In today’s unpredictable world, having financial stability is increasingly crucial. Establishing an emergency cash reserve offers a buffer against unforeseen challenges.

In situations where electronic banking is down or compromised, having cash in hand ensures basic needs, such as groceries and transportation, are covered without causing undue stress.

What Financial Advisors Recommend

Annalee Leonard, president of Mainstay Financial Group, stresses the significance of having cash for three to five days’ worth of living expenses.

In the wake of major disruptions like natural disasters, electronic banking could be affected. This makes cash essential, especially if access to ATMs or banking institutions becomes restricted or entirely unavailable.

Determining the Right Amount to Save

To create an effective emergency fund, two central questions must be addressed: the expenses during a large-scale emergency and the practical savings amount.

Priyanka Prakash from Fit Small Business underscores the value of keeping some physical cash ready. This is especially pertinent when standard banking procedures are interrupted.

Target Savings for Essentials

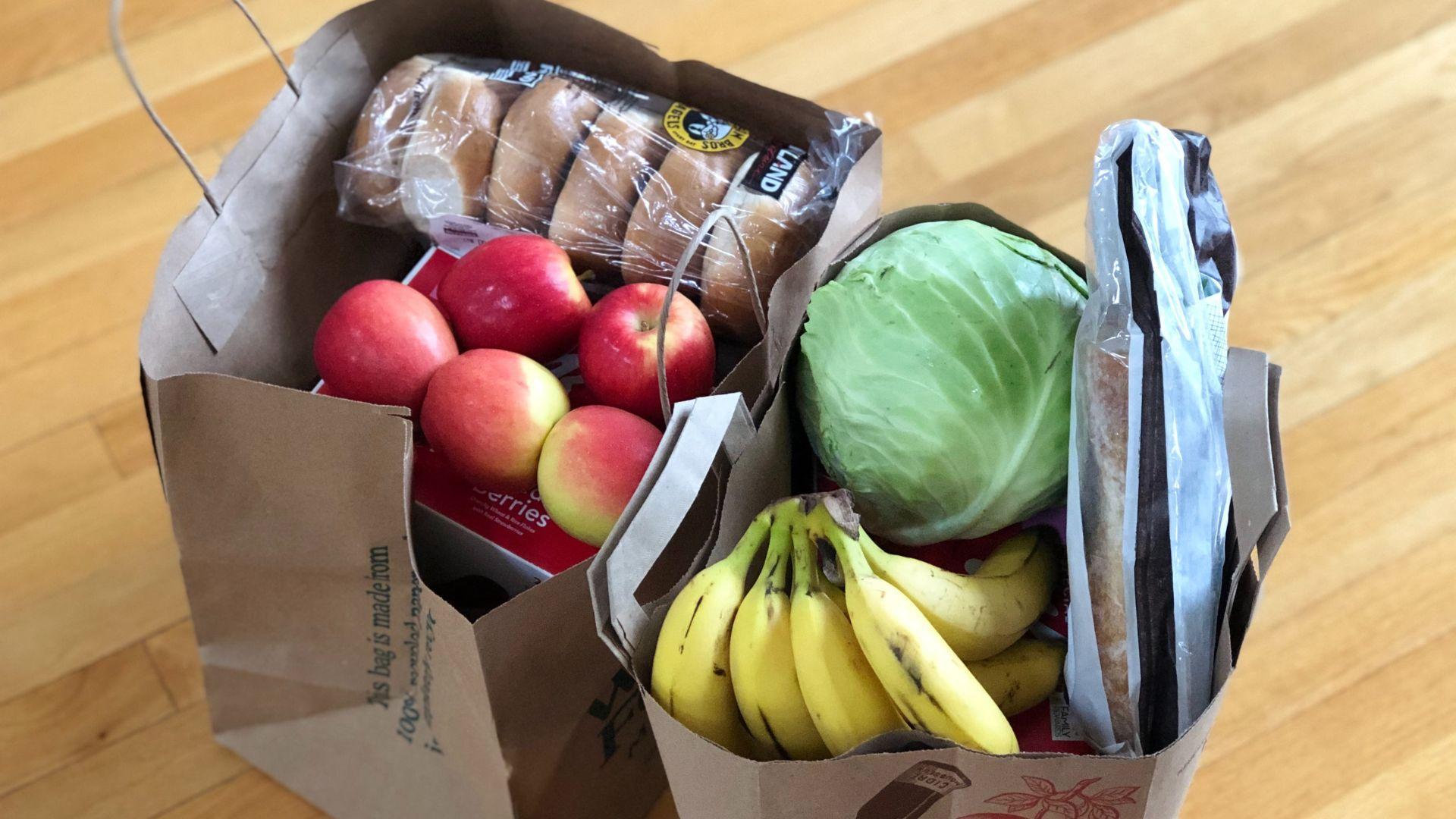

Brett Tharp, a CFP from eMoney Advisor, advises keeping enough to cater to basics such as food, water, medicine, accommodation, and transportation.

Following expert guidance, it appears that setting aside around $2,000, a figure also supported by Gregory Brinkman of Brinkman Financial, might be a practical target for many individuals.

No One-Size-Fits-All in Emergency Savings

Emergency funds should be tailored to individual needs and lifestyles. It’s important to note that there isn’t a universally optimal amount.

Rather, personal circumstances and comfort levels play a significant role. According to Prakash, even modest savings are more advantageous than none, highlighting the fund’s importance.

Costs to Consider During a National Crisis

In a large-scale crisis, essential goods and services often experience inflated prices. Increased demand and potential price gouging can play a part in this surge.

By anticipating and incorporating these increased expenses into your emergency funds, you can be better prepared and avoid potential financial pitfalls.

Items for a Basic Survival Kit

A comprehensive emergency kit might include various items. Think about essentials like batteries and tools (approximated at $122), a well-stocked first aid kit ($48), a selection of nonperishable food items ($120), vital medications ($38), and an array of spare clothing ($44).

These tools can prove invaluable during unexpected challenges.

Differentiating National and Regular Emergency Funds

While a regular emergency fund serves personal crises, like sudden job losses or medical events, a national emergency fund caters to broader, impactful situations.

This could be where digital transactions face limitations. Ideally, these funds should be held in cash, with Prakash warning against assets with potential volatility, such as stocks.

Beginning Your Emergency Fund

Creating a robust and detailed budget serves as a foundation for an effective emergency fund. Renowned financial expert Rachel Cruze endorses the zero-based budget method.

This strategy ensures each dollar has a defined role, streamlining spending and emphasizing savings as a priority.

Setting and Reaching Savings Goals

Having clear and achievable savings objectives is of utmost importance. Financial expert Dave Ramsey often suggests starting modestly and then breaking these goals down into smaller, monthly targets.

Automating your savings, perhaps by dedicating a fixed portion of your monthly earnings, can simplify and bolster this process.

Cash Storage Recommendations

While home cash storage offers convenience, large sums can be risky. Prakash advises caution due to concerns like theft and inflation. To mitigate these risks, she proposes keeping a majority in banks, which offers interest.

Chris Hogan, another financial expert, strongly suggests using secure storage methods, such as robust, fireproof safes.

Navigating Financial Difficulties without an Emergency Fund

For those lacking an emergency fund, it’s crucial to prioritize essential costs. Rachel Cruze stresses the importance of necessities, like housing and food, above all else.

One should also endeavor to sidestep additional debt during challenging times and explore options to supplement income. And for those with outstanding debts, proactive communication with lenders might provide some relief.