Hospital chain Steward Health Care, entangled in a tight spot with Medical Properties Trust, is now officially filing for bankruptcy protection.

As the largest physician-owned system in the U.S., Steward is scrambling to secure a hefty $75 million in initial funding, with a potential extra $225 million on the line if they meet certain conditions.

Financial Struggles Lead to Hospital Closures

The Dallas-based giant isn’t just grappling with bankruptcy; it’s also been shutting down hospitals left and right due to a severe cash crunch.

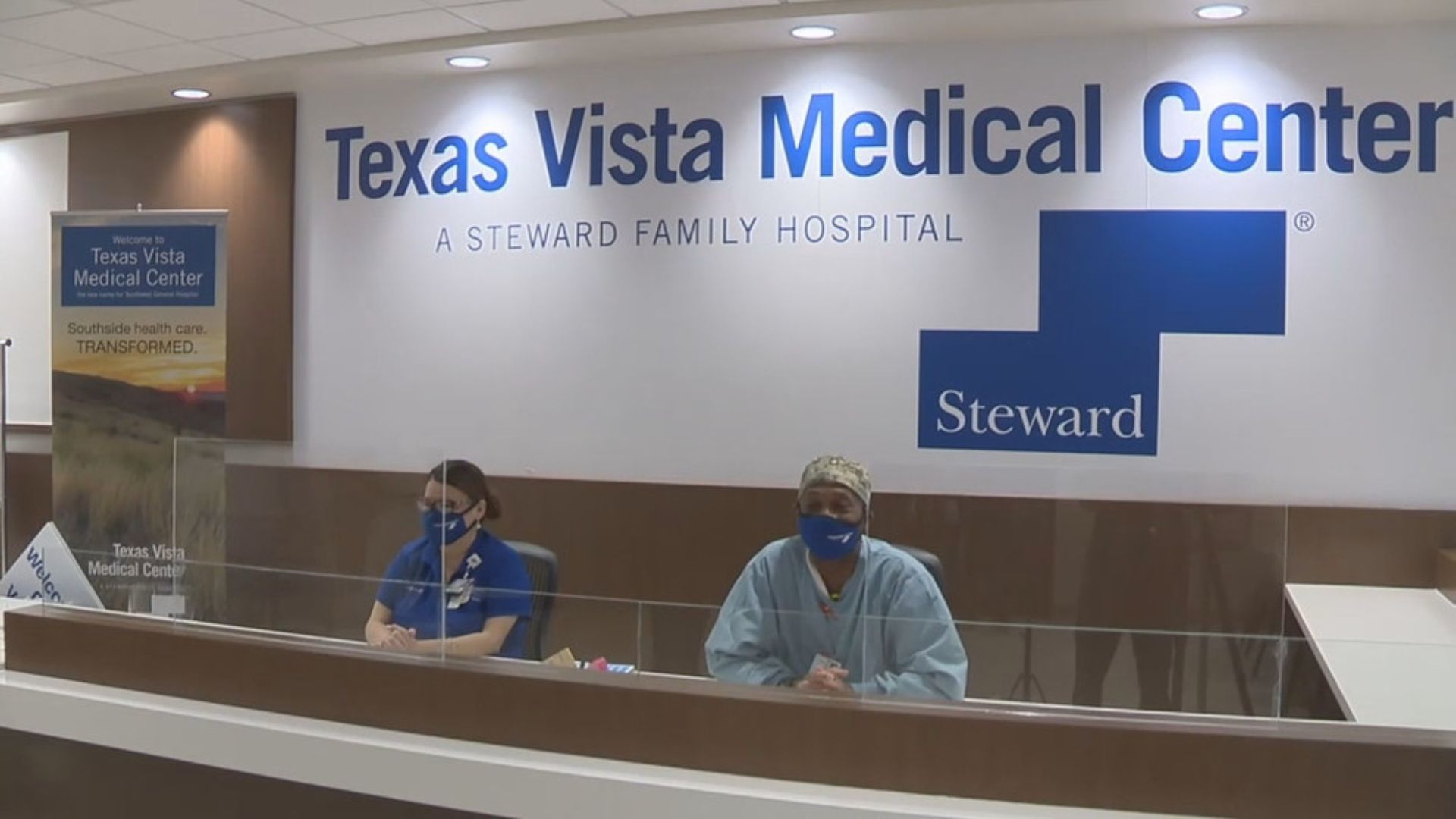

Notably, a key facility in San Antonio was closed last year amidst a flurry of lawsuits from unpaid vendors. This left a whopping half-million people with only one hospital to turn to.

Unpaid Bills and Unusual Circumstances

Some of Steward’s hospitals have been dealing with extreme situations due to financial instability.

The Wall Street Journal reports that unpaid vendors led to one hospital in Florida becoming infested with bats, and another had garbage collection services discontinued, which resulted in trash accumulation and subsequent state health department warnings.

Lease Agreements and Financial Pressure

Criticism has been directed towards Steward’s financial management, particularly its dealings with Medical Properties Trust.

The relationship has involved purchasing hospital buildings from Steward and leasing them back, a strategy that has reportedly placed additional financial burdens on the hospital system.

The Weight of Debt

Steward’s financial saga includes staggering losses exceeding $800 million between 2017 and 2020.

The pandemic only worsened their plight, hiking nurse labor costs and delaying profit-heavy elective surgeries. Now, their financial instability threatens the care of 2.2 million patients annually.

Senators Step In

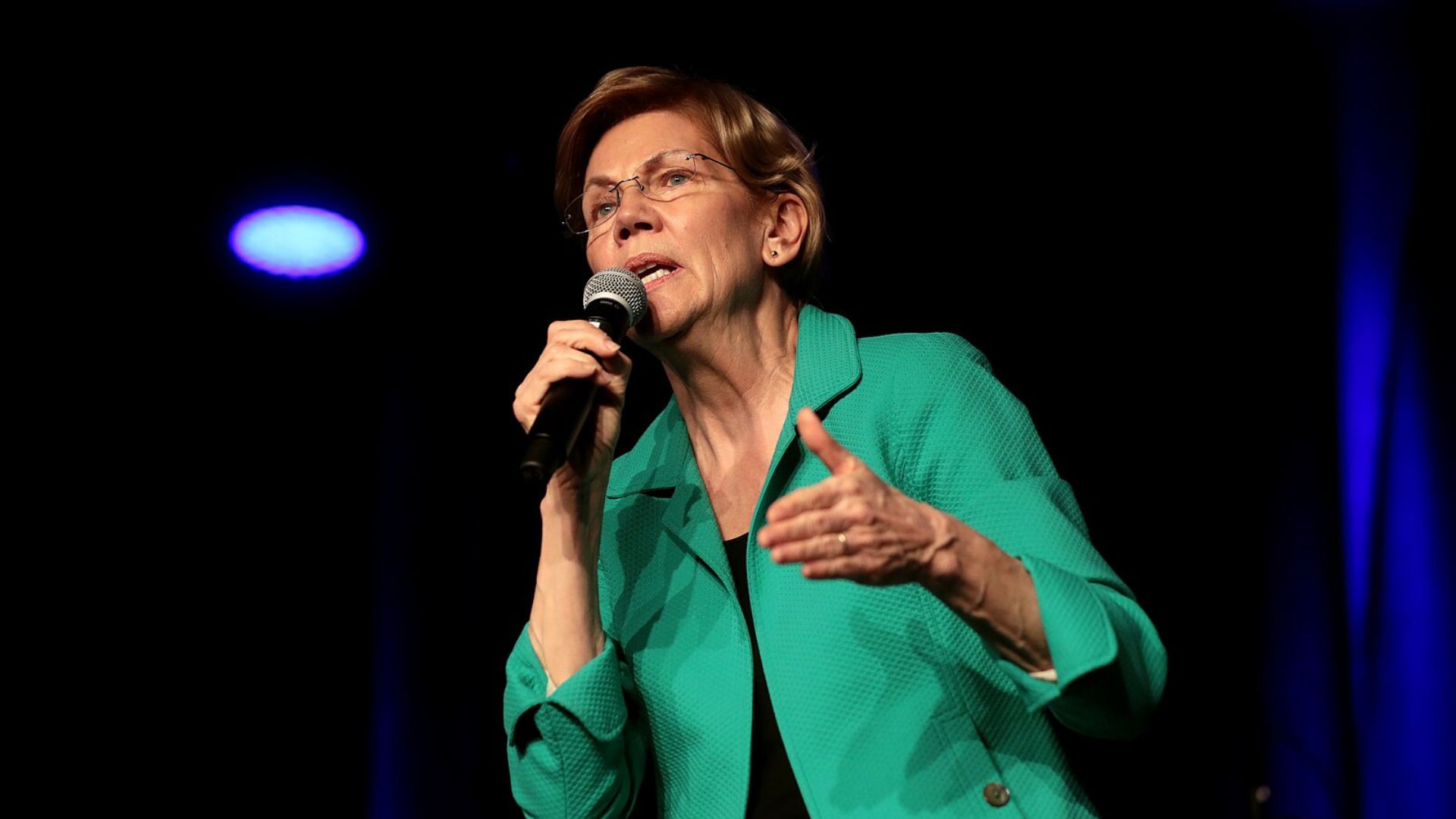

The situation has caught the attention of U.S. Senators Elizabeth Warren and Edward Markey, who accuse MPT of pushing Steward towards financial disaster with burdensome lease payments.

Their concern illustrates the gravity of Steward’s predicament as it struggles under the weight of its financial obligations.

A Glimmer of Hope?

In January, Medical Properties Trust disclosed that it was “working with Steward to develop a plan to strengthen Steward’s liquidity and restore its balance sheet, optimize MPT’s ability to recover unpaid rent, and ultimately reduce MPT’s exposure to Steward.”

This plan is crucial for the future stability of both Steward and MPT.

The Bigger Picture

Steward isn’t just a small piece of MPT’s portfolio; it represents a significant chunk, approximately 19%, or $3.5 billion of MPT’s assets.

Last year, MPT had to write down $714 million due to Steward’s declining fortunes, a hefty price that highlights the scale of Steward’s troubles.

Financial Support to Other Tenants

Besides Steward, Medical Properties Trust has extended financial support to other struggling entities such as Prospect Medical Holdings in Los Angeles.

This pattern of support showcases MPT’s role in stabilizing its tenants during financial hardships.

What’s Next for Steward?

As Steward finalizes its debtor-in-possession financing and navigates bankruptcy proceedings, the healthcare community watches closely.

The outcome will not only affect Steward’s future but also the broader healthcare landscape, particularly in communities already impacted by hospital closures.

Community Consequences

The closure of Steward-operated hospitals has left gaping holes in healthcare access, especially in areas like San Antonio and Massachusetts.

The impact of these closures goes beyond the financial sheets, affecting the health and well-being of millions.

Looking Ahead

With critical funding in the pipeline and strategic plans unfolding, the next chapters in Steward’s story will be crucial.

How they tackle their massive financial challenges—and the effectiveness of MPT’s support—will likely influence the future of healthcare provision in their communities.

Broader Impact on Healthcare Delivery

The bankruptcy and potential sale of Steward Health Care’s hospitals pose significant implications for healthcare delivery, particularly in Massachusetts, where it operates a substantial network.

The disruption could lead to longer wait times and reduced access to specialized care. This transition might compel neighboring hospitals to absorb an unexpected influx of patients, challenging their capacity and resources.

Potential Buyers and Their Influence

Entities likely to purchase Steward’s hospitals could range from other large healthcare systems to private equity firms. Each type of buyer would bring different priorities, potentially reshaping the mission and operational strategies of the hospitals involved.

This shift could either enhance the quality of healthcare provided or prioritize financial efficiencies over patient care.

The Role of Real Estate in Healthcare Economics

Steward’s relationship with Medical Properties Trust highlights a critical aspect of modern healthcare economics: the impact of real estate ownership.

Leasing back properties can burden hospital operations with significant financial overheads, influencing everything from staffing levels to patient care quality. This arrangement often shifts financial risks onto the healthcare providers.

Future of Employee Relations and Job Security

The uncertainty surrounding Steward Health Care’s bankruptcy could lead to significant anxiety among its workforce. Job security and employee morale are at risk, potentially affecting patient care.

How Steward manages its workforce during this restructuring will be crucial for maintaining operational stability and ensuring continuous care delivery.

Impact on Community Health Services

Potential hospital closures would be detrimental to community health services, especially in less-served areas. These communities might face increased health disparities as a result.

The ongoing healthcare crisis could lead to higher emergency room visits and worse health outcomes in communities that lose access to regular and specialized medical services.

Legal and Regulatory Repercussions

Given its debt, Steward’s bankruptcy proceedings will likely draw significant legal and regulatory attention. These could involve scrutiny of the sales processes and the impacts on community healthcare commitments.

Massachusetts officials are keen on ensuring transparency and adherence to healthcare regulations to protect community interests.

Other Healthcare Bankruptcies

Steward Health Care is not the first healthcare provider to file for bankruptcy, and it certainly won’t be the last.

In recent years, large hospital systems like Hahnemann University Hospital in Philadelphia and Verity Health System in California have also faced financial struggles leading to closures or significant downsizing of services.

Technological Investments and Healthcare Innovation

Financial distress might constrain Steward’s ability to invest in emerging medical technologies and innovations.

This limitation could hinder their competitiveness and ability to provide high-quality, modern healthcare, potentially leading to a decline in patient outcomes and satisfaction as resources become stretched.

Mental Health and Public Stress

The financial instability of a major healthcare provider like Steward Health Care not only disrupts physical health services but also impacts community mental health.

Uncertainty about hospital closures and healthcare availability can increase public stress and anxiety, further straining mental health resources.

Strategies for Financial Recovery

To navigate its financial crisis, Steward might consider strategies such as restructuring debt, optimizing operational efficiencies, or divesting non-core assets.

Engaging in strategic partnerships or alliances could also provide the necessary support to stabilize finances and ensure continued service provision.

The Future of Steward Health Care

The future of Steward Health Care will likely involve significant restructuring, with possible changes in ownership and operational strategies.

The outcome of these changes will ultimately shape the company’s ability to serve its communities and fulfill its healthcare mission. Stakeholders are closely monitoring these developments, understanding their potential long-term impact on healthcare provision and community health.

Adapting to Community Needs in Transition

Effective communication and collaboration with local health officials and community leaders will be essential during this time. By understanding and responding to community concerns, Steward can help ensure that essential healthcare services remain accessible and responsive during this period of uncertainty and change.

This approach will not only support public health but also potentially build back trust and goodwill that could be pivotal in stabilizing the organization post-bankruptcy.