“Shark Tank” star Mark Cuban is promising to put his money where his mouth is when it comes to promoting workplace diversity. In a reply on the social media platform X, he said he would compete against or short the stocks of firms that do not value diversity in their workplace and hiring.

Cuban is an outspoken advocate of diversity, equity, and inclusion in business. In his own business, he insists that he never hires on the basis of race, gender, or religion.

Cuban’s Controversial X Post

A back and forth between Mark Cuban and several users on X culminated with a response by Cuban where he declared he wanted to short and compete against negative diversity companies.

“I’m not telling anyone how to run their business. I’m telling you what I think is good for business. But if you find the companies who think diversity is a negative, let me know. I want to short them or compete against them,” he said on X.

What is Shorting?

In the world of business and stocks, shorting is the practice of betting against the price of a stock, hoping to make money while the price falls.

How it works is that the shorter borrows stocks from a stockholder, who immediately sells them at a high price. After the price falls, the borrower buys the stocks back at a lower price, returning the borrowed stocks to the stockholder and keeping the difference in profit.

Why is Shorting Seen as Bad?

Since the process of shorting relies on the falling price of a stock, shorters are often seen as contributing to and instigating the failure of companies. If enough people short a stock at once, the company’s failure can be a self-fulfilling prophecy.

People have criticized shorting for creating an artificial market because borrowing increases the number of shares being traded above the shares normally issued. It is also seen as bad because it is essentially selling something someone doesn’t own.

Is Short Selling Illegal?

No, short selling is currently legal; however, some wish it would be banned. One form of short selling, known as “naked short selling,” can be illegal in some circumstances.

Naked short selling is when a person sells shares of a security that does not exist. It is different from regular short selling because the short seller is not borrowing an already existing stock from someone else.

Shorting Has a Purpose in the Market

While stock traders betting on securities and firms to fail with stocks they don’t even own leaves a bad taste in some people’s mouths, it has a legitimate purpose in the market. Short sellers are an important check against overvalued stocks in the market.

Without short sellers risking capital for a possible reward, inflated stocks could cause instability in the stock market, leading to an eventual bubble burst or market crash.

How Shorting Has Been Used in a Bad Way

In 2021, a small group of commercial-level stock traders on Reddit upset the market of short sellers as an act of revenge. These stock traders organized to find out which stocks were being shorted and coordinated their purchases to force short sellers to lose money. They did this by propping up the stock prices of beloved companies like GameStop and AMC, who were suffering under a “short squeeze.”

Grassroot stock investors view shorting as an evil way that large firms actively try to tank beloved businesses many people like just to make a quick buck.

SEC’s New Rules on Shorting

After the Redditors on r/wallstreetbets made a splash in 2021, the Security Exchange Commission (SEC) worked to institute new rules to address concerns in the market. The SEC is the government agency that oversees stock trades and investment funds.

In 2023, the SEC instituted Rule 13f-2, which requires large investment firms to report their short positions and create more transparency in the market (via The Street).

Controversy around DEI

Cuban’s X post is the latest contributor to the conversation around diversity, equity, and inclusion (DEI). Advocates of DEI look at the lack of diversity in major companies and at the top levels of society and want to force these companies to change their hiring practices.

Opponents of DEI view the practice as anti-meritocratic and discriminatory against qualified candidates. Opponents of DEI prefer companies to take a colorblind approach to hiring employees.

Cuban on Diversity

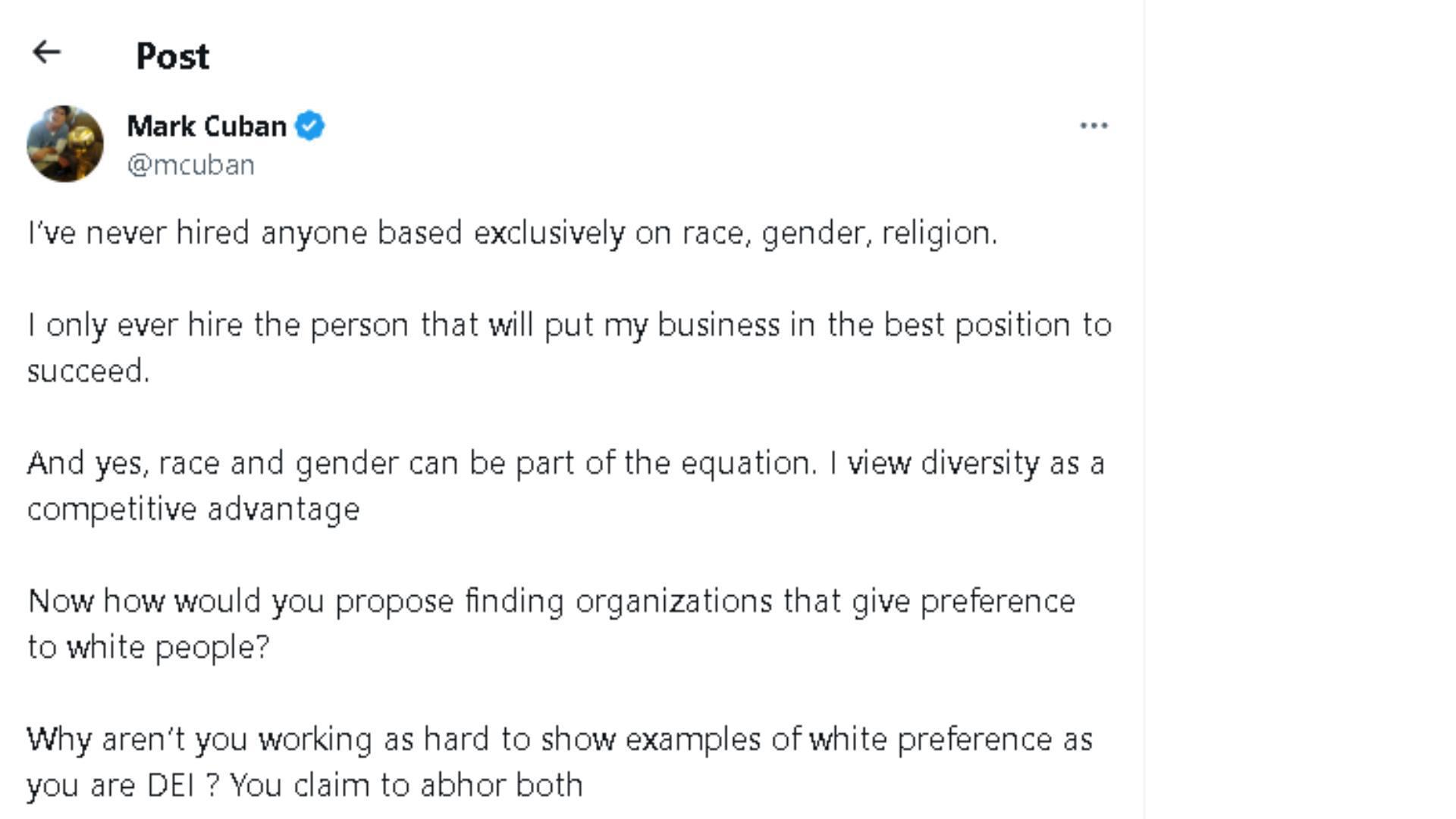

In an X post above his short-selling threat, Cuban outlined his position on diversity in his own workplace.

“I’ve never hired anyone based exclusively on race, gender, religion. I only ever hire the person who will put my business in the best position to succeed. And yes, race and gender can be part of the equation. I view diversity as a competitive advantage,” he said on X.

Arguments for DEI

Proponents of DEI say that when companies have a diverse staff, the business benefits greatly. Diverse thinking can contribute creative, new ideas that can change things up.

Activists for DEI also promote inclusion training as part of the process, which helps employees of all backgrounds feel comfortable working side-by-side. Unlike a colorblind approach, DEI tries to foster differences among employees and celebrate them.

The Conversation Going Forward

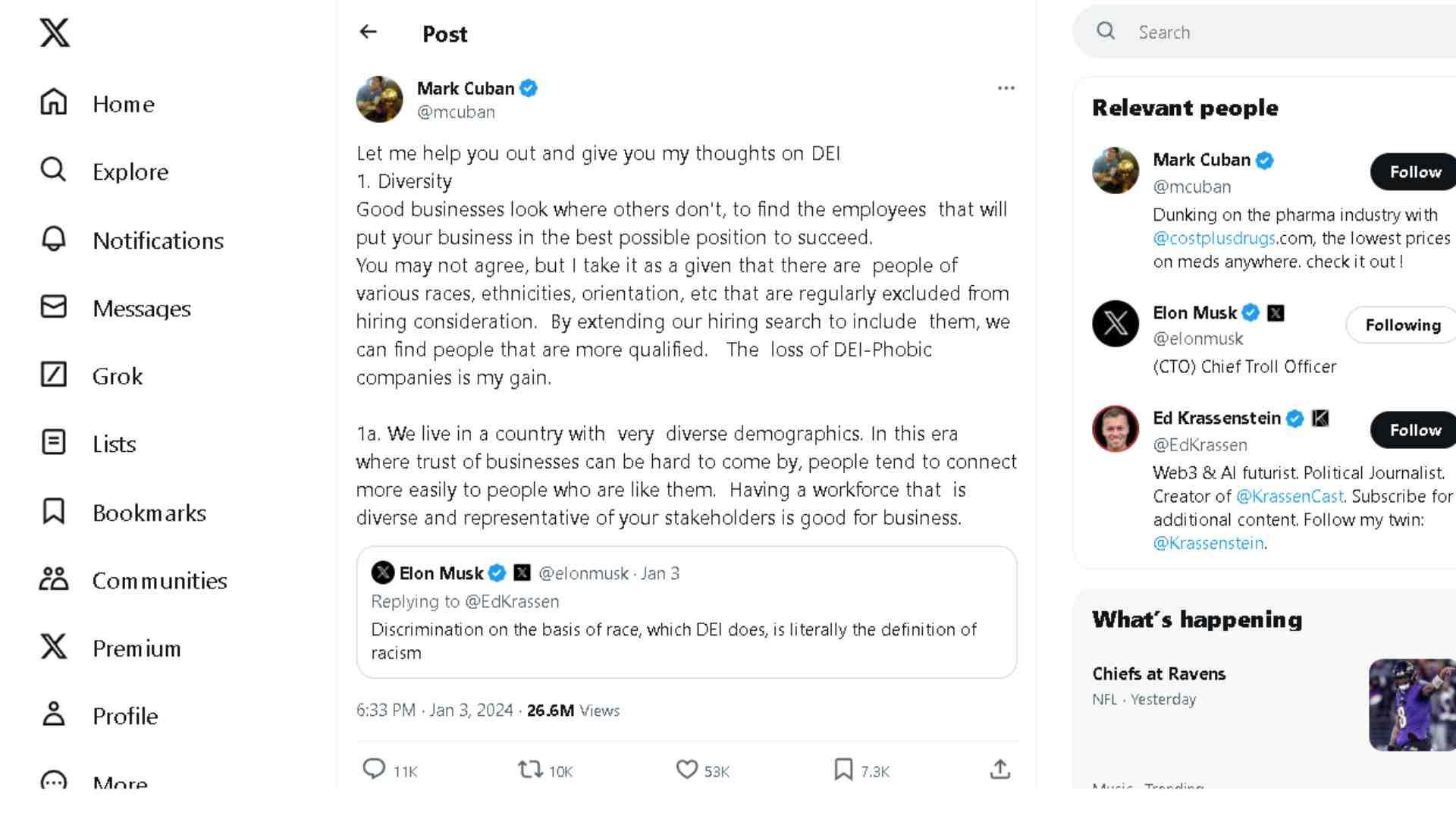

The argument around DEI in America’s businesses continues to rage on, with both sides divided on how to address the problems that DEI highlights. Fights on the social media platform X have become more frequent, with large figures like Mark Cuban and X CEO Elon Musk going to battle with each other.

In January, Cuban and Musk sparred over the idea that DEI is actually racist despite purporting to be addressing racism on X.