When Treasury Secretary Janet Yellen was questioned about feeling the impact of inflation while grocery shopping, her crisp response was a simple “No.”

This answer took both the interviewer and the public by surprise, contrasting sharply with the expected concern over rising prices.

The Inflation Dilemma as Elections Loom

As the U.S. nears another presidential election, inflation continues to dominate concerns.

A robust economy could boost President Biden’s appeal, but the ongoing issue of soaring grocery prices threatens to erode public trust in his economic management. The electorate is keeping a keen eye on these developments as they prepare to vote.

The Surge in Grocery Bills

Under the current administration, Americans have been hit with steep increases in grocery prices, seeing double-digit hikes that are causing widespread alarm and impacting household budgets.

This significant uptick has left many questioning how they’ll manage their finances if costs continue to climb.

Ways To Cut down on Grocery Shopping

The issue with grocery shopping has become so bad that there are now tips to reduce grocery shopping to help people save money on even the very basics.

This includes getting brand loyalty points, shopping in multiple stores to get the best prices for each item, and going into the store with a plan to try and avoid going over your budget.

People Are Sharing Their Grocery Expenses Online

The cost of grocery shopping has become so bad that people have taken to social media to share their grocery expenses. The only issue is that it didn’t exactly go to plan.

Everyone is allowed to buy the odd treat here and there instead of just sticking to the basics. However, when one person shared that their grocery shop had cost them over $270, other users pointed out that if they had cut down on snacks such as Doritos and Pringles, their shop wouldn’t have cost that much.

Shrinkflation and Grocery Stores

Another issue is shrinkflation in grocery stores. This is the shrinking of product sizes while their prices remain the same or continue to rise.

Snack companies appear to be the main culprits. However, some could argue that snacks aren’t an essential part of a grocery shop, so people could avoid shrinkflation by only buying the essentials.

Yellen’s Routine Market Visits

Despite a net worth reported around $20 million, Janet Yellen insists she shops at the grocery store weekly and feels no sticker shock at the register.

This revelation has sparked discussions about the disconnect some officials might have with the general populace’s economic experiences.

Analyst Comments on Persistent High Prices

During a discussion on the state of the economy, Jennifer Schonberger pointed out that despite falling shipping and global food costs, grocery prices remain stubbornly high.

She posed the question, “It’s sticker shock, isn’t it?” only to be abruptly interrupted by Yellen’s decisive “No,” ending the conversation unexpectedly.

Yellen Explains the Price Spikes

Yellen offered an explanation for the stubbornly high grocery prices, attributing them to increased operational costs, including wages.

She stated, “I think largely it reflects cost increases, including labor cost increases that grocery firms have experienced, although there may be some increases in margins,” shedding light on the complexity of pricing dynamics.

Issue of Rising Labor Costs

Many grocery stores are now paying their workers more to match the new minimum wage, which has been raised due to the rising cost of living.

While this might be good for employees who previously couldn’t afford the very basics, it is bad news for customers as they will suffer from rising food prices as a consequence.

Cutting Down on Essentials

Adding to her comments, Yellen then said that she has met with several grocery CEOs who have said that they are cutting costs on essentials, such as bread and milk.

While this might help shoppers a little bit, it doesn’t explain how high prices have become in other areas when grocery shopping. Essentials may be a priority, but everyone deserves to be able to afford just the odd treat, which many people cannot afford.

Millionaires Don’t Notice Rising Prices

As someone who has millions in the bank, Yellen is less likely to be affected by rising prices than the average person.

With many people throughout the US having to check the prices of items and add them up with a calculator before buying anything, including staying away from some of the basics because they can’t afford them, Yellen seems to be in the minority with this.

Outlook on Inflation

Yellen is optimistic about inflation, anticipating a decrease that will align with the Federal Reserve’s target of two percent by next year.

This forecast is a glimmer of hope for many Americans grappling with the escalating cost of living, offering a possible end to their financial strain.

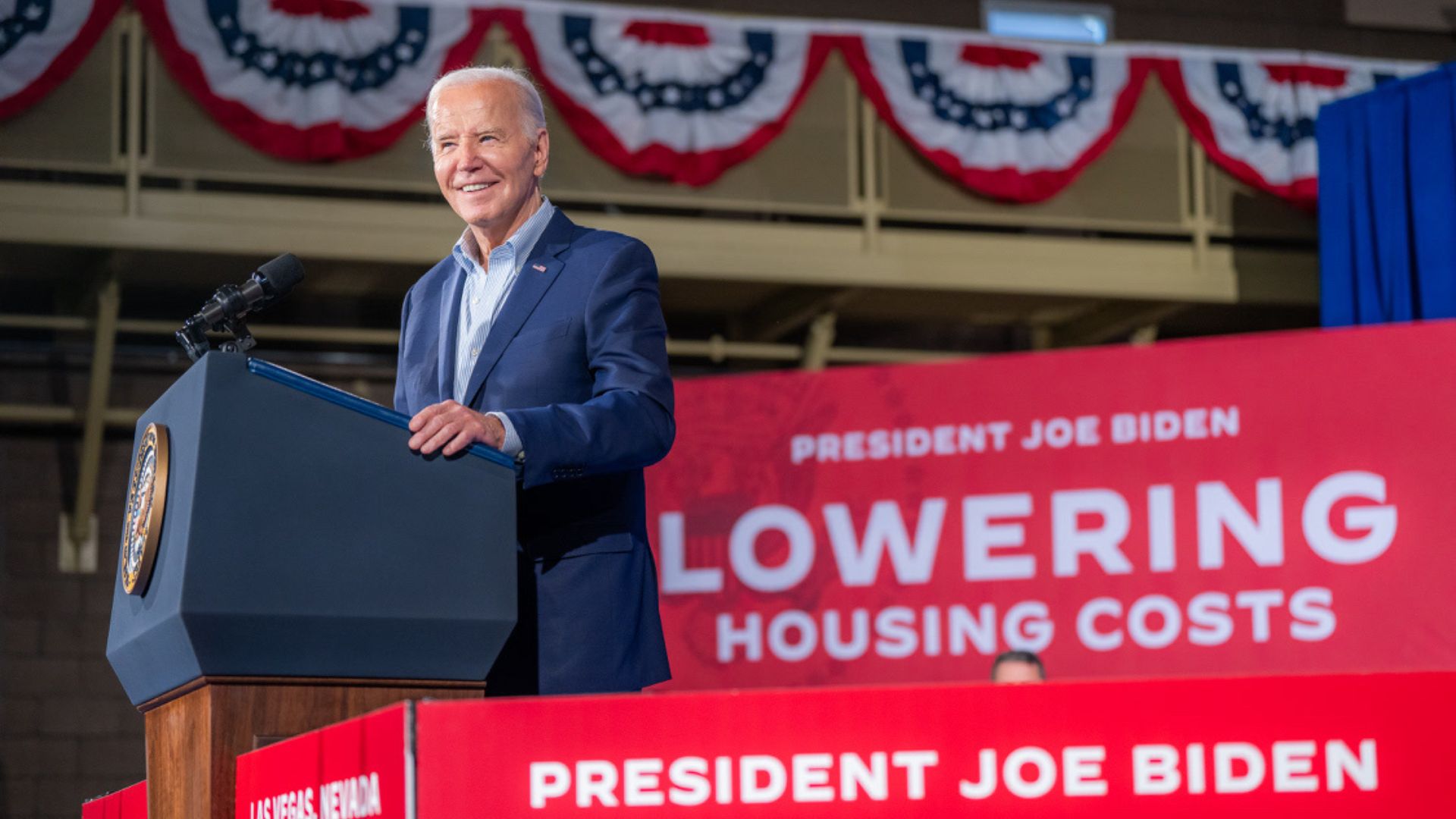

Biden’s Housing Strategy

In response to the enduring high costs of living, the Biden administration has launched initiatives to enhance affordable housing access.

These include a notable $100 million funding effort over three years, aimed at easing the financial burden on many Americans.

Housing Costs and Inflation

Yellen attributes the slow reduction in inflation primarily to high housing costs, rather than broader policy issues.

Her focus during a recent Minneapolis visit highlighted the administration’s commitment to tackling this pressing problem through targeted investments.

$1.1 Trillion in Credit Card Debt

Currently, there is around $1.1 trillion in credit card debt in the US. Grocery shopping contributes to part of this, with rising prices also contributing.

Average food prices have risen by 21% since January 2021. However, cereal, chicken, and vegetables are up 25%, and flour, bread, and butter are up 35%. Eggs and peanut butter have risen the most, and are up 40%.

Economic Anxiety Influences Voter Sentiment

With the 2024 election on the horizon, inflation and economic stability remain at the forefront of voters’ minds. The ongoing debate over grocery and housing costs is emblematic of broader economic challenges that could sway electoral outcomes.

Observers and analysts are closely monitoring these trends and their potential impact on voter behavior.

Inflation Has Gone Down

Despite inflation being high, it has gone down over the last few years. This is after it reached a 40-year high of 9.1% in June 2022.

By May 2024, this number had gone down to 3.3%. However, this is still higher than the Federal Reserve’s target, which remains at 2%.

Biden’s Perspective on Inflation

President Biden has openly acknowledged the challenges of inflation, asserting that despite the rise in prices, American consumers have more disposable income.

His statement, “They have the money to spend,” has met with mixed reactions, highlighting the nuanced views on economic recovery and consumer confidence.

The Biden Administration Wants To Lower Housing Costs

Due to rising costs in all areas of life, the Biden administration has been trying to devise ways to lower these costs in some areas, possibly hoping that this will reflect more favorably on him in the upcoming presidential election.

They have announced steps to increase access to affordable housing to try and lower the cost of living that has risen since the pandemic.

Joe Biden or the Pandemic?

The COVID-19 pandemic began at the beginning of 2020, and Joe Biden took office as US President in January 2021, when the US and the rest of the world were still at the height of the pandemic.

While some people will blame Biden for the rise in inflation, others say the pandemic is to blame. Some people will even say it is a mixture of the two to blame.

Biden Claims Inflation Isn’t That Bad

Whether it’s an attempt to win over voters or something he genuinely believes, Biden has claimed that the high costs and inflation people complain about aren’t quite correct.

Biden has claimed that the polls are wrong and that Americans aren’t struggling for money as they have plenty in their pockets.

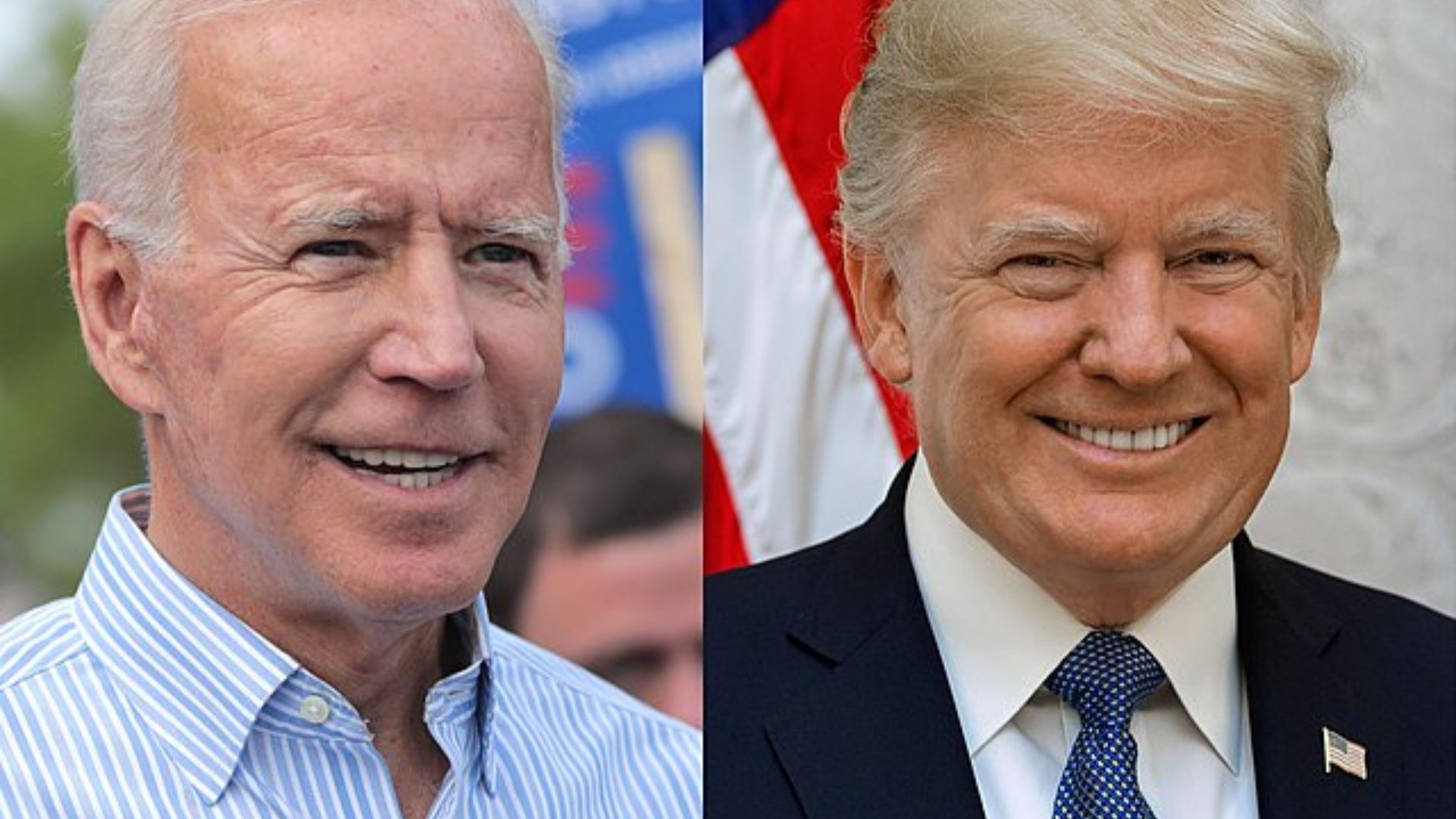

Biden vs Trump

When looking at the cost of the average American’s grocery shop, there is a massive difference between the cost under the Biden administration vs the cost under the Trump administration.

Under Trump, the average American grocery shop cost $107.81. Under Biden, this shop has gone up to $168.16, which equates to a 55.98% increase.

Contrasting Economic Visions

The economic strategies of Donald Trump and Joe Biden are sharply defined as the election approaches. Trump is advocating for aggressive tariffs and tax reductions, while Biden focuses on raising corporate taxes but sparing middle-class families.

These divergent approaches underline the critical economic choices facing voters as they consider their options for leadership.