Shelitha Robertson, a former assistant city attorney and police officer in Atlanta, has been charged in a scheme involving fraudulent Paycheck Protection Program (PPP) loans amounting to over $7 million.

This case highlights a serious breach of trust by a public servant, unfolding amidst the challenges of the pandemic. According to the Department Of Justice, Robertson’s actions represent a significant violation of the law and public trust.

The Fraudulent Scheme

The scheme involved Robertson, a 62-year-old Atlanta resident, submitting fraudulent PPP loan applications for four businesses she owned.

The applications contained false information, including inflated numbers of employees and exaggerated average monthly payroll figures. This deceit enabled Robertson to secure much larger PPP loans than she was legitimately entitled to, as per the Department of Justice.

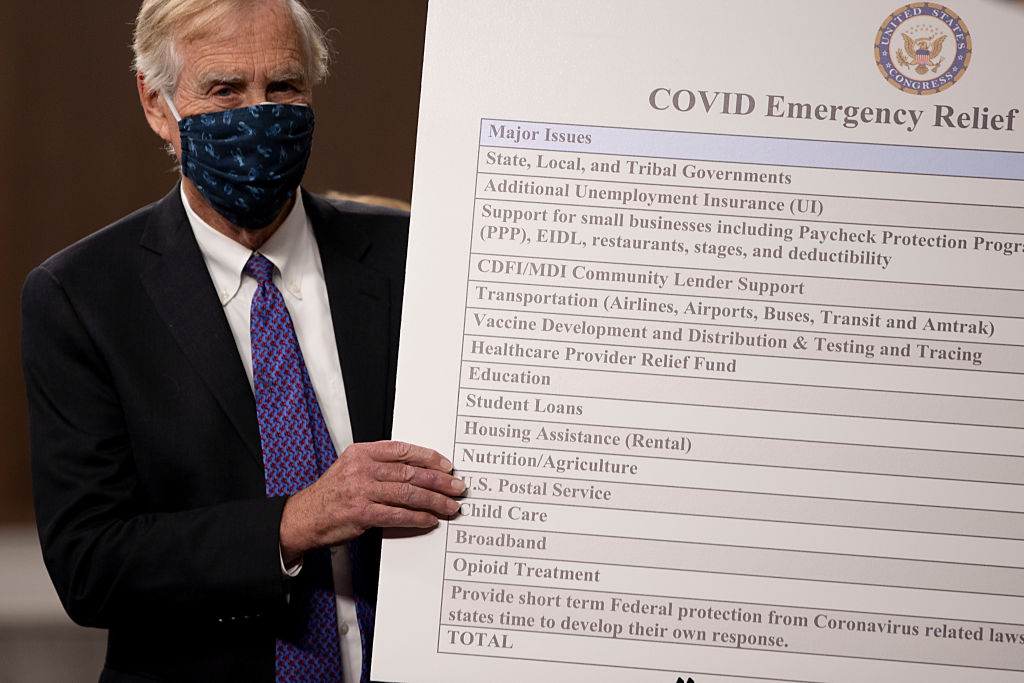

Understanding the Payment Protection Program

It’s important to understand what the PPP or Paycheck Protection Program is. It was first authorized in 2020 as part of the Coronavirus Aid, Relief, and Economic Securities Act (CARES).

President Biden and his administration introduced the PPP in order to ensure small businesses survived the lock down.

Robertson Owns Several Water & Infrastructure Companies

And as Robertson was a small business owner, with several water and infrastructure companies under her name, she was technically eligible for the loans.

However, Robertson applied for all four of her companies, Atlanta Custom Motors, MO Griggs Contracting, Tritan, and The Renee Group, some of which weren’t even operating at the time.

Inflated Application Details

The Atlanta Journal-Constitution reports that Robertson’s fraudulent PPP loan applications were a key part of her scheme. By inflating the number of employees and payroll figures, she was able to unjustly obtain substantial loan amounts.

This misrepresentation of business details was a deliberate attempt to manipulate the PPP loan system for personal gain.

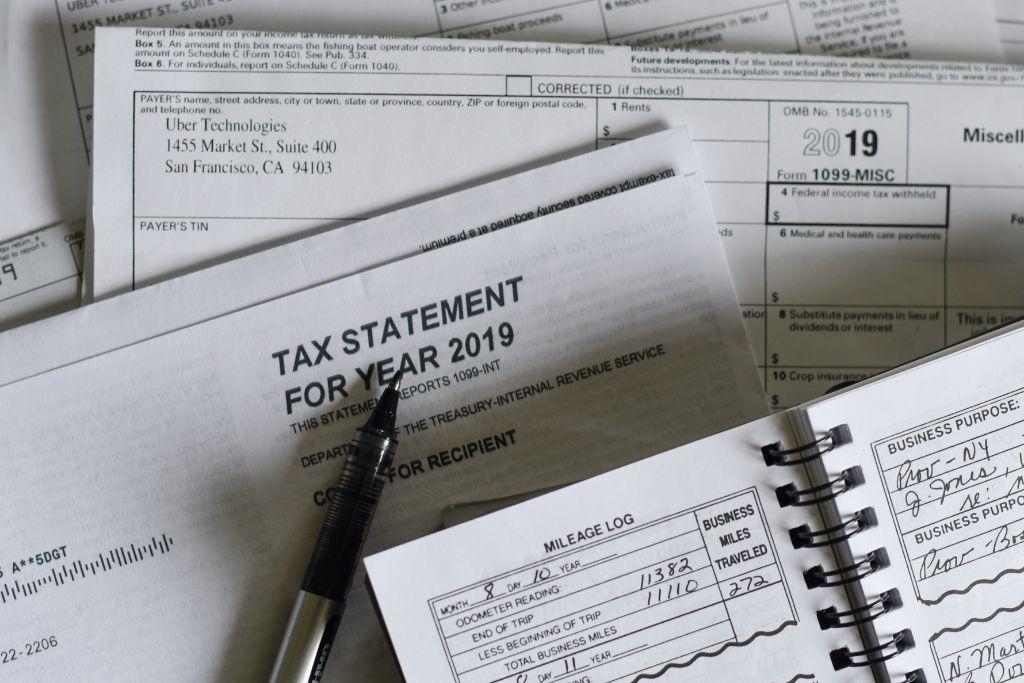

Submission of False Documents

According to the DOJ, to further support her fraudulent claims, Robertson and a co-conspirator submitted fabricated tax documents.

These false documents were crucial in her plan to obtain the PPP loans unlawfully. Such actions not only misrepresented her businesses’ financial situations but also violated legal and ethical standards.

Robertson Only Had 13 Employees, Not 427 as She Claimed on the Loans

One very clear lie that Robertson told when applying for the loans was that her company had a total of 427 employees that needed to be paid.

However, it was later revealed that at that time, she only had 13 employees on her payroll.

Robertson Blamed Her Co-Conspirator

Robertson’s co-conspirator was her best friend and fellow small business owner, Chandra Norton.

When Robertson was officially charged with fraud, the very first thing she did was blame Norton for everything.

Prosecutor Says These Allegations Are “Ludicrous”

Robertson’s lawyer called Norton “financially desperate” and an “evil genius,” claiming that Norton was the mastermind behind it all.

However, prosecutor Bernita Malloy noted that this claim “defies logic and is absolutely ludicrous.”

Norton Was the “Computer Whiz” Said Robertson

Robertson and her lead attorney Craig A. Gillen also argued that it couldn’t have been Robertson running the show because she barely knows how to use a computer.

On the other hand, they say, Norton is a computer whiz and a “master of deception.”

Robertson Threatened to Kill Her Best Friend

Norton and Robertson were once best friends, but since their crimes have come to light, they have completely turned on each other.

In fact, Robertson even threatening to kill Norton at one time, through Gillen argued she didn’t really mean it, saying,“There’s no history of violence or anger or danger by the defendant to anybody other than the statement she made when she was arrested.”

Norton Already Plead Guilty

When the two women were first charged with fraud, Norton almost immediately plead guilty and took a deal.

Her deal included cooperation with the federal government to take down Robertson, so it’s really no surprise that their friendship dissolved.

Misuse of Funds

With Norton’s help, it became clear that rather than using the PPP funds for their intended purpose of supporting businesses during the pandemic, Robertson diverted these funds for personal use.

As reported by Newsweek, her purchases included luxury items such as a Rolls-Royce, a motorcycle, and a 10-carat diamond ring costing $148,000.

Social Media Rumors

On social media, there are unconfirmed reports suggesting that Robertson also purchased a Barbie pink-colored Bentley.

While this detail remains unconfirmed, it has added to the public interest and discussion surrounding the case, highlighting the extravagance of Robertson’s alleged spending.

Financial Transfers to Family

It has been discovered that Robertson transferred some of the fraudulently obtained funds to her family members and even Chandra Norton, according to the DOJ.

She reportedly sent $400,000 to Norton and $50,000 to her daughter, who hasn’t been charged.

The Trial Evidence

The trial brought to light the extent of Robertson’s fraudulent activities. The evidence presented in court detailed how she exploited the PPP loan system.

This legal process is crucial in determining the consequences of her actions and ensuring justice is served.

Public Reaction

The public has reacted strongly to the news of Robertson’s fraud. Many people, especially those affected by the pandemic, feel betrayed by her misuse of a program designed to help struggling businesses.

This case has struck a chord with the general public, who expect honesty and integrity from their public officials.

PPP Funds Should Not Have Been a “Source of Personal Enrichment”

U.S. Attorney Ryan K. Buchanan responded in a recent statement saying, “CARES Act loans were designed to help sustain small businesses during the pandemic, not to serve as a source of personal enrichment.”

He went on to say, “We will continue to vigorously investigate and prosecute anyone who fraudulently obtains these critical funds.”

Legal Ramifications

The DOJ released the information that a federal jury found Robertson guilty of one count of conspiracy to commit wire fraud, three counts of wire fraud, and one count of money laundering.

Since entering a plea of not guilty in December 2022, Robertson had been free on bond. However, she has since been taken into custody to await her sentencing on April 11. Each count of conspiracy to commit wire fraud and wire fraud carries a potential sentence of up to 20 years, while the charge of money laundering could result in a sentence of up to 10 years.

Robertson Says She Plans to Appeal the Court’s Decision

The former attorney reportedly said she’s not going to simply sit back and accept the verdict.

Shelitha Robertson plans to appeal the court’s decision as soon as possible.

Repaying the Loans Was the “Right Thing to Do”

Interestingly, Robertson has already paid back the millions of dollars she defrauded from the government.

And her lawyer explained that she did so “because it was the right thing to do, not because she got caught.”

Norton’s Lawyers Say Robertson Thought She Could “Wash Her Hands” of Her Crimes

The debate continues as to whether it was really Robertson or Norton heading the fraudulent scheme. And attorneys on both sides have had choice words to say about the other defendant.

Prosecutor Bernita Malloy said in her closing statement, “There’s no level to which (Robertson) wouldn’t stoop to justify her criminal conduct. She disguised what she did to avoid getting caught. She thought she could wash her hands of it all.”

Broader Implications

This case is important as it highlights vulnerabilities in emergency aid programs like PPP.

It also highlights the need for more robust safeguards and monitoring to prevent such fraud in the future. The situation has raised questions about the effectiveness of oversight mechanisms in place for such programs.

Understanding the Impact of the Fraud Case

The case of Shelitha Robertson serves as a significant reminder of the responsibilities that come with public service.

Her actions and their consequences have a lasting impact, emphasizing the need for vigilance and integrity in the management and distribution of public funds.