Former Home Depot and Chrysler CEO Bob Nardelli made recent comments on the Fox Business show “Cavuto: Coast to Coast” that spelled out the bad omens for US economic recovery.

Nardelli warned that recent employment trends suggest the American economy will continue to struggle as several large companies in many industries have been instituting layoffs, with more job cuts possible on the horizon.

Bob Nardelli Joins Fox News to Discuss US Economy

Bob Nardelli is a former corporate executive who became CEO of Home Depot in December 2000 despite having no previous retail experience.

He used the skills he acquired working at General Electric to become one of the best executives of the era, eventually taking on the job of chairman and CEO at Chrysler in 2007.

Former Home Depot CEO Sounds Alarm on American Economy

Nardelli sat down with Fox Business in February of this year to discuss the current state of the American economy.

In his comments to Fox Business, Nardelli outlined how he thinks attempts to blame corporate America for inflation will fail.

The American People ‘Will Not Be Duped’

According to Nardelli, the nation’s citizens must understand the recent inflation didn’t start with corporate America. He suggests that “a whole host of things are driving this up, wage increases.”

“The general population will not be duped by this aversion to try and blame inflation on corporate America. It starts at the raw materials, it starts at transportation, it starts at energy,” former Home Depot and Chrysler CEO Bob Nardelli said. (via Fox Business)

Mass Layoffs

Nardelli went into specifics about employee layoffs with big companies, which he viewed as a significant shift of employment in the US economy.

“We’re now seeing people being laid off,” he continued, “If you look at chips, they’ve laid off almost 40,000 people. We’re seeing a tremendous shift in employment out there where people are being laid off,” he said. (via Fox Business)

Recent Alarming Job Cuts

According to Fox Business, huge companies in the past few weeks announced huge job cuts. Cisco, a huge multinational tech company, planned to cut thousands of jobs. In total companies planned to cut over 82,000 jobs in just the month of January.

Cisco reportedly has cut 84,900 employees globally as of July 2023. It’s unclear just when this tide of corporate job cuts intends to stop.

Job Cuts Are Accelerating

Fox Business recently reported that layoffs have surged to their second-highest level in January of this year.

Layoffs increased by an astronomical 136% during the month, which is a worrying way to start the year.

Highest Layoffs Since 2009

The US is undoubtedly experiencing a period of high job losses, with experts citing high interest rates and inflation as some of the main drivers of these layoffs.

To find a higher job cut level, one would have to go back to the financial crisis in January 2009.

Nardelli Doesn’t Predict a Soft Landing

Nardelli went on to mention the extensive layoffs witnessed at companies such as Ford and GM in recent months.

“Ford laid people off because of EV[s]. GM laid people off because of the cruise program. We’re just seeing Stellantis lay people off because of the UAW wage increase,” Nardelli said. (via Fox Business)

No Hope For A Soft Landing

When speaking on the future of the economy, Nardelli doesn’t believe the nation will experience a soft landing.

“So no, I think we’re still in an inflationary period. I think we’re not going to see a soft landing, which would be my prediction, but I hope I’m wrong,” he said.

His Predictions Have Been Correct So Far

According to Fox Business, Nardelli had previously correctly predicted that the CPI number, a measurement that reflects the price people in the economy pay for certain goods or services, would rise.

CPI stands for Consumer Price Index and is a common measurement that economists use to measure the effects of consumer inflation over time.

Everyday Goods Continue to Climb in Price

According to the Labor Department, the consumer price index has continued to rise.

This index measures the price of everyday items, including groceries, gasoline, and rent. According to their report, it rose by around 0.3% in January.

The Economy Can’t Afford Current Interest Rates

Nardelli told Fox Business that the current interest rates are unsustainable and are harming both individuals and businesses.

“We’ve seen companies where we’ve had $2 million of interest rates now explode to $12, $13, $14 million. And the free cash flow that we generate is going to pay the man,” Nardelli said.

Impossible to Budget

Nardelli went on to suggest it’s almost impossible for Americans to budget with the current rates.

“We cannot afford the type of interest rates that we’re buried [in] today. I mean, you couldn’t afford it as an individual in trying to balance your budget,” he said.

Some Blame Goes to The Biden Administration

Nardelli views the current administration as cynically looking out for their political interests instead of what is good for the economy in the long run.

“This is all about, I think, trying to buy votes. This is all about an administration that is out of control,” he said.

The Government Needs to Spend Less

Inflation Levels Still High

According to US Inflation Calculator, the inflation rate in 2024 is 3.1% which is significantly down from the pandemic years when it reached as high as 7%. However, this inflation rate of 3.1% is still far above what the rate was in 2019 and 2020.

In 2019 the US inflation rate was 2.3% and in 2020 it dropped to 1.4%.

Inflation Hurts Workers

A high inflation rate is another punch to the gut for workers who might be victims of this latest string of layoffs. Even if they can successfully land another job, they will find that their wages can not quite keep up with the rising costs in the economy.

According to the Economic Policy Institute, worker wages have been stagnant for nearly five decades straight.

America’s Suffering Middle Class

If Nardelli’s predictions come to pass, it is another slap in the face for Americans struggling middle class. An analysis by the Economic Policy Institute in 2015 found that income inequality cost the average middle-class worker around $17,957 in yearly income in 2007.

As people argue over where to place blame for current economic conditions, the average American worker continues to suffer from the consequences of them regardless.

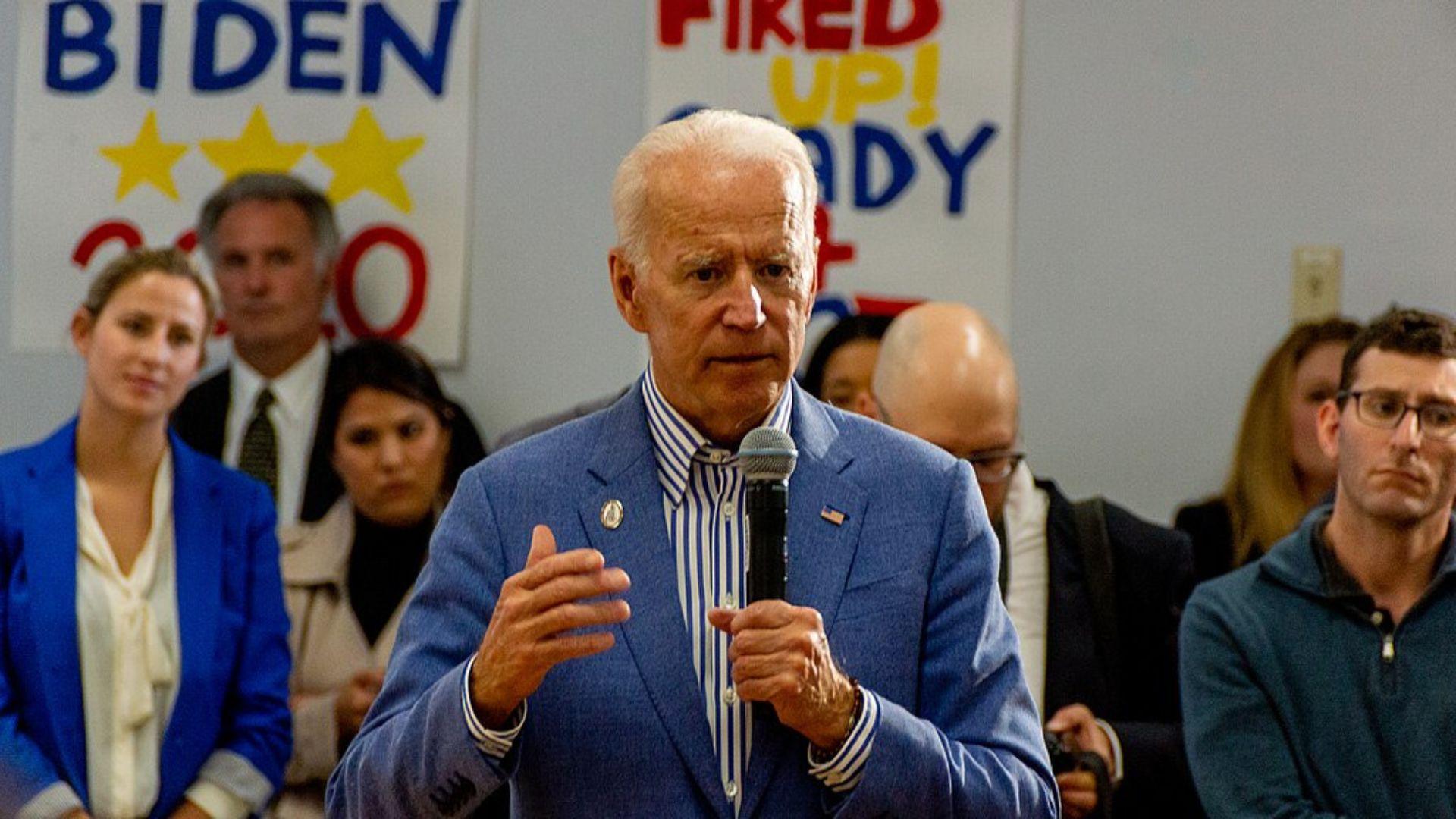

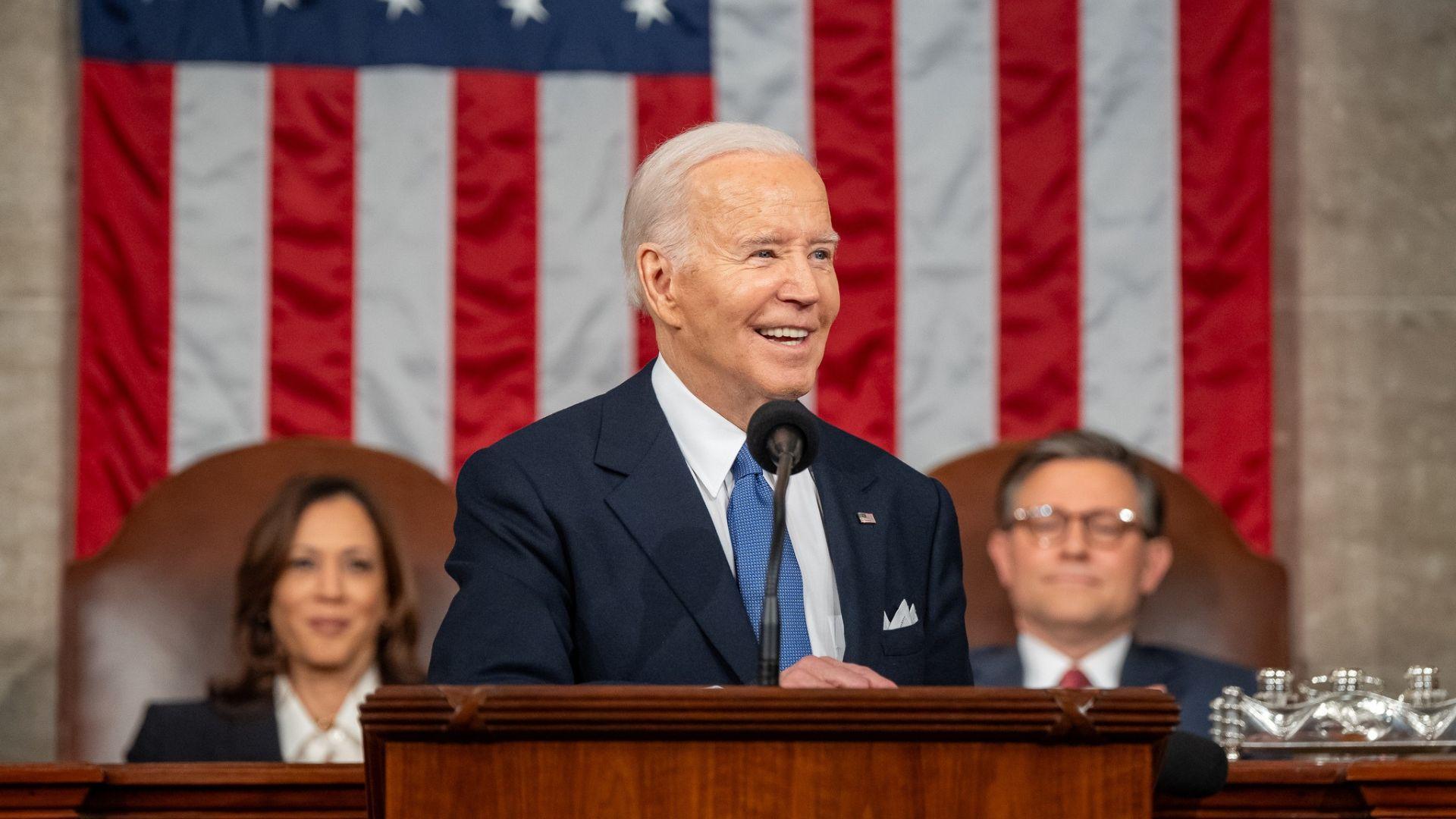

Biden Aims to Steer Nation From Recession

In early March, President Joe Biden used his State of the Union speech to discuss his plan to steer the American economy clear of a recession.

He also spoke of his plans to help the economy should he receive a second term as president by placing higher taxes on companies and the wealthiest inhabitants of the nation.

Raising Tax for the Rich

The tax breaks signed into power by former president Donald Trump are set to expire in 2025. Biden made reference to this in his speech, suggesting that it’s time for big corporations and the richest inhabitants of America to pay more taxes.

Of the rules he aims to implement, a new 25% minimum tax for billionaires could raise over $500 billion over the next ten years.

Biden Slams Trump’s Tax Breaks

Speaking on the tax breaks issued by Trump in 2017, Biden criticized the decision, claiming the corporations don’t need any further help.

“Do you really think the wealthy and big corporations need another $2 trillion in tax breaks?” said Biden, per The Washington Post.

Biden Lists Major Plans for the Economy

During the speech, Biden referenced several other plans aimed at helping the US Economy.

The president’s administration plans to tackle the high interest rates associated with the housing crisis and even plans to tackle shrinkflation.

America is Rising

Biden finished his speech by suggesting that under his guidance, the US economy will thrive once again.

“America is rising,” Mr. Biden said. “We have the best economy in the world.”