Peter Doelger, an 86-year-old former business magnate, faced a significant financial crisis, losing nearly his entire fortune.

Despite amassing wealth from a successful career, Doelger, who was suffering from dementia, entrusted JPMorgan with his finances. Once a prosperous businessman with opulent homes in Boston, Palm Beach, and Paris, the result of these investments was a loss of $50 million, forcing him to move in with relatives.

Investment Decisions Amidst Dementia

Despite his advancing dementia, Peter Doelger was treated by JPMorgan as a ‘sophisticated investor’, capable of making complex financial decisions.

This situation raises questions about the adequacy of investor classifications, particularly when clients are grappling with mental health issues.

The Cost of Trust: Fees and Declining Fortunes

Peter Doelger’s trust in JPMorgan resulted in the bank earning millions in fees and interest, while his own fortune dwindled. This situation is an example of the potential consequences when a client’s health issues are not adequately considered in financial dealings.

It highlights the delicate balance between client trust and the responsibilities of financial institutions in managing their client’s assets, especially in cases of health vulnerabilities.

From Wealth to Dependency

The journey of Peter Doelger from a wealthy investor to being financially dependent is not just a story of monetary loss but also highlights the struggles of aging and health deterioration.

His case is a stark reminder of how quickly circumstances can change, especially for those suffering from debilitating conditions like dementia.

Yoon Doelger’s Perspective

Yoon Doelger, Peter’s wife, speaking to Bloomberg said “We had 100 percent trust in them that they will manage our assets,’ she continues “We didn’t expect them to make us a fortune but at least make us comfortable.”

This aspect of the story emphasizes the difference between client expectations and the realities of high-stakes investment strategies.

The Doelger Legacy: From Success to Financial Ruin

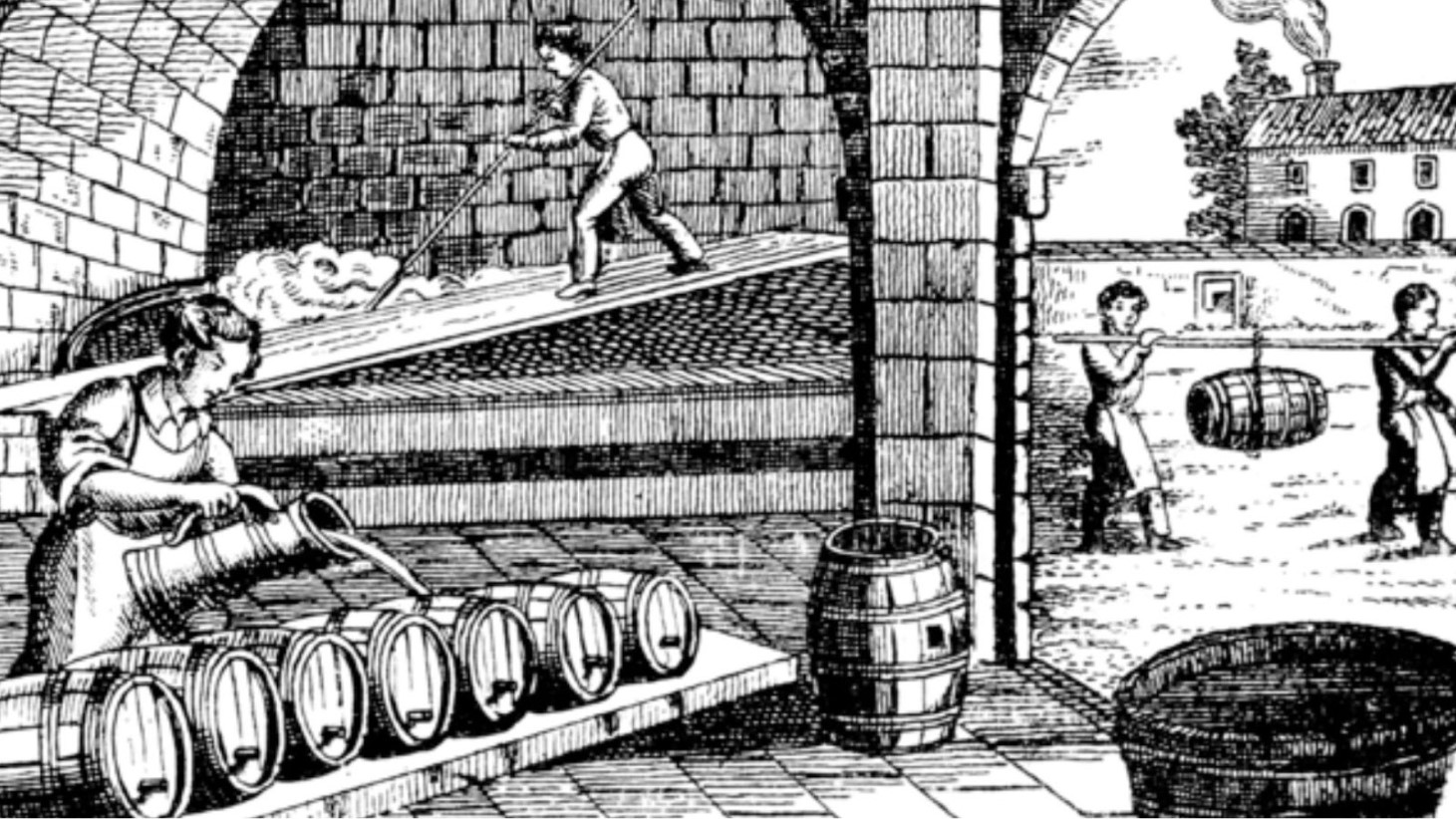

The Doelger family, with roots tracing back to a successful brewery business in the 19th century, faced a stark contrast in fortune with Peter Doelger’s financial decline.

This historical context adds depth to Peter Doelger’s story, showing how a family’s legacy of success can be dramatically altered across generations, particularly when new challenges like health issues intersect with financial management.

The Significance of the ‘Big Boy Letter’

The ‘big boy letter’ signed by Peter Doelger marked a critical point in his relationship with JPMorgan. It was intended to signify his understanding and acceptance of the risks associated with his investments.

This development is crucial in understanding the legal and ethical implications of such agreements, particularly when signed by individuals who may not fully comprehend their consequences due to health issues.

Health and Wealth: A Dual Decline

Peter Doelger’s story is marked by a simultaneous decline in both health and wealth.

His journey from a successful businessman to a person with dementia and significant financial losses exemplifies the intertwined nature of health and financial stability.

Doelger’s Losses During COVID-19

The COVID-19 pandemic’s impact on the global economy had a direct effect on Peter Doelger’s already declining financial situation.

The pandemic exacerbated his investment losses, demonstrating how global economic crises can have profound personal impacts, especially on individuals already facing financial challenges.

The Legal Battle: Seeking Accountability

The Doelger family, led by Peter’s wife and son-in-law attorney, initiated a legal battle against JPMorgan.

This legal fight represents their effort to seek accountability and justice for the financial losses incurred.

JPMorgan’s Defense: A Question of Responsibility

In response to the lawsuit, JPMorgan has claimed that it is not at fault, arguing that Peter Doelger was informed of and understood the risks involved in his investments.

This defense raises important questions about the extent of a financial institution’s responsibility towards its clients, especially in cases where the client’s ability to make informed decisions may be compromised.

Implications for Financial Industry

The case of Peter Doelger has sparked discussions on the need for reform in the financial industry, particularly concerning the protection of vulnerable investors.

Advocates for change are calling for financial institutions to bear greater responsibility in identifying and responding to signs of cognitive decline in their clients.