A $15,000 IRS bill could change the American tax code forever and cost the United States Government up to $340 billion.

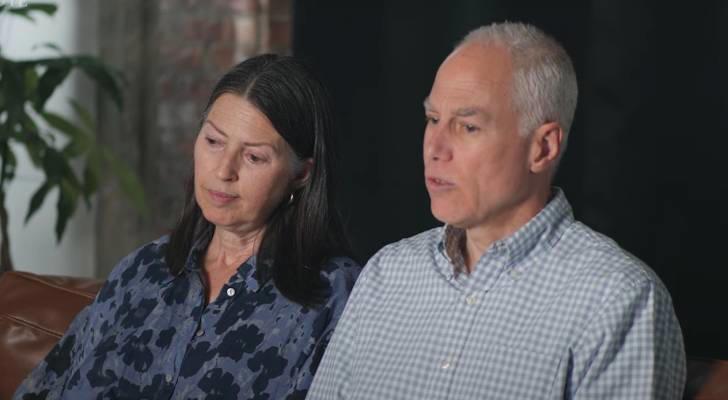

This all started when the U.S. government told Charles and Kathleen Moore they owed $14,729 in taxes for a company they made in India.

Couple Argues They Never Made a Profit from Investment

The Supreme Court heard the couples’ lawsuit on December 5, arguing that they never received a profit from their investment.

This makes logical sense because if you don’t make money, then you don’t pay tax.

Does Reinvested Money Still Get Taxed?

The Moores claim they never received a profit from their investment; instead, the money was reinvested into their company, KisanKraft.

Because they never received the income, the Moores believe they should not be taxed on the money.

Does Their Money Get Taxed or Not?

Their case centers around the Tax Cuts and Jobs Act that was made in 2017, under the mandatory repatriation tax.

The Moores have a 13% stake in KisanKraft after investing $40,000 in 2005. However, the Tax Cuts and Jobs Act placed a levy on U.S. taxpayers who own more than 10% of a foreign company, and the Moores’ company is in India.

Is Charging Tax on Unrealized Income Unconstitutional?

The Moores are asking for a refund on the tax they paid, arguing that it is unconstitutional and a direct violation of the apportionment requirements.

Lawyer Andrew Grossman told the Supreme Court a “gain is not income unless it has been realized by the taxpayer.”

What Are Unrealized Gains and Why Do They Matter in This Case?

According to Vanguard, Gains that are “on paper” are unrealized.

This means if you bought a share for $10 and it’s now worth $12, you have an unrealized gain of $2. You won’t pay any taxes until you sell the share.

Charles Moore Speaks Out on the Lawsuit

The argument the Moores are presenting to the federal court is that they were taxed on their personal property rather than any income from the corporation.

“If you haven’t received any income, how can you be required to pay income taxes?” Charles Moore asks in a video posted by the Competitive Enterprise Institute, who is representing the couple. “It seemed, to both of us, unconstitutional.”

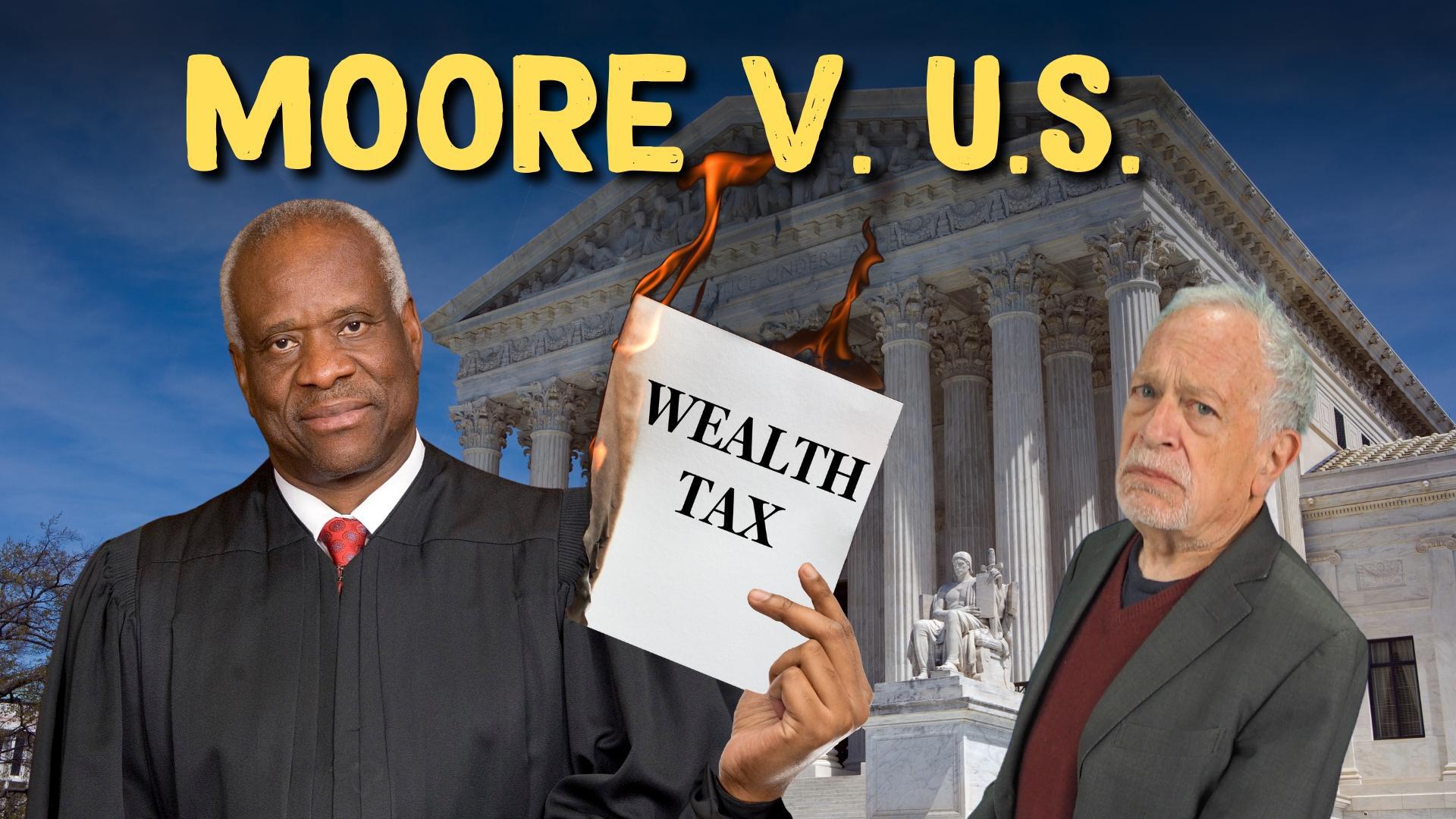

The Government Is Unlikely to Rule in Favor of the Moores

The government’s lawyer said that ruling in favor of the Moores could cause a “sea change in the operation of the tax code” and cost “several trillion dollars” in lost revenue.

If the Supreme Court rules in favor of their argument, it could completely reshape the United States Tax Code.

The Government Could Have to Pay Up to $5 Trillion

A lawyer at Holland & Knight, Josh Odintz is in support of the government. He states that ruling in favor of giving the Moores a refund could “invalidate large parts of the Internal Revenue Code.”

This would cost the government more than 5 trillion dollars.

If They Rule in Favor, The Rich Get Richer

A major concern is that if we require income to be realized before it can be taxed then could lead to “increased economic distortions, create policy uncertainty, and reduce federal revenue.”

If they rule in favor of the refund, it will lead to wealth disparity as this will mean the very wealthy can hold on to assets strategically that allow them to avoid paying taxes altogether.

How Can the Billionaires’ Income Tax Bill Keep Everyone Accountable?

To keep those who may find loopholes in keeping large amounts of wealth and not paying their fair share in taxes, the Billionaires Income Tax was introduced.

The bill would tax individuals with more than $1 billion in assets or who make $100 million in income for three years at a 20% rate, on realized and unrealized income.

Supreme Court Is Leaning Toward a Narrow Ruling

Ron Wyden is rooting for the Billionaires Income Tax Act and says that if the Moores win their case, this would prevent the bill from passing.

However, it would seem that the Supreme Court is leaning towards a narrow ruling to avoid impacts on the tax code.

How Often Does the US Tax Code Change?

US Tax Codes change every year, some years more than others. The next few years may see more changes than we are used to.

There will be a few big changes in 2024 including an annual inflation adjustment and the income thresholds that determine tax brackets. The latter could have implications for many tax payers.

What Exactly Were the Moores Investing In?

KisanKraft Machine Tools Private Limited was designed to get Indias poorest regions better tools and equipment for farming.

Success was almost immediate, the revenue of the company has increased annually since the initial investment by the Moores.

How Many Tax Laws Could Change?

Mitchell M Gans was quoted in Newsweek as suggesting that many more tax laws could change as a result of this one ruling.

Apparently many current laws could become vulnerable to change depending entirely on how SCOTUS rules.