rake in over $5.3 million in funding. Yet, according to the SEC, very little of this money was used for the intended purpose.

“Most of that money is now gone, used instead by Abdo and Titanium to make Ponzi-like payments to earlier investors, transfer funds to Abdo’s relatives and related parties, and pay Abdo’s personal expenditures,” said the SEC.

It All Began in Florida

According to records, Abdo registered Titanium Capital with the state of Florida nearly a decade ago.

While the original address was 113 Magnolia Ave., it changed to locations in Deltona, North Palm Beach, and even a mobile home at 1041 Maytown Rd.

Built Upon a Foundation of Lies

The indictment alludes to the fact that the company’s website pushed several lies, including the idea that “Titanium is part of a multi-billion dollar holding company.”

Others included that Titanium was registered with the SEC and that the company guaranteed a 15% rate of return for investors, all of which were blatant lies.

Luring in Potential Victims

According to the SEC, the web of lies allowed Abdo and his co-conspirators to lure in 162 investors from around the world.

They were all under the impression that their investments “were used to secure loans to third-party traders” using “a proprietary multi-currency exchange platform” and that Titanium had never registered “a single monthly loss.”

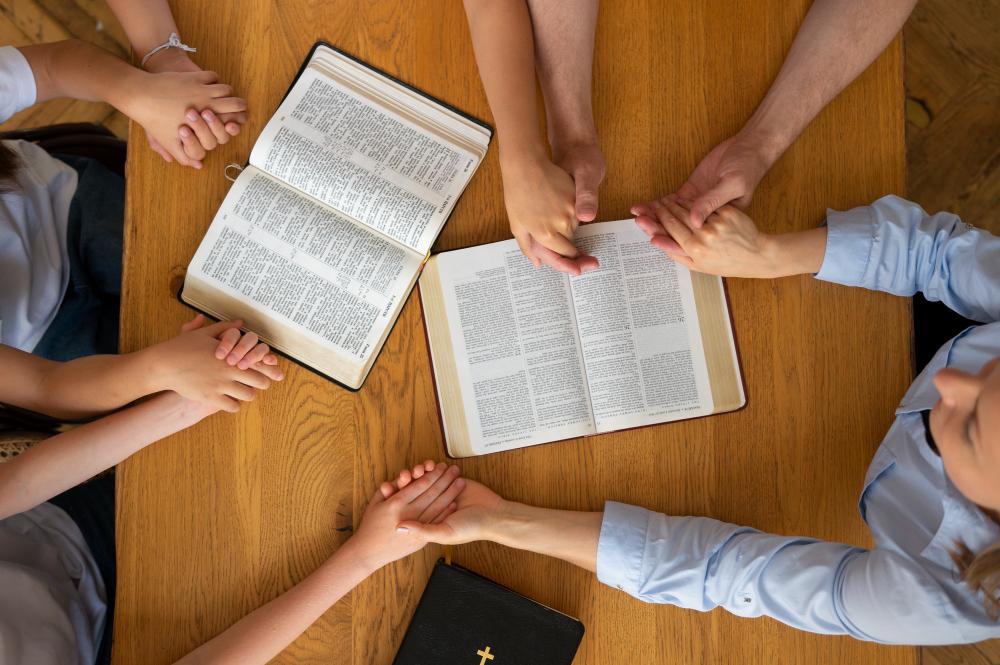

A Man of God

Abdo would refer to his faith in God to exploit the trust of religious investors from around the world.

The SEC complaint said: “For example, in 2021, a promoter introduced Investor 6 to Abdo to discuss Titanium. Investor 6 was not convinced he would invest until Abdo told him they were of the same faith. Abdo’s shared affinity made Investor 6 trust Abdo and believe his assertion that Titanium was a safe investment.”

Abdo Uses Faith to Win Over Investors

Similarly, Abdo used religion to win over a Florida couple in their 50s. The couple, referred to in court documents as Investors 7 and 8, were first introduced to Abdo back in 2015 at a church in Turkey.

“Over the course of three years, Investors 7 and 8 signed several Subscription Agreements with Abdo, investing approximately $190,000,” said the SEC.

Abdo Splashes Out on Expensive Hotels

According to the court documents, Abdo would go on a spending spree as he traveled across Europe and beyond.

Hotels in Malta, Turkey, and Austria were all charged to the company’s debit card. He also purchased flights from numerous airlines and made clothing and food purchases using the same card.

Court Documents Reval Shocking Purchases

Court documents say a Pennsylvania-based investor wired approximately $35,000 to Abdo’s company back in February 2020. The records claim Abdo spent $8,000 of this on travel and nearly $2,000 on food and moved the rest to the accounts of nine friends.

Court documents reveal that in September 2023, “Abdo directly offered to sell Titanium securities to an undercover agent.”