Transparency can be a good thing in politics. When political leaders open up about, for example, paying their taxes, chances are good that taxpayers will put their trust in them.

Now President Joe Biden and first lady Jill Biden’s tax return has been reported. The announcement marked the federal tax-filing deadline.

Presidential Taxes

How much does the President and the First Lady pay in federal income taxes? They paid $146,629 based on their income report of $619,976.

The First Couple’s effective federal tax rate is 23.7%. And this year marks the 26th year Biden has released federal tax returns during his public life.

Higher Than in 2022

The Bidens’ joint income in 2023 was higher than the one they reported for 2022, which was $579,514. Joe Biden’s presidential salary alone is $400,000, while Jill Biden’s teaching position in Northern Virginia Community College earned her $85,985.

The First Lady also reported $4,115 in royalties from former book publications. The First Couple collected $129,876 in taxable interest, pensions and annuities, Social Security benefits, and IRA distributions. These have gone up from what they reported in 2022, which caused the increase in income.

Charitable Contributions

When it comes to charity, the Bidens reported contributions amounting to $20,477 to 17 charities. These include a $5,000 donation to the Beau Biden Foundation, named after their late son.

Also, the Bidens paid $30,908 in Delaware income tax. Meanwhile, Jill Biden reported paying $3,549 in taxes in Virginia.

The Second Couple’s Taxes

Similarly, Vice President Kamala Harris and her husband, Doug Emhoff, reported their taxes.

They paid $88,570 in federal income tax in 2023—an effective 19.7% federal tax rate for their joint income of $450,299. The Second Couple’s charitable donations amounted to $23,026.

White House Statement

The White House released a statement saying, “Once again demonstrating his commitment to being transparent with the American people, President Biden has released the most tax returns of any commander-in-chief while in office.”

The statement continued, ”President Biden believes that all occupants of the Oval Office should be open and honest with the American people, and that the longstanding tradition of annually releasing presidential tax returns should continue unbroken.”

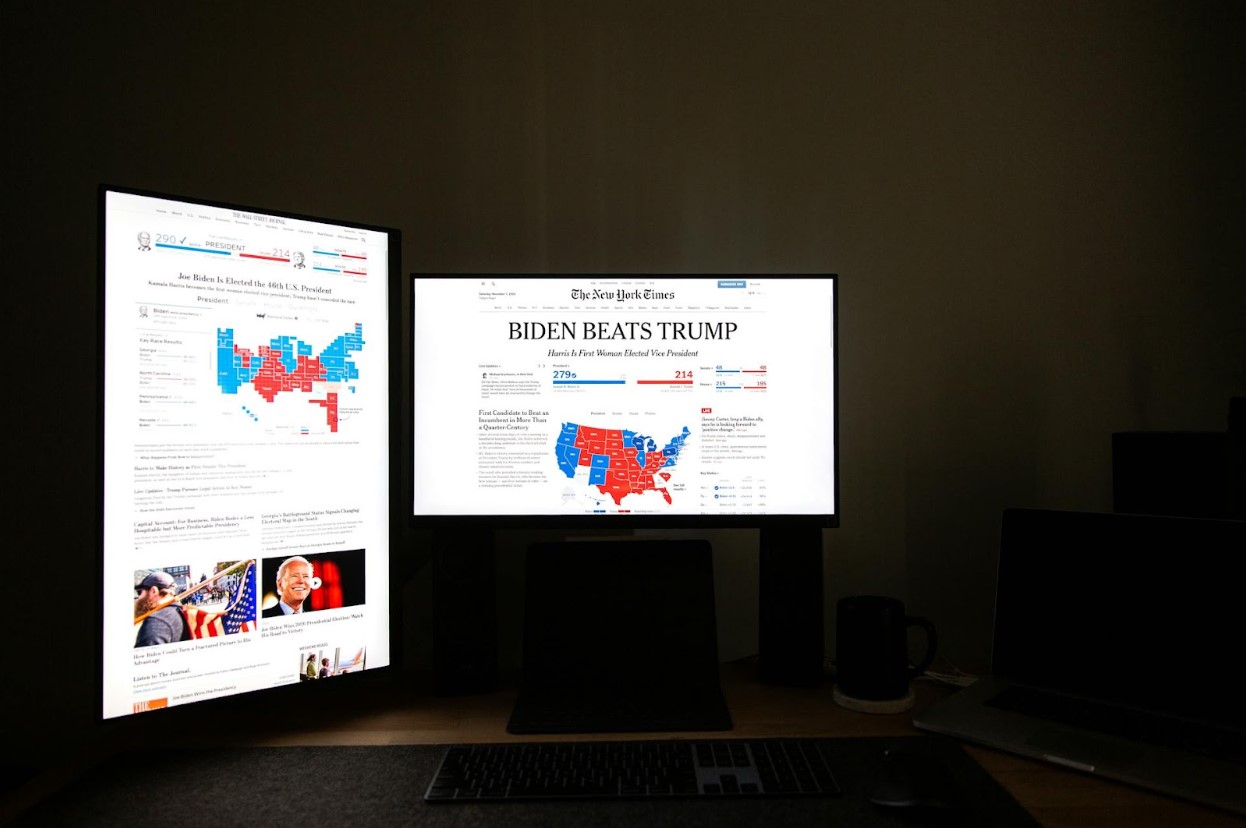

Jab Against Trump

The statement, while it does promote honesty and transparency, can also be seen as a jab against former President Donald Trump, the presumptive Republican nominee.

Trump is once again declining to release his latest federal returns after breaking from the presidents’ habit of disclosing the documents—a bipartisan tradition.

Unwillingly Released Tax Returns

Trump hasn’t volunteered any past tax returns. But the House Democrats, in 2022, released 6 years of Trump’s tax returns (2015-2020) for the time he was president and campaigned for the presidency.

The House Ways and Means Committee, then controlled by the Democrats, used oversight powers to obtain the documents from the Internal Revenue Service.

Trump’s Small Tax Payments

Tax experts in the Joint Committee on Taxation found the former POTUS paid only $1.1 million in federal income taxes during his first 3 years in the Oval Office.

In 2020, when he claimed a loss of $4.8 million, he paid no federal tax. But the Trump campaign spokesperson said Trump’s family business has always been targeted by Biden and the Democrats.

Trump’s Taxes Illegally Leaked

Karoline Leavitt, the spokesperson for Trump’s campaign, answered questions whether Trump will make his 2023 tax returns public.

“President Trump has released more information to the American public about his personal finances than any candidate in history,” she said. But the reports on his past tax returns, on the other hand, were “illegally leaked by the IRS.”

No Word on Tax Filing

Trump himself is not offering any information about his 2023 tax filing. Instead, he posted on social media saying that American families benefited from tax cuts passed while he was in office.

The former president also said if Biden got his way, people would be facing “colossal” tax increases.

Trump Interested in Tax Cuts

It may sound like pre-election campaigning, but a report by Reuters said that the Republican presumptive candidate was interested in a new middle-class tax cut if he returned to the White House.

One of the ideas presented to Trump is cutting the federal payroll tax, in which Trump is keen but not committed to yet. However, since the movie may worsen the country’s budget deficit, it’s only going to target him for more criticism. And perhaps, he should consider opening up about his own taxes first before thinking about any tax cuts for the people.