As Bank of America raises its hourly minimum wage to $24, outperforming California’s recently approved $20 minimum wage for fast-food workers, questions are surfacing about how these increments could worsen previously rising inflation.

With inflation currently a critical worry for consumers and policymakers, such significant pay climbs across businesses might add to additional cost increases, extending the impact to the overall economy.

Aggressive Strategy

The minimum wage at Bank of America will go up from $23 to $24 per hour in October, affecting thousands of the bank’s 212,000 employees, particularly those in customer-facing positions like tellers and call center workers.

The move is important for the bank’s aggressive strategy to remain competitive in a constrained labor market, where worker deficiencies have become more evident in positions that can’t be performed remotely.

Increasing Wages

Starting around 2019, the bank has consistently expanded its wages, beginning at $15 an hour with a guarantee to reach $25 by 2025.

This pay increase likewise comes amid rising inflation and developing worries that higher wages across numerous sectors might additionally drive costs up. The U.S. Bureau of Labor Statistics appraises that banks will have to fill 27,000 teller positions yearly over the next ten years.

Pressure to Compete

Bank of America intends to address labor shortages by raising wages above the $18.10 per hour national average for bank tellers in 2023. Yet, as compensation pressures develop, they could have far-reaching consequences beyond the labor market.

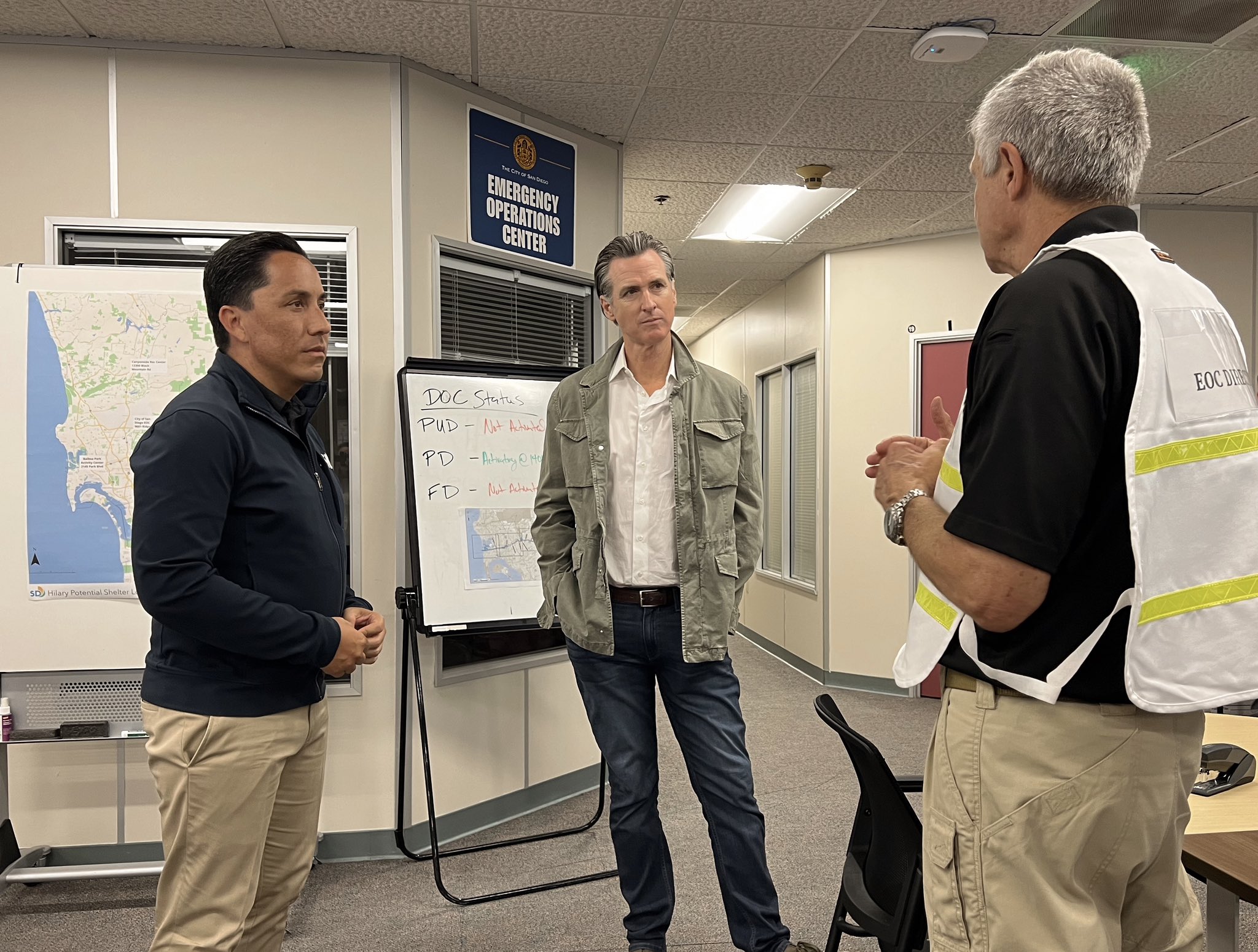

On the West Coast, California Governor Gavin Newsom has signed legislation that increased the minimum wage for fast food workers to $20 an hour, beginning in April 2024.

Fast Food Council

The legislation introduces a Fast Food Council, allowing laborers a voice in setting wages and working circumstances, further enabling employees in the battle for better compensation. For some, this addresses a huge win following years of activism.

Governor Newsom, during the bill signing, expressed, “California is home to more than 500,000 fast-food workers who – for decades – have been fighting for higher wages and better working conditions. Today, we take one step closer to fairer wages.”

Historic Legislation

This new law may pave the way for future wage increases in other industries and is regarded as historic for the fast food industry.

While this pay increment is a triumph for workers, especially in one of the country’s most costly states, it could add to rising costs in the fast food industry and beyond.

Consequences of Increased Wages

As wages go up, the expenses of labor and products, especially in labor-intensive sectors, will typically go up, frequently passed on to consumers as higher costs.

Inflationary pressures have long been linked to rising wages, especially when they occur across industries at such a rapid rate. As industries raise wages to draw in and keep laborers, they frequently need to expand costs to remain profitable.

Feedback Loop

This dynamic can make a feedback loop: as wages rise, costs rise, driving laborers to request even higher wages in order to keep up with the cost of living.

Bank of America’s choice to raise wages might mirror a momentary need to address laborer deficiencies, yet the likely long-term influence on inflation can’t be overlooked.

Spreading to Other Sectors

With fast food laborers likewise seeing a compensation boost to $20 an hour in California, these pay increases could spread to different sectors, adding to overall higher inflation.

Wage increases are necessary for workers trying to make ends meet, especially in high-cost areas like California and major urban centers where Bank of America operates.

Far-Reaching Effects

However, these pay raises may have far-reaching economic effects that go beyond the workers themselves.

That’s what the broader concern is; as wages rise, the inflated expense of work will be passed on to consumers, potentially raising costs across the board. The fast food industry, for example, may see an increase in menu costs as chains battle to offset the higher employee expenses.

Potential for Higher Fees

Additionally, financial institutions like Bank of America could see functional costs rise, possibly prompting higher fees for banking services.

Even though these wage increases are meant to improve workers’ quality of life, they come at a time when household budgets are already being squeezed by inflation. With food costs, rent, and energy costs continuing to rise, extra inflationary pressures could make it significantly more difficult for consumers to stay above water in the current economic landscape.

Preventing an Inflationary Cycle

As wage increases continue, the challenge will be to keep these increments from spiraling into an inflationary cycle that influences all consumers, whether or not they are getting more significant compensation.

If businesses can’t absorb the expenses of these pay increments, price increases are likely to follow, putting additional pressure on the economy.

As the minimum wage debate continues, it remains to be seen how increases will have a long-term impact on the economy.