A recent report stated that unleaded regular gas underwent a 14% price jump when considering at the national average price of gas. Their report cited AAA data, which says that nationwide, the price of gas has increased more than 40 cents per gallon since 2024 began.

Experts are attributing this price increase to a “spring bump” where people begin traveling more as warmer weather sets in, driving up prices because of increased demand for gasoline.

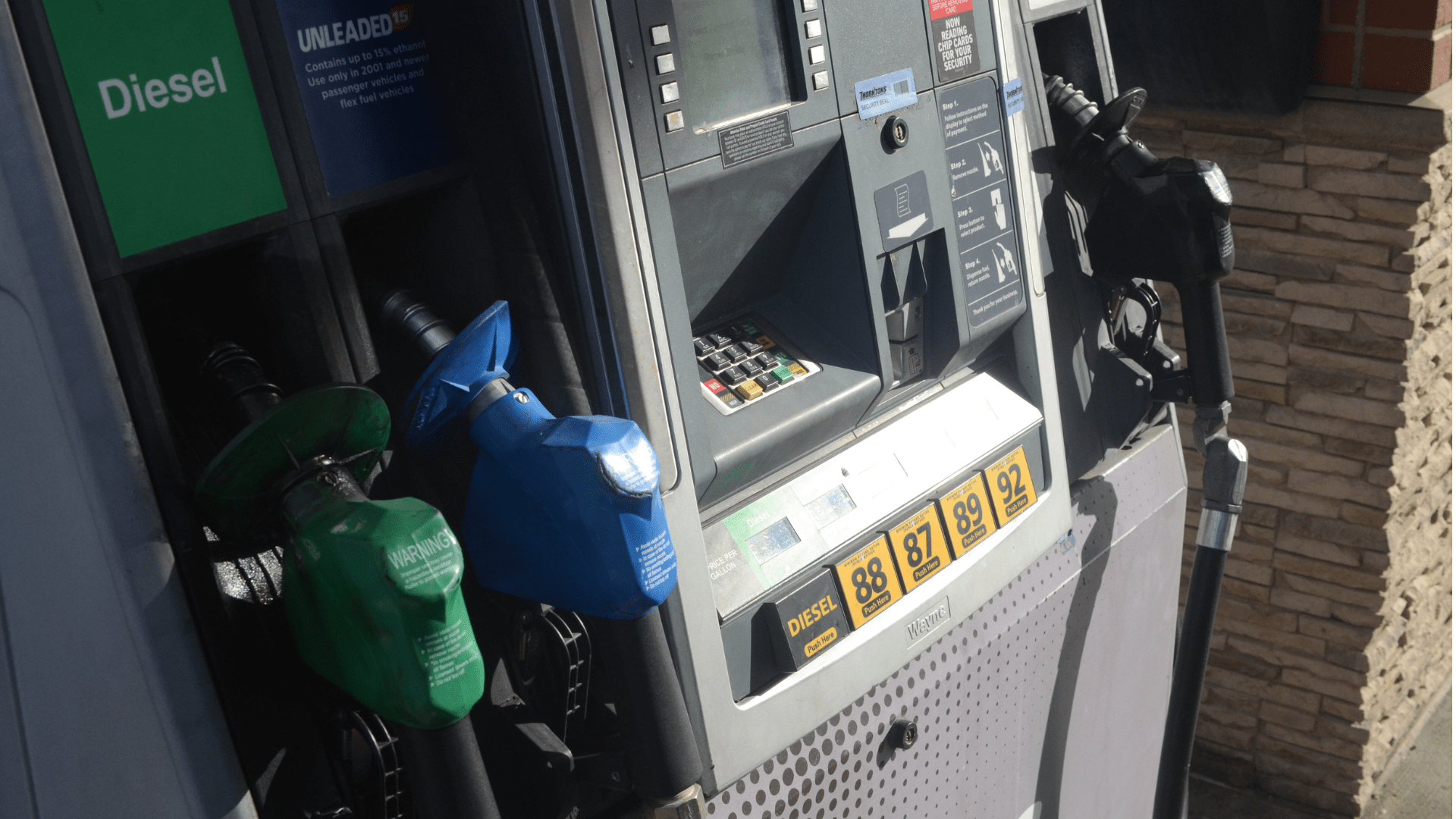

Understanding Gasoline Grades

Gasoline comes in three primary grades — regular, mid-grade, and premium (via U.S. Energy Information Administration (EIA)). Each grade has a different octane level which influences engine performance and efficiency.

Premium gas, with the highest octane rating, is recommended for high-performance engines to prevent knocking and improve longevity. Despite its higher cost, using the correct grade can save money in the long run by optimizing vehicle performance.

AAA Data

The American Automobile Association (AAA) keeps a running tally of the retail price of gas. The current national average is $3.536 per gallon for regular fuel. For comparison, the highest recently recorded national average price for regular unleaded gas was $5.016 in June 2022.

Currently, the state paying the most for gas is California, with a current price average of $5.083 per gallon.

Historical Gas Price Fluctuations

Over the past decade, gas prices have experienced significant fluctuations (via EIA). A graphical analysis shows peaks typically during the summer months and lows in winter, reflecting seasonal demand changes.

Notably, prices spiked to record highs in June 2022, emphasizing the impact of global events and market dynamics on fuel costs. Understanding these trends can help consumers anticipate changes in gas expenses.

Spring Bump

The “spring bump” as some experts call it, describes customer behavior patterns to demand more fuel as they take increasing trips in warmer weather.

To accommodate this demand, companies and gas refineries switch to a more expensive blend of summer fuel that emits less pollution, further increasing the price of gas.

Environmental Impact of Gasoline Use

Increased gasoline consumption has direct environmental implications, including elevated air pollution and greenhouse gas emissions (via EIA). The switch to a summer blend, while more costly, plays a crucial role in reducing these impacts during months of high vehicle use.

This blend’s formulation helps decrease evaporative emissions, contributing to cleaner air during the warmer months.

Business as Usual

Patrick de Haan, the head of petroleum analysis at GasBuddy, made comments to ABC that suggest this price increase falls within expert expectation.

“Spring break travel is here. This is the time of year Americans start using more gasoline…We’re basically right on par with what we tend to see,” said de Haan.

The Role of OPEC+ in Global Oil Prices

The Organization of the Petroleum Exporting Countries (OPEC+) significantly influences global oil prices through its production decisions (via Investopedia). By adjusting output levels, OPEC+ can tighten or saturate the market, directly affecting gasoline prices worldwide.

Recent cuts in oil production have led to higher crude prices, underlining the group’s pivotal role in the energy sector.

Summer Blend

The switch to the summer blend of gasoline is part of an effort to mitigate the environmental impacts of the increasing amounts of drivers on the road.

This price increase has been happening for the past six years, excluding the abnormality of the outbreak of the COVID-19 pandemic in 2020. Prices rose an average of 50 cents a gallon during this time period during those years.

Advancements in Refinery Technology

Technological advancements in refinery processes have improved the efficiency of producing both winter and summer gasoline blends (via NACS).

These innovations not only help meet environmental regulations more effectively but also have the potential to stabilize fuel prices by reducing production costs. As refineries adopt these technologies, consumers may see less volatility in gas prices.

Demand Rising

Despite drivers decrying rising gas prices when they happen, demand for gas continues to increase.

The U.S Energy Information Administration forecasts that more people will be putting more miles into their gas-powered vehicles than in past years. They predict that driver miles in 2024 will be 5% more than in 2019, and 6% more in 2025.

The Push Towards Renewable Energy

As investments in renewable energy sources like solar and wind power increase, the shift towards cleaner energy could decrease the demand for gasoline.

According to the International Energy Agency (IEA), this transition is expected to have long-term implications for fuel prices and environmental sustainability. Governments and corporations worldwide are prioritizing renewables, signaling a gradual move away from fossil fuel dependence.

What About Electric Vehicles?

Despite an increase in investment and a loyal customer base, EVs have so far failed to capture the attention of many American auto customers. Factors like safety, reliability, and high up-front costs keep people away from purchasing EVs, leaving them to invest in gas-powered ones.

Surveys suggest that most Americans don’t want an electric car, despite the various tax benefits and other incentives there are for purchasing them.

Innovations in Electric Vehicle (EV) Technology

Electric Vehicle (EV) technology has seen significant advancements, including longer battery lives and shorter charging times (via SparkCharge). These improvements make EVs more appealing, potentially reducing gasoline demand as more consumers opt for electric options.

Despite high upfront costs, the long-term benefits and increasing availability of charging infrastructure are drawing more buyers towards EVs.

Concerns on the Horizon

While the current gas price jump falls within analyst expectations, there are still reasons to worry that the price may continue to rise.

De Haan mentions that the crude oil market is experiencing supply limitations and factors like geopolitical conflicts happening around the world could contribute to market disruptions.

Geopolitical Conflicts and Oil Supply

Geopolitical conflicts, such as tensions in the Middle East or the Russia-Ukraine war, can severely disrupt global oil supply chains (via Humanities and Social Sciences Communications). These disruptions lead to fluctuations in oil prices, affecting gasoline costs at the pump.

The intricate balance of global politics and energy resources underscores the volatility of oil markets and the consequent impact on consumers.

US Oil Production Breaking Records

What may confuse some gas customers is that the price of gas at the pump is going up despite US oil production reaching historic levels. Typically, as a market rule, when the supply of something goes up, the price for that good goes down.

International Energy Statistics show that the United States is producing 12.9 million barrels a day, which is more than any nation at any point in history has produced.

The Global Impact of U.S. Oil Exports

According to the Center for Strategic & International Studies, the U.S. status as a net oil exporter has reshaped global oil markets, influencing global pricing strategies. Exporting oil means that domestic production impacts more than just U.S. gas prices.

It also affects international markets. This role contributes to the complexity of global oil dynamics, where U.S. policy and production levels can influence worldwide energy prices.

Exporting Oil

To explain this discrepancy one must look at the amount of oil that the US exports. All the oil the US produces does not go to its citizens.

According to the U.S Energy Information Administration, the United States exported petroleum to around 180 countries and four U.S. territories in 2022.

The Future of Gas Prices

Expert forecasts suggest that gas prices may continue to experience volatility due to factors like oil production levels, technological advancements in the energy sector, and geopolitical events (via IEA).

However, increased refinery capacity and improvements in fuel efficiency could moderate future price spikes. Understanding these trends is key for consumers and industries alike to navigate the future energy landscape.

World Prices

The cost to produce oil in the United States is not always the cheapest option, which incentivizes customers to not rely on United States oil and import it from elsewhere instead. However, because these customers are importing oil, they are subject to the price fluctuations that can happen with extreme world events.

A Nature article from January estimated that the Russia-Ukraine war caused the price of crude oil to fluctuate between 52.33% and 56.33%.

Consumer Strategies for Saving on Gas

To combat rising gas prices, consumers can adopt several strategies, such as utilizing fuel-efficient driving practices, maintaining regular vehicle servicing, and using apps to find the best gas prices.

Simple changes, like reducing excess vehicle weight and avoiding aggressive driving, can significantly improve fuel economy, helping drivers save money despite fluctuating gas prices.

Hope for Prices to Fall Again

de Haan thinks it’s likely that lower gas prices will return as the weather turns cold again in the fall. He remarked that when this happens supply and demand will come into a better balance, as more gas customers are off the roads sheltering from the weather.

“By the end of the year, lower gas prices will return,” de Haan said.

Transitioning Away from Fossil Fuels

The global shift towards electric vehicles and renewable energy sources marks a pivotal transition away from fossil fuels. This movement, aimed at combating climate change and reducing environmental impact, could lead to a decrease in gasoline demand.

As the world hopefully embraces cleaner energy technologies, the long-term outlook for gas prices may become more stable, benefiting both the planet and consumers.