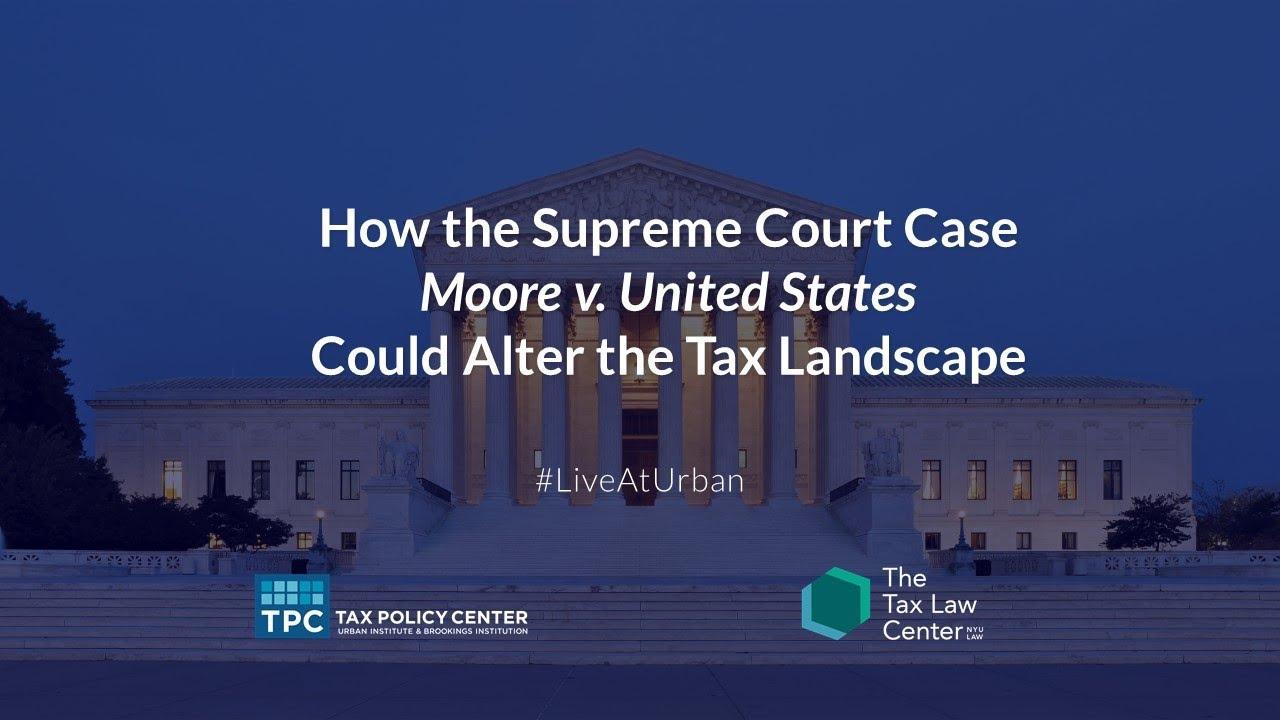

A $15,000 IRS bill could change the American tax code forever and cost the United States Government up to $340 billion.

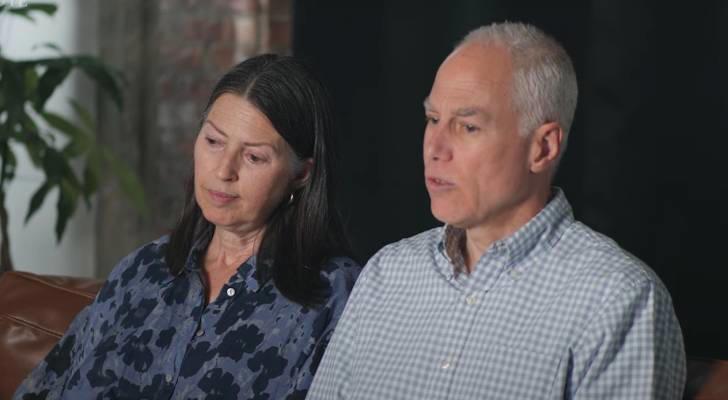

This all started when the U.S. government told Charles and Kathleen Moore they owed $14,729 in taxes for a company they made in India.

Couple Argues They Never Made a Profit from Investment

The Supreme Court heard the couples’ lawsuit on December 5, arguing that they never received a profit from their investment.

This makes logical sense because if you don’t make money, then you don’t pay tax.

Does Reinvested Money Still Get Taxed?

The Moores claim they never received a profit from their investment; instead, the money was reinvested into their company, KisanKraft.

Because they never received the income, the Moores believe they should not be taxed on the money.

Does Their Money Get Taxed or Not?

Their case centers around the Tax Cuts and Jobs Act that was made in 2017, under the mandatory repatriation tax.

The Moores have a 13% stake in KisanKraft after investing $40,000 in 2005. However, the Tax Cuts and Jobs Act placed a levy on U.S. taxpayers who own more than 10% of a foreign company, and the Moores’ company is in India.

Trump’s Tax Reform and Its Disputed Legacy

The New York Times reports that the Trump administration’s Tax Cuts and Jobs Act, aimed at bringing back profits held overseas by American companies and individuals, is now a focal point of legal debate. The Supreme Court case Moore v. United States, directly challenges this aspect of Trump’s tax reform.

This case not only questions the effectiveness of these reforms but also highlights the ongoing controversy surrounding their impact on individual taxpayers and the broader economy.

The Supreme Court and the Tax Cuts and Jobs Act

The ongoing Supreme Court case, Moore v. United States, brings into question specific elements of Donald Trump’s Tax Cuts and Jobs Act, particularly the repatriation tax on foreign assets.

The Moore case’s outcome could significantly influence the U.S. government’s ability to tax investment profits, potentially reshaping how key provisions of the 2017 tax reform are implemented and enforced in the future, as reported by The New York Times.

Potential Consequences of the Supreme Court Ruling

The Moore case could redefine the concept of “income” in the U.S. tax code. The New York Times reveals that the Republicans on the Supreme Court could establish a new standard where profits must be paid out as cash before being taxed.

This decision could have broad implications for various types of taxes, including wealth taxes, potentially altering the landscape of the federal tax system.

Implications for Future Taxation Policies

The New York Times explains that the Supreme Court’s decision in the Moore case could set a precedent for future taxation policies, particularly regarding the taxation of “unrealized profits”.

The case illustrates the dynamic nature of tax law and the ongoing debate about the scope and limits of taxation in the United States. The outcome could have far-reaching consequences for both individual taxpayers and the overall structure of the U.S. tax system.

Is Charging Tax on Unrealized Income Unconstitutional?

The Moores are asking for a refund on the tax they paid, arguing that it is unconstitutional and a direct violation of the apportionment requirements.

Lawyer Andrew Grossman told the Supreme Court a “gain is not income unless it has been realized by the taxpayer.”

What Are Unrealized Gains and Why Do They Matter in This Case?

According to Vanguard, Gains that are “on paper” are unrealized.

This means if you bought a share for $10 and it’s now worth $12, you have an unrealized gain of $2. You won’t pay any taxes until you sell the share.

Charles Moore Speaks Out on the Lawsuit

The argument the Moores are presenting to the federal court is that they were taxed on their personal property rather than any income from the corporation.

“If you haven’t received any income, how can you be required to pay income taxes?” Charles Moore asks in a video posted by the Competitive Enterprise Institute, who is representing the couple. “It seemed, to both of us, unconstitutional.”

The Government Is Unlikely to Rule in Favor of the Moores

The government’s lawyer said that ruling in favor of the Moores could cause a “sea change in the operation of the tax code” and cost “several trillion dollars” in lost revenue.

If the Supreme Court rules in favor of their argument, it could completely reshape the United States Tax Code.

The Government Could Have to Pay Up to $5 Trillion

A lawyer at Holland & Knight, Josh Odintz is in support of the government. He states that ruling in favor of giving the Moores a refund could “invalidate large parts of the Internal Revenue Code.”

This would cost the government more than 5 trillion dollars.

If They Rule in Favor, The Rich Get Richer

A major concern is that if we require income to be realized before it can be taxed then could lead to “increased economic distortions, create policy uncertainty, and reduce federal revenue.”

If they rule in favor of the refund, it will lead to wealth disparity as this will mean the very wealthy can hold on to assets strategically that allow them to avoid paying taxes altogether.

How Can the Billionaires’ Income Tax Bill Keep Everyone Accountable?

To keep those who may find loopholes in keeping large amounts of wealth and not paying their fair share in taxes, the Billionaires Income Tax was introduced.

The bill would tax individuals with more than $1 billion in assets or who make $100 million in income for three years at a 20% rate, on realized and unrealized income.

Supreme Court Is Leaning Toward a Narrow Ruling

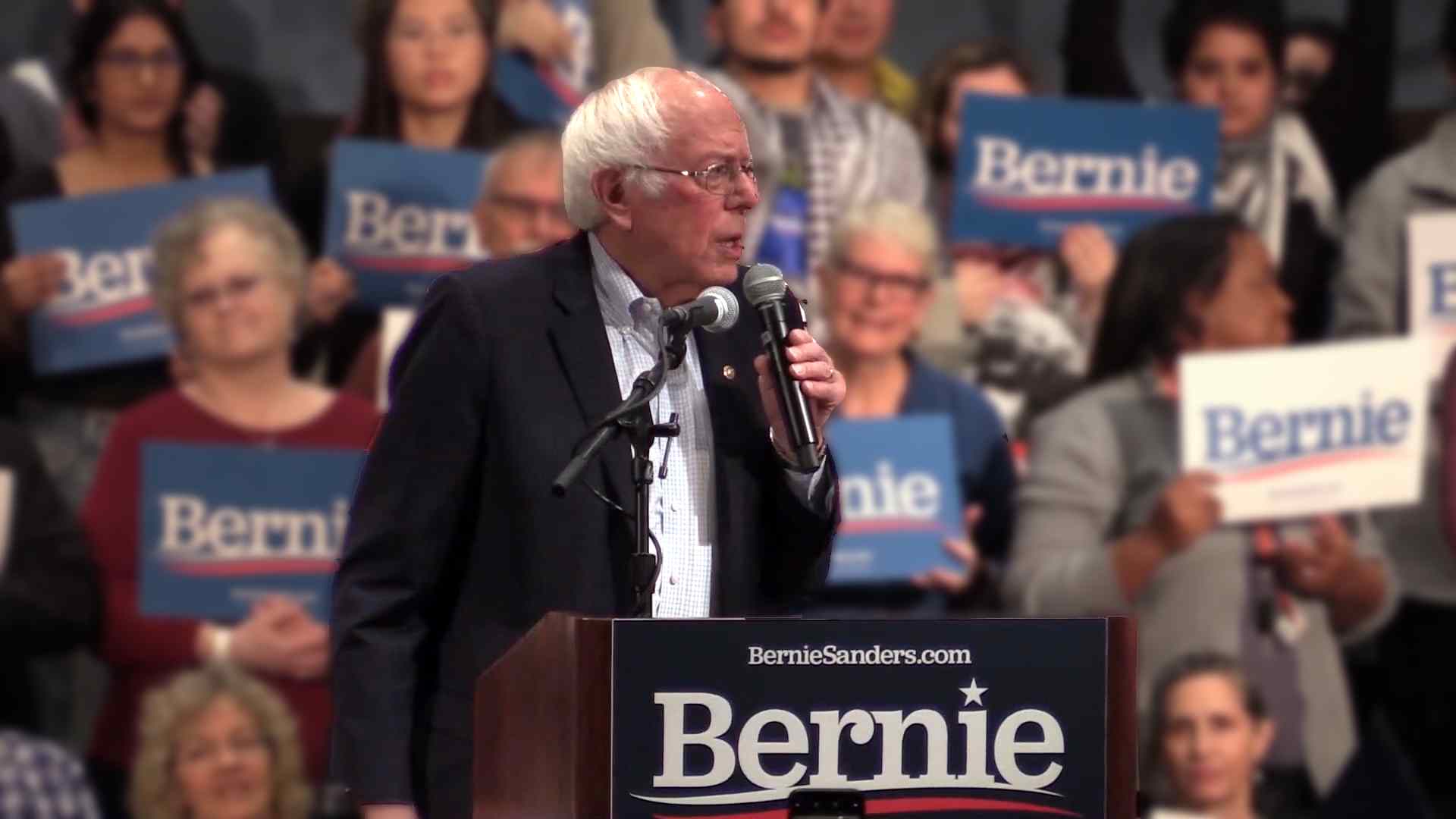

Ron Wyden is rooting for the Billionaires Income Tax Act and says that if the Moores win their case, this would prevent the bill from passing.

However, it would seem that the Supreme Court is leaning towards a narrow ruling to avoid impacts on the tax code.

Who are America’s Billionaires?

While some may think of billionaires as a large group because of the sheer quantity of wealth they control, this group’s numbers are exceedingly small.

According to Forbes in 2023, there are only 735 billionaires based in the United States. When taking aim at the ultra-rich, focusing on billionaires might not be a large enough target. While there are only 735 billionaires in America, the number of millionaires in the country numbers over 22 million.

Why Are Politicians so Focused on Billionaires?

From billionaire wealth taxes to increases in capital gains taxes, there seems to be a lot of political energy directed at billionaires recently. There is a growing sentiment among American voters that billionaires should not be allowed to continue to exist the way they do.

Bernie Sanders made a central part of his presidential run in 2020 an attack on billionaires. He made no secret of his desire to get rid of every billionaire which CNN reported in 2019, an idea that saw populist support.

Billionaires are Top Spenders

It seems with the glut of billionaire tax proposals and other bills to capture wealth from America’s richest residents that politicians are focused on making billionaires pay more into the system.

This might seem especially surprising considering that many billionaires are also some of the biggest political spenders. OpenSecrets, an organization that sheds light on political spending, reported in 2017 that billionaires are some of the top political spenders.

The Richest People in the Country

According to data published by Statista in November 2023, the 20 richest people in America all have a net worth that individually exceeds $35 billion.

The richest person in the United States as of June 2023 was Elon Musk, who had an estimated net worth of $180 billion. Four other names on the top 20 list exceed $100 billion in total net worth, including Jeff Bezos, Larry Ellison, Warren Buffer, and Bill Gates.

How Often Does the US Tax Code Change?

US Tax Codes change every year, some years more than others. The next few years may see more changes than we are used to.

There will be a few big changes in 2024 including an annual inflation adjustment and the income thresholds that determine tax brackets. The latter could have implications for many tax payers.

Do Americans Want the Tax Code to Change?

The Hill recently reported on a poll by the University of Chicago Harris School of Public Policy and The Associated Press-NORC Center for Public Affairs Research that showed two out of three Americans feel like they spend too much on federal taxes.

The majority of Americans feel like taxes are unfair and they don’t feel the return on their investment.

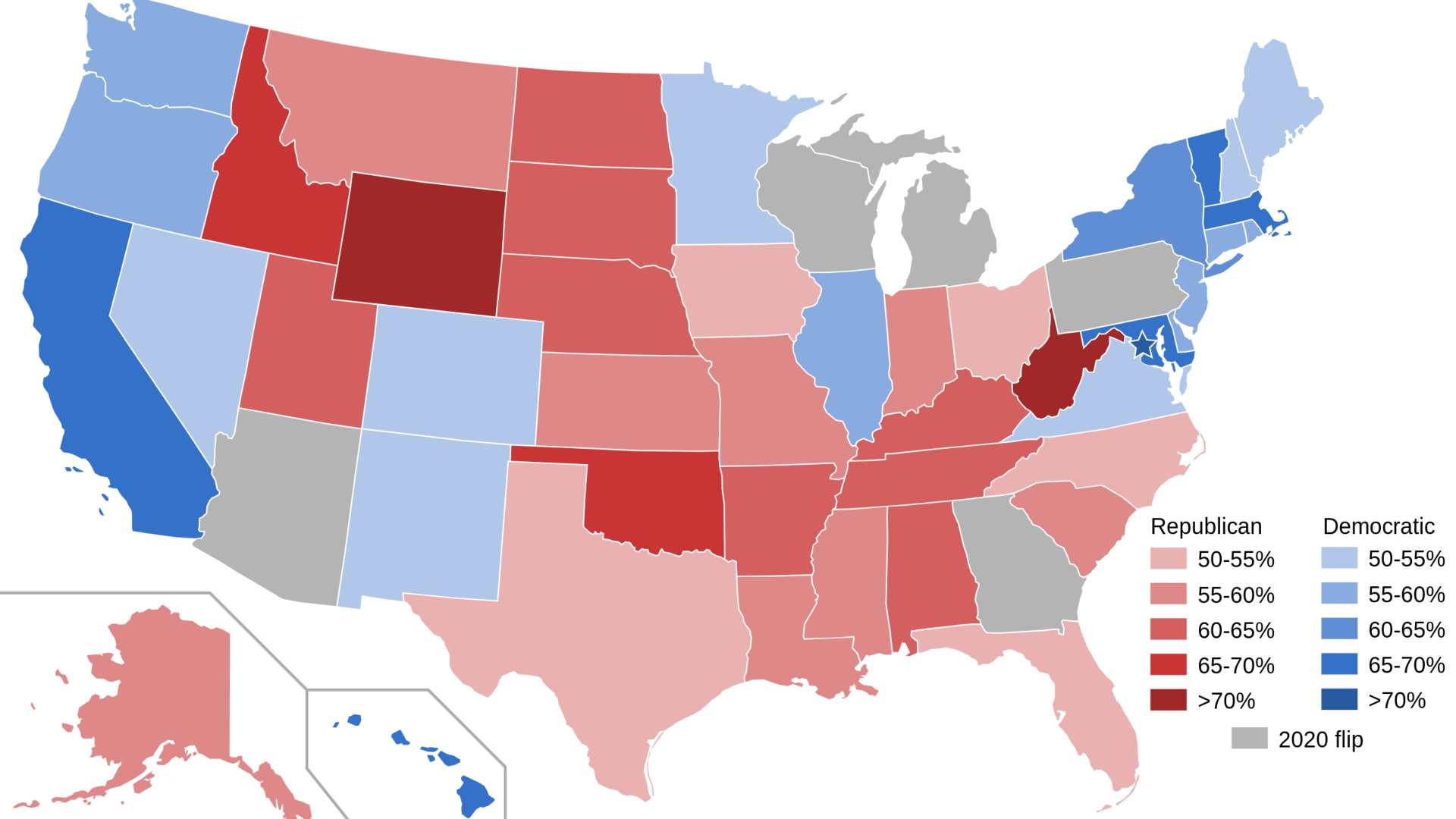

Republican Vs Democrat Opinions on Federal Taxes

Republicans are more likely than Democrats to view federal taxes as unfair. However, this divide lessens when it comes to more local taxes. A professor at the University Chicago Harris School of Public Policy named Chris Berry commented on a reason for this phenomenon.

“One of the things you’ll hear said is, ‘There’s no Democratic or Republican way to collect the trash or pave the streets,’” he said. “We tend to think of local government as less partisan.”

The Young and Old Divide on Federal Taxes

Older generation Americans aged 60 years or older are more likely to have a positive view according to the Chicago Harris study. Younger adults generally feel that the way their tax dollars are spent is unfair.

These younger generation Americans think the government isn’t spending money on things worth investing in. They would rather the government spend more money on national healthcare, education, or things to help the average American.

The Tax Information Gap

Studies like the one reported by The Hill generally show that Americans have a poor understanding of what goes into calculated taxes and government spending.

The study found that only 2 out of 10 American adults reported understanding how their local property taxes are calculated. Only about 1 in 4 Americans report understanding how federal income tax is calculated very well.

The Problem of Low Information Voting

One of the disadvantages of the current US system is that voters are alienated from the processes that determine how the country is run. This is because voters are generally uninformed on issues and vote for big-party candidates as a sort of tradition.

A Just Facts survey that tested voter knowledge on important voting issues found that voters across the board answered questions correctly at a rate less than 50%. Republican voters answered correctly 47% of the time on the high end and Democrat voters answered the same questions correctly 34% of the time on the low end.

A System That Discourages Participation

Pew Research Center found in 2022 that participation in elections in the United States is behind many other countries in the world.

Participation in US elections ranked 31st out of 50 from countries that Pew Research looked at with recent elections. The United States is sometimes seen as an important founding country for democratic values, but in recent years it hasn’t been living up to its reputation.

Taxes are Necessary for Budget Shortfalls

Recent downturn in the economy stemming from world events like the global pandemic has put a strain on the American taxpayer, causing shortfalls in some government budgets. Pew Charitable Trusts reported recently that state budget problems have spread since the pandemic.

Even high-population states with significant tax bases like California and New York are having trouble balancing the books. Now, nearly half of Americans live in a state that either has a short-term budget gap or a long-term running deficit for its government.

Navigating the 2024 Tax Changes

The 2024 tax season introduces significant changes to tax brackets, impacting American taxpayers. With the national filing date set for January 29th, it’s crucial to understand these adjustments.

Marketplace reports that The IRS has made these changes in response to inflation, although tax rates have remained unchanged. This development is vital for taxpayers to comprehend as it directly affects their financial planning for the year.

Understanding Inflation Adjustments in Tax Brackets

Ashlea Ebeling, a personal finance reporter at The Wall Street Journal, explains that the tax brackets have been widened due to inflation adjustments. This means that taxpayers can earn more before moving into a higher tax bracket.

Ebeling states, “And since we’ve seen inflation, they’re wider this year.” These adjustments provide some relief to taxpayers, allowing them to retain more of their income at a lower tax rate.

Inflation Levels in the United States

Inflation has been a major contributor to recent US economic woes.

Macrotrends calculated that inflation reached a fever pitch at 8% in 2022, which is the highest rate it has been in decades. While the rate of inflation has slowed down recently, the damage was already done and will have far-reaching consequences for the American tax base.

Example of Tax Bracket Changes for 2024

To illustrate the impact of these changes, Ebeling offers a comparison between the 2023 and 2024 tax brackets.

For instance, in 2023, income up to $11,000 was taxed at 10%, but in 2024, this threshold increases to $11,600, as reported by Marketplace.

Shift in Inflation Adjustment Methodology Since 2017

The Wall Street Journal reports that In 2017, Congress altered the method for inflation adjustments, leading to slower increases in tax brackets. Ebeling points out, “It was in 2017 Congress switched to the slower method of inflation adjustments.”

This change is significant because it means that the tax brackets are not rising as rapidly as they could, potentially leading to higher tax liabilities over time. The Joint Committee on Taxation projected that this change would cost Americans $133 billion over a decade.

Stability and Future of Tax Rates

The current tax rates, ranging from 10% to 37%, were established by the 2017 tax overhaul and are set to expire at the end of 2025.

Ebeling clarified to Marketplace: “The rates only change if Congress changes them.”

Key Dates and Obligations for 2024 Tax Filing

January 29th marks the start of the 2024 filing season. April 15th is not only the filing deadline but also the due date for tax payments.

Speaking to Marketplace, Ebeling notes, “You always have to remember that’s not just the due date to file, but it’s the due date to pay.” This distinction is critical for taxpayers to avoid penalties. For states like Maine and Massachusetts, the due date extends to April 17th due to state holidays.

What Exactly Were the Moores Investing In?

KisanKraft Machine Tools Private Limited was designed to get Indias poorest regions better tools and equipment for farming.

Success was almost immediate, the revenue of the company has increased annually since the initial investment by the Moores.

How Many Tax Laws Could Change?

Mitchell M. Gans was quoted in Newsweek as suggesting that many more tax laws could change as a result of this one ruling.

Apparently many current laws could become vulnerable to change depending entirely on how SCOTUS rules.