A Los Angeles restaurant has made headlines due to a unique billing approach: a 4% surcharge on every bill.

The primary purpose? To cover health insurance for their staff. This decision has stirred a variety of reactions from the public, prompting discussions about the current state of healthcare funding in the service sector.

Online Reactions Emerge

Social media platforms like X (formerly Twitter) and Reddit have been abuzz about the 4% surcharge.

Some users found the charge questionable, and one particular comment on Reddit read, “This is absurd.” The online community is divided, with many wondering if this is the right way to address employee benefits.

Calls for Transparent Pricing

Instead of a distinct surcharge, why not increase menu prices by 4%? This question emerged frequently.

Many individuals believe that presenting such a cost separately could be a strategic move by the restaurant to make a statement or even potentially mislead customers regarding pricing.

The Prevalence of Surcharges

The concept of restaurant surcharges isn’t novel. A study by the American Restaurant Association reported that 15% of restaurant operators contemplated adding fees to combat increasing operational costs.

These charges vary widely, addressing everything from general services to more surprising ones like tap water.

The Restaurant’s Statement

Addressing the growing controversy, restaurant owner Zach Pollack took to Instagram. He stressed that his business wasn’t pioneering this approach.

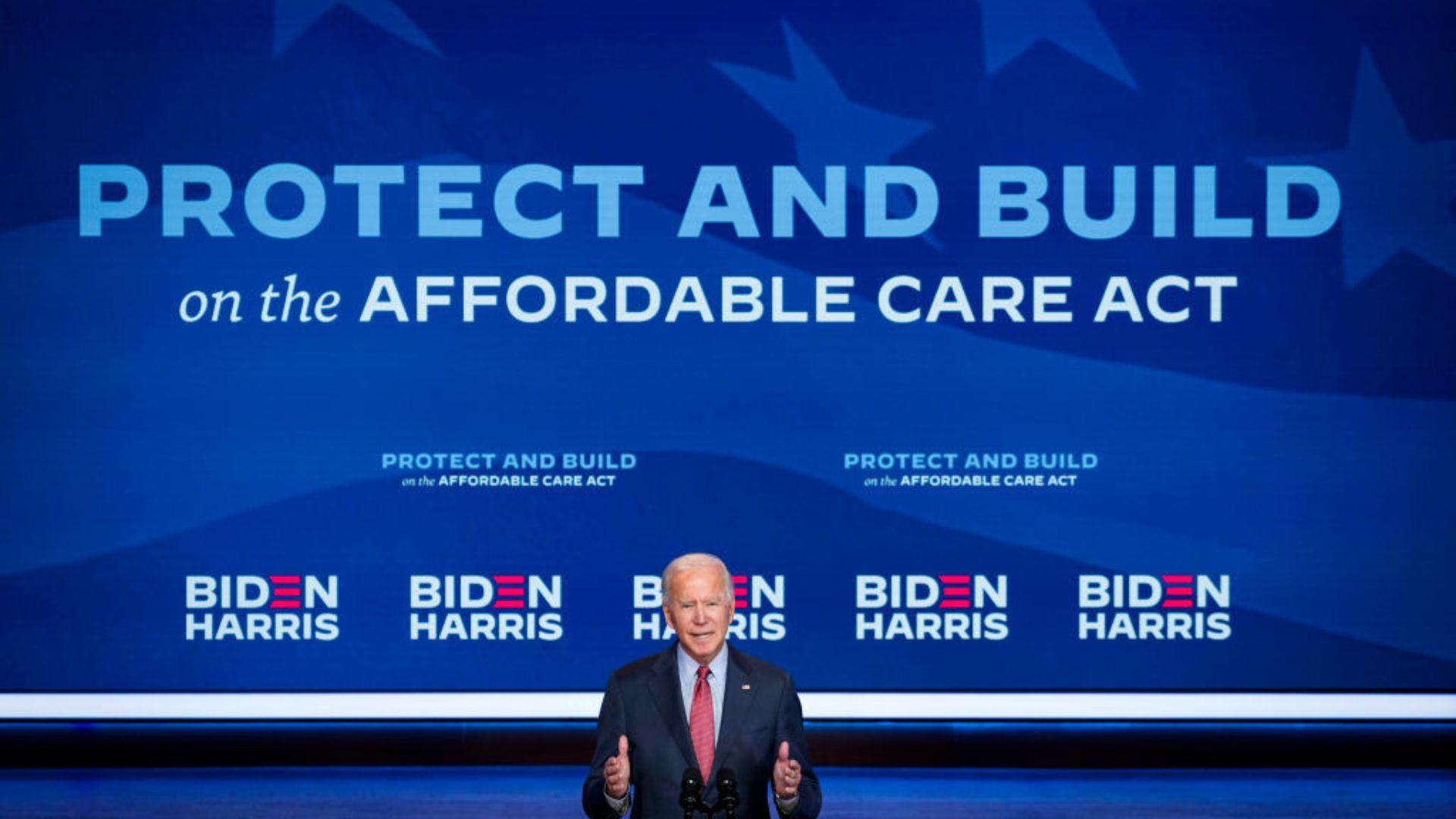

Many restaurants, he noted, have implemented similar charges, primarily due to the regulations and financial pressures introduced by the Affordable Care Act.

Impact of ACA on Businesses

The Affordable Care Act’s provisions state that any business employing over 50 full-time workers must offer them essential health coverage.

However, navigating these regulations often comes at a steep price. Consequently, businesses are left searching for strategies to offset the mounting costs.

The Growing Burden of Healthcare

The Bureau of Labor Statistics paints a stark picture: U.S. households, on average, dedicate a significant 8% of their annual income to health care.

Given the heavy financial strain imposed by healthcare, individuals and families nationwide are in a continuous quest to manage and mitigate these ever-growing costs.

The Role of Health Savings Accounts

Amidst rising costs, the Health Savings Account (HSA) offers a beacon of hope. Paired with high-deductible health insurance plans, an HSA allows individuals to allocate tax-free funds.

This money can be invested and later utilized for a variety of medical expenses, providing some financial relief.

The Value of Regular Insurance Shopping

Health insurance is no different from other services; there’s value in comparative shopping. Those who hold private health insurance policies are encouraged to periodically seek cost-effective alternatives.

They might discover plans that offer either a more affordable rate or additional benefits for the same price.

Healthy Lifestyle Choices and Cost Savings

Prioritizing one’s health has multiple benefits. Beyond the evident advantages for personal well-being, healthy living can also significantly reduce potential medical expenditures.

Consistent exercise and a nutrient-rich diet can lessen the probability of costly health complications in the future.

Regular Health Check-ups

Leveraging the full potential of one’s health insurance and ensuring consistent medical check-ups is of paramount importance.

By addressing potential health concerns at an early stage, individuals can effectively reduce the risk of sudden and costly medical interventions in the future.

Addressing Health Costs in Service Industries

The evolving landscape of healthcare funding presents challenges for businesses and individuals alike.

The decisions made by businesses, such as the restaurant’s surcharge, showcases the pressing need for comprehensive solutions. As costs rise, informed and proactive approaches to healthcare become increasingly crucial.