From Applebee’s having to close dozens of locations this year to Red Lobster declaring bankruptcy — big American chain restaurants are floundering under inflation and declining foot traffic since the Coronavirus pandemic, says “Shark Tank” star Kevin O’Leary.

He wrote in a column for the Daily Mail that “the U.S. restaurant industry finds itself on the menu.”

Not Fully Recovered

O’Leary went on to state, “Seemingly every day, there’s a headline announcing a bankruptcy, layoff or store closure impacting one of the country’s most beloved brands.”

He asserts that many restaurants have not fully recovered from the pandemic’s effects, including the fact that customers are much more comfortable ordering meals to be delivered to their homes.

“No Longer Receiving Footfall”

Additionally, fewer people are having lunch with coworkers as a result of the shift to remote or hybrid employment.

O’Leary said, “This has been devastating to businesses that invested in brick-and-mortar locations. Eateries in urban locations have been hit especially hard as their expensive locations are no longer receiving the footfall they need to meet rent.”

Supply Chain Issues

The rise in food prices has been attributed to lingering supply chain issues as a result of the pandemic according to O’Leary.

As per the U.S. Department of Agriculture (USDA), from 2019 to 2023, the all-food Consumer Price Index increased by 25% — higher than other significant categories, including housing and medical care.

Avian Flu and Ukraine

Supply chain problems added to the inflation in food costs in 2020-21, the USDA says, while an avian flu outbreak and the war in Ukraine further increased prices in 2022.

O’Leary adds that inflation is driving many customers to tighten their wallets and pull back on optional spending during a difficult economic climate.

“A Luxury That Many Can’t Afford”

O’Leary stated, “In this economy, an ‘upscale McDonald’s’ is a luxury that many can’t afford.”

He says that while some restaurants have had to cut back or even go bankrupt, others are moving to locations with less expensive rents or becoming commercial kitchens that only provide takeout options with no in-store dining.

$5 Meal Deals

In an effort to attract customers, other chains, such as McDonald’s and Starbucks, chose to offer $5 meal deals to customers.

In any case, financial experts say this pullback on spending could be something to be thankful for — at least for the Americans who are tightening their budgets and making smarter spending decisions.

“Reprioritize Their Cash Flow”

Andrew Herzog, a certified financial planner and associate wealth manager at the Watchman Group in Texas, reported to MarketWatch, “Americans need to reprioritize their cash flow in difficult times.”

However, he doesn’t think that it will be the end for industry giants, though the future for smaller brands is unclear, “McDonald’s and Starbucks will survive.”

Downsizing

Brands like Boston Market and other smaller chain restaurants have had to considerably downsize over the past few decades, unable to keep up with consumer demands.

O’Leary goes on to say, “The once-booming chain Boston Market, which boasted 1,200 locations in the 1990s, is now reportedly down to two dozen.”

Rising Costs

The impact of inflation has led to supply costs skyrocketing with no signs of them going down, particularly essential ingredients that customers wouldn’t be happy to go without.

O’Leary states, “Food costs – especially for proteins like chicken, beef and seafood – are up 30 to 40 percent over the last 36 months.”

Lack of Customers

Following the Covid-19 pandemic a significant portion of the American workforce still hasn’t returned to the office.

It’s estimated by Pew Research Center that roughly 22 million employed adults, which amounts to 14% of the workforce have not returned to the office which could be having an impact on the footfall that fast food chains are missing.

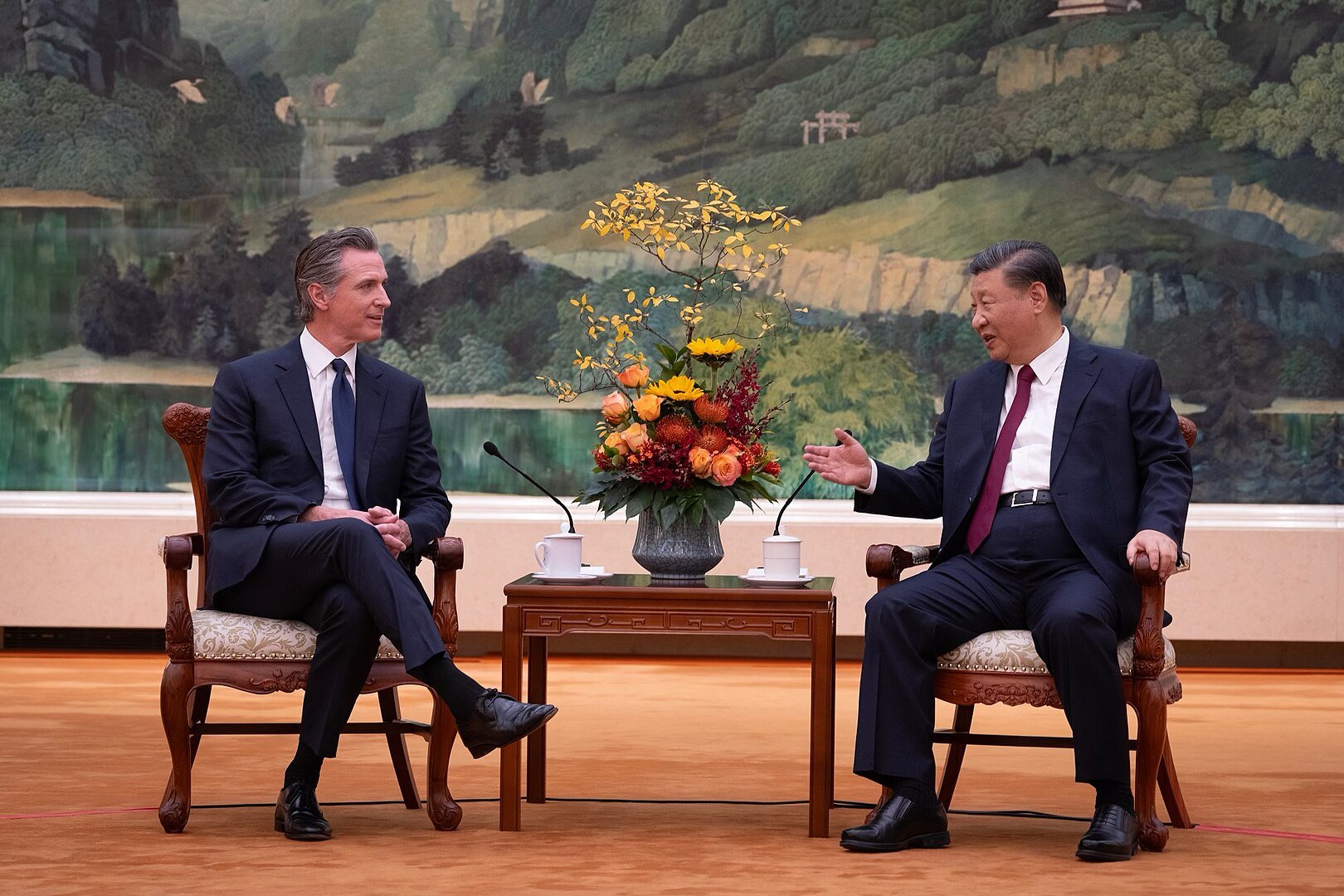

California Impact

The impact has been felt strongly in California where Governor Gavin Newsom has raised the wages for fast-food workers to $20 in a move which has drawn criticism from the industry.

One California trade group has estimated that approximately 10,000 workers were fired before the law was even in effect on April 1.

Elsewhere franchisees publicly debated replacing workers with digital order-taking kiosks.