As inflation remains high in the US, young Americans across the nation have voiced their concern for the future as bills keep mounting and the price of everyday goods continues to surge.

One angered Gen Z influencer went on a rant on TikTok detailing his everyday struggles, claiming he and many others in his generation simply cannot afford to live.

Cost of Living Leaves Younger Generations Feeling Hopeless

Inflation has made the past few years particularly difficult in America. Now, a new study released by Fidelity reveals that concern for the future continues to mount among the nation’s younger generations.

In their 2024 State of Retirement Planning study, Fidelity revealed that around 57% of millennials, along with 56% of Gen Zers, say they are struggling to save for retirement due to the higher cost of living.

Young Generations Voice Concern on Social Media

Throughout this prolonged period of inflation, many of the nation’s younger generations have taken to social media apps such as X and TikTok to voice their concern for the future.

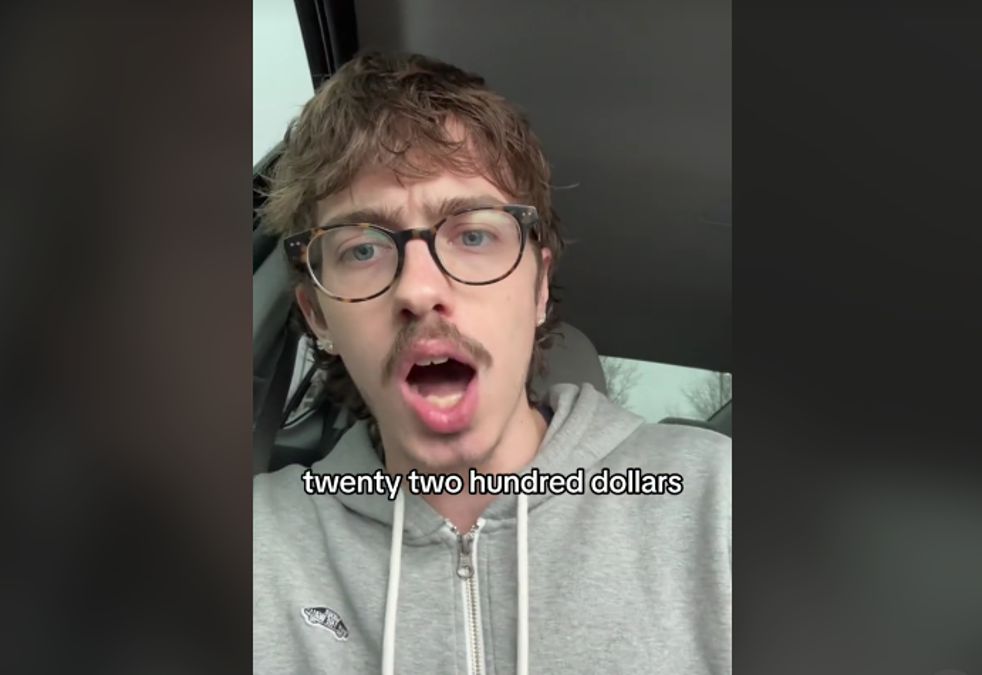

@nicsmnrs took to his TikTok page to speak on behalf of Gen Zers and Millennials who simply believe they cannot afford to live.

Gen Zers Cannot Afford to Live

In a video uploaded to his TikTok page, @nicsmnrs claims he makes significantly more than minimum wage yet struggles with his finances due to inflation.

“Can somebody explain to me in crayon-eating terms why I make over three times the federal minimum wage and I cannot afford to live?” he said.

90 Hours Per Week is Not the Goal

As the video continues, the influencer argues Americans should not have to work 90 hours per week just to get by.

“And I do not want to hear the ‘Pull yourself up from your bootstraps, work 90 hours a week.’ That’s not the goal, guys,” he said.

Life is a Struggle for Many Americans

@nicsmnrs then went on to speak about the exorbitant rent prices in many major US cities.

“A one-bedroom apartment, $1,800. Two-bedroom apartment, $2,200. Who the f*** can afford that? It is embarrassing to come out and say that it is a struggle to survive right now. But I know so many people are struggling,” he said.

Inflation Continues to Rise in the US

Data released by the Labor Department in mid-April reveals that inflation continued to rise in March for the third consecutive month, per Fox Business.

Ultimately, this means the price of everyday items, including gas, rent, and groceries, will remain high for millions of Americans across the nation.

March Sees Rise in the Price of Housing of Gasoline and Rent

In March, US citizens experienced another jump in the price of gas, with the national average rising by around three cents to $3.56 per gallon.

In addition, an increase in the price of housing was another primary driver of inflation in March, according to Fox Business.

TikTok Influencer Makes a Second Video

The original video posted by @nicsmnrs has garnered an impressive 8.8 million views on the platform. This led to the young American to post another video, further expanding on the first.

During the second video, Nic explained he had previously voted for the Republican Party, hoping they could have reduced the cost of living.

High Cost of Living Won’t Be Fixed Says TikTok Influencer

“I just now realized that regardless of which side I vote, it won’t be fixed,” Nic said.

“They continue to pull these bulls. The spending budgets that they keep approving, the foreign aid they keep sending out when we need that in America.”

Government Spending is Getting Worse

Towards the end of the video, Nic suggests a portion of the blame for the current financial situation in the US should be directed towards government spending.

“Government overreaching, government overspending has continued to happen, and it is getting worse and worse,” he said.

Americans Continue to Struggle Through Inflation

The interaction with Nic’s video, alongside its high view count, pays tribute to the collective mindset of Americans who feel they are reaching breaking point.

If inflation continues to rise in the US, it will undoubtedly affect the everyday lives of millions of Americans. However, it will also negatively affect younger generations’ savings and retirement plans.