Every generation has its own set of struggles to deal with, and it seems that the big one for Generation X is going to be retirement.

Gen X has faced a unique set of challenges, making retirement harder to achieve than previously thought.

Who Is Generation X?

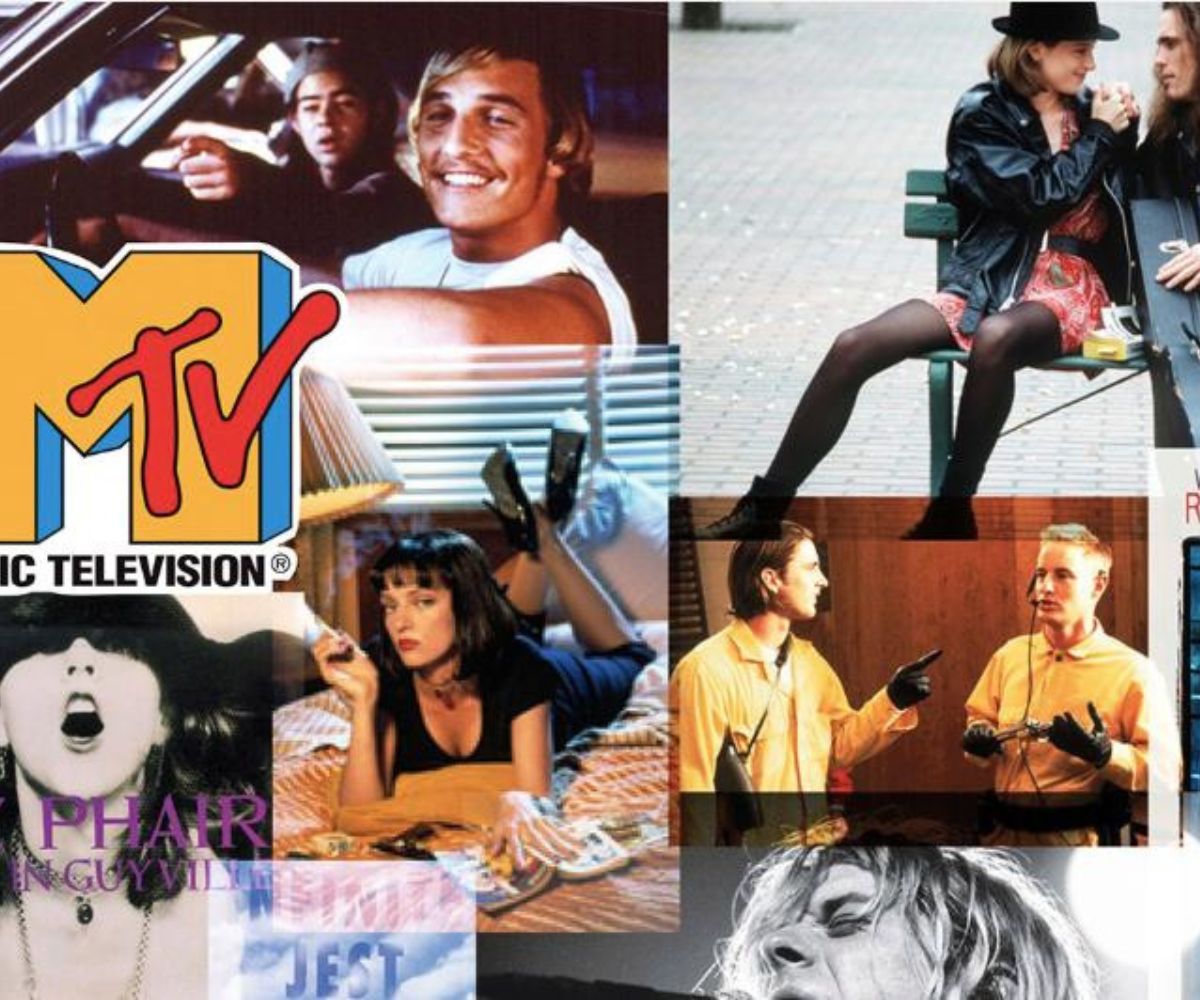

Generation X includes anyone born between the years of 1965 and 1980; those who played the first video games, loved Michael Jackson, and were just the right age to really appreciate the 90s.

But while their upbringing may have been full of pop culture, now, when retirement is just around the corner, Gen X isn’t having nearly as much fun.

Gen X Is Reaching Retirement, and They’re Not Ready

According to the 2023 U.S. Retirement Survey conducted by Schroders, Gen X, who make up 20% of the population, have the largest wealth gap of any age group.

And more than 60% of them reported that they do not feel confident in their ability to retire anytime soon, even though, for some, it’s only a few years away.

Other Generations Feel Much More Confident

Comparatively, 53% of baby boomers and even 49% of millennials said they absolutely feel confident that they will have the money they need for a comfortable retirement.

It’s important to note that those statistics are just the perceptions of those surveyed, not the actual amount of money they have or will have for retirement.

Why Are Gen Xers So Much More Pessimistic than Other Generations?

Realistically, there are millions of Americans who are in no way prepared for retirement. However, Gen X are especially worried as they were and are the generation of change when it comes to retirement.

Gen Xers are the first generation not to receive a pension; in fact, only 14% of Xers have one. And while no generation after them got one either, millennials understood what that meant for savings before they even joined the workforce.

Pensions Versus 401Ks

Baby boomers almost all got pension funds, which offered retirees monthly benefits for the rest of their lives.

However, Gen Xers were the first to rely solely on 401Ks for retirement, which is an employer-sponsored program in which a person diverts some of their own salary for the future.

Gen Xers Saw a Serious Increase in Costs

As well as losing the right to a pension fund, Gen Xers also saw an extreme increase in costs compared to the baby boomers.

The rising price of college tuition, as well as health care costs, housing, and the general cost of living, simply meant more spending for Gen X than for their predecessors.

Living in Today’s World

Of course, it’s not just what happened when Gen Xers were younger that is affecting their ability to retire comfortably; it’s also what’s going on in the world right now.

Historically, other generations could start saving for retirement in their 40s, but with inflation increasing throughout the country and the cost of living rising every year, it may be extremely challenging for a Gen Xer to catch up.

Most Gen Xers Are Actively Saving for Retirement

What’s especially frustrating for many Gen Xers is that they are actively saving for retirement; they just can’t get the money they know they will need to be comfortable.

In fact, the average Gen X household only has $40,000 in savings. And as the National Institute on Retirement Security (NIRS) states that $1.1 million is the average for a dream retirement, it’s clear most Gen Xers are way behind.

71% of Gen Xers Own Their Homes

One good thing that Gen Xers have going for them compared to the younger millennials is that 71% of them already own homes.

However, financial experts say that having a slow-growing 401K and a home might not be enough for many Gen Xers to fulfill their dreams of retirement.

Can Gen Xers Change the Tide?

According to the NIRS, Gen Xers who checked “yes” in the box that asked if they didn’t feel confident in their ability to retire need to make adjustments to their spending and savings as soon as possible.

While many Gen Xers are still looking after their own parents as well as their children, including paying for nursing homes, college tuition, and much more, if they want to retire, they will need to seriously cut back on any unnecessary spending.

“The Dream of Retirement Is Going to Be a Nightmare”

Sadly, even though it seems Gen Xers are doing their absolute best to prepare for the imminent reality of retirement, it will be a real struggle for many.

Executive director of the NIRS, Dan Doonan, said it clear as day: “The American dream of retirement is going to be a nightmare for too many Gen Xers.”