The United States has made strides in its battle against persistent inflation and the looming recession after adding over 216,000 jobs last month.

Initial expectations suggested around 176,000 new jobs would come in December. Yet, to the nation’s surprise, they blew past this estimation, leaving economists hopeful about the future.

Jobs Data Blows Past Initial Expectations

Data released last week by the Bureau of Labor Statistics revealed the United States added over 216,000 jobs last month (via The Guardian).

While economists were shocked by the increase, they were also happy to see unemployment staying below 4%. Experts are happy to call it a win following a long year of impressive resilience to the current financial problems hitting the states.

New Data Puts Fears to Bed

The increase in available jobs across the nation went against earlier fears, which foresaw a recession that may have drastically increased unemployment.

Yet, after the creation of 40,000 more jobs than economists initially expected, it appears things aren’t as bad as once thought (via Yahoo! Finance).

Small Wins Across the States

December brought with it small gains across the entirety of the nation, including an increase of 4.1% in hourly wages.

Private sector workers experienced a 0.4% increase in their earnings. The Christmas month also saw the continuation of unemployment remaining below 4%, resulting in the longest stretch since the ’60s.

Yale Scholar Shares Her Thoughts

As a research scholar at Yale Law School, Martha Gimbel spoke to The Hill about the end of the year. “Overall, solid headline numbers, but some of the dynamics under the hood are more worrying,” she said (via MSN).

According to her, downward regions of past job gains played a role in this. Economists initially estimated around 199,000 new jobs in October and 155,00 in November. Yet these figures were dropped to 173,00 and 105,000 respectively.

Year That Went Beyond Expectations

While President Biden has received criticism for the two-year inflation that’s swept the nation, others believe 2023 was an economic success.

Brendan Boyle, the House Budget Committee ranking member, told The Hill, “With a total of 2.7 million new jobs created, 2023 was a year that beat economic expectations by every metric.”

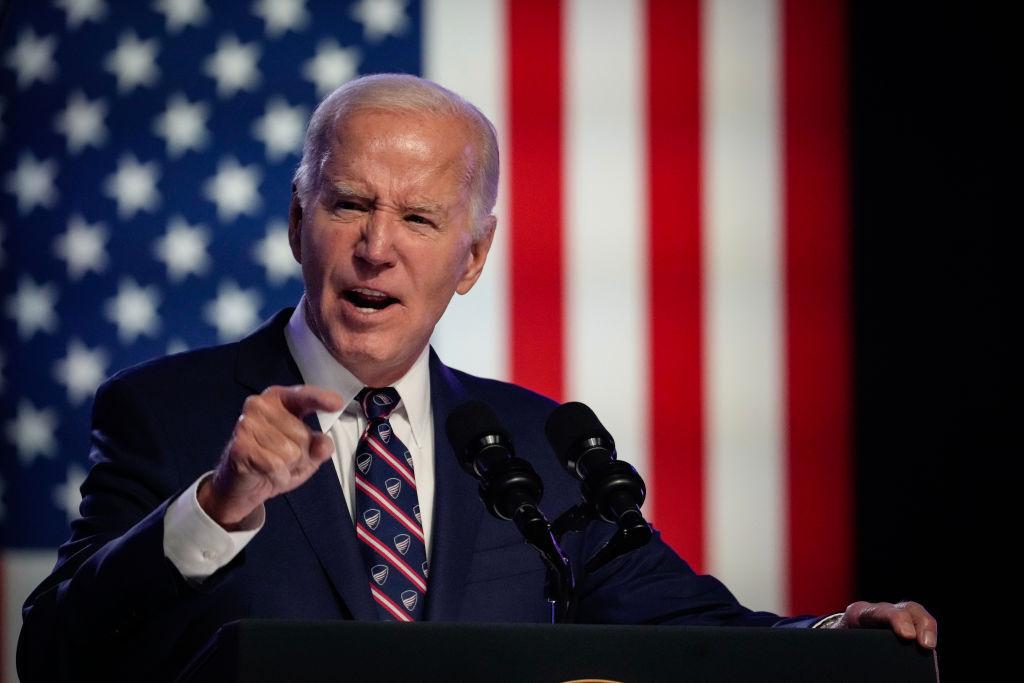

Biden Hopes Economic Gains Can Help with New Term

President Joe Biden will no doubt be hoping the recent job increase reports and the steady unemployment rate will work in his favor as he gears up to run for another term.

“Wages and consumer confidence are up, the economy is growing, and in 2024, President Biden and Democrats will keep working to lower costs and get working families more breathing room,” said Boyle.

Failing Economy Set to Hinder Biden’s Chances

Undoubtedly, voters will be impressed with the labor market under the Biden administration. However, persistent criticism centered on the economy’s performance under his watch may dent his chances of another term.

Nonetheless, the increasing number of available jobs will help the president as he attempts to win reelection this year.

Solid Labor Market

Eric Merlis, managing director of Global Markets, believes Biden could be in with a good chance based on the strong labor market.

“Coming off an extremely strong 2022, last year’s labor market was very solid overall, with continued employment advances across the board. The strength of the labor market has helped stave off the recession that was anticipated by most economists,” Merlis said (via MSN).

Fed Cut Now Less Likely

Eric Merlis explained that the proposed Federal Reserve interest cuts now seem less likely thanks to the strong labor market under Biden.

“Because of today’s strong jobs number, the Fed cut in March now seems less likely,” he said.

Likelihood of Premeptive Rate Cuts Reduced

Merlis is not alone in his opinion about the reduced chance of cuts. According to Andrew Patterson, a senior international economist from Vanguard, the recent labor market news has reduced the chance of preemptive cuts.

“Strong headline job growth and wage growth above 4% combined with Fed communications, including the minutes, emphasizing the need to remain higher for longer decrease the likelihood of preemptive rate cuts,” he said (via Yahoo! Finance).

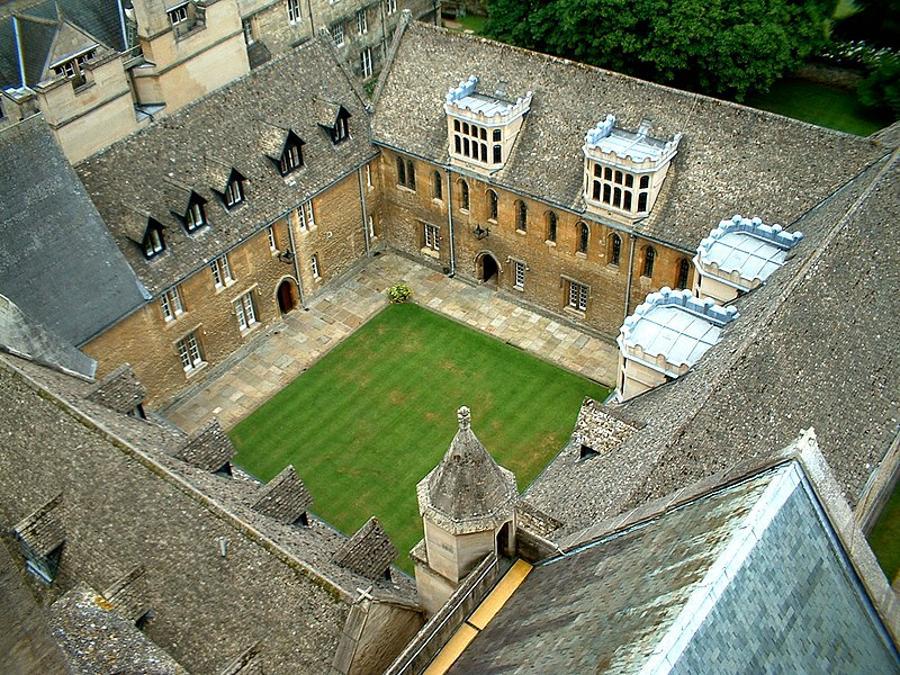

Oxford Economist Speaks on Situation

The leading U.S. economist at Oxford Economics, Nancy Vanden Houten, believes the Fed will begin to cut rates in May.

She told The Guardian, “There is a lot of noise in the data, but we continue to expect that there will be enough evidence of a further loosening in labor market conditions and a decline in inflation more broadly to allow the Fed to begin cutting rates in May.”