There is an ongoing debate as to whether the younger generations, such as Millennials, are experiencing a much more challenging economic climate than their parents, or if they simply aren’t making good financial decisions.

And this week, “Shark Tank” host and expert investor Kevin O’Leary weighed in on the subject, saying that Millennials, not the economy, are the problem.

What Did Kevin O’Leary Say About Millennials?

In an interview with Fox News, Kevin O’Leary spent the first few minutes discussing the stock market, China, cryptocurrencies, and various other statistics about the state of the current economy.

But at the end of the interview, a Fox reporter told O’Leary that Millennials reportedly want over half a million dollars per year to be happy, to which O’Leary responded, “Wake up and smell the roses, everybody. Are you kidding? Now get back to work … and stop whining about it.”

The Study O’Leary Is Talking About

The study that O’Leary and his interviewer were discussing was a survey of working Americans conducted by Empower.

In the survey, they found that while Baby Boomers would be “happy” with a $124,000 annual salary, Millennials apparently believe $525,000 a year is the minimum to “feel happy.”

Kevin O’Leary Says Making Half a Million Dollars Is Nearly Impossible

During the Fox interview, O’Leary was laughing as he explained his take on this staggering statistic.

He said, “The average salary in America is about $62,000, and what this study says is that everybody is unhappy. Now, if you’re a Baby Boomer like me, you know how hard it is to make $500,000, so I applaud anybody who has received that. But the idea that you’re just going to get gifted $500,000 to be happy … Wake up and smell the roses.”

O’Leary Recommends Working More Jobs

O’Leary also said to Millennials, “Get to work, hold three jobs down, raise some kids, and pay off your mortgage and stop whining about it.”

With these strong words of advice from a financial guru, many are wondering if he’s right and Millennials’ expectations are too high and their work ethic too low. But others believe that O’Leary is simply wrong in his assessment of this generation.

Millennials’ Lives Are Much different from Baby Boomers at Their Age

One cold hard fact in support of Millennials’ financial frustrations is that the current economy is incredibly different from it was when their parents, the Baby Boomers, were their age.

Collected data reports that, thanks to inflation, Americans have 87% less purchasing power than they did in 1971. And that extreme percentage significantly affects this generation’s ability to purchase property.

The Housing Market Is Out of Control

The housing market itself is quite a mess right now. Interest rates are sitting comfortably at 7%, the average price of a starter home is $300,000, and experts at Moneywise say that to buy a home, a person or household needs to have an annual income of at least $81,360.

The housing market issue is, of course, stopping many Millennials from purchasing homes, which is leading to more and more money wasted on expensive monthly rent.

Millennials Are Drowning in Student Loan Debt

Millennials, unlike Baby Boomers, also have extreme amounts of student loan debts as college became wildly more expensive than it was 30 years ago.

The average Millenial has $42,637 of student debt looming over them. However, 9 out of 10 Baby Boomers don’t have any student loans to pay off.

Child Care Costs More Than Ever Before

Another argument that specifically combats Kevin O’Leary’s comment that Millennials should get three jobs and have children is that child care and the cost of having children is higher than ever before.

A recent report from Care.com states that families now spend an unbelievable 27% of their entire household income on child care. Which, of course, in addition to other necessary expenses like rent, utilities, car payments, and insurance, leaves little extra for anything else.

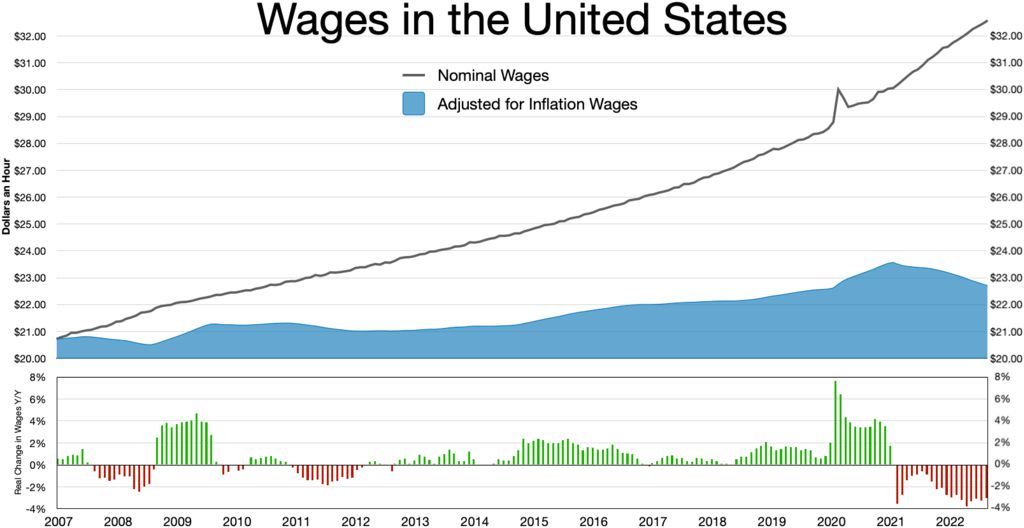

Wages Haven’t Risen at the Same Rate as the Cost of Living

Another solid statistic for Millennials is something that all financial experts agree upon, which is that wages and salaries have not risen at the same rate as the general cost of living.

According to Yahoo! Finance, child care is more than 220% more expensive than it was in 1990, remodeling a home cost $19,800 in 1992 and $43,437 in 2023, and a new car was only $15,042 in the ’90s, whereas now, it’s $35,423. However, the average salary in 1990 was $50,200, and in 2023, it’s only marginally higher at $62,000.

The Younger Generation Hasn’t Even Begun Saving for Retirement

It’s important to note that with the ever-increasing cost of living, stagnant wages, expensive homes, high interest rates, and out-of-control child care costs, Millennials are really struggling to save.

Generation X was the last to receive any kind of pension plan, so Millennials are all on their own, and it is extremely probable that the economy is going to be significantly affected by their lack of retirement savings in another 30 years.

Millennial Are in Trouble Either Way

There are two sides to this debate. One is that Kevin O’Leary is correct in his assessment that Millennials simply need to work harder and be smarter with their cash. And the other is that the current economic climate has made it nearly impossible to do so.

But no matter which side feels true to you, the bottom line is the Millennials are in trouble and something will have to change, either at home or within the economy, if they ever want to feel financially secure.