A group of multimillionaires is advocating for governments to increase taxes on the wealthy. They argue that such measures would enhance economic stability and benefit society as a whole.

This movement has seen participation from high-net-worth individuals who believe that their wealth places them in a unique position to contribute to systemic change and address economic disparities.

A Personal Transformation Inspired by Literature

In 2017, Gemma McGough, a multimillionaire from the UK, experienced a significant shift in her worldview after reading “This Changes Everything” by Naomi Klein, Wired reports.

The book, which discusses the impact of capitalism on climate change, inspired her to make personal changes, including replacing her Porsche with a Tesla. McGough’s journey reflects a growing awareness among the wealthy of their potential role in fostering economic equity.

Founding a Socially Responsible Company

According to Wired, after her realization, McGough founded Eleos Compliance, a company based on the principles of B Corp certification, emphasizing transparency, social, and environmental accountability.

This move was part of her broader effort to ensure her wealth was used in a way that aligned with her values of contributing positively to society and the environment.

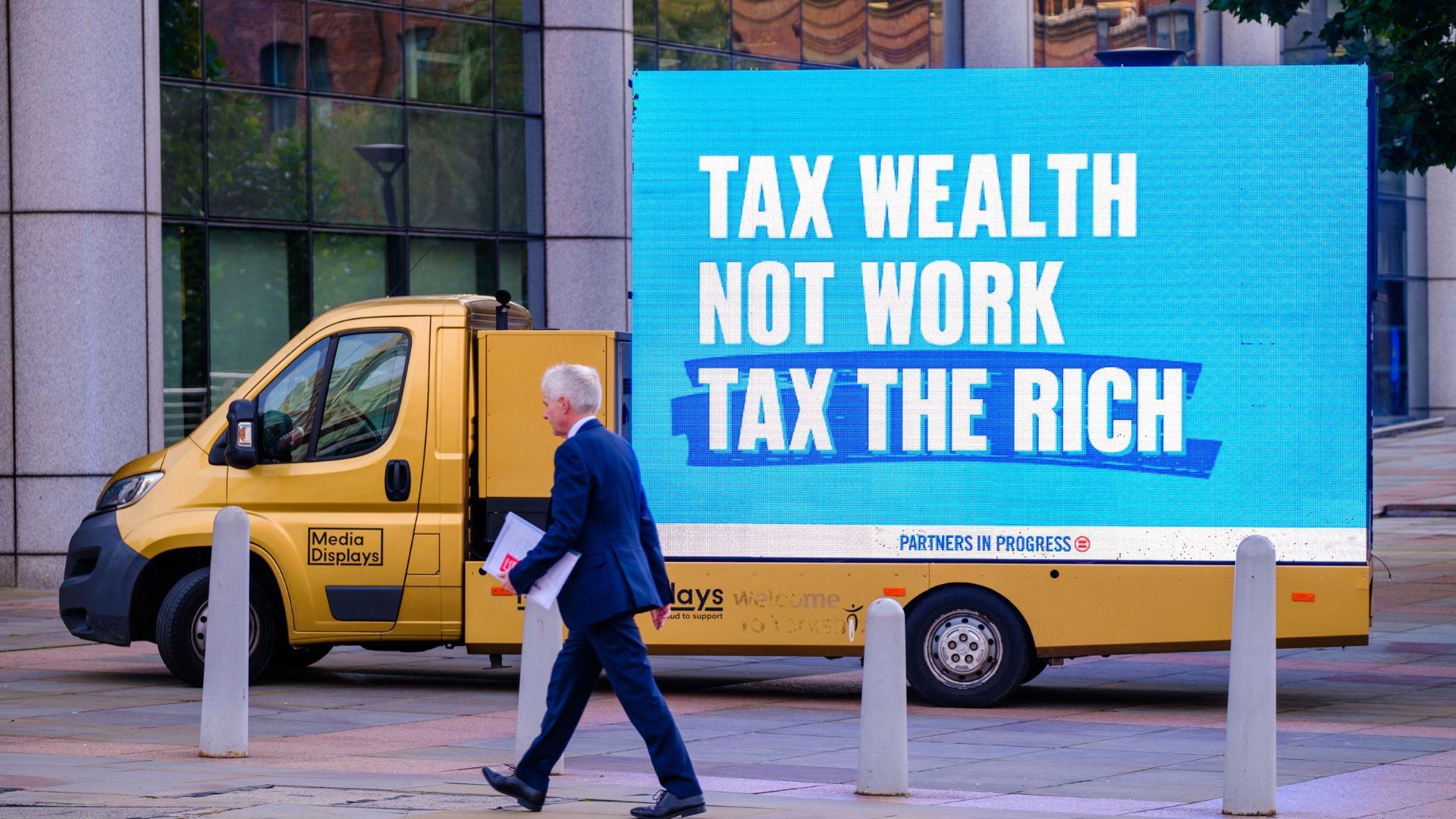

The Tax System’s Inequities Revealed

Wired explains that McGough came to see the tax system as unfair when she noticed the discrepancy in tax rates between salaried income and income from investments and assets.

Her analysis led her to conclude that she, and others in her position, could be contributing more to the public coffers, highlighting the need for tax policy reform to address these inequities.

Seeking Solutions Beyond Philanthropy

Despite giving away approximately £400,000 to environmental causes, McGough recognized that philanthropy alone was insufficient to address systemic issues.

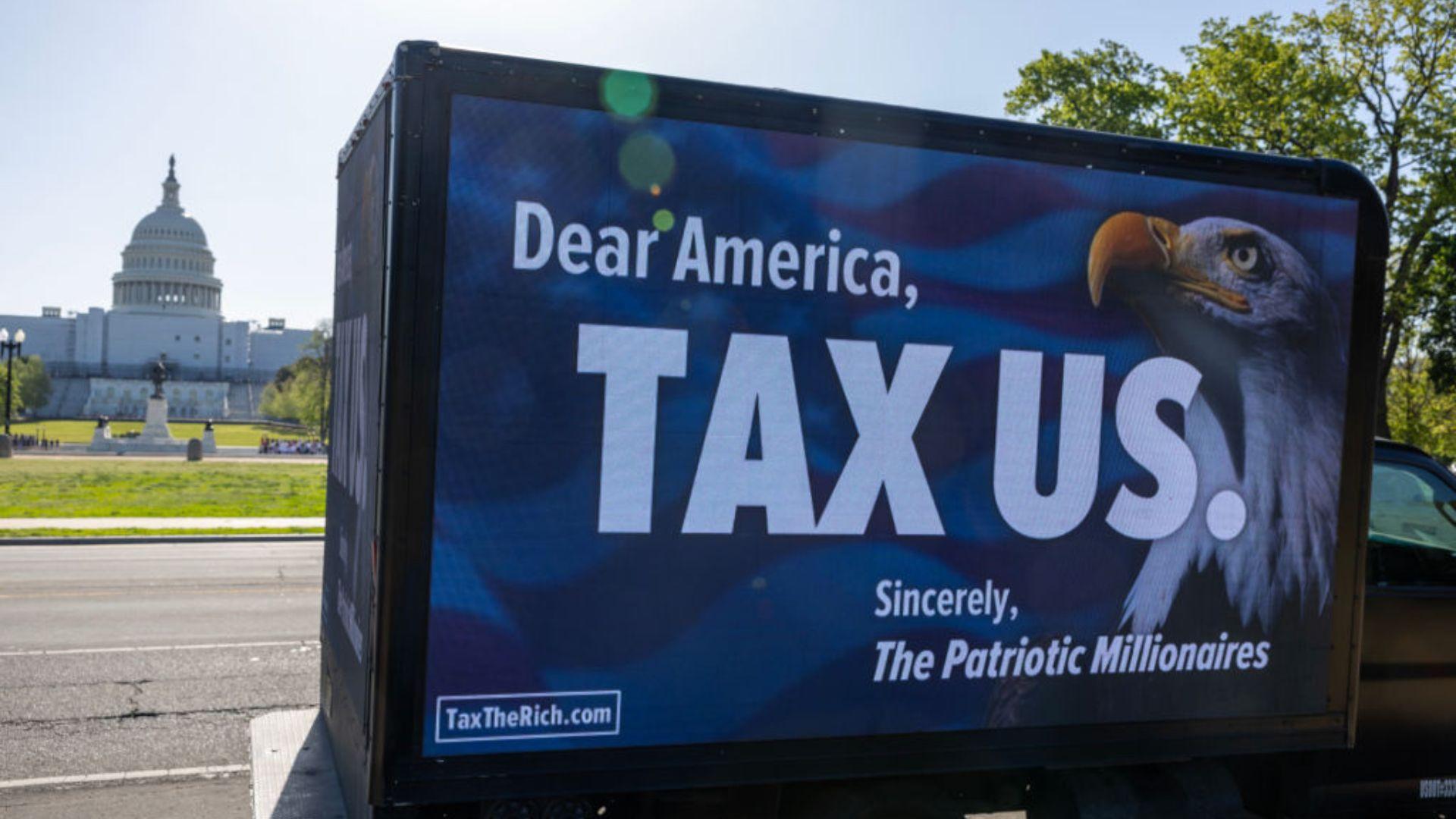

Wired notes that she then joined the Patriotic Millionaires, a group advocating for higher taxes on the wealthy, to push for changes that could have a more widespread and lasting impact on society.

A Diverse Group Advocating for Tax Reform

The Patriotic Millionaires include a mix of individuals, from company founders and CEOs to heirs uncomfortable with their inherited wealth, and former financiers like Gary Stevenson, who has become an inequality YouTuber, according to Wired.

These members have come together to use their influence and resources to lobby for tax reforms that would ensure the wealthy pay their fair share.

Economic Stability Through Wealth Taxes

Le Monde reports that the group argues that taxing wealth could lead to greater economic stability by supporting a healthy, educated workforce and a robust middle class.

This approach, they believe, would not only address inequality but could also benefit the economy by increasing consumer spending power.

From Humble Beginnings to Wealth Advocacy

McGough’s background in the working class and her journey to becoming a multimillionaire have influenced her perspective on wealth and taxation, Wired notes.

Her personal experience has made her more attuned to the issues of inequality and the need for the wealthy to contribute more to society.

The Case for a Fair Share of Taxation

The Guardian explains that the Patriotic Millionaires are driven by the belief that the current tax system allows the richest individuals to avoid paying a fair share.

They point to the stark contrast in wealth distribution and the strain on public services as evidence that reform is necessary to ensure a more equitable society.

Addressing the Challenges of Implementing a Wealth Tax

The group acknowledges the challenges in proposing a wealth tax, including bureaucratic hurdles and concerns about capital flight, Wired explains.

However, they are committed to overcoming these obstacles through advocacy and research, demonstrating a pragmatic approach to achieving their goals.

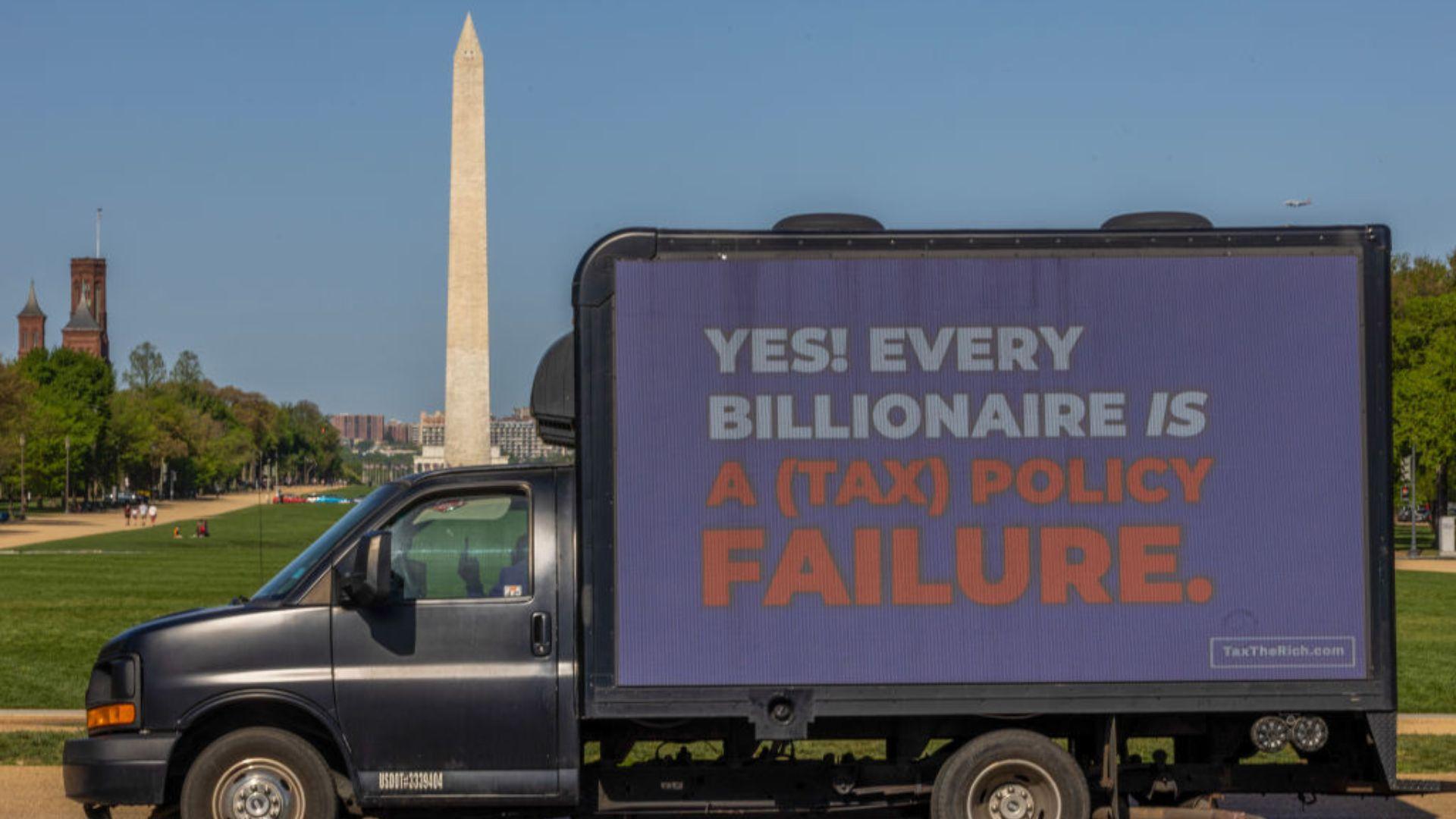

Advocacy for Wealth Taxation

This new class of millionaires is actively seeking to influence policy through direct advocacy.

Wired reports that they engage with parliamentary groups and partner with organizations like Tax Justice UK to promote the introduction of new wealth taxes as a means to address economic inequalities and fund public services.

A Vision for the Future of Taxation

The Patriotic Millionaires’ efforts to project their message onto prominent buildings and their active participation in public debates reflect their commitment to raising awareness and advocating for a wealth tax, as reported by The Guardian.

Their actions are part of a broader movement seeking to address economic disparities through tax reform, aiming to create a more just and equitable society.