California is home to nearly 40 million people, more than half of whom are estimated to be homeowners. If you’re a California homeowner (or looking to be one), finding affordable home insurance is going to be a challenge.

Environmental concerns, such as climate change and extreme weather, have always been a concern for insurers. But increased wildfire severity and rising home construction costs have finally driven some insurers to tip over. Seven of California’s largest property insurers have decided to limit new homeowners policies in the state.

Who Are Limiting Their Policies?

There are many property insurers in California, but the biggest seven that are now limiting new homeowners policies in the Golden State are State Farm, Allstate, Farmers, USAA, Travelers, Nationwide and Chubb.

Their decision naturally raised questions about the stability of California’s home insurance market. Many are also wondering what this means for the future of home ownership in California, a state where the cost of living is already exorbitant.

Reasons for Limiting Policies

The risks are just too great, according to the insurers. Companies are blaming wildfires, inflation (that raised reconstruction costs) and higher prices for reinsurance they buy to boost their balance sheets and protect themselves from catastrophes.

Outdated state regulations have also been blamed. Some of these claims were disputed by some consumer advocate groups.

Several Insurers Pulling Out

Effective February 1, 2024, The Hartford no longer writes new property insurance policies in California. Even though the company only writes about 2% of California’s home insurance policies, their partnership with AARP had given them further reach.

Meanwhile, effective late February, American National stopped offering home insurance in nine states, including California. The decision impacted around 36,000 policies. The company cited inflation, profitability issues and high claims volume as pertinent issues.

The Crisis Reached New Heights

The insurance crisis reached new heights last March when leading insurer State Farm General announced it wouldn’t renew 72,000 property owner policies statewide.

State Farm General joined Farmers, Allstate and other companies in either not writing or limiting new policies or tightening underwriting standards.

How Homeowners Are Affected

A spokesperson for the California Department of Insurance explained how homeowners could be affected. If the homeowner is based in San Fernando Valley, they’ll likely still have many insurance companies from which to buy a policy.

But if the homeowner lives in what’s called the “wildland urban interface” (a hillside, canyon or other neighborhoods close to nature) your options are likely limited and costly. That is, if there’s even a policy to buy.

Last Resort Insurer

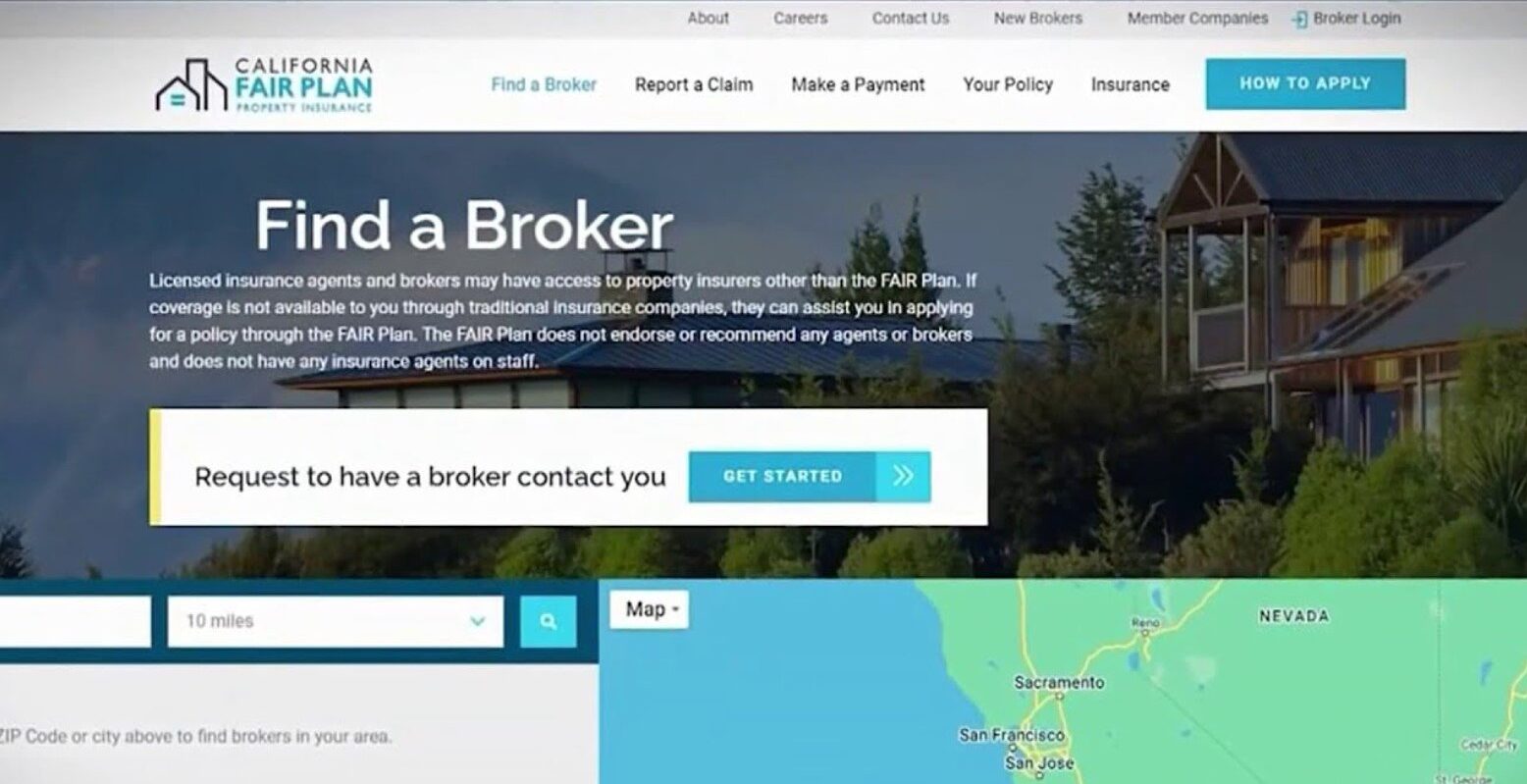

The situation has driven thousands of homeowners to turn to California FAIR Plan, an insurer of last resort funded by the industry offering policies with limited coverage.

Otherwise, homeowners are advised to find out which insurers are writing coverage in their neighborhoods through the Insurance Department. The Department also said it would guide homeowners by phone or online chat regarding insurance matters.

What the State Government Is Doing

The state government is not idle in dealing with this crisis. Last year, there was an attempt to reach a fix in the Legislature but it fell apart.

Then, following Gov. Gavin Newsom’s executive order, Insurance Commissioner Ricardo Lara announced in September a package of executive actions called the Sustainable Insurance Strategy to reform the market by the end of the year.

The Sustainable Insurance Strategy

This strategy introduced by Lara aims to expedite the review process for insurers seeking rate hikes and allow them to consider adding the project costs of future catastrophes into their rates. They will also be able to consider the costs for reinsurance, which they can attribute to their California operations.

The package also intends to move homeowners back onto the roles of commercial insurers and off the FAIR Plan while also improving the finances and coverage of the state’s insurer of last resort.

Insurance Reforms

The Sustainable Insurance Strategy is also intended to be a kind of insurance reform that would streamline the regulations originally created by Proposition 103 in 1988. Prop 103 was what drove these large insurance companies to pull out of the insurance market in California in the first place.

Lara is at least aware of how outdated Prop 103 was, saying they were established in an “age of papers and pay phones.” In February this year, the commissioner introduced draft regulations to improve rate approval process for insurers in several markets, including homeownership.

Running Into Opposition

Many in the Capitol thought the reforms were straightforward, but still they ran into stiff opposition from the Personal Insurance Federation of California, a lobbying group for property and casualty insurers. The Federation claimed that these reforms would give regulators too much authority.

Lara’s proposal to include a “catastrophe modeling” for future fires, storms and big insurance events, as well as the cost of reinsurance in premiums, are also considered controversial among consumer advocates.

Not Time to Panic Yet

While the state government and legislators sort out the issue of the reforms, California homeowners can still stay calm and not panic yet. There are still around 100 insurers writing home insurance policies in the state. And just because seven of the biggest insurers have limited or stopped writing new policies, current policies are still being honored.

Furthermore, in 2022 Lara released draft regulations (which are now in effect) that require insurers to give discounts to homeowners who improve their homes’ wildfire resilience. If they take 10 specific actions to ensure their homes are safe, they qualify for a discount. The Insurance Department has approved about 140 insurer rate applications that took the program into account.