McDonald’s franchisee owner Scott Rodrick gave a recent interview with Fox Business describing the difficulty he is having adjusting to California’s new minimum wage increase for fast-food workers. This wage increase requires them to be paid $20 per hour.

The law applies only to chains with establishments of more than 60 locations in the hopes of targeting big corporations. However, franchisee owners of store locations are often small business owners themselves and are struggling to keep things running amid soaring costs.

An Eternity

The minimum wage hike to $20 per hour has only been in effect since April 1, but Rodrick told Fox Business it feels like an eternity.

“The last 12 days since this unprecedented law impacted franchisees in California has literally been a whirlwind, frankly it feels like an eternity,” Rodrick said.

Can’t They Just Raise Prices?

Supporters of the minimum wage increase argue that these owners should easily be able to raise prices to pay for the employee raises, but franchisee owners like Rodrick explain it’s not that easy.

“I realized that my customers’ appetite for higher prices is not unlimited. So when I take price to relieve margin pressure, it has to be done thoughtfully with a plan. Charging $10 for an Egg McMuffin or $20 for a Big Mac, for me, is a nonstarter,” said Rodrick.

Trying to Survive

Rodrick, who runs 18 McDonald’s locations in California, was asked about what price the menu item prices would have to increase to fully pay for the wage hike.

Rodrick said in response to the question was price was just “one lever” business owners have. “I have to grow revenue and reduce the cost of my PNL to survive,” he told Fox Business. “This is my family’s 50th year in the McDonald’s business, and I plan on fighting and surviving for another 50 years.”

Combination of Strategies

In the interview, Rodrick emphasized that the solution to figuring out the franchise business model in California will come down to a combination of different strategies, all of which need careful tinkering.

Rodrick said he is looking at strategies around adjusting prices, optimizing labor, re-evaluating capital expenditures, and figuring out ways to increase market share.

Possibility of Layoffs

Interviewer Stuart Varney asked Rodrick about the possibility of layoffs to pay for the wage increase but Rodrick wanted that option to be a last resort.

“There’s a lot of discussion on that subject on restaurants closing, restaurants laying people off. Frankly, in my organization, that’s the very last thing I’m looking at,” he said. “I have 800 people — 800 human beings that run my restaurants, so that’s the last lever that I’m looking at.”

McDonald’s Meeting

In a McDonald’s conference earnings call, the company’s leaders talked about the struggles around affordability. CFO Ian Borden emphasized that pricing decisions at restaurants will need to be “consumer-led.”

CEO Chris Kempczinski said: “I think what you’re going to see as you head into 2024 is probably more attention to what I would describe as affordability.”

Policy Woes

This wage increase is just the latest example of a series of policy decisions that have business owners fearing the future of the state’s economy.

California also has the country’s top marginal income tax rate and recently progressive Democrats have tried to push a wealth tax that opponents say would have been a job killer.

5th Largest Economy

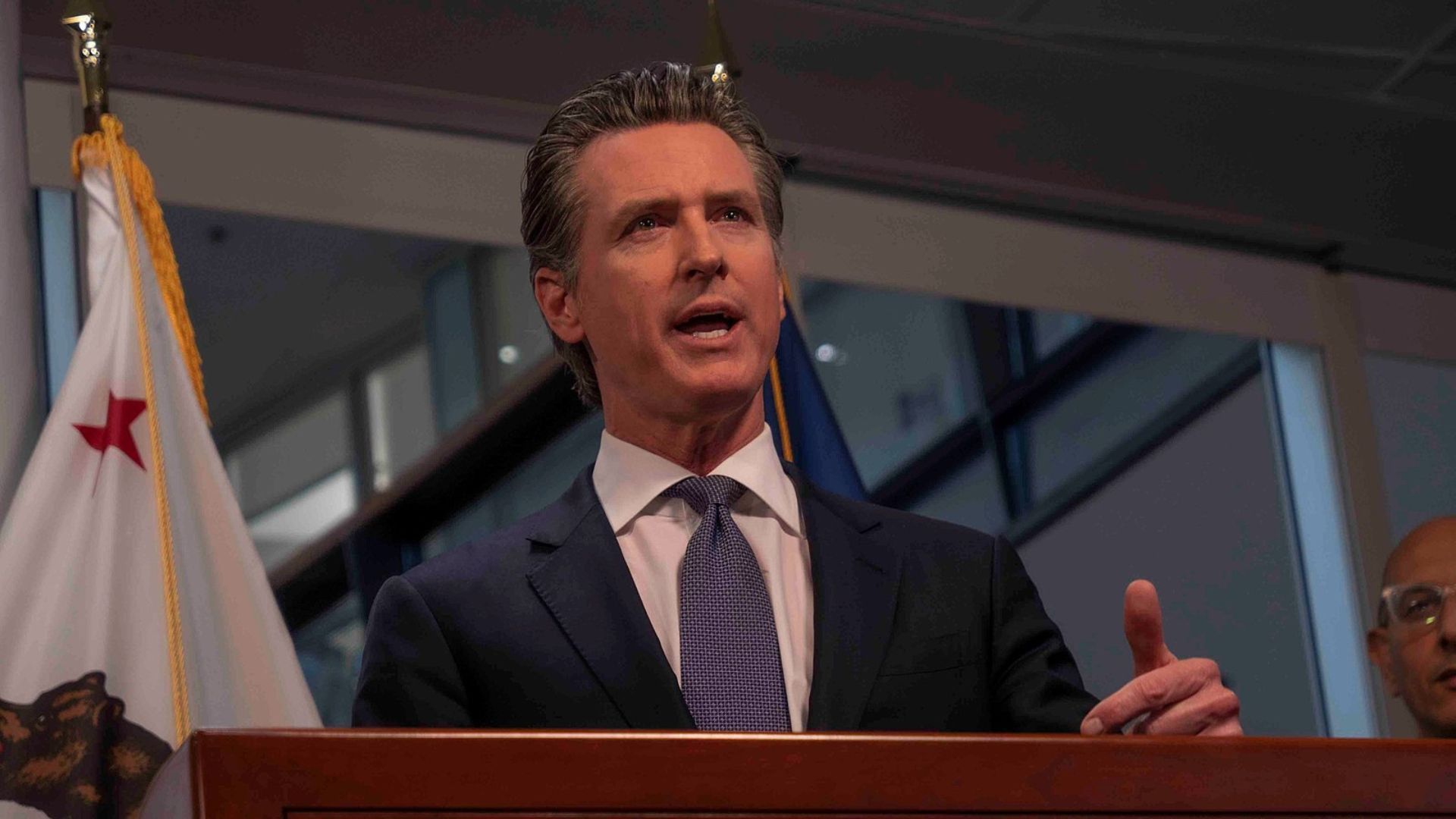

In 2022, California had the fifth-largest economy in the world and was on track to become the fourth-largest. That year Governor Gavin Newsom boasted about the state’s budget $97 billion surplus.

Fast-forward to today and the state is projected to have a budget deficit of at least $31 billion. Its newest sweeping minimum wage increase is generating headlines of beloved locations of people’s favorite stores like Fosters Freeze closing. Recent economic fumbles by the state’s progressive policies have some reconsidering California’s previous reputation as the state that creates millionaires.

No Longer Booming

California’s once fast-growing economy fueled by agriculture and a successful tech sector has now hit several roadblocks that have economists worried.

A marked rise in unemployment and the growing deficit combined with more people migrating out of the state is responsible for a government revenue shortfall that has lawmakers scrambling to come up with a budget for.

Economy Struggling

A report by the California Center for Jobs and the Economy found that the state’s economy may actually drop from its five-largest economy ranking down to sixth.

The state’s GDP growth was 32nd in the nation during 2023 from a host of factors. High gas prices and unaffordable housing combined with the highest unemployment rate in the country are all bad signs for its economic future.

How Did We Get Here?

It’s hard to place the blame solely on one person, policy, or set of circumstances, but it’s clear to many California residents that something has gone wrong. Polling in recent months has shown that the economy and the budget deficit rank among California voters’ top issues.

Some have pointed out that the contrast between thriving states like Texas and the recently struggling California comes down to a difference in government policy. California spends much more funding its government programs than Texas does while Texas has become the nation’s fastest-growing state economy.